Why crypto stocks are shaking and what you should look into their earnings?

At the Bitcoin 2024 conference, Trump made significant promises to the crypto community, including:

• Classifying Bitcoin as a U.S. strategic reserve asset

• Dismissing the current SEC chair

• Establishing a Bitcoin Presidential Committee

• Encouraging power plants to enhance electricity supply for Bitcoin mining

He also predicted that Bitcoin's market value would surpass gold and committed to retaining the federal government's holdings of approximately 210,000 Bitcoins, making the U.S. the first nation to officially include Bitcoin in its strategic reserves. Meanwhile, Democratic presidential candidate Harris is engaging with the cryptocurrency industry to ease tensions. This news boosted Bitcoin prices past $70,000, with a nearly 20% rebound since July 5. The market is now watching to see if Bitcoin can return to its March highs or achieve new records.

Recent surge in crypo stocks

Crypto stocks also have shown strong performance this year. The Bitcoin HODL company $MicroStrategy(MSTR.US)$ has excelled with a 177% increase in its stock price since the beginning of the year, outperforming even Nvidia while the trading platform $Coinbase(COIN.US)$ has also enjoyed a near 40% rise. Several factors contribute to this phenomenon:

1. Bitcoin price increase: The rise in Bitcoin prices directly propels the stocks of related companies. As a digital asset, Bitcoin's price fluctuations have a direct impact on these companies' financial performance.

2. Market sentiment: Increased investor confidence in the cryptocurrency market has led to a flow of funds into related stocks. Enhanced interest from institutional investors has also played a significant role.

3. Improved regulatory environment: The regulations in some countries are becoming clearer and more supportive of Bitcoin and blockchain technology, boosting market confidence.

