Why Has the Financial Conditions Index Become More Accommodative After the Rate Hikes?

Richard Koo, Chief Economist at the Nomura Research Institute, pointed out a problem currently troubling the Federal Reserve in his latest report: The Fed used to effectively regulate the economy through adjusting policy interest rates and the supply of bank reserves; however, despite consecutive significant rate hikes, financial conditions remain relatively loose.

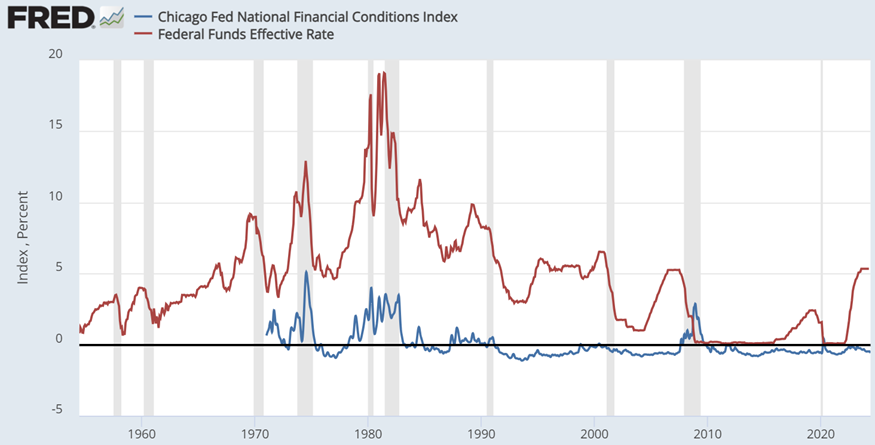

Indeed, as shown in the chart, the long-term correlation between the FCI and policy interest rates has visibly vanished since 2008. What are the reasons behind it?

1. The Biden Administration's fiscal cycle led to refinancing momentum in the economy

SIFMA's data on US social financing shows that over the past two years, the scale of equity, bond, and credit financing in the US private sector has significantly contracted. However, this was offset by the government sector's support for social financing.

On the one hand, based on a bipartisan consensus on "de-risking," the Biden administration-led IIJA, CHIPS, and IRA acts, supported by historically large fiscal deficits, have promoted massive domestic investments and factory constructions in strategic industries through direct subsidies, tax incentives, and other industrial policies. They also advance the strategy of "friend-shoring" outsourcing to reduce dependency on China's supply chain and consolidate America's lead in key areas.

Since government deficits equal the private sector's surplus, a spiral is formed: as corporate profits rise, asset prices increase and the collateral value rises; accordingly, the default risk and risk premiums decrease; finally, financing capacity improves, and liquidity rises.

The Chicago Fed's NFCI is a key indicator reflecting liquidity. Regarding contributions to the NFCI, the Chicago Fed classifies 105 indicators into Risk, Credit, and Leverage. Under high-interest constraints, Leverage has been relatively stable over the past year, while Risk and Credit have become significantly more accommodative.

Looking at these specific indicators, we can see that Credit and Risk are highly correlated with asset prices. This reflects a mutual causation between asset prices and financial conditions. The self-reinforcing effect is very significant.

Indeed, since 2020, the FCI has shown a significant correlation with major assets such as Bitcoin, US stocks, copper, and gold.

Overall, the current financial system has shifted from the Fed’s financing system to the economy’s own refinancing system, which relies more on balance sheet capacity and presents stronger pro-cyclical characteristics.

2. The Federal Reserve has tended towards being overly protective since the Bernanke era

The market tends to believe that the Fed will always ensure systemic financial risks do not occur, a concept known as the Fed Put.

After the 2008 financial crisis, the Fed cut interest rates 10 times in a row, reducing the policy rate floor from 5.25% to zero. To address the ineffectiveness of conventional monetary policy in a zero-interest environment, Bernanke initiated quantitative easing, which was akin to the Federal Reserve stepping in as the lender of last resort, providing financial institutions with almost unlimited liquidity support. The money was plentiful enough to match any potential bank runs, in order to restore market confidence and rebuild trust in the banking system.

Similarly, Powell seems ready to add a new account item (such as BTFP 2.0) at any time, through temporary unlimited balance sheet expansion, to timely block any abnormal market liquidity movements, especially before the elections.

QE indeed changed/cultivated a generation of investors' risk preferences. When investors expect the implicit protection of the Fed Put, they naturally tend to take higher risks, even affecting capital market valuations.

It is worth mentioning that as of this past Friday, BTFP still had a scale of over a hundred billion dollars. A lot of banks obtained lower-cost liquidity from the Fed discount window, and then engage in risk-free arbitrage by depositing it back at the Fed at an overnight rate of 5.5% as reserves.

The Fed's interest expenses far exceed its income. In 2023, the Fed paid a total of $281.1 billion to financial institutions, while the total interest on its bond holdings was $163.8 billion. This led to the Fed's highest-ever loss of $114.3 billion last year.

Behind the resilient private sector balance sheets, it is still the public sector that is propelling the economy forward.

As Druckenmiller said in a May interview: "... At the end of last year, the Federal Reserve clearly made a 'mistake': they started discussing rate cuts too early at the December FOMC meeting, which reignited financial conditions. And to some extent, they were trapped by their own forward guidance, unable to escape, just as they had insisted all through 2021 that 'Inflation is Transitory.' — I remember telling my partners at the time that we should be hearing this narrative in March (at the next FOMC meeting), not now, when inflation could actually have come down to the level they needed. " During this period, Bitcoin rose from about $30,000 to $70,000, and there were also significant changes in the NASDAQ, copper, gold, and U.S. bond markets.

■ How should investors respond?

U.S. monetary and fiscal policy is more sensitive during an election year. If the Biden administration can reduce the deficit and engage in active diplomatic negotiations to keep key inflation and employment data within a stable range, systemic risks may not necessarily erupt before the election. Geopolitical risks around the time of the Paris Olympics may decrease, coupled with ample liquidity, meaning the rise seen since the beginning of this year may not be over. However, as previously mentioned, how to achieve long-term fiscal balance is a more severe challenge. If not handled properly, it could trigger a second inflationary spiral.

Investors need to discern in which areas there has been a real increase in productivity. While the rise in asset prices could be due to currency devaluation, it could also result from a significant leap in output. In the field of innovation, even if the asset price frenzy caused by currency depreciation ends, those companies with rapidly growing EPS will still bring excess returns.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment