ヒデ1977

Set a live reminder

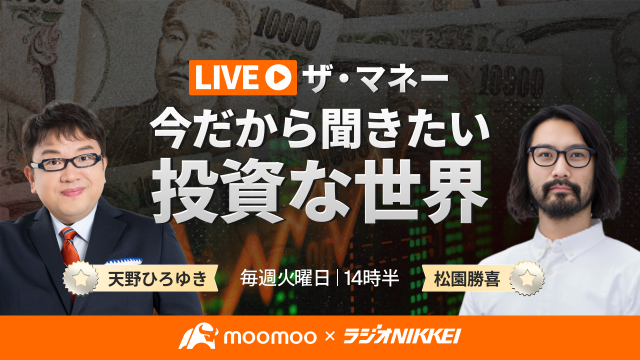

We will enjoy learning about investment themes overflowing domestically and internationally, such as topics that are currently moving the market and technologies that will change the world in the future.

Participants: Hiroyuki Amano (Kyai~n) / Katsuyoshi Matsuzono (restoration hardware labo Representative Director and President) / Shinichi Kamata (Radio NIKKEI commentator) / Hitomi Yagi

*This program does not solicit investment or other actions.

Please make the final decision regarding investment on your own.

Participants: Hiroyuki Amano (Kyai~n) / Katsuyoshi Matsuzono (restoration hardware labo Representative Director and President) / Shinichi Kamata (Radio NIKKEI commentator) / Hitomi Yagi

*This program does not solicit investment or other actions.

Please make the final decision regarding investment on your own.

Translated

The Money ~ The Investment World You Want to Know Now - Hiroyuki Amano and Katsuyoshi Matsuzono (2024.10.15)

Oct 15 13:30

6

ヒデ1977

liked

Former Chairman and CEO of IBM, Mr. Sam Palmisano, stated that Intel needs to rethink its chip manufacturing and design strategies. $Intel (INTC.US)$

Translated

2

ヒデ1977

reacted to

Should I buy Intel gradually if it falls below $19? It seems that the return would be higher than Nvidia in the case of long-term investment.

Translated

15

ヒデ1977

voted

For those who didn't have confidence in NVDA, thank you so much! I was able to buy a lot at $123. Everyone is really nice, aren't they! $NVIDIA (NVDA.US)$

I was troubled by the investment method the other day, but NVDA is just right! I feel refreshed and cheerful! If I continue with the investment, it will solve everything!

I was troubled by the investment method the other day, but NVDA is just right! I feel refreshed and cheerful! If I continue with the investment, it will solve everything!

Translated

22

3

ヒデ1977

reacted to and commented on

ヒデ1977

reacted to

$NVIDIA (NVDA.US)$

If the market opens with peace of mind, there may be a crash.![]()

Even if the market opens without a crash and you're feeling relieved, it may reverse and crash in the next 2 hours.![]()

It's scary because it's possible 😱

If the market opens with peace of mind, there may be a crash.

Even if the market opens without a crash and you're feeling relieved, it may reverse and crash in the next 2 hours.

It's scary because it's possible 😱

Translated

16

ヒデ1977

reacted to

ヒデ1977

liked

Since July, $S&P 500 Index (.SPX.US)$ has accumulated a 0.44% decline, led by high-tech stocks. $Nasdaq Composite Index (.IXIC.US)$Has fallen by a cumulative 3.3%. On the other hand, the Dow Jones Average and the S&P 500 Equal Weight Index have been on an upward trend in July. Represented by value stocks $Dow Jones Industrial Average (.DJI.US)$Has risen by over 4% cumulatively, representing small-cap stocks $Russell 2000 Index (.RUT.US)$ Has also risen by nearly 10%.

Since signs of inflation cooling were seen in the Consumer Price Index on July 11, investors have been moving away from large tech stocks and showing a preference for a more diverse range of sectors. Economic cyclical sectors such as small-cap stocks, real estate stocks, and industrial stocks, which are more susceptible to the effects of the economy and interest rates, have been pushing up.

Among them, the US conglomerate $3M (MMM.US)$has shown a sudden rise of 20% after the earnings announcement and has risen by over 24% in the month. $Mohawk Industries (MHK.US)$ 、 $D.R. Horton (DHI.US)$ 、��������...

Since signs of inflation cooling were seen in the Consumer Price Index on July 11, investors have been moving away from large tech stocks and showing a preference for a more diverse range of sectors. Economic cyclical sectors such as small-cap stocks, real estate stocks, and industrial stocks, which are more susceptible to the effects of the economy and interest rates, have been pushing up.

Among them, the US conglomerate $3M (MMM.US)$has shown a sudden rise of 20% after the earnings announcement and has risen by over 24% in the month. $Mohawk Industries (MHK.US)$ 、 $D.R. Horton (DHI.US)$ 、��������...

Translated

35

12

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)