Key points in the earnings reports of three companies

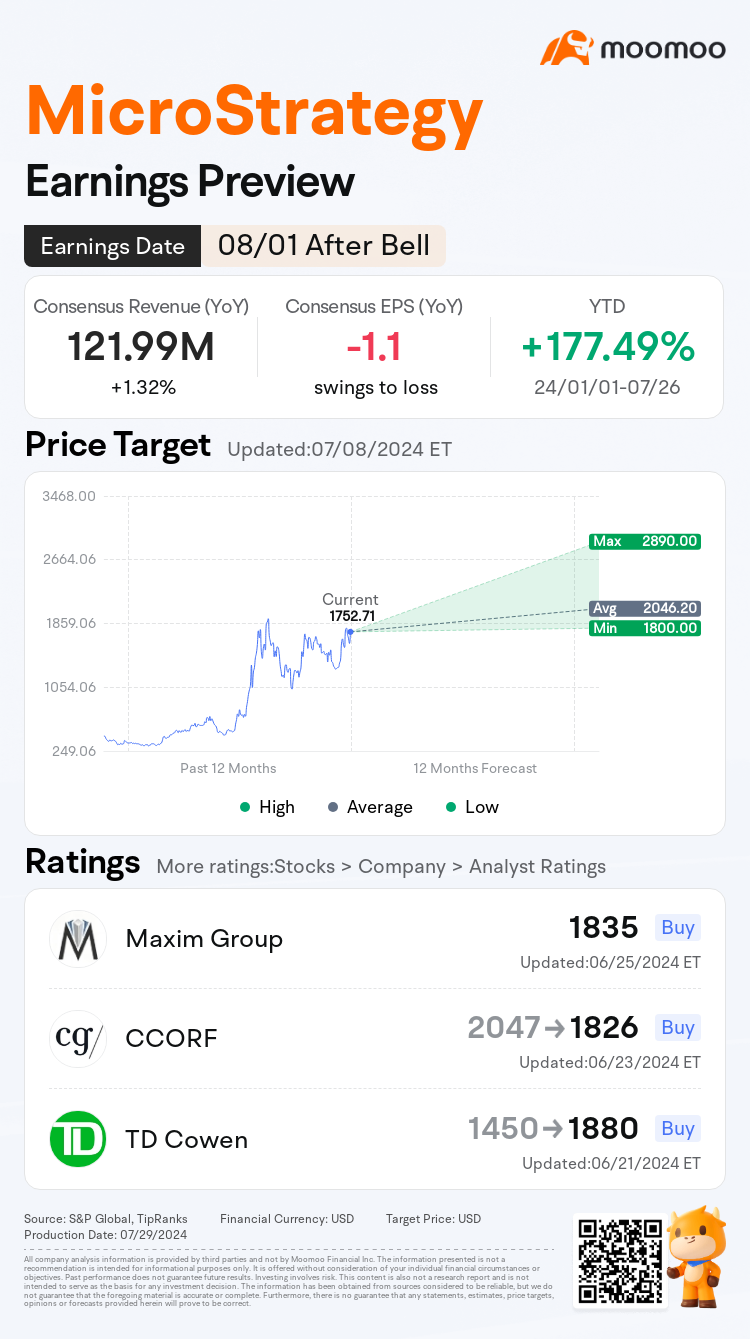

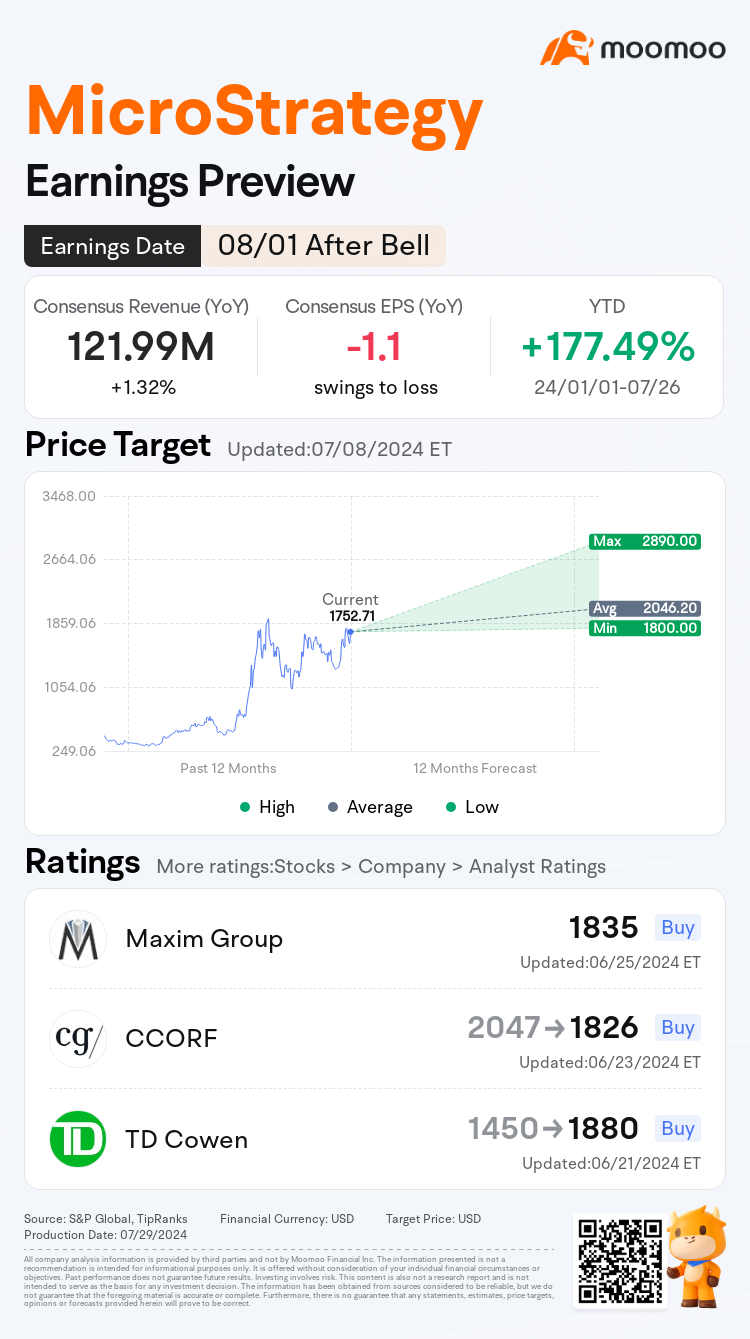

MicroStrategy: Upcoming stock splits

$MicroStrategy(MSTR.US$ is a business intelligence, mobile software and cloud-based services company, focused on accumulating bitcoin. The company held 226,331 bitcoin as of June 20.

MicroStrategy is scheduled to report its financial results for the second quarter after the market closes on August 1. Additionally, MicroStrategy will implement a 10-for-1 stock split via a dividend for shareholders of record as of the market close on August 1. The stock is expected to start trading on a split-adjusted basis when the market opens on August 8.

Marathon Digital: Mining efficiency

Marathon Digital, a company focused on Bitcoin mining, will have its earnings report reflect the industry's health. Recently, $Marathon Digital(MARA.US$ purchased $100 million worth of Bitcoin, increasing its holdings to over 20,000 BTC. Additionally, MARA announced a comprehensive "HODL" strategy for its Bitcoin financial policy, which includes retaining all mined Bitcoin and making regular additional purchases.

Last June, Marathon mined 590 Bitcoin at a rate of 19.7 BTC/day, while Riot mined 255 Bitcoin at rates of 8.5 BTC/day. On a YoY basis, Marathon’s production declined 40%, whereas Riot’s declined 45%. Despite the low hashprice of $0.04 per TH/s, Marathon’s operational hashrate increased 102% to 26.3 EH/s, demonstrating better mining efficiency compared to its peers.

Coinbase: Speculative token revenue

As a globally recognized cryptocurrency exchange, Coinbase’s earnings report will directly reflect the activity level in the cryptocurrency trading market.

$Coinbase(COIN.US$ has diversified its revenue streams beyond transactions through subscriptions, blockchain rewards, and interest income, but it faces stiff competition from larger exchanges like Binance, which may limit its appeal.

The company generates a significant portion of its trading revenue from altcoins, with 55% of transactional revenue in Q1 coming from non-Bitcoin, non-Ethereum trades, and 43% of trading volume excluding these assets plus USDT. There is a risk that the cryptocurrency market could consolidate into a few dominant coins, reducing speculative altcoin trading and potentially diminishing the spreads and fees Coinbase earns, impacting its revenue.

The upcoming earnings reports of $MicroStrategy(MSTR.US$, $Coinbase(COIN.US$, and $Marathon Digital(MARA.US$ will be crucial for investors to assess their future performance.

If you're accustomed to around the clock, the fixed hours of the stock market can feel limiting. However, moomoo's 5*24-hours trading feature bridges this gap, allowing you to continue trading even after the stock market has closed. With moomoo's 5*24-hours trading feature, you can promptly react to these developments, maximizing your ability to capture rising stock price trends.

For more functional tutorials, please refer to the article below:

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102188459 : Tq

MYJaeger : gogogo crypto to da moon

105384139 MYJaeger : Bitcoin will go down