Will U.S. Tech Stocks Rally Continue Amid Shifting Fed Rate Cut Expectations?

Last week, U.S. stocks displayed significant divergence. The $Dow Jones Industrial Average (.DJI.US)$, dominated by cyclical sectors, fell sharply, while large-cap tech stocks led the $NASDAQ 100 Index (.NDX.US)$ and $S&P 500 Index (.SPX.US)$ indices to continue their upward momentum.

Nvidia Boosts Tech Stocks Again

Last week, $NVIDIA (NVDA.US)$ provided a significant boost to U.S. tech stocks, while the broader market pulled back amid ongoing concerns about high interest rates. This marked a pause in a multi-week rally that had pushed equity indexes to near-record highs, fueled by robust earnings from major technology companies.

The release of FOMC minutes revealed that some members favored maintaining high interest rates for an extended period, which kept U.S. Treasury bond yields close to 4.5%. High bond yields make stocks less attractive compared to bonds and also strengthen the dollar, negatively impacting the earnings of large U.S. companies with significant overseas operations. This contributed to declines in the S&P 500 and Dow Jones indexes.

Conversely, Nvidia reported impressive revenues of $26 billion, exceeding Wall Street's expectations and reinforcing the strong performance of other tech giants like $Microsoft (MSFT.US)$, $Alphabet-A (GOOGL.US)$, $Amazon (AMZN.US)$, and $Meta Platforms (META.US)$. This helped the tech-heavy Nasdaq continue its gains.

The two themes moving the market this week were Nvidia's earnings and the Federal Reserve. The day before Nvidia reporting, the S&P 500 hit an all-time high. Meanwhile, various Fed officials have been telling the market that the central bank plans to keep interest rates higher for longer, which dealt a bit of a blow to the market's confidence that there will be a few rate cuts this year. So, even though Nvidia posted stellar revenue and earnings, the Fed speech pushed the market lower," said Gianmaria Feleppa, CEO of UCapital Fintech Group.

