アイラ✚

reacted to and commented on

アイラ✚

liked and commented on

I will explain in detail while looking at raw data on the unemployment rate and the number of people employed in the non-farm sector.

[Precautions]

If you are attending this concert, please be sure to follow the instructions below.

*Audio and video distribution may be temporarily suspended or delayed due to problems with equipment such as computers, communication environments, etc.

*For the smooth progress of the concert, please refrain from continuously posting inappropriate comments and stamps (star explosions).

*Comments may be deleted without notice at the administrator's discretion. Also, comments from those who violate manners may be restricted. Please be aware in advance.

*For customers watching the live stream on a smartphone, you can hide the sticker by turning the smartphone on its side and tapping the screen.

*This concert is hosted by Moomoo Securities. Using the chat function, you can ask Levanas 1 question directly to Mr. Lehman.

The questions to be answered will be taken up by Levanas 1 by Mr. Lehman. Please note that we have a limited amount of time to respond, so we may not be able to answer all of the questions we receive...

[Precautions]

If you are attending this concert, please be sure to follow the instructions below.

*Audio and video distribution may be temporarily suspended or delayed due to problems with equipment such as computers, communication environments, etc.

*For the smooth progress of the concert, please refrain from continuously posting inappropriate comments and stamps (star explosions).

*Comments may be deleted without notice at the administrator's discretion. Also, comments from those who violate manners may be restricted. Please be aware in advance.

*For customers watching the live stream on a smartphone, you can hide the sticker by turning the smartphone on its side and tapping the screen.

*This concert is hosted by Moomoo Securities. Using the chat function, you can ask Levanas 1 question directly to Mr. Lehman.

The questions to be answered will be taken up by Levanas 1 by Mr. Lehman. Please note that we have a limited amount of time to respond, so we may not be able to answer all of the questions we receive...

Translated

[Employment Statistics] [Fastest Live] [First Moomoo] We will analyze the labor market faster and more deeply than anywhere else!

Sep 1 20:00

100

23

8

アイラ✚

liked

Employment statistics for May have been released.

Number of people employed in the non-farm sector is 339,000 (forecast 19.0)

Unemployment rate 3.7% (forecast 3.5)

Average wage 4.3% (forecast 4.4)

Immediately after the announcement, the dollar and yen quickly broke through 139 yen, but they quickly returned to 138 yen with a long beard.

The number of employed people has risen significantly, but as the unemployment rate worsens and wage increases have settled down, the direction of the dollar and yen is not clear.

It won't go up even if I want to raise it. I got that impression. I'm paying attention to the US exchange rate on Friday after this.

Number of people employed in the non-farm sector is 339,000 (forecast 19.0)

Unemployment rate 3.7% (forecast 3.5)

Average wage 4.3% (forecast 4.4)

Immediately after the announcement, the dollar and yen quickly broke through 139 yen, but they quickly returned to 138 yen with a long beard.

The number of employed people has risen significantly, but as the unemployment rate worsens and wage increases have settled down, the direction of the dollar and yen is not clear.

It won't go up even if I want to raise it. I got that impression. I'm paying attention to the US exchange rate on Friday after this.

Translated

12

アイラ✚

liked and commented on

Black Monday, the collapse of the IT bubble, the Lehman shock, and the recent coronavirus shock.

Historic crashes of over 30% have also occurred 8 times in the past 100 years in the US stock market.

However, there is a track record of US stocks (S&P 500) continuing to hit new highs since all of those crashes.

I think this is the reason why we should manage US stocks over a long period of time to form assets.

Currently, it is in the news that Japanese stocks have updated their high price after the bubble, but the high price of the bubble has not yet been updated.

After all, the situation where Japanese stocks have not yet been able to update their high at the end of 1989/12 for over 30 years has not changed.

Of course, the current rise in Japanese stocks will continue, and the highest price may be hit for the first time in 35 or 40 years.

However, “this time is different” is a danger signal when it comes to investing.

If long-term investment is assumed, I would choose US stocks, which have already continued to update their highest prices since all crashes so far, rather than Japanese stocks, which have no track record of breaking the highest prices.

Historic crashes of over 30% have also occurred 8 times in the past 100 years in the US stock market.

However, there is a track record of US stocks (S&P 500) continuing to hit new highs since all of those crashes.

I think this is the reason why we should manage US stocks over a long period of time to form assets.

Currently, it is in the news that Japanese stocks have updated their high price after the bubble, but the high price of the bubble has not yet been updated.

After all, the situation where Japanese stocks have not yet been able to update their high at the end of 1989/12 for over 30 years has not changed.

Of course, the current rise in Japanese stocks will continue, and the highest price may be hit for the first time in 35 or 40 years.

However, “this time is different” is a danger signal when it comes to investing.

If long-term investment is assumed, I would choose US stocks, which have already continued to update their highest prices since all crashes so far, rather than Japanese stocks, which have no track record of breaking the highest prices.

Translated

51

2

1

アイラ✚

voted

Spoiler:

![]() At the end of this post, there is a chance for you to win points!

At the end of this post, there is a chance for you to win points!

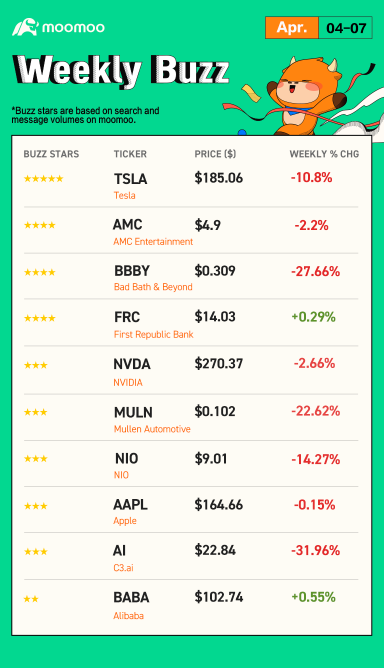

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

U.S. equity markets were mixed this week as the latest labor market data suggested a slo...

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

U.S. equity markets were mixed this week as the latest labor market data suggested a slo...

+5

29

23

6

アイラ✚

liked

Retail Traders are fully prepared for next week's "Bank Earnings". Reminds me of 2008.

$SVB Financial (SIVBQ.US)$ $Walmart (WMT.US)$ $Costco (COST.US)$ $Procter & Gamble (PG.US)$

$SVB Financial (SIVBQ.US)$ $Walmart (WMT.US)$ $Costco (COST.US)$ $Procter & Gamble (PG.US)$

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

アイラ✚ : Please take good care of your throat!

アイラ✚ : I think TQQQ is good!

アイラ✚ :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

アイラ✚ : Are Turkish liras eligible for investment?

アイラ✚ : Thank you very much.