Zscaler (ZS) Cloud SD-WAN Primary Revenue Contributor To Watch

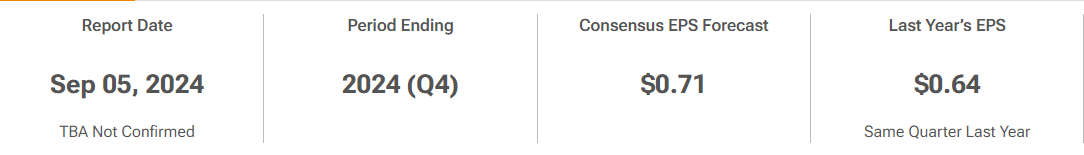

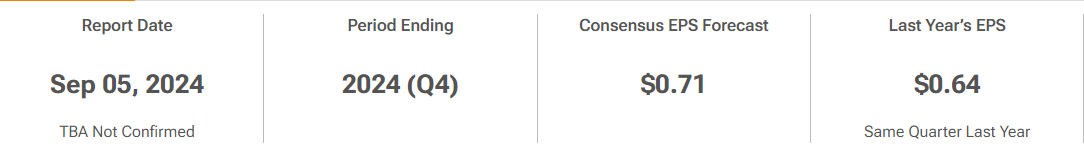

$Zscaler (ZS.US)$ is scheduled to report its quarterly result on 03 Sep 2024 for the period ending 31 July 2024 after the market close.

Zscaler is expected to show a rise in quarterly revenue of 24.8% increase in revenue to $567.933 million from $455.01 million a year ago. This is higher than the figure provided in Zscaler’s guidance on 30 May 2024 for the period ended 31 July where revenue was between 565.00 million and 567.00 million.

The consensus EPS forecast was also higher at 71 cents per share than the EPS guidance on 30 May 2024 which was between 0.69 and 0.70.

Sustained Robust Demand For Zscaler Security and Networking Solutions Expected

Zscaler’s fourth-quarter results are expected to reflect the sustained robust demand for its security and networking solutions, given the continuous growth in the global security space. The solid adoption of ZS’ in-cloud security platform, Zero Trust Exchange, due to the ongoing digital transformation across enterprises and the rising trend of hybrid work is likely to have acted as key catalysts.

Zscaler projects non-GAAP income from operations between $107 million and $109 million. The company’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 33.4%.

Software-Defined Wide Area Network (SD-WAN) Adoption Key To Zscaler Revenue Contribution

The growing adoption of Software-Defined Wide Area Network (SD-WAN) solutions may have acted as a primary driver in the fiscal fourth quarter.

Per the latest Global Market Insights report, the market size for SD-WAN solutions and products is expected to reach $69 billion by 2032 from $7.2 billion in 2023, witnessing a CAGR of 27%. As there are only a handful of vendors that offer security and SD-WAN solutions, ZS has been benefiting from the increasing opportunities in this space. The company’s partnerships with VMware and Silver Peak have been helping the company secure SD-WAN deliveries. This is expected to have aided Zscaler’s fiscal fourth-quarter performance.

Zscaler Market Share On Cloud Should Increase

Based on the end use, the on-premises segment held approximately 70% of the market share in 2023 and is projected to grow by 2032. WAN solutions offer scalability and flexibility, some businesses, particularly those with stringent security and compliance requirements, prefer to keep critical network functions and data on-premises. This desire for control stems from concerns about data privacy, regulatory compliance, and the need to maintain uninterrupted access to mission-critical applications and services, especially in industries such as finance, healthcare, and government.

On-premises SD-WAN solutions provide organizations with the autonomy to customize and optimize their network architecture according to their specific requirements while ensuring greater visibility, security, and reliability over their network traffic and data. We should be seeing more organization exploring the cloud solutions as most workloads are slowly migrating to the cloud.

Solutions On Global SD-WAN growing

Estimate for fourth-quarter revenues from Channel Partners and Direct Customers is pegged at $517.2 million and $48.2 million, respectively. The remaining performance obligation at the end of the fourth quarter to be approximately $3.86 billion is expected.

Nevertheless, growing investments to improve sales and marketing (S&M) capabilities and higher research and development (R&D) costs may have weighed on the company’s fiscal fourth-quarter bottom line. Zscaler witnessed a year-over-year increase of 17.3% in non-GAAP S&M and 29.1% in non-GAAP R&D expenses in the last reported quarter. Total non-GAAP operating expenses climbed 22.2% year over year in the last reported quarter.

Zscaler (ZS) Price Target Forecast

Based on 31 Wall Street analysts offering 12 month price targets for Zscaler in the last 3 months. The average price target is $232.04 with a high forecast of $290.00 and a low forecast of $180.00. The average price target represents a 16.03% change from the last price of $199.98.

If we were to look how ZS have been trading, its stock price is near its previous earnings highs, so we need an exceptionally positive earnings before we see a significant move in the stock price.

Zscaler (ZS) Year-To-Date Returns

Though there have been pretty positive long term forecast on ZS earnings and their product growth, but investors have suffered a less than 10% loss in stock price year to date.

I am expecting ZS to show in its upcoming earnings that they have the capacity to drive the product portfolio expansion, and also to capture more customer for its cloud based SD-WAN.

I will be monitoring this stock as the current stock price looks like a potential entry.

Zscaler (ZS) Technical (MACD and KDJ)

If we were to look at the MACD and KDJ, ZS is showing potential of an upside prior to its earnings, though we are seeing buying demand picked up, but I would think investors would be interested to know how much revenue have SD-WAN generated? Compared to the R&D cost spend, we could be also seeing a rise in their operating expenses.

So a positive and better-than-expected revenue and lower operating expenses should help ZS get back confidence from the investors.

Summary

Zscaler will be facing competitions from bigger player like Cisco on its SD-WAN, so their core products expansion as well more customer acquisition might help ZS to provide a better guidance for the year.

I am expecting a higher operating expenses, so we might not see a very high profit but we might see more orders for its SD-WAN with the growth of solutions deployed into cloud.

Appreciate if you could share your thoughts in the comment section whether you think ZS should be able to grow their customer acquisition on the cloud as more and more organization move their solutions to the cloud?

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment