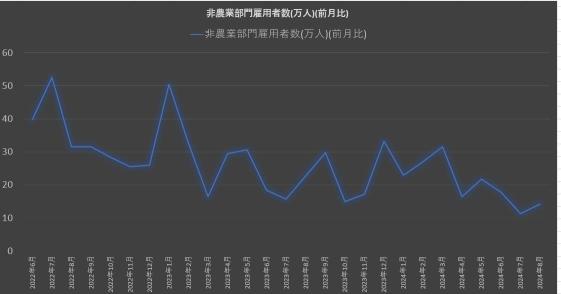

The overall value fell year-on-year, but the core rose month-on-month![]()

The American economy is strong![]()

Interest rate reversal is taking place![]()

The American economy is strong

Interest rate reversal is taking place

Translated

+1

6

The market seems stable without a significant increase in the unemployment rate.![]()

Translated

+1

6

There was no anticipated decline.![]() The employment statistics for tomorrow are the next important factor.

The employment statistics for tomorrow are the next important factor.![]()

Translated

4

Almost no change 🤔 Will the prospect of a rate cut slightly retreat?

Not a surprise, so the market is strong.![]()

Not a surprise, so the market is strong.

Translated

6

The situation is rising compared to the previous month, but it is decreasing compared to the previous value.![]()

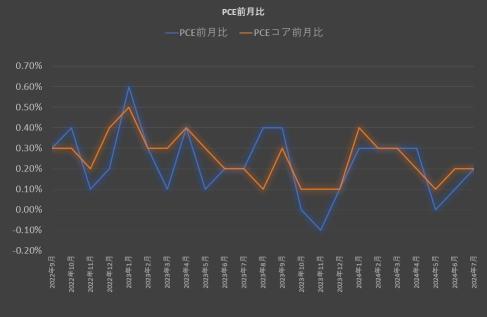

I think it's within the range of financial estimates, considering the impact of high oil prices.![]()

Will the stock price continue to have a buyback movement today?![]()

I think it's within the range of financial estimates, considering the impact of high oil prices.

Will the stock price continue to have a buyback movement today?

Translated

3

The PPI, which was rising at one point, has steadily declined.![]()

If it's just a small decrease like this, it shouldn't have a negative impact on the market.![]()

With the decrease in interest rates, today's US stocks also seem promising.![]()

If it's just a small decrease like this, it shouldn't have a negative impact on the market.

With the decrease in interest rates, today's US stocks also seem promising.

Translated

6

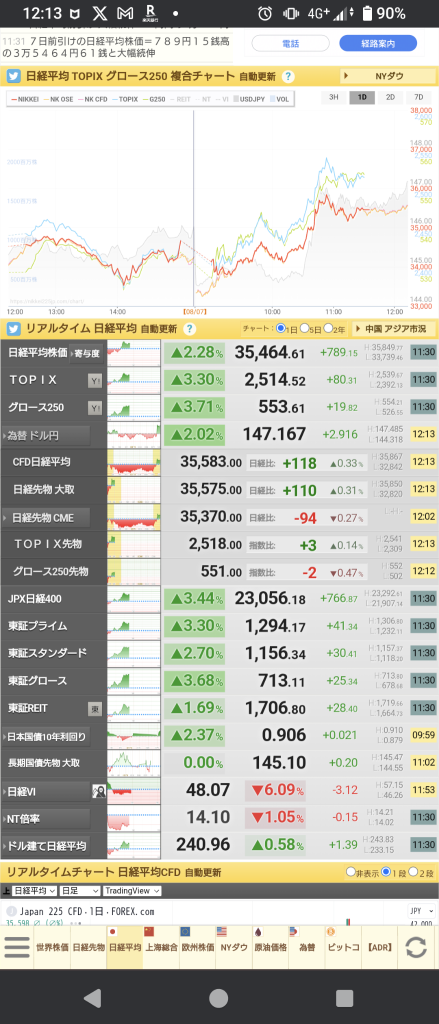

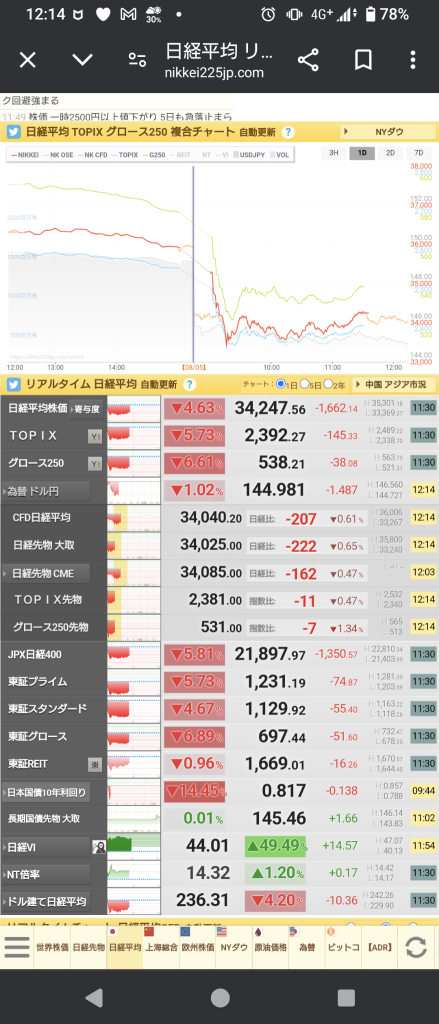

The statement from Bank of Japan Deputy Governor Uchida saying "Not raising interest rates in the unstable financial capital markets" led to a weak yen and high stock prices.![]()

I was worried because futures were weak, but they have shown a strong increase.![]()

Oh? Is there a possibility of a V-shaped recovery?