Traders Delay Rate-Cut Expectations

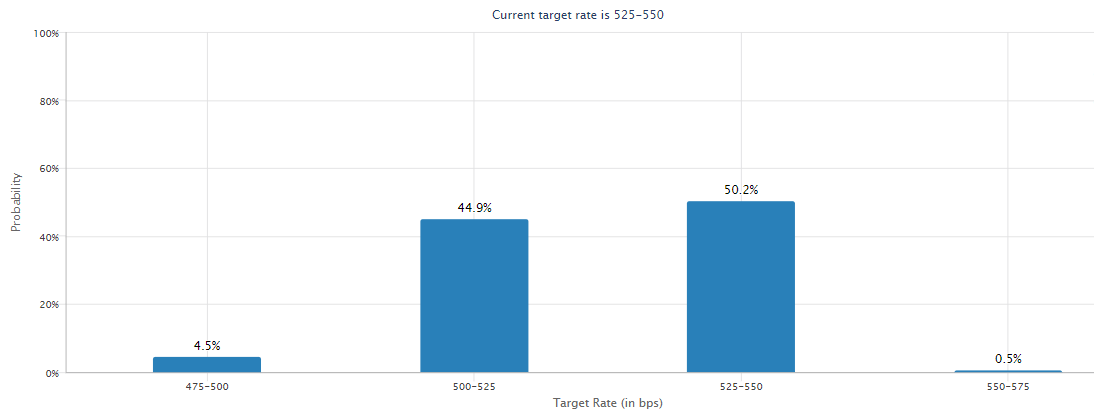

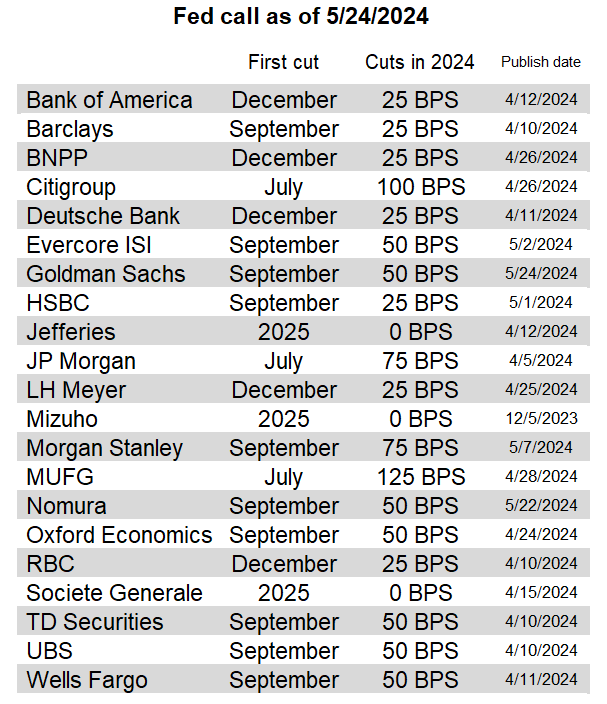

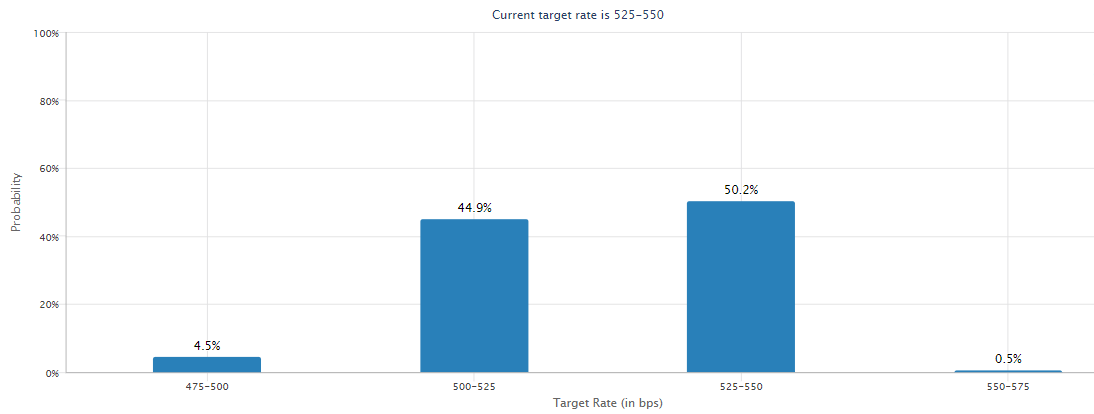

Traders and economists agree that the Federal Reserve is unlikely to cut rates in June and July, but the outlook beyond that is uncertain. According to the CME Group's FedWatch tool, traders now see a 44.9% chance of a rate cut in September, down from 65% a week ago.

Goldman Sachs has also adjusted its forecast, now expecting a rate cut in September. Interestingly, a small number of traders are now considering the possibility of a rate hike due to strong economic data and comments from some Federal Reserve officials. While the chance of a rate hike was zero last week, traders are now pricing in a 1% chance for both the June and July meetings. Fed Chair Jerome Powell has downplayed the likelihood of imminent rate hikes.

Comments from Fed officials suggested that a July cut would likely require not just better inflation numbers but also meaningful signs of softness in the activity or labor market data. After the stronger May PMIs and lower jobless claims, this does not look like the most likely outcome," wrote Goldman Sachs economist David Mericle.

Key Indicators to Watch This Week

This week, two key indicators — the first revision of Q1 2024 GDP and consumer confidence — will shed light on economic growth. Additionally, the Fed's favored inflation gauge, the Personal Consumption Expenditures (PCE) index, will provide insights into inflation trends and the validity of the Fed's high rate policy. Arnim Holzer, Global Macro Strategist at Easterly EAB Risk Solutions, anticipates the Fed will maintain a less dovish stance on interest rates, predicting that the equilibrium rate will rise, leading to increased market volatility and lower multiples.

The VIX is likely to rise, and there's a chance for a retest of EMB downside. Higher rates will benefit sectors with strong balance sheets and less economic sensitivity, such as utilities and healthcare. At the same time, consumer-sensitive firms will struggle due to slower fiscal stimulus and stressed household finances," Holzer said.

Source: CME Group, The Wall Street Journal, IBT, Investopedia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

搞经济 抄底 加仓 : I wonder how long FED gonna play with the rate cut game

or maybe their thinking of the next game plan before they end this.. what would it be.. Treasury again? Oil? USD?

or maybe their thinking of the next game plan before they end this.. what would it be.. Treasury again? Oil? USD?

吴液烦 搞经济 抄底 加仓 : It could be real estate

搞经济 抄底 加仓 吴液烦 : That's right. After walking around, it's almost like real estate in the US

Anthony tan81 : base on the list showing the prediction of the cuts on when![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

surely that mufg is smoking to much hopium

wow 125bp cut on July

come on I think it's more like a wishlist for them too