ロダン

commented on

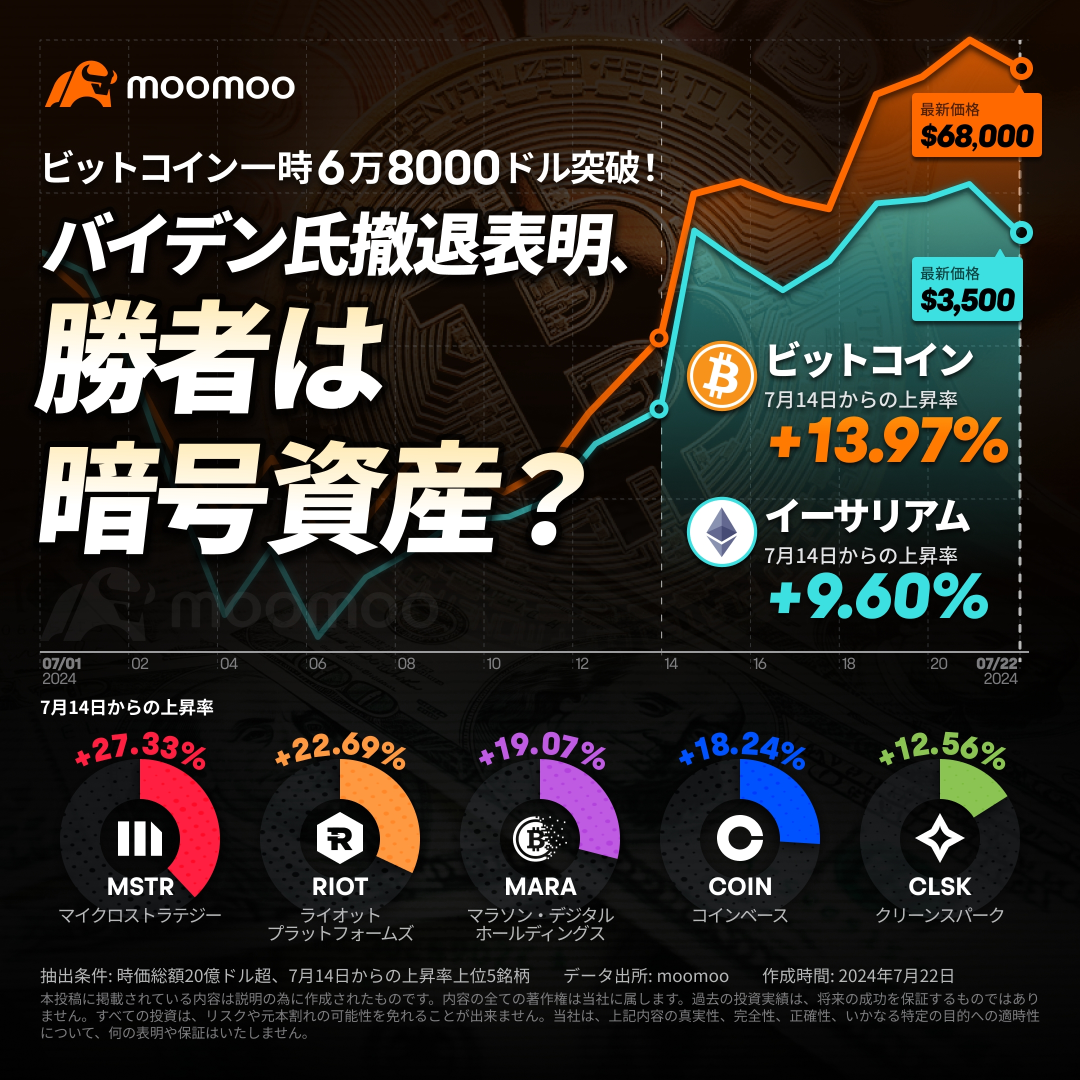

U.S. President Joe BidenHe made it clear that he will "withdraw" from the presidential election since the November election.He stated in a letter posted on social media that he could not calm the resistance within the Democratic Party to his candidacy after a disastrous performance in the debate, and announced that he would withdraw from the presidential election. He supported Vice President Kamala Harris as his successor. Toshimitsu Motegi, Secretary-General of the Liberal Democratic Party, said on the 20th, "We still cannot say for sure, but the current atmosphere in the United States is moving from a "nearly bearish" to a "confirmed bearish" trend.With less than 4 months until the November election, Biden's withdrawal could potentially worsen the turmoil on Wall Street in the short term. The 'Trump Trade' that gained momentum after Biden's presidential debate (positive for energy companies, banks, and bitcoin but negative for electric vehicles and renewable energy) may lose steam. uncomfortably close.

High-tech companies are preparing for earnings reports. With Biden's withdrawal announcement, what will be the market's direction?

![]() The current atmosphere in the United States is moving from a "nearly bearish" to a "confirmed bearish" trend.

The current atmosphere in the United States is moving from a "nearly bearish" to a "confirmed bearish" trend.

今週、 $Alphabet-A (GOOGL.US)$Ya $Tesla (TSLA.US)$such as the earnings reports of large-cap tech stocks...

High-tech companies are preparing for earnings reports. With Biden's withdrawal announcement, what will be the market's direction?

今週、 $Alphabet-A (GOOGL.US)$Ya $Tesla (TSLA.US)$such as the earnings reports of large-cap tech stocks...

Translated

26

2

11

ロダン

commented on

Good morning, moomoo users! We will deliver hot stocks for the morning session and the latest rating information.

Strengths and weaknesses of today

7/4 [Strength Weakness Material]

Three points to focus on in the morning session

●TOPIX surpasses the highest value.

● $ABC-Mart (2670.JP)$For the 1st quarter of the fiscal year ending in February 2025, revenue increased by 8.6% compared to the same period last year to 96.215 billion yen, and operating profit increased by 9% to 18.408 billion yen.

● $Suncall (5985.JP)$In the US, the production capacity of electric car distribution components is expected to increase fivefold by 2027.

Active stocks and hot stocks

$Kawasaki Heavy Industries (7012.JP)$The stock price has fallen. There is suspicion that the company raised slush funds through fictitious transactions with trading partners to cover the expenses of submarine crew members and food and drink. According to the Nikkei newspaper, the amount misappropriated could potentially exceed several billion yen.

$Sumitomo Metal Mining (5713.JP)$The stock price has risen significantly, with the rise in non-ferrous metal prices being seen as a contributing factor.

$ABC-Mart (2670.JP)$The fell sharply, the final 2... for the period from March to May.

Strengths and weaknesses of today

7/4 [Strength Weakness Material]

Three points to focus on in the morning session

●TOPIX surpasses the highest value.

