コロミ

liked

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ I'd like to get to know someone who is like me.

Entered at the lowest point of today's discount promotion.

Entered at the lowest point of today's discount promotion.

Translated

4

3

コロミ

reacted to and commented on

3

4

コロミ

liked

$SPDR S&P 500 ETF (SPY.US)$ Last night's forecast of today's market, how can I not love the US stock market? Every day is full of challenges, but also within expectations.

Translated

3

コロミ

liked

$SPDR S&P 500 ETF (SPY.US)$ A typical day trip in the U.S. stock market. Some people made a big harvest, some stood on high ground and kept watch, some found it difficult to get on board, and just watched the hustle and bustle. The daily market, full of variety in life. 😎

Translated

2

1

コロミ

liked and commented on

$Tesla (TSLA.US)$ The upper target is around 185/200.

Translated

5

4

コロミ

liked and commented on

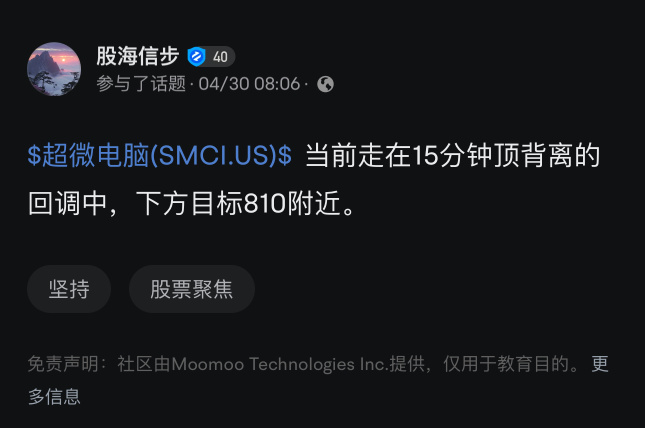

$Super Micro Computer (SMCI.US)$ Yesterday morning, when Smci rose by around 2% intraday, I made a note from a technical perspective suggesting an imminent pullback. Less than a minute after sending out the note, I heard the price dropping continuously until yesterday's close. Wouldn't it have been great to exit at that time and buy back at today's low point? The next rebound target is around 780/805. 😎

Translated

7

2

コロミ

liked

$SPDR S&P 500 ETF (SPY.US)$

Large cap deduction - Analyzing the current situation faced by both long and short sides to anticipate trends in advance, going with the trend is the key to profitability. (Pure technical analysis) I take notes to backtest my own success rate, identify shortcomings for future learning and improvement. These are purely personal opinions and do not constitute any investment advice. If you do not like it, please take another route.

When trading stocks, you should have a global view, first looking at the macro stage where the large cap currently stands. I will analyze the candlestick patterns at the quarterly/weekly/daily levels of Spy separately, then move on to analyzing overnight market movements from a micro perspective down to 5 minutes/15 minutes/30 minutes.

Starting with the quarterly candlestick chart, since early April, the large cap has shown a double top structure with severe bearish divergence, multiple indicators resonating, indicating a strong need for a significant retracement. Personally, I believe this retracement will last at least 3 months or more, with potential rebounds in between, but the overall trend will be downward.

Next, looking at the monthly candlestick chart, since early April, the large cap has exhibited a rising wedge bearish pattern with divergence in volume and price. The retracement targets on the monthly level are around 480/457/436/415, depending on where the support holds. Stay tuned to see how it unfolds.