However, the fact remains that there was an interest rate hike, so if the USA starts lowering interest rates, the yen is likely to strengthen gradually.![]()

The Bank of Japan must have been anxious as the market is influenced so much.![]()

I was worried because futures were weak, but they have shown a strong increase.

Oh? Is there a possibility of a V-shaped recovery?

However, the fact remains that there was an interest rate hike, so if the USA starts lowering interest rates, the yen is likely to strengthen gradually.

The Bank of Japan must have been anxious as the market is influenced so much.

Translated

6

A dramatic surge today, quite a volatile market, isn't it?![]()

Yesterday's selling was excessive, so it's seen as buyback, and considering the rise in the USD/JPY, it may be from overseas investors.![]()

If it's the short selling buyback, it's not a full-fledged uptrend, so be cautious of selling on rebounds.![]()

With such a large movement, I believe the next uptrend will take some time to materialize.![]()

It is noteworthy what will happen in the afternoon session 🙆

Yesterday's selling was excessive, so it's seen as buyback, and considering the rise in the USD/JPY, it may be from overseas investors.

If it's the short selling buyback, it's not a full-fledged uptrend, so be cautious of selling on rebounds.

With such a large movement, I believe the next uptrend will take some time to materialize.

It is noteworthy what will happen in the afternoon session 🙆

Translated

5

Good morning![]()

The VIX temporarily exceeded 60 and there was quite a bit of volatility in US stocks, but it ended up falling by about -3%![]()

Nikkei futures have rebounded 6%![]() What can we expect today?

What can we expect today?

However, there are still 38 VIX, so you need to be careful about price movements![]()

Generally, it is said that stocks are bought when VIX exceeds 30, but it is good if VIX gradually falls, but there is also a possibility that it will still rise from now on, so wait and see![]()

Well then, let's do our best for a day today![]()

The VIX temporarily exceeded 60 and there was quite a bit of volatility in US stocks, but it ended up falling by about -3%

Nikkei futures have rebounded 6%

However, there are still 38 VIX, so you need to be careful about price movements

Generally, it is said that stocks are bought when VIX exceeds 30, but it is good if VIX gradually falls, but there is also a possibility that it will still rise from now on, so wait and see

Well then, let's do our best for a day today

Translated

8

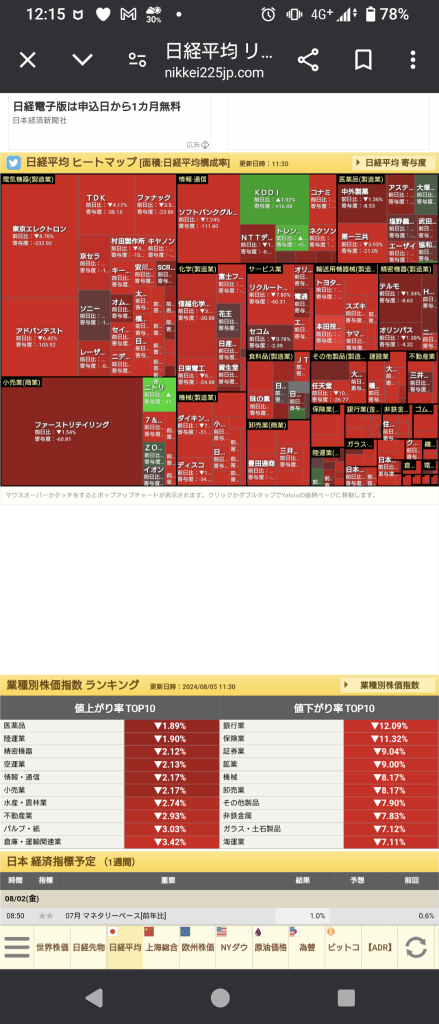

drastic decline... 34000 is a temporary rebound line isn't it![]()

However, be aware that deception will occur many times during falling markets, so if you enter easily, you will be burnt![]()

Banking and insurance-related sales are big today too![]()

Overall, it's probably like overseas players are fleeing from Japanese stocks ~ Nikkei won't stop falling until the appreciation of the yen stops![]()

It seems that wait-and-see will continue for a while![]()

However, be aware that deception will occur many times during falling markets, so if you enter easily, you will be burnt

Banking and insurance-related sales are big today too

Overall, it's probably like overseas players are fleeing from Japanese stocks ~ Nikkei won't stop falling until the appreciation of the yen stops

It seems that wait-and-see will continue for a while

Translated

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)