Will US Stocks Keep Soaring with Cooling Rate Cut Expectations?

Despite facing higher-than-expected CPI and PPI last week and the decreased likelihood of rate cutting in March and May, the U.S. stock market only experienced a slight drop overall last week, which is truly remarkable, especially considering that $S&P 500 Index (.SPX.US)$ and $Dow Jones Industrial Average (.DJI.US)$ reached historic highs.

The resilience of the U.S. stock market can be attributed to several factors, including:

1. Recession Concerns Ease, Trading Focus Shifts to Macro Fundamentals

Interest rate movements can potentially impact equities, but they are not the only concern for stock market investors. The dynamics of the stock market are also strongly tied to the robustness of the U.S. economic landscape.

Since the start of 2024, the U.S. economy has continued to show solid performance, with key economic indicators revealing a still-booming job market. The number of new jobs and wage growth have both exceeded expectations. Despite a recent dip in January's retail sales data, this decline is seen more as a result of transient factors rather than a trigger for recession concerns.

2. Better-Than-Expected Financial Performance

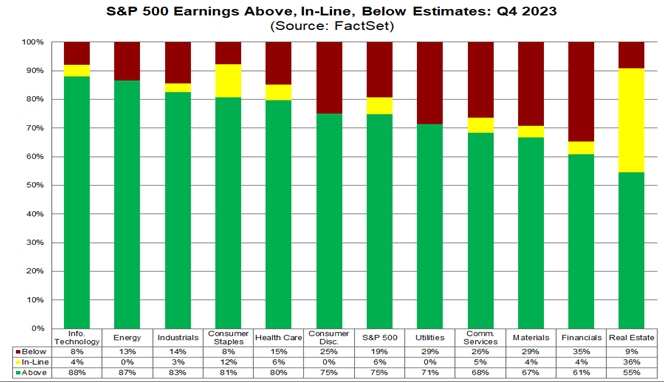

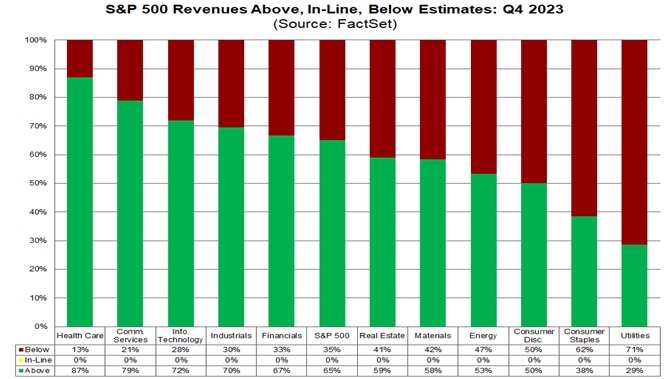

The financial reporting season is drawing to a close, with 79% of S&P 500 companies having released their financial reports by February 16. According to FactSet, 75% of these companies have reported actual EPS above estimates, with overall earnings being 3.9% higher than expected. In terms of revenues, 65% of S&P 500 companies have reported actual revenues above estimates, with overall revenues exceeding estimates by 1.2%.

Looking to the future, analysts are forecasting earnings growth of 3.9% for Q1 2024 and 9.0% for Q2 2024 on a year-over-year basis. For CY 2024, they are anticipating a year-over-year earnings growth of 10.9%.

3. AI Remains an Important Driving Force in the Market

Since the start of this year, AI has remained a core focus of the market, with its performance continuing to impress. Among the Mag 7, except for Nvidia, which has yet to release its financial result, companies such as $Meta Platforms (META.US)$ and $Alphabet-C (GOOG.US)$ have reported impressive results. In addition, tech-stocks like $NVIDIA (NVDA.US)$, $Microsoft (MSFT.US)$, $Super Micro Computer (SMCI.US)$, $Arm Holdings (ARM.US)$ and $Taiwan Semiconductor (TSM.US)$ have experienced an obvious rise in their share prices.

The recent release of Sora by OpenAI has once again captured the market's attention, providing investment opportunities in the AI industry chain.

4. Optimism Spreads Beyond the Mag 7

With growing prospects of a soft landing for the U.S. economy, optimism is mounting for the uptrend in U.S. stocks beyond those tech giants. Notably, the equal-weighted S&P 500 Index, which exhibits a P/E ratio of nearly 16x, representing a 17% discount compared to the benchmark standard valuation.

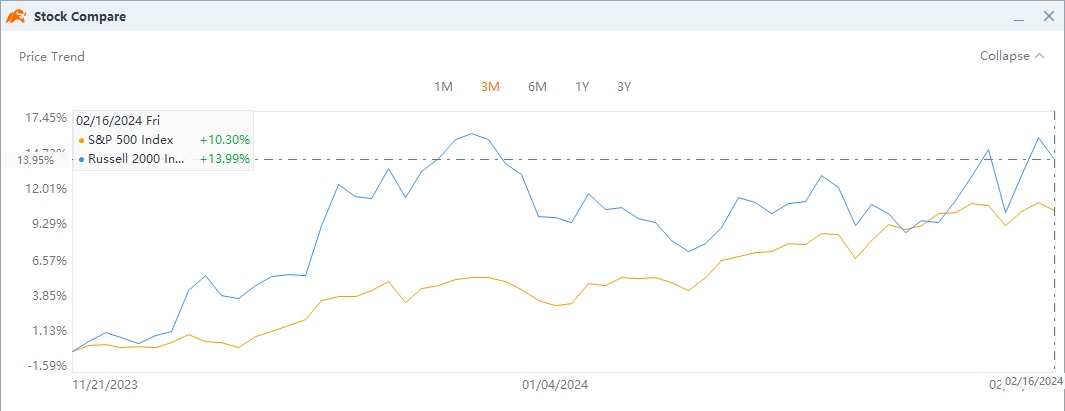

U.S. stocks have diversified beyond a handful of tech heavyweights, with capital flowing into a broader array of industries. Over the past three months, the Russell 2000 small-cap index has outperformed the S&P 500, delivering a performance that exceeds it by 3.69 percentage points.

According to Goldman Sachs analysts, the Russell 2000 index is expected to generate a return of approximately 9% within the next six months and 15% within the next twelve months.

Michael Wilson, who is known for his bearish views on Wall Street, is now predicting that the US stock market will see gains in areas that have not been as popular as the big tech companies that have been the main drivers of the rally until now.

How Will U.S. Stocks Perform in the Future?

Goldman Sachs increased its year-end goal for the S&P 500 benchmark, according to a report released on February 16th by a team led by David Kostin. The new target is 5200, which is roughly a 4% increase from current levels. Previously, the brokerage had predicted that the index would end 2024 at 5100.

Increased profit estimates are the driver of the revision.

In January, BlackRock, the world's largest asset management company, upgraded its outlook for the US stock market from "neutral" to "overweight", stating that,

Markets are pricing a soft economic landing where inflation falls to 2% without a recession. With markets tending to focus on one theme at a time, this narrative can support the rally over our tactical horizon and allow it to expand beyond tech.

By Moomoo News Marina

Source: Barron's, CNBC, FactSet, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

頭等散戶 : Will definitely rise in the major index

頭等散戶 頭等散戶 : I messed up.