$WISeKey (WKEY.US)$ 👀in good here what’s happening ? lets c...

$WISeKey (WKEY.US)$ 👀in good here what’s happening ? lets check out and plan the trade …

Risk Level: 8 (High)

WISeKey presents a high risk level due to its financial instability, characterized by a large retained earnings deficit and unprofitable status, despite positive current stock sentiment and developments. Volatile price movements near the 52-week high could mean potential for significant gains, but also substantial losses. The company's balance between assets and liabilities indicates a strained financial structure, increasing the risk profile for investors. The risk is exacerbated by the fact WISeKey operates in a less attractive sector with limited broad industry attractiveness. As a result, investors should approach with caution, fully aware of potential volatility.

Support and Resistance Levels

Support Level: $3.44, derived from consolidation data, marks a previous foundational price the stock can rely on.

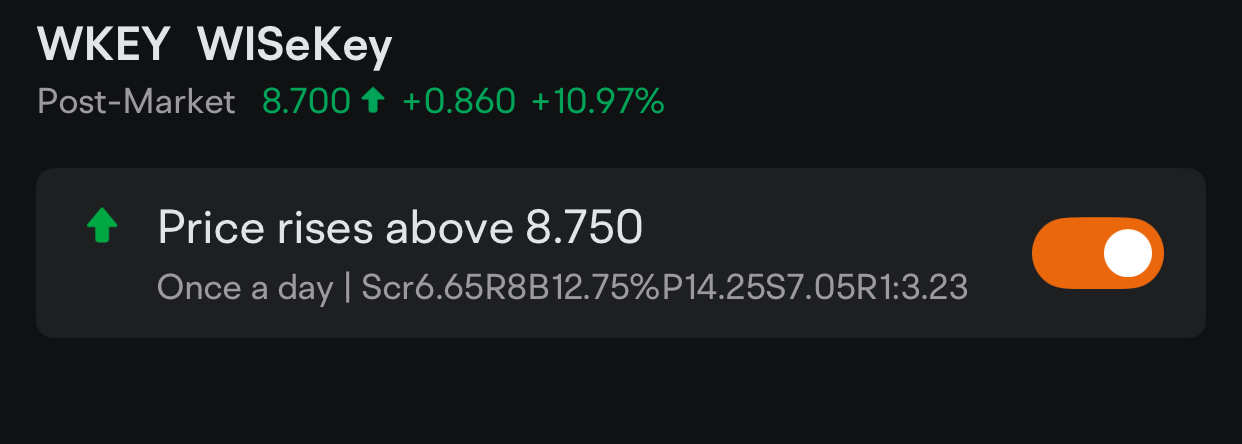

Resistance Level: $8.75, reflecting the 52-week high and recent peak price, acts as a potential ceiling unless a new catalyst pushes past.

Trading Strategy

Given the worksheet score and positive catalysts, a cautious yet opportunistic long trading strategy is advocated. With available equity of $10,000, this entails capitalizing on the current momentum, considering the entry and exit thresholds to harness potential benefits optimizing the risk/reward ratio. The chosen entry price aligns with the present optimal market conditions, expecting it to break past the current support. By setting a profitable exit price that maximizes upward trajectory prospects and a strict stop loss to minimize downside risk, WISeKey presents as a tactical trade opportunity.

Entry Price: $8.75

Profitable Exit Price: $14.25

Stop Loss Price: $7.05

Position Size: 145 shares

Allocation: 12.75% of available equity

Risk/Reward Ratio: 1:3.23

Conclusion

WISeKey's investment viability is highlighted by the strategic satellite partnership, but it's muddled by financial woes and sector appeal. Although WISeKey demonstrates promise in swing trading due to its momentum and robust news influence, its profitability concerns and sector status warrant caution. Traders exploring short-term profits should consider their risk tolerance but focus on a disciplined approach toward the trade plan due to current volatility. Thus, sensible monitoring and realization of news/events and technical indicators are essential.

Final Verdict: Trade

The favorable scoring, boosted by strategic advancements and positive stock momentum, makes WISeKey an attractive swing trade candidate. Its potential for price appreciation exceeds the risks, underscored by recent performance and industry innovations, aligning well with strategic trading plans.

WISeKey presents a high risk level due to its financial instability, characterized by a large retained earnings deficit and unprofitable status, despite positive current stock sentiment and developments. Volatile price movements near the 52-week high could mean potential for significant gains, but also substantial losses. The company's balance between assets and liabilities indicates a strained financial structure, increasing the risk profile for investors. The risk is exacerbated by the fact WISeKey operates in a less attractive sector with limited broad industry attractiveness. As a result, investors should approach with caution, fully aware of potential volatility.

Support and Resistance Levels

Support Level: $3.44, derived from consolidation data, marks a previous foundational price the stock can rely on.

Resistance Level: $8.75, reflecting the 52-week high and recent peak price, acts as a potential ceiling unless a new catalyst pushes past.

Trading Strategy

Given the worksheet score and positive catalysts, a cautious yet opportunistic long trading strategy is advocated. With available equity of $10,000, this entails capitalizing on the current momentum, considering the entry and exit thresholds to harness potential benefits optimizing the risk/reward ratio. The chosen entry price aligns with the present optimal market conditions, expecting it to break past the current support. By setting a profitable exit price that maximizes upward trajectory prospects and a strict stop loss to minimize downside risk, WISeKey presents as a tactical trade opportunity.

Entry Price: $8.75

Profitable Exit Price: $14.25

Stop Loss Price: $7.05

Position Size: 145 shares

Allocation: 12.75% of available equity

Risk/Reward Ratio: 1:3.23

Conclusion

WISeKey's investment viability is highlighted by the strategic satellite partnership, but it's muddled by financial woes and sector appeal. Although WISeKey demonstrates promise in swing trading due to its momentum and robust news influence, its profitability concerns and sector status warrant caution. Traders exploring short-term profits should consider their risk tolerance but focus on a disciplined approach toward the trade plan due to current volatility. Thus, sensible monitoring and realization of news/events and technical indicators are essential.

Final Verdict: Trade

The favorable scoring, boosted by strategic advancements and positive stock momentum, makes WISeKey an attractive swing trade candidate. Its potential for price appreciation exceeds the risks, underscored by recent performance and industry innovations, aligning well with strategic trading plans.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment