たんさん_1183

liked

If living in modern times,there is often a tendency to be dominated by material desires.andThe desire for Goldis also something that can often take control over our lives.

For example, when in elementary school,when you were in elementary school,having 0.05 million yen a month would have been quite exciting.

You could easily buy your favorite Gaming and toys.

However, as you reach your 20s and 30s, you can no longer be satisfied with 0.05 million, 0.1 million, 0.2 million, or 0.3 million.

That's why.OrdinaryIt is because of that.

The reason I have been saying for a long time thatmoney is not importanthas this kind of meaning.

No matter how much is earned, or how many favorite things are bought,satisfaction cannot be achieved.。

Next, if there are no more desired items,a sense of losswill torment.

The reason modern people cannot be happy isTimebecause they invest resourcesin making money.

Doing work that they don't want to do and find boring,their own time.Using it means that no matter how much is earned, happiness cannot be achieved.

There must be a purpose in making investments.If the goal is to generate income,it becomes quite difficult to earn continuously.

Currently, the market is favorable, but Stocks arecyclical.The period of stagnation or decline is longer when viewed.

Investing is enjoyable.And, also, it can make money. That would be good, but,

If the thought is that investing is fun because it can make money, ...

For example, when in elementary school,when you were in elementary school,having 0.05 million yen a month would have been quite exciting.

You could easily buy your favorite Gaming and toys.

However, as you reach your 20s and 30s, you can no longer be satisfied with 0.05 million, 0.1 million, 0.2 million, or 0.3 million.

That's why.OrdinaryIt is because of that.

The reason I have been saying for a long time thatmoney is not importanthas this kind of meaning.

No matter how much is earned, or how many favorite things are bought,satisfaction cannot be achieved.。

Next, if there are no more desired items,a sense of losswill torment.

The reason modern people cannot be happy isTimebecause they invest resourcesin making money.

Doing work that they don't want to do and find boring,their own time.Using it means that no matter how much is earned, happiness cannot be achieved.

There must be a purpose in making investments.If the goal is to generate income,it becomes quite difficult to earn continuously.

Currently, the market is favorable, but Stocks arecyclical.The period of stagnation or decline is longer when viewed.

Investing is enjoyable.And, also, it can make money. That would be good, but,

If the thought is that investing is fun because it can make money, ...

Translated

11

1

たんさん_1183

commented on

$BigBear.ai Holdings (BBAI.US)$

Why does everyone.

Want to Buy Big Bear AI?

Is it because there is a lot of expectation?

Or, if there is anything, please let me know 😯.

Why does everyone.

Want to Buy Big Bear AI?

Is it because there is a lot of expectation?

Or, if there is anything, please let me know 😯.

Translated

1

8

たんさん_1183

liked

Columns About stock "Education"

Recently, the two posts I made each gathered about 100 likes, which makes me feel good like a Buddha.

The kanji for 'Buddha bear suffering' is written as "Bookmark". The bear market is tough, so it expresses the stance of maybe preaching when there's time.

However, today's preaching is the last one. There is a saying that even the Buddha's face can only be seen three times. I am kind, but I am not a good person. One must discard a gentle nature in the process of improving trading skills. Trading is essentially a denial of others' entries/exits. "To take profit here, you are wrong." "To cut losses here, you are wrong," in other words, it is about finding the major mistakes of others.

The stance behind discovering extraordinary stocks is a simple one: "mediocre stocks don't matter." In competitive gaming communities, there are often top players who say about those in the top 1%, "that guy isn't impressive at all." Statistically, this perception is incorrect and the standards are too high, but the attitude of only evaluating the top 0.1% is something that should be held in stocks. However...

The kanji for 'Buddha bear suffering' is written as "Bookmark". The bear market is tough, so it expresses the stance of maybe preaching when there's time.

However, today's preaching is the last one. There is a saying that even the Buddha's face can only be seen three times. I am kind, but I am not a good person. One must discard a gentle nature in the process of improving trading skills. Trading is essentially a denial of others' entries/exits. "To take profit here, you are wrong." "To cut losses here, you are wrong," in other words, it is about finding the major mistakes of others.

The stance behind discovering extraordinary stocks is a simple one: "mediocre stocks don't matter." In competitive gaming communities, there are often top players who say about those in the top 1%, "that guy isn't impressive at all." Statistically, this perception is incorrect and the standards are too high, but the attitude of only evaluating the top 0.1% is something that should be held in stocks. However...

