ひぽくりっと

liked

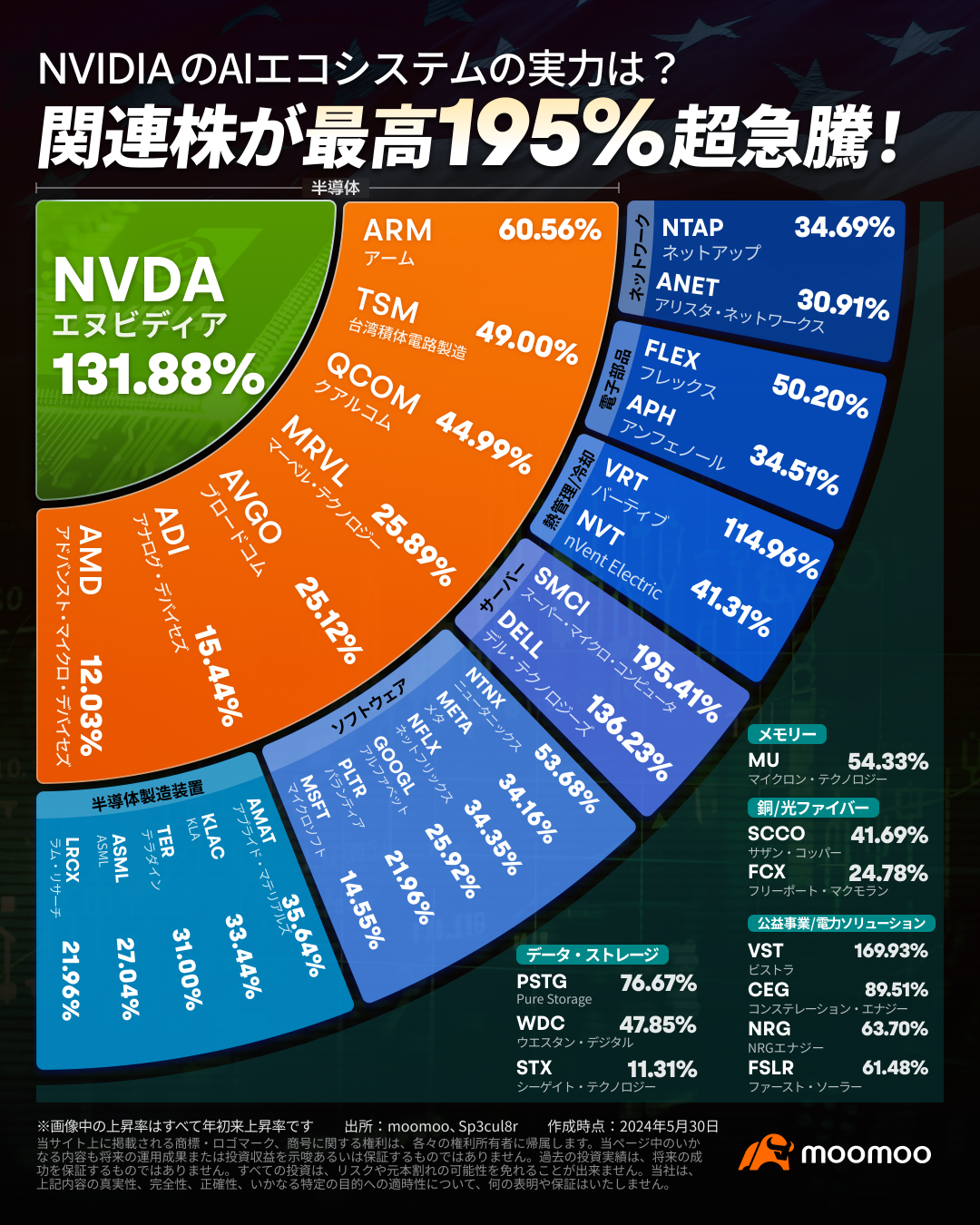

● $NVIDIA (NVDA.US)$isA rise of 20% or more in the 4 days after financial results were announcedThen,The year-to-date rate of increase is 130%It has also reached

● NVIDIA's entire AIAI ecosystem has also been strengthened, and it is more important to have a deep understanding of its components.

● The AI ecosystem extends from chips to utilitiesCovers many key areasDoing it.

●Semiconductor companies that have established close cooperative relationships with NVIDIA since the beginning of the year12% to 60%The rate of increase is increasing.

● Brands such as utility/power solutions, servers, thermal management/cooling, and data storage are also improving high performance.

The stock price of “AI Emperor” NVIDIA has once again entered a sharp rise mode,An increase of 20% or more in the 4 days after financial results were announcedIt was recorded. As a driving force in the AI field, NVIDIA'sThe year-to-date rate of increase is 130%It has also reached. This track record not only highlights NVIDIA's overwhelming strength in the AI field, but also suggests limitless possibilities for the future. Furthermore, not only NVIDIA,The AI ecosystem is also gradually getting stronger, NVIDIA's AI...

● NVIDIA's entire AIAI ecosystem has also been strengthened, and it is more important to have a deep understanding of its components.

● The AI ecosystem extends from chips to utilitiesCovers many key areasDoing it.

●Semiconductor companies that have established close cooperative relationships with NVIDIA since the beginning of the year12% to 60%The rate of increase is increasing.

● Brands such as utility/power solutions, servers, thermal management/cooling, and data storage are also improving high performance.

The stock price of “AI Emperor” NVIDIA has once again entered a sharp rise mode,An increase of 20% or more in the 4 days after financial results were announcedIt was recorded. As a driving force in the AI field, NVIDIA'sThe year-to-date rate of increase is 130%It has also reached. This track record not only highlights NVIDIA's overwhelming strength in the AI field, but also suggests limitless possibilities for the future. Furthermore, not only NVIDIA,The AI ecosystem is also gradually getting stronger, NVIDIA's AI...

Translated

125

3

ひぽくりっと

liked

The reason I learned about it was an advertisement, and now it is a securities application that “understands large trading trends.”

Translated

3

ひぽくりっと

liked

$NVIDIA (NVDA.US)$

I'd like it to go up to 1,200.

I'd like it to go up to 1,200.

Translated

27

ひぽくりっと

reacted to

Are Japanese stocks doing well this week? Rice that is getting a lot of attention in the market $NVIDIA (NVDA.US)$Ahead of the announcement of financial results on the 22nd, the wait-and-see mood is likely to expand in the first half of the week. Triggered by financial statements, etc. showing the expansion of demand for artificial intelligence (AI), etc.There is a possibility that the impact will spread to related stocks around the worldThere is. Meanwhile, as observations of lower US interest rates increase, interest is also being drawn to trends in long-term US interest rates.

Currently, while the Dow Average and Nasdaq Index hit their highest values, the Nikkei Average has been in an adjustment phase for close to 2 months. Depending on NVIDIA's financial results, it is possible that the upward trend will intensify all at once. Since demand for generative AI is strong, market expectations for NVIDIA financial results are high. If financial results are good, semiconductor-related stocks will be bought, and the Nikkei Average is expected to test the 39,000 yen range. Conversely, it is possible that the trend will fall again. That positive content was evaluated in NVIDIA's financial results for February, and amid strong semiconductor stocks, the Nikkei AverageThe highest value was updated for the first time in 34 yearsI ran up to.

Multiple agencies have announced NVIDIA's first quarter financial results and second quarter guidance...

Translated

63

3

ひぽくりっと

voted

$Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF.US)$

Do you have margin financing and securities lending, single options, and leveraged products like Leveraged Nassen? I do not hold leveraged products as a general rule. I suffered heavy losses before with Leveraged ETFs (^_^;)

Actually, since around the summer of this year, I have a few shares of an ETF [TMF] that allows 3x leverage on long-term US bonds. It feels like holding a 100 yen betting ticket emotionally.

Do you have margin financing and securities lending, single options, and leveraged products like Leveraged Nassen? I do not hold leveraged products as a general rule. I suffered heavy losses before with Leveraged ETFs (^_^;)

Actually, since around the summer of this year, I have a few shares of an ETF [TMF] that allows 3x leverage on long-term US bonds. It feels like holding a 100 yen betting ticket emotionally.

Translated

3

2

ひぽくりっと

liked and commented on

As long as you are doing copy trading, you will never win in your lifetime.

If you buy stocks recommended by someone and make a profit once, what happens to that profit you made?

You buy things you want to buy, right?

You do things you want to do, right?

What will you do if you run out of the money you earned?

Won't you try to earn in the same way again?

Did you make a profit again?

Did you incur a loss?

Even if you make a profit, you won't use it???

If you lose next, won't you try to make it up???

In this cycle

Has your ability improved?

The world where you either run out of gold, become good at trading, or give up while still at a loss.

Winning in the wrong way is like a gift of losses to your future, you know~.

Copy trading is a typical example of that.

If you buy stocks recommended by someone and make a profit once, what happens to that profit you made?

You buy things you want to buy, right?

You do things you want to do, right?

What will you do if you run out of the money you earned?

Won't you try to earn in the same way again?

Did you make a profit again?

Did you incur a loss?

Even if you make a profit, you won't use it???

If you lose next, won't you try to make it up???

In this cycle

Has your ability improved?

The world where you either run out of gold, become good at trading, or give up while still at a loss.

Winning in the wrong way is like a gift of losses to your future, you know~.

Copy trading is a typical example of that.

Translated

5

5

ひぽくりっと

commented on

$HSC RESOURCES (01850.HK)$

I have started a small initiative. I have joined another group and shared my experience with fraud in the group. Some people block me immediately, but I will continue. I don't want others to fall into the trap. I also hope that the same thing can be done for new traders.

