With Rising Costs and Peak Foot Traffic, Restaurant Industry Might Face More Challenges Ahead

■ Restaurant Industry is generally stable but has an uncertain outlook for the economy

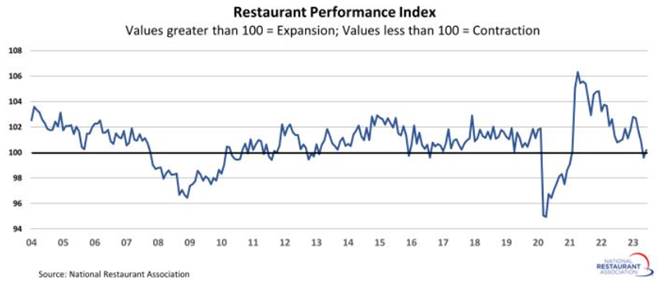

The National Restaurant Association's Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of the U.S. restaurant industry – stood at 100.2 in June. The data was released on July 31st.

The RPI is measured in relation to a neutral level of 100. While the overall RPI nudged back above 100 after a one-month dip into contraction territory, Restaurant operators remain much less bullish about the economy.

■ Mixed performance for restaurant stocks

Among the stocks in the S&P Supercomposite Restaurants index, sixteen of the twenty-two rose in the first half of 2023, with Shake Shack (71.3%), Chipotle (46.5%) being the top performers. However, Papa John's (down 9.5%) and Dine Brands (down 8%) experienced the biggest declines. The index's six major members include McDonald's (43% weighting), Starbucks (23%), Chipotle (11%), Yum! (8%), and Darden (4%).

■ Americans' wages are finally outpacing inflation.

The trend of more than two years of real income (adjusted for inflation) declines was reversed this year.Annual real weekly wages were up 0.2% in May and 0.6%in June.

■ Total menu pricing exceeds commodity and labor inflation, boosting margins

Bloomberg consensus calls for average same-store sales growth of 5.6% and operating margin of 16.3% in 2023 for the restaurant companies.

■ Tech, Delivery Can Ease Discount Dependence

Fast-food chains can leverage delivery and technology to attract convenience-seeking diners and reduce the need for discounting. With digital menu boards, kiosks, and mobile-order and pay apps, customers can easily access menus and place orders, leading to larger check averages. In addition, mobile apps like those from Domino's and Starbucks provide valuable customer data that can be used for personalized marketing campaigns with higher returns on investment compared to traditional advertising methods. The convenience of delivery also prompts customers to pay premium prices for their orders, further boosting sales performance.

■ Loyalty Programs Drive Customer Frequency

Implementing robust loyalty programs can help restaurants drive digital engagement, gather valuable customer data, and increase same-store sales and market share. Successful examples include Chipotle, whose loyalty program attracted 33 million members since 1Q19 and effectively converted them into app users for other channels like order-ahead and white-label delivery. Similarly, Domino's 28 million loyalty members provide rich customer data to send targeted digital offers, invitations, and reminders based on dining frequency, leading to increased effectiveness. Starbucks' active rewards members, totaling 30.8 million, contributed to 57% of US sales in fiscal 2Q. The company aims to reach 40 million US members in the long term. Other fast-food chains like Burger King, Jack in the Box, KFC, Taco Bell, and Wendy’s have launched or revamped their own rewards programs in recent years.

■ 10% pay increase for fast-food workers since last year

Fast-food workers saw their pay increase by 10% compared to last year, while full-service hourly staff are now up 12.5% from an extremely rocky 2020. Not only was it the largest increase in decades, it brought average overall food-service wages above $15 per hour for nonsupervisory employees, according to Bureau of Labor Statistics data.

Shake Shack and Cheesecake Factory have the highest percentage of company-owned units in states that are raising the minimum wage.

■ Traffic dropped since more people chose to eat at home

The Bureau of Labor Statistics said July restaurant industry price increases (7.1% annualized) outpaced retail food (3.6%) for the third straight month. That could motivate consumers to eat at home more often.

In general, the current restaurant industry is facing economic uncertainties. However, some companies with more significant cost reduction and efficiency enhancement and stronger customer acquisition capabilities will still maintain long-term competitive advantages and stand out.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

RDK79 : Time to go out to eat :))