If NVIDIA's stock price falls to $148 or lower, the strategy will achieve maximum profit because both options will expire worthless, and the investor earns the difference in option premiums received when opening the position. Therefore, the maximum profit = $1.866 million minus $1.566 million = $300,000.

Bone85 : What this mean

careful Beaver_5781 : NVIDIA will be a hot stock going forward.

Lets Gamble :

Lets Gamble Bone85 : Precisely..

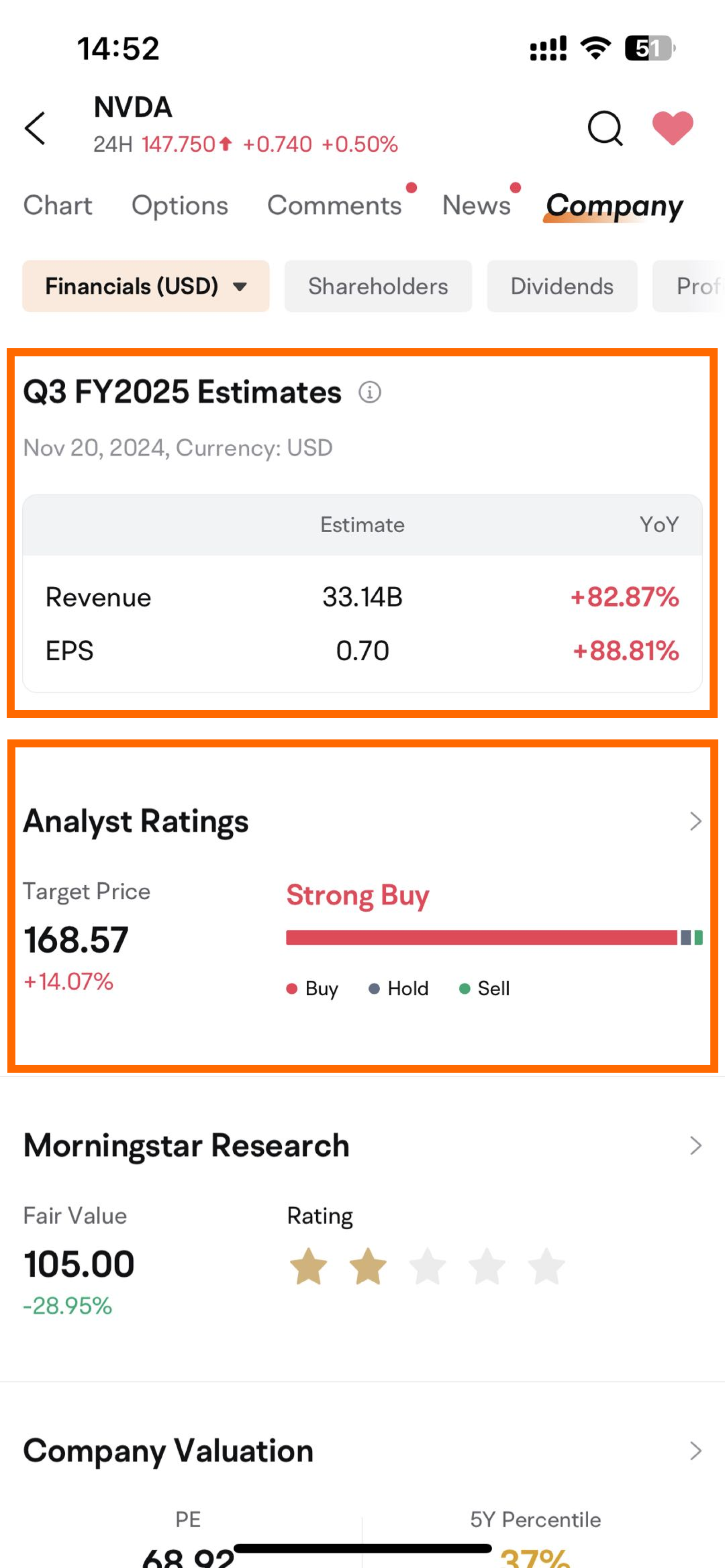

Blockode Trading : Fair value 105, u only see what u want to see

Peanny : Rise

edmaxx76 :

Harrygreenball : great insight

Robert Cumbie : hmmm

Southgate : Looks like big money is on Team Bear while retail investors are over bullish.

View more comments...