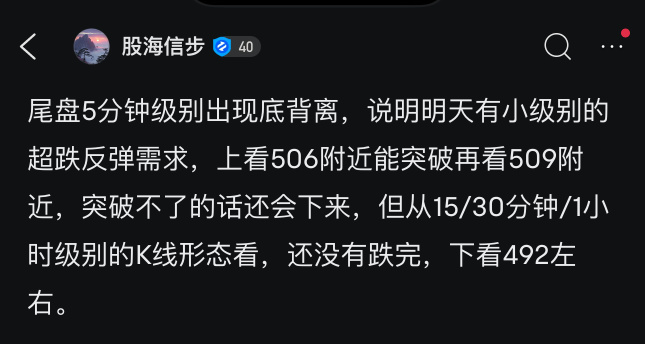

Let's take a look at the weekly chart. After three consecutive weeks of decline starting from early April, there was a rebound last week. At the beginning of this week, a bearish signal of a dark cloud cover appeared at the rebound high point on the weekly chart, indicating the end of this round of rebound and an imminent decline. Looking down at the weekly chart levels 492/488/480.

Moving on to the daily candlestick chart, in early April, Spy showed a rising wedge bearish pattern and began to oscillate...

Large cap deduction - Analyzing the current situation faced by both long and short sides to anticipate trends in advance, going with the trend is the key to profitability. (Pure technical analysis) I take notes to backtest my own success rate, identify shortcomings for future learning and improvement. These are purely personal opinions and do not constitute any investment advice. If you do not like it, please take another route.

When trading stocks, you should have a global view, first looking at the macro stage where the large cap currently stands. I will analyze the candlestick patterns at the quarterly/weekly/daily levels of Spy separately, then move on to analyzing overnight market movements from a micro perspective down to 5 minutes/15 minutes/30 minutes.

Starting with the quarterly candlestick chart, since early April, the large cap has shown a double top structure with severe bearish divergence, multiple indicators resonating, indicating a strong need for a significant retracement. Personally, I believe this retracement will last at least 3 months or more, with potential rebounds in between, but the overall trend will be downward.

Next, looking at the monthly candlestick chart, since early April, the large cap has exhibited a rising wedge bearish pattern with divergence in volume and price. The retracement targets on the monthly level are around 480/457/436/415, depending on where the support holds. Stay tuned to see how it unfolds.

Let's take a look at the weekly chart. After three consecutive weeks of decline starting from early April, there was a rebound last week. At the beginning of this week, a bearish signal of a dark cloud cover appeared at the rebound high point on the weekly chart, indicating the end of this round of rebound and an imminent decline. Looking down at the weekly chart levels 492/488/480.

Moving on to the daily candlestick chart, in early April, Spy showed a rising wedge bearish pattern and began to oscillate...

Translated

17

2

2

コロミ

liked

$Amazon (AMZN.US)$ In the military tent, the sand table deduction is synchronized with the battle situation. From the commander's battlefield map, it can be seen that the battle stopped abruptly at 175 targets of the Head Tip Air Force bombing at the 15-minute level, without any deviation. 😎

Translated

3

3

コロミ

commented on

$SPDR S&P 500 ETF (SPY.US)$ Large Cap has repeatedly backtested the resistance level near 510 before. Yesterday, there was a 30-minute divergence at the end of the session, indicating a strong demand for a pullback. After releasing the pressure in the early trading today and touching the first support level near 506.44, a TB structure was formed at the 15-minute level, along with volume-price divergence, momentum divergence, and other indicators resonating. Subsequently, after a weak rebound, it continued to drop to the second support level near 504.3, forming a double bottom pattern at the 5-minute level before starting to rebound, with a target retracement near 506.73/507.30. It was mentioned a few days ago that Large Cap presents a bearish trend from the hourly to daily levels, with an overall downward trend, caution should be exercised in chasing highs. Patience is required in volatile markets, whether it's the narrow range oscillation at the resistance zone after a rebound or the time needed to complete the bottoming process after a phase of reaching the bottom. Patience is the minimum quality a trader should have; without it, it's better not to dabble in the stock market. Those who think Large Cap's movement should conform to your rhythm are just passing through; it's downright ridiculous to hastily leave comments below my notes to vent your private grievances, lest you expose your own stupidity and ignorance to my disdain.

Translated

8

4

コロミ

liked and commented on

Translated

8

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)