Why J.P. Morgan Identifies TSMC as a Key Player in the AI Field

As the world rushes to make use of the latest wave of AI technologies, one piece of high-tech hardware has become a surprisingly hot commodity: the graphics processing unit, or GPU. A top-of-the-line GPU can sell for tens of thousands of dollars, and leading manufacturer $NVIDIA (NVDA.US)$ has seen its market valuation soar past US$2 trillion as demand for its products surges. Amidst this surge, $JPMorgan (JPM.US)$ analyst Gokul Hariharan's team has identified TSM as a pivotal force in AI processing both in data centers and at the edge, anticipating significant expansion driven by AI over the next three to four years.

J.P. Morgan raised its price target on TSM shares to NT$850 from NT$770 citing AI revenue expectations. TSM stock has risen over 5% on Thursday.

Why Analysts Are Bullish on TSM

• The Key AI Semis Enabler

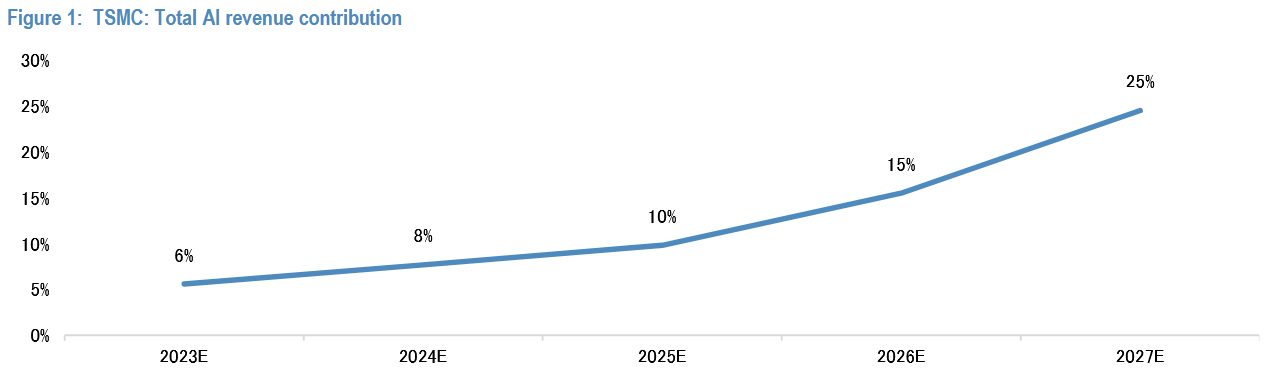

According to J.P. Morgan, the company's critical position in powering AI semiconductors is solidifying. This is evident as TSM ramps up production of multiple technologies in 2024, including Graphics Processing Units (GPUs), Application-Specific Integrated Circuits (ASICs), and edge-AI processors, with further advancements expected in 2025. The analysts predict a substantial increase in AI-related revenue, reaching 25% by 2027, with edge-AI beginning to make a noteworthy contribution.

The contribution of AI to datacenter revenue is expected to increase to 19% by 2027, propelled by the shift from general to accelerated computing, sustained AI training demand, and expanding AI inference applications. This trend is anticipated to drive significant growth in the semiconductor industry in the coming years. The demand for logic semiconductors in AI datacenter accelerators is predicted to rise to support enhanced computing power, and the adoption of advanced packaging technologies like CoWoS and SoIC is likely to grow due to the increasing use of chiplets and high-bandwidth memory (HBM).

Major datacenter GPUs, such as those from Nvidia, $Advanced Micro Devices (AMD.US)$, Intel Habana Gaudi, and high-volume ASICs like $Amazon (AMZN.US)$ Inferentia/Tranium, $Alphabet-A (GOOGL.US)$'s Google TPU, and $Microsoft (MSFT.US)$ aia, are all being manufactured by TSMC.

• Intel Outsourcing Ramping Up

Recent reports suggest that $Intel (INTC.US)$ may outsource the production of some CPU components of its upcoming Arrowlake CPUs to TSMC, in addition to the Lunarlake mobile processors and key chiplets in other PC platforms. Checks indicate a growing likelihood of this happening, which could lead to even stronger growth from Intel's outsourcing to TSMC in 2025-26. This shift could result in TSMC manufacturing approximately 90% of PC CPUs in the first half of 2025 (including Intel Arrowlake, Lunarlake, Apple M3, and AMD Zen processors), significantly broadening TSMC's market within high-performance computing (HPC).

If Intel outsources 50% of Arrowlake production, its revenue to TSMC could hit $8-9 billion in 2025, exceeding prior estimates of $5.5-6 billion. Intel may become TSMC's second-largest N3 customer in 2025, after Apple. The long-term sustainability of Intel's demand beyond 2026 is uncertain, but the increased outsourcing to TSMC could diminish interest in Intel's own foundry services and further strengthen TSMC's scale advantage.

• Opportunities in the N3 Era

TSMC is expected to see a robust pipeline for its N3 technology in 2024 and 2025 with increased demand from clients such as Bitmain, $Qualcomm (QCOM.US)$, and Intel. Despite a slight dampening in Apple's demand due to weaker iPhone sales and no significant die-size growth in upcoming processors, growth from Bitmain is anticipated due to a recovery in cryptocurrency pricing. Qualcomm is also increasing orders to cater to rising AI smartphone demand and its strong presence in the high-end market segment.

Additionally, as AI accelerators transition to N3 in the second half of 2025, a stronger ramp-up for the N3 process node is expected.

With this diversified client base, N3 capacity is forecasted to reach approximately 100,000 wafer starts per month (wfpm) by the end of 2024 and grow to around 150,000 wfpm by the end of 2025. N3 is anticipated to be a major revenue generator, with its 2026 revenue projected to be approximately 48% higher than N5's peak revenue.

Source: J.P. Morgan, Seeking Alpha

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Smackerboy : Obviously he owned TSMC's shares

70183993 : with make in USA push, TSM need to move their production to US which will sank their profit.

102283722 : Go

silversurfer222 : why did jp Morgan have Tesla taken out or the Titanic sank ,

james Isles : moving to the USA is the best thing. safety first