Translated

79

5

7

たんさん_1183

liked

$BigBear.ai Holdings (BBAI.US)$

The buying pressure is reverting, the buying is strong, a complete reversal is unlikely, but please keep above 2.86.![]()

The buying pressure is reverting, the buying is strong, a complete reversal is unlikely, but please keep above 2.86.

Translated

6

6

たんさん_1183

liked

$E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$

$Bitcoin (BTC.CC)$

Based on the previous economic Indicators, CPI is gradually declining, employment is also healthy, PPI has remained almost flat compared to the previous month, retail revenue will be reported next week, but regarding retail, various consumer sentiments may have fluctuated due to tariffs, so it might be wise not to over-rely on the most recent data. The finances of American households are stable; hence, regarding consumption, looking at the ISM non-manufacturing numbers, the service industry, which accounts for 70% of the whole, is robust and inflation is calming down, so the possibility of worsening is low. Therefore, the real GDP growth rate is unlikely to show negative growth in the future, and there is no sight of recession, so there are no worries.![]()

Since there is no data indicating a negative surprise for the FOMC, it is not surprising that the market is starting to move in earnest ahead of the FOMC.

The market has already priced in that there will be almost no interest rate cuts, and since Powell has already stated that the economy is strong, I don't think any economic Indicators released afterwards will change that outlook.

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$

$Bitcoin (BTC.CC)$

Based on the previous economic Indicators, CPI is gradually declining, employment is also healthy, PPI has remained almost flat compared to the previous month, retail revenue will be reported next week, but regarding retail, various consumer sentiments may have fluctuated due to tariffs, so it might be wise not to over-rely on the most recent data. The finances of American households are stable; hence, regarding consumption, looking at the ISM non-manufacturing numbers, the service industry, which accounts for 70% of the whole, is robust and inflation is calming down, so the possibility of worsening is low. Therefore, the real GDP growth rate is unlikely to show negative growth in the future, and there is no sight of recession, so there are no worries.

Since there is no data indicating a negative surprise for the FOMC, it is not surprising that the market is starting to move in earnest ahead of the FOMC.

The market has already priced in that there will be almost no interest rate cuts, and since Powell has already stated that the economy is strong, I don't think any economic Indicators released afterwards will change that outlook.

Translated

28

3

たんさん_1183

commented on

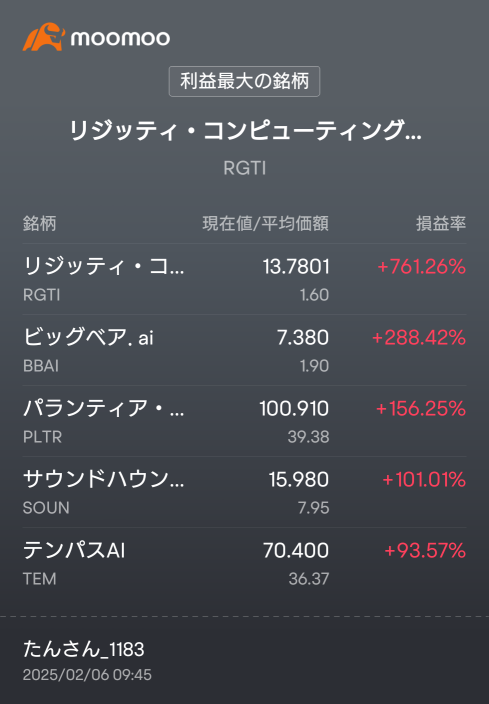

I have entered the fifth month since starting in September last year. I have hardly changed my stock selection, and only added to my positions when the Tempus stock price dropped.

I still have a lot to learn about Candlestick patterns and such, but I will continue to hold with a strong grip 🤣

(I just don't know the timing for taking profits lol)

I hope to continue doing my best while referring to everyone's posts in the future.

I still have a lot to learn about Candlestick patterns and such, but I will continue to hold with a strong grip 🤣

(I just don't know the timing for taking profits lol)

I hope to continue doing my best while referring to everyone's posts in the future.

Translated

loading...

75

10

たんさん_1183

commented on

たんさん_1183

liked

♦️ March 19 (Wednesday) Keynote Speech on Leather Jackets

♦️ March 21 (Friday) Quantum Day

♦️ March 21 (Friday) Quantum Day

Translated

8

. It's the company's fifth year, so it might be good to hold on patiently.

. It's the company's fifth year, so it might be good to hold on patiently. .

.

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)