Xiaomi enters the electric vehicle market, and its unique advantages help long-term development. What is the future trend of the stock price?

summary

Xiaomi's entry into the electric vehicle market has achieved initial results. With industry growth and Xiaomi's competitive advantage, the long-term prospects are bright.

Technology is a rapidly changing industry, but Xiaomi's unique market position is difficult to replicate, and similar competitors are unlikely to emerge in the foreseeable future.

For companies that have a competitive edge in high-growth industries, their valuations don't seem high.

Smartphone manufacturer Xiaomi (OTCPK: XIACF) (OTCPK: XIACY) is the only major smartphone manufacturer in the world with an electric vehicle business, and the electric vehicle industry has huge long-term growth prospects. For a company with a competitive advantage in an industry with long-term growth prospects, Xiaomi's current valuation is not high, which is worth paying attention to.

backgrounds

Xiaomi is known for its competitive smartphones, which offer high specs at a relatively affordable price. Additionally, Xiaomi has an extensive ecosystem of devices, including wearables, TVs, and hundreds of other household devices such as lamps, air conditioners, washing machines, refrigerators, and robot vacuums, which can be controlled remotely via Xiaomi smartphones. In less than 20 years since its establishment, Xiaomi has become the third-largest smartphone supplier in the world (after established companies Samsung and Apple). As of fiscal year 2023, Xiaomi's revenue was close to $40 billion (an average annual growth rate of more than 15% over the past eight years). Although hardware margins were initially limited to 5%, overall profit margins continued to grow thanks to strategies focused on high-end and high-margin after-sales service; gross margin increased from 4% in FY2015 to 21% in the most recent fiscal year (ending December 2023). Despite significant investment in R&D, which increased from 2% in FY2015 to 7% in FY2023, the operating margin increased from a negative value eight years ago to 6% in the most recent fiscal year.

Electric vehicles are a new long-term growth opportunity

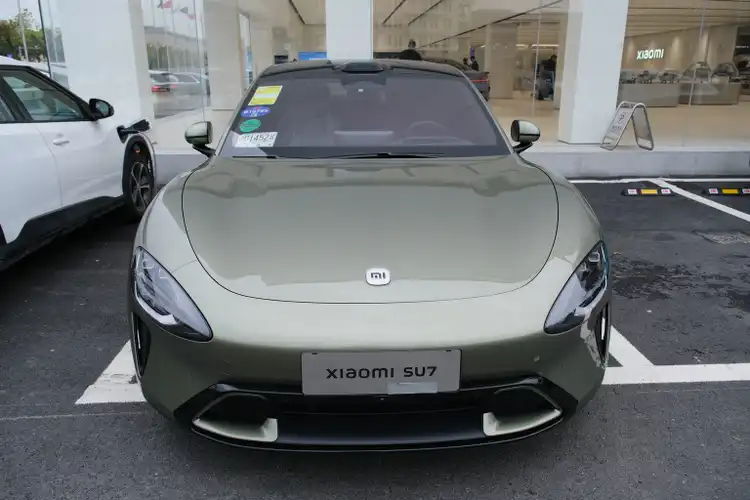

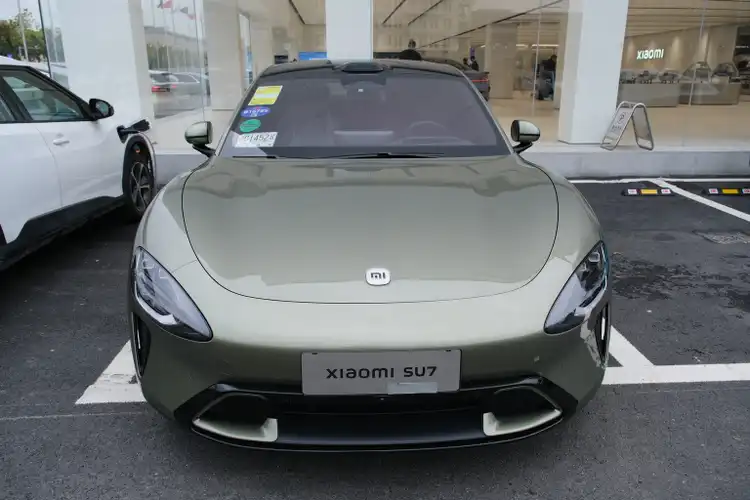

Xiaomi recently entered the electric vehicle sector, completed CEO Lei Jun's “Man and Car Owner” smart ecosystem strategy, and is expected to support Xiaomi's continued revenue and profit growth. Although China's electric vehicle market is already quite saturated and competitive (and the price war is still ongoing), Xiaomi still has some advantages and can get a share of this growing market. Xiaomi is the only player that offers a unique ecosystem of hardware and software built around its smartphone and internal operating system, which gives it an edge over electric car rivals when it comes to smart cockpits. For example, Xiaomi's new electric vehicle SU7 supports more than 1,000 Xiaomi smart home devices, allowing Xiaomi owners to control household appliances directly from within the car (such as turning on the lights at home) before returning home. Furthermore, Xiaomi is a household name in many countries, which gives it a marketing advantage over less well-known electric vehicle competitors.

Xiaomi's electric vehicle marketing strategy involves attracting users who have already invested in the Xiaomi ecosystem. The starting price of the Xiaomi SU7 is 215,000 yuan, which is more expensive than BYD, but about 30,000 yuan lower than Tesla. The value proposition of the Xiaomi SU7 is similar to the positioning strategy of its smartphone business, namely high specifications and an affordable price. Xiaomi management claims that the SU7 surpasses Tesla in terms of cruising range (SU7 is 700 km, while Tesla Model 3 is 567 km). However, the Xiaomi SU7 still needs to catch up. For example, it lags behind Tesla in terms of autonomous driving capabilities. The company believes it will take 3-5 years to close the gap. Despite this, the SU7 sold out within 24 hours, receiving 90,000 orders (in comparison, Tesla sold around 600,000 vehicles in China in 2023), which shows that the company's strategy resonated well with the target market.

As a result, although a latecomer in a highly competitive industry, Xiaomi's electric vehicles still look promising to seize important long-term growth opportunities. In China, the world's largest electric vehicle market, internal combustion engine vehicles still account for a large share (slightly less than half) of total vehicle sales, leaving considerable room for electric vehicle sales to grow. Bloomberg estimates electric vehicle sales in China will grow 20% this year. Elsewhere, SU7 may be expected to gain market share in some countries in Europe and Southeast Asia. For example, in Spain and Southeast Asia, where Xiaomi has a significant share of the smartphone market (Xiaomi is the leading smartphone brand in Spain with a market share of 28%, ranking third in Southeast Asia, with a market share of about 15%), electric vehicle sales in these regions are on the cusp of rapid growth. Consumers in these markets usually focus on value for money, and Xiaomi is one of the most advantageous companies in this regard.

Competition is intense, but similar rivals are unlikely to emerge in the near future

Among the world's major smartphone manufacturers, Xiaomi is the only company that has a viable electric vehicle product so far. Apple (AAPL) stopped the car project after ten years of development, Samsung (OTCPK: SSNLF) has just started their car project, and the company signed a cooperation agreement with Hyundai in January of this year. Huawei has an emerging electric vehicle business, but due to US sanctions, their smartphone business outside of China is currently relatively limited. Compared with international smartphone manufacturers, Xiaomi's advantage in electric vehicles is partly its supply chain advantage in China, which occupies a very important position in the electric vehicle manufacturing supply chain from batteries to rare earth processing capabilities. In the foreseeable future, it seems unlikely that a similar competitor will emerge and pose a threat to Xiaomi's market.

Electric vehicles open up a further path for service business growth

Xiaomi's SU7 follows a strategy similar to its smartphone products, where hardware is sold at low margins, which are offset by more profitable service revenues. Although the SU7 is currently being sold at a loss, it may be possible to reach break-even as sales increase. At the same time, higher service revenue margins can offset short-term losses while boosting long-term revenue and profit growth. As a reference, as of the first quarter of 2024, about half of Apple's revenue comes from services, and services only account for about one-tenth of Xiaomi's revenue, which shows that there is plenty of room for growth. In particular, Xiaomi targets high consumer groups while implementing a high-end strategy.

valuing

According to the latest investor report, Xiaomi's share of the smartphone market in China is 14%. Bloomberg estimates that China's electric vehicle sales this year will be around 10 million units, an increase of 20% over the previous year. Assuming that Xiaomi accounts for about 5% or 500,000 of China's electric vehicle market share with its cheapest models in the medium term, the company could add about $14 billion in additional revenue to its revenue, or about 35% higher than the revenue of about $39 billion in 2023. In three years, this translates into an annual growth rate of about 14%, which is not unrealistic. At this point, they may still be slightly at a loss (Tesla's sales volume in China is around 600,000 units; it is estimated that the company will achieve break-even after recent price cuts; the cheapest model sells for around 250,000 yuan).

It is conservatively assumed that Xiaomi's net profit margin falls slightly to 4%, which means net profit of about $2 billion, while the expected price-earnings ratio is 28 billion US dollars, which means that the market value at the end of the three-year period will be 72 billion US dollars, or an increase of more than 7% per year from the current market value of 58 billion US dollars. Considering that Xiaomi still has huge growth potential in the international market (Apple's current price-earnings ratio is 29 and Tesla's is 70), the expected price-earnings ratio of 28 does not seem excessive. This not only supports further growth, but also continues to increase profitability through economies of scale and expanding service revenue.

From this perspective, Xiaomi is worth investors' consideration. If investors want to enter the market, they can regularly monitor relevant stock prices on the new multi-asset trading wallet BiyaPay and buy or sell stocks at the right time. It can not only deposit USDT to trade Xiaomi related US stocks and Hong Kong stocks, but also deposit USDT to withdraw US dollars and Hong Kong dollars to bank accounts, and then withdraw fiat money to invest in other securities.

risks

The US imposes 100% tariffs on Chinese electric vehicles, but at this stage, the impact on Xiaomi is limited because Xiaomi has almost no presence in the US, whether it's a smartphone or electric car (in this regard, the US hardly imports Chinese electric vehicles), and probably won't have any significant presence in the US in the foreseeable future. However, if other countries impose tariffs on Chinese electric vehicle imports, Xiaomi's overseas growth prospects may be limited to its domestic market, which may affect its valuation. Furthermore, Xiaomi faces fierce competition from Huawei, which also has an IoT ecosystem spanning smart home devices, smartphones, and electric vehicles.

conclusions

Analysts currently have a positive attitude towards Xiaomi, the only major smartphone manufacturer that has successfully entered the competitive electric vehicle market. Its unique competitive advantage enables it to occupy a position in a competitive yet rapidly growing market. This position is unlikely to be jeopardized in the short term, which should allow Xiaomi to establish sufficient scale and drive profits through more profitable service revenue. Furthermore, its valuation is not high, and the stock is less risky, so it can be a good investment choice for investors with high risk tolerance.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment