With Expectations for a Rate Cut in March Back, Could US Stocks Be Poised for a New Trend?

The United States released two “contradictory” inflation reports last week. The consumer price index increased 0.3% in December and 3.4% from a year ago, compared with respective estimates of 0.2% and 3.2%, which shows inflation still holding a grip on the U.S. economy.

However, the producer price index released last Friday decreased 0.1% for a third straight month - the longest streak since 2020. After that, stock futures pared losses while the two-year treasury yield dropped to the lowest level since May. Traders boosted bets that the Fed will begin cutting interest rates in March.

Obviously, behind the scenes of a rebounding equity market are stubborn signals that anything short of a quick death for inflation spells big trouble for traders.

It's visible in the growing sensitivity of large swaths of the market to bonds, with two thirds of the S&P 500 moving in unison with yields – doing better when rates fall and vice versa. That's the most since 2001, according to Societe Generale SA data.

Notes: The estimate is based on a five-year rolling correlation to 10-year Treasuries

At the heart of the matter for equities are valuations, whose expansion last year has left them especially vulnerable to unforeseen outcomes in the path of Fed policy. Wall Street bulls who powered a massive rally to close out 2023 have little room for error should inflation prevent Powell from easing policy significantly in the coming months.

“Without bond yields going down a large chunk of the market has a significant valuation headwind,” said Andrew Lapthorne, SocGen's head of quantitative research. “We have a lot of market capitalization that is expensive, and this is creating a positive correlation to bonds.”

But it's worth noting that last week, several Federal Reserve officials poured cold water on the market's expectations for aggressive rate cuts within the year. Count Loretta Mester among those who think it’s premature to consider cutting interest rates at the March meeting. The Fed Bank of Cleveland president said last Thursday that inflation data suggests policy makers have more work to do.

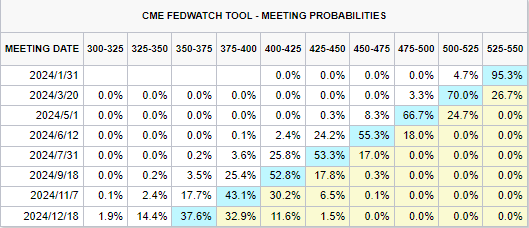

Despite that, traders are currently pricing in around six quarter-point rate cuts for this year -double than what the central bank projects - and betting that the first-rate reduction may come as early as March. Moreover, Barclays Plc. shifted its forecast for first interest-rate cut from June to March last Friday.

As traders tank up on risky stocks, bonds and credit, any hawkish warnings now sound increasingly jarring, yet their potential impact and risks grow by the day.

What should we focus on next?

Earnings season is just around the corner

A double-digit stock rally led by megacaps in 2023 means an ever-enlarging chunk of the benchmark index is acutely tied to long-term earnings prospects — and hence more sensitive to rising yields. Therefore, the ability of companies to deliver greater earnings surprises during earnings season is critical to supporting a continued rally in the stock market.

Inflation progress in focus

Fed officials face a bumpy path bringing inflation back to the 2% target. “Last Thursday’s CPI report demonstrates that while inflation is broadly in retreat, the pace of that retreat is slowing,” Michael Purves, the founder of Tallbacken Capital Advisors, wrote in a note. “The bar for cuts is simply a lot higher than it might have appeared after the December FOMC.”

So Mooers, what are your thoughts on when the Fed might cut rates this year? And which stocks are you predicting to shine during the earnings season?

Source: Bloomberg, CNBC, S&P 500

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 19

19

74126981 : I just want to know when to cut interest rates

103564118 : inflation is caused by high cost of services not products. that is why CPI increased.

BiggSlimm : I feel like that hotter than expected CPI report was a fluke, although I do believe March may be just a hair too soon. My guess is May.