$The Glimpse (VRAR.US)$

One week after the insider buying information. Only regret is not buying wholeheartedly!

One week after the insider buying information. Only regret is not buying wholeheartedly!

Translated

11

なー0056

liked

$C3.ai (AI.US)$ I see, so the financial results failed, huh. It's going to be a long journey again.

Translated

5

なー0056

liked

I apologize for the lengthy text.

Although it may be an eyesore compared to senior colleagues, I will reflect on this year with self-examination and repentance.

I found quantum and AI-related stocks in books, selected them while weaving fantasies, and since I don't understand quantum, I bought all of them and then evaluated their strengths and weaknesses.![]()

Last fall to early this year, amidst buying Quantum and AI, AI suddenly hit the mark, unable to take profits cleanly, and the quantum sector hit rock bottom in the summer.![]()

In addition, I was late to the ETF market.![]()

Nevertheless, it was good that all types of quantum were bought, with the thickest RGTI taking off first (although partial profits were poorly timed).

It was disappointing not to be able to buy ARQQ through the merger, but the field of quantum cryptography should be essential, and I hope that venture companies will continue to strive. Don't lose to the major players.![]() I want to promote it somewhere.

I want to promote it somewhere.

After the merger, you were down by 60%.![]() It's still around $1 before the merger, so there is still a long way to go, right?

It's still around $1 before the merger, so there is still a long way to go, right?

When QUBT avoided delisting, I was delighted as if it were my own child.![]()

You entered at 0.7 and kept it in limbo, but if it had been merged, it wouldn't have risen this much, you did well.

Quantum computing, in my personal opinion, should be a noteworthy hardware technology when combined with ions and put into practical use...

Although it may be an eyesore compared to senior colleagues, I will reflect on this year with self-examination and repentance.

I found quantum and AI-related stocks in books, selected them while weaving fantasies, and since I don't understand quantum, I bought all of them and then evaluated their strengths and weaknesses.

Last fall to early this year, amidst buying Quantum and AI, AI suddenly hit the mark, unable to take profits cleanly, and the quantum sector hit rock bottom in the summer.

In addition, I was late to the ETF market.

Nevertheless, it was good that all types of quantum were bought, with the thickest RGTI taking off first (although partial profits were poorly timed).

It was disappointing not to be able to buy ARQQ through the merger, but the field of quantum cryptography should be essential, and I hope that venture companies will continue to strive. Don't lose to the major players.

After the merger, you were down by 60%.

When QUBT avoided delisting, I was delighted as if it were my own child.

You entered at 0.7 and kept it in limbo, but if it had been merged, it wouldn't have risen this much, you did well.

Quantum computing, in my personal opinion, should be a noteworthy hardware technology when combined with ions and put into practical use...

Translated

loading...

39

5

なー0056

liked

Quickly sell at the morning high price‼️

Translated

3

1

なー0056

commented on

なー0056

liked

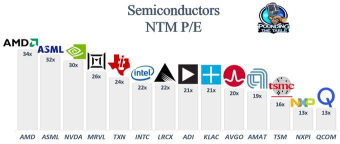

AI chip market will be one of the top growing markets, with a 50% CAGR to ~$300B by 2030 -- let's delve into the world of semiconductors, exploring the competitive moats of each top player & examining where they stand based on the NTM P/E ratio 👇

$Advanced Micro Devices (AMD.US)$ (Advanced Micro Devices)

• Competitive Advantage: Their key innovator in high-performance computing and graphics technologies, leveraging their Ryzen and EPYC processors to disrupt the market with high-caliber...

$Advanced Micro Devices (AMD.US)$ (Advanced Micro Devices)

• Competitive Advantage: Their key innovator in high-performance computing and graphics technologies, leveraging their Ryzen and EPYC processors to disrupt the market with high-caliber...

13

5

なー0056

liked

It's the old Raytheon $RTX Corp (RTX.US)$ and Japanese heavy equipment stocks $IHI (7013.JP)$ The decline in decline is tremendous...

Both are stocks I was considering investing in at a reasonable timing, but I'm afraid it's uncertain how much loss will be due to aircraft engine failure 💦

https://newswitch.jp/p/38482

Both are stocks I was considering investing in at a reasonable timing, but I'm afraid it's uncertain how much loss will be due to aircraft engine failure 💦

https://newswitch.jp/p/38482

Translated

7

なー0056

liked and commented on

なー0056

liked

In the minutes, everyone agreed that cautious progress can be made, emphasizing the cautious stance going forward. On the other hand, everyone agreed that interest rates should remain restrictive for the time being, and while there is a possibility of the end of the rate hike cycle, the Federal Reserve is also emphasizing the intention to prolong the current high interest rates.

Translated

2

なー0056

liked

There are several futures markets around the world that serve as benchmarks for crude oil prices.

Among them, the representative futures market is WTI. This is an abbreviation for "West Texas Intermediate" and refers to crude oil produced in the western part of Texas and the southeastern part of New Mexico in the USA. In most Japanese newspapers and television programs, the reported "crude oil price" is the dollar price of WTI.

Now, Chart 1 shows the long-term price of WTI crude oil futures from February of last year to the present.

Until June of this year, the price of WTI crude oil had been relatively stable in the range of 63 to 83 dollars. However, as you can see from this chart, the price suddenly entered an upward trend at the end of June this year. As you may already know, the announcement by the Organization of the Petroleum Exporting Countries (OPEC) and Russia to reduce oil exports significantly impacted this price increase.

Once again, the Fibonacci retracement, which serves as a reference for price fluctuations within the chart, has been added. The horizontal dashed line considers the high of $130.59 in March 2022 as 100 percent, and displays the percentage decline from the low of $63.64 on May 4th. The numerical values written within Chart 1 are ratios that are often consciously noted as significant levels in the market...

Among them, the representative futures market is WTI. This is an abbreviation for "West Texas Intermediate" and refers to crude oil produced in the western part of Texas and the southeastern part of New Mexico in the USA. In most Japanese newspapers and television programs, the reported "crude oil price" is the dollar price of WTI.

Now, Chart 1 shows the long-term price of WTI crude oil futures from February of last year to the present.

Until June of this year, the price of WTI crude oil had been relatively stable in the range of 63 to 83 dollars. However, as you can see from this chart, the price suddenly entered an upward trend at the end of June this year. As you may already know, the announcement by the Organization of the Petroleum Exporting Countries (OPEC) and Russia to reduce oil exports significantly impacted this price increase.

Once again, the Fibonacci retracement, which serves as a reference for price fluctuations within the chart, has been added. The horizontal dashed line considers the high of $130.59 in March 2022 as 100 percent, and displays the percentage decline from the low of $63.64 on May 4th. The numerical values written within Chart 1 are ratios that are often consciously noted as significant levels in the market...

Translated

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)