Why Does Warren Buffett Eye Canadian Investment Opportunities?

At the start of Berkshire's yearly gathering in Omaha on Saturday, Buffett indicated that it's quite likely their cash reserves will reach $200 billion by the end of the current quarter, citing a scarcity of significant acquisition prospects.

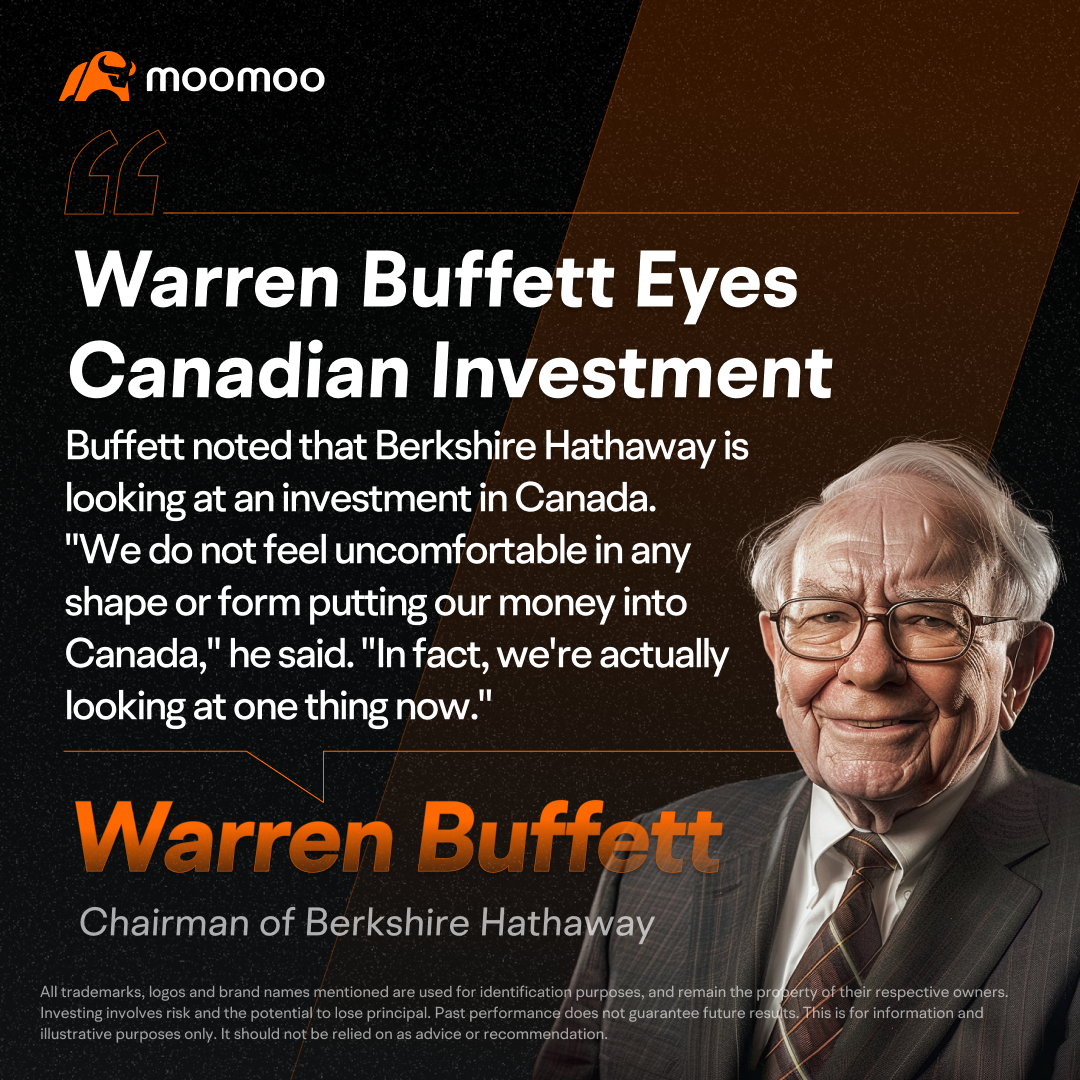

Buffett addressed the assembled multitude, expressing a desire to utilize these funds but emphasizing a commitment to invest only when the risk is minimal and the potential for substantial profit is high. He mentioned that the company is on the lookout for the rare, substantial opportunity and revealed they are considering an investment in Canada.

Why Buffett Eyes Canada for Investment

• Previous Investment

The interest in Canadian investment opportunities comes as no surprise to those familiar with Buffett's investment moves.

The legendary investor has previously invested in the country. He once acquired a stake of approximately $300 million in Home Capital Group, which market participants interpreted as a sign of trust in the distressed Canadian mortgage underwriting firm.

• Existing Assets

Mr. Abel, who additionally chairs Berkshire Hathaway Energy, oversees the company's existing ventures in Canada. These include the subsidiary Berkshire Hathaway Energy Canada in Calgary, with an extensive infrastructure of 13,000 kilometers of transmission lines and 300 substations through AltaLink in Alberta.

During the meeting, Mr. Abel highlighted the company's substantial presence in Canada, spanning across various operational sectors and including investments in other businesses. He affirmed their ongoing interest in expanding investments in Canada, citing a favorable and familiar business environment.

I would say the economy moves very closely to the U.S. So the results we're seeing out of our various businesses that report both the U.S. and Canadian operations aren't drastically different," Mr. Abel said. "On the energy side, for example, we make very substantial investments up there in Alberta. But again, it's very consistent with how that economy is growing."

• Similar Business Operations to the U.S.

At the Berkshire Hathaway annual shareholder meeting, Warren Buffett discussed his investment approach, highlighting his trust in Canada's economic steadiness and the comparable nature of business practices between Canada and the United States.

There's a lot of countries we don't understand at all," Buffett said. "So, Canada, it's terrific when you've got a major economy, not the size of the U.S., but a major economy that you feel confident about operating there."

Source: CNBC, Financial Post, The Globe and Mail, money.ca

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104405975 : How can I invest in gold coins if I don't have any money,![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

AI beater : The unemployment rate of Canada keeps going high and the productivity of Canada continues to drop. However, there are opportunities in natural resource, infrastructure and retail business.

$Brookfield Corp (BN.CA)$ $Loblaw Companies Ltd (L.CA)$$West Fraser Timber Co.Ltd (WFG.CA)$$Stella-Jones Inc (SJ.CA)$$Canadian Natural Resources Ltd (CNQ.CA)$