Will Rate Cut Expectations Trigger a Shift from Large to Small Caps?

As June's Consumer Price Index (CPI) indicates a slight deceleration in inflation, rising to 3% from the previous year, investors are recalibrating their portfolios, pivoting away from the large-cap technology and that have propelled market indexes to record peaks. There's a noticeable shift towards small-cap stocks and traditionally defensive sectors such as real estate and utilities, which are poised to benefit from a potential interest rate decline.

In response to the CPI readings, the small-cap $Russell 2000 Index (.RUT.US)$ soared by 3.57% to close at 2,125.04 on Thursday, marking the largest spread between it and the tech-heavy $Nasdaq Composite Index (.IXIC.US)$ since January 2021. The broader $S&P 500 Index (.SPX.US)$ also declined by 0.9%.

Subtle CPI Shift Sparks Rate Cut Speculation

Market analysts suggest that the shift reflects a growing consensus that smaller companies stand to benefit more from the current environment of interest rate cuts. Typically more sensitive to interest rate changes, small-cap firms often rely more heavily on debt financing than their larger counterparts. The recent rate reductions are poised to reduce borrowing costs, potentially enhancing the profitability of small firms that depend on bank loans and variable-rate debt.

In the first half of the year, investors had sought refuge in large tech stocks like Nvidia, driven by a strategy to hedge against inflation by backing firms with AI-driven fundamentals and strong cash flows, which have lower correlations with inflation and economic downturns. However, as inflationary pressures ease, a pivot towards interest rate trade has become evident, with capital flowing out of tech giants and into smaller companies.

Investors often invest through ETFs that track the Russell 2000 index to obtain similar returns while diversifying risk from single companies experiencing negative events.

According to Ashish Shah, Chief Investment Officer of Public Investments at Goldman Sachs Asset Management, U.S. small-cap stocks are predicted to rebound in the second half of 2024, offering attractive valuations for investors looking to diversify beyond large-cap stocks. Shah highlighted the potential for small caps to provide access to the high growth potential associated with future mid and large-cap market leaders, further bolstered by the certainty around rate cuts.

Valuation Advantages

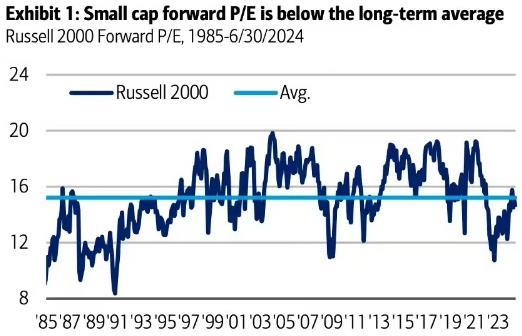

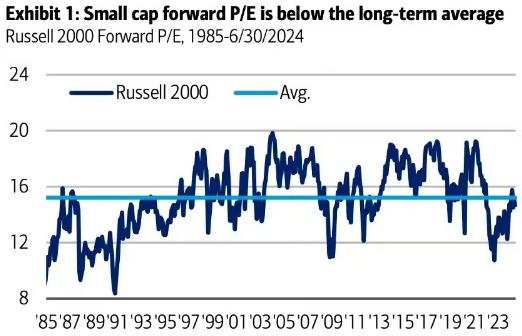

When assessing current valuations of small caps, they appear more affordable compared to historical averages, albeit modestly so—with price-to-earnings ratios 7% lower and forward price-to-earnings ratios being 1% lower.

However, their price-to-earnings growth (PEG) ratios are 9% higher, signaling that growth expectations are indeed lower than in the past, possibly due to less apparent benefits from AI development. In contrast, large-cap stocks are trading at a premium on various valuation metrics, but with PEG premiums lower than dynamic P/E ratios, indicating that growth expectations remain stronger for large caps, aligning with investment banks' earnings forecasts, explaining why the stock price were rising

From a relative valuation standpoint, small caps are currently trading at about 0.7 times the valuation of large caps, a level that is near the lows reached during the 2000 internet bubble when the market favored giants like $Cisco (CSCO.US)$ and $Microsoft (MSFT.US)$ .

Bank of America forecasts a 15% year-over-year decline in small-cap 2Q earnings, an improvement from the 20% fall in the previous quarter. Moreover, the median small cap is expected to see an 8% drop in earnings compared to a 5% fall in 1Q, signaling adaptation to the tepid demand environment through cost-cutting and enhanced efficiency.

Market aftermath

In a twist of market fate, hedge funds and sophisticated investors who had bet against small caps faced a reckoning as the Russell 2000 index railed on Thursday, the widest margin on record. Data from the CFTC revealed a net short position against Russell 2000 futures had increased by 9.5 percentage points over five weeks, the most significant move since March 2020. However, the broad market failed to anticipate the magnitude of the rotation away from the year's favored stocks.

Capital previously sheltered in technology stocks could be a form of defensive play. During the first half of the year, a prevalent strategy among U.S. stock investors was to seek refuge in large tech companies, such as Nvidia, whenever inflation exceeded expectations, leading to a reduction in small-cap holdings. The rationale was that the fundamentals of major tech corporations are driven by artificial intelligence, exhibiting low correlation with inflation and economic downturns, and are backed by robust cash flows so far this year.

Nicholas Colas, co-founder of DataTrek said that small caps can outperform large cap“from time to time,” and that they do best “when blasting off from a cyclical low, one where high yield spreads are declining and the U.S, economy is recovering from a recession.”

The trend could gain further momentum with the onset of rate cuts, as historical analysis by Jefferies indicates that small caps typically outperform large caps in the year following Federal Reserve rate reductions. The logic is straightforward: lower rates can boost small-cap earnings and aid in debt management, potentially heralding a new era of small-cap predominance in the market landscape.

Source: MarketWatch, Seeking Alpha, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103819410 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104476495 : hi

104250779 : Big

54088 FROM RWS : wow

polite Crane_9645 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103757351 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)