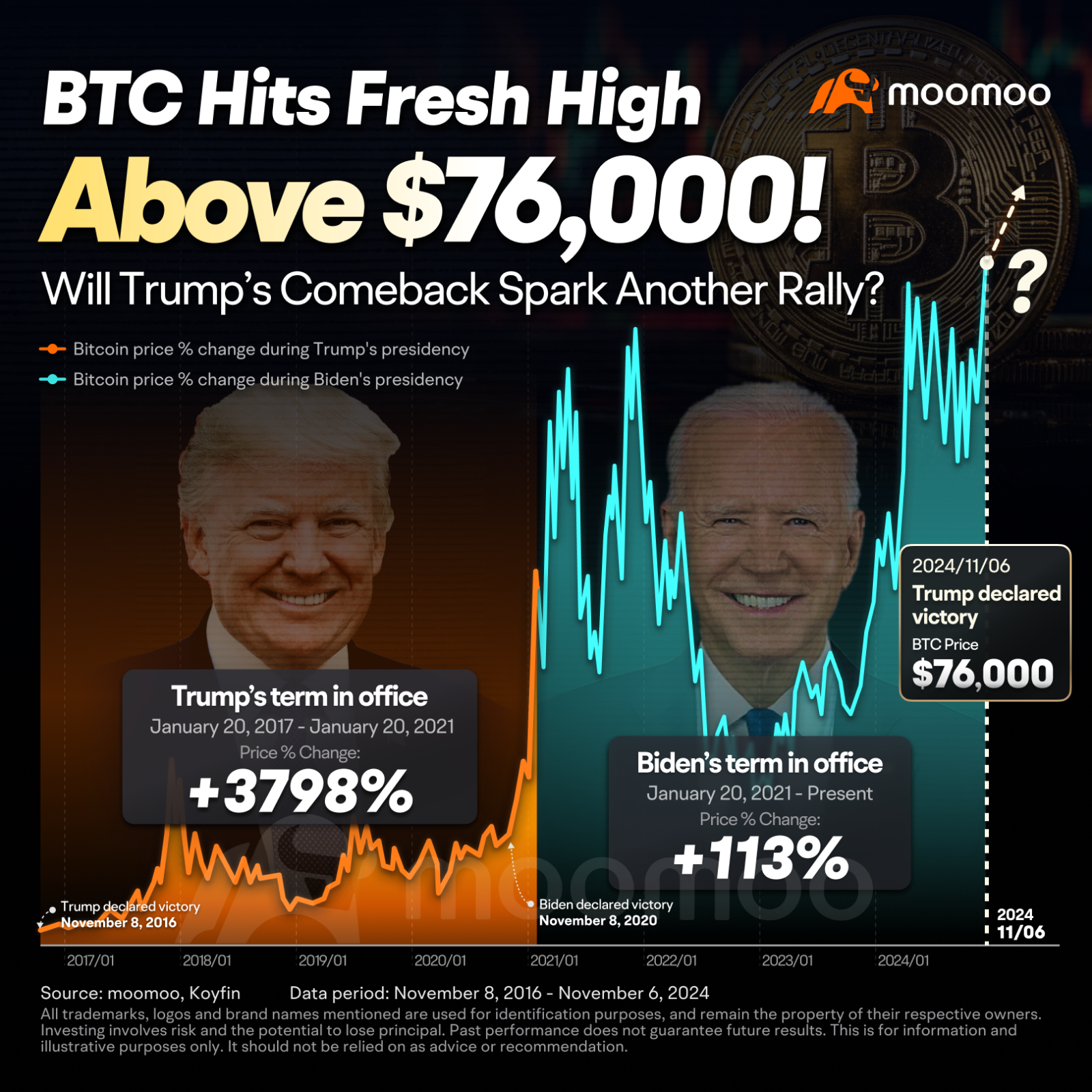

In addition, Fadi Aboualfa, Research Director at Copper.co, pointed out that according to valuation models, Bitcoin could reach $100,000 when Trump is sworn in as president in January. Bernstein Asset Management also released a report predicting that if Trump wins the election, Bitcoin's price will exceed its historical high of $73,800 and might reach the $80,000 to $90,000 range in the following weeks.

Alice Lim choo : good

Xinran1331022 : If you add or buy now. I am sure it will fall

Talented Mr Ripley : World War III is sparked