I have started a small initiative. I have joined another group and shared my experience with fraud in the group. Some people block me immediately, but I will continue. I don't want others to fall into the trap. I also hope that the same thing can be done for new traders.

Translated

9

6

ひぽくりっと

liked

There are people who are reluctant about US stocks for fear that the yen will appreciate in the future, but exchange rate risks do not affect performance over the long term, so you can ignore them.

For example, there are people who are afraid of exchange rate risks and invest only in Japanese stocks, and Japanese companies that invest in them have exchange rate risks. In fact, export companies, starting with the Japanese manufacturing industry, tend to be weak when the yen appreciates, so it is impossible to escape exchange risk by investing in Japanese stocks.

If you want to completely eliminate exchange risk, you have no choice but to refrain from investing. However, since the value of currency gradually declines over the long term, not investing is also a risk.

In other words, no one can completely eliminate all risks, so I think it would be wiser to ignore exchange rate risks that do not affect performance in the long run and invest in US stocks and emerging market stocks.

For example, there are people who are afraid of exchange rate risks and invest only in Japanese stocks, and Japanese companies that invest in them have exchange rate risks. In fact, export companies, starting with the Japanese manufacturing industry, tend to be weak when the yen appreciates, so it is impossible to escape exchange risk by investing in Japanese stocks.

If you want to completely eliminate exchange risk, you have no choice but to refrain from investing. However, since the value of currency gradually declines over the long term, not investing is also a risk.

In other words, no one can completely eliminate all risks, so I think it would be wiser to ignore exchange rate risks that do not affect performance in the long run and invest in US stocks and emerging market stocks.

Translated

64

3

ひぽくりっと

reacted to

What do you think will be the movement of gold-related stocks from the second half of 2023 to 2024? As the economy worsens, gold is bought, so there is investment potential in gold mining stocks, as Tarou always says. I would be happy if you could teach me the timing for investment and recommended stocks.

Translated

43

2

ひぽくりっと

reacted to

paddy $Amazon (AMZN.US)$The 23Q3 (fiscal year ending July-9) financial results were announced after the local closing on the 26th. Currently, stock prices are up 6% on Friday.

![]() Earnings Highlights

Earnings Highlights

![]() Online shopping is strong where sales and profits exceed expectations, and cost control is also effective

Online shopping is strong where sales and profits exceed expectations, and cost control is also effective

Amazon's third-quarter sales were 143.083 billion dollars, up 13% from the same period last year, and surpassed market expectations of 141,563 billion dollars, up 11% from the same period last year.

What is the sales volume of the cloud business that is attracting attention12%An increase of 23.059 billion dollars. The rate of increase in sales fell to a record lowApril-6 monthsIt's been flat since then.Although the sales growth rate of the cloud business fell slightly short of expectations, drastic cost suppression progressed, and strong internet shopping business boosted profits。Chief Executive Officer Andy Jassie (CEO) at the financial results briefingThe cloud business is stable, and many contracts were signed at the beginning of this fiscal yearI explained it to investors. There was a scene where stock prices, which rose after financial results were announced, broke the closing price on 1:26 due to disgust with the sense of stagnation in the cloud business. Jashi at the financial results briefing...

Amazon's third-quarter sales were 143.083 billion dollars, up 13% from the same period last year, and surpassed market expectations of 141,563 billion dollars, up 11% from the same period last year.

What is the sales volume of the cloud business that is attracting attention12%An increase of 23.059 billion dollars. The rate of increase in sales fell to a record lowApril-6 monthsIt's been flat since then.Although the sales growth rate of the cloud business fell slightly short of expectations, drastic cost suppression progressed, and strong internet shopping business boosted profits。Chief Executive Officer Andy Jassie (CEO) at the financial results briefingThe cloud business is stable, and many contracts were signed at the beginning of this fiscal yearI explained it to investors. There was a scene where stock prices, which rose after financial results were announced, broke the closing price on 1:26 due to disgust with the sense of stagnation in the cloud business. Jashi at the financial results briefing...

Translated

![Amazon rises by about 6% or more, signs of cloud business acceleration [financial summary] do you know more than anywhere else](https://sgsnsimg.moomoo.com/feed_image/181250687/f40130b30bc33ed5964047b8fe73e3a2.png/thumb)

![Amazon rises by about 6% or more, signs of cloud business acceleration [financial summary] do you know more than anywhere else](https://sgsnsimg.moomoo.com/feed_image/181250687/a7848de7dcd43424b5f42bea242891ea.png/thumb)

![Amazon rises by about 6% or more, signs of cloud business acceleration [financial summary] do you know more than anywhere else](https://sgsnsimg.moomoo.com/181250687/editor_image/5274c4eab8203ae38065503ad3086e11.png/thumb)

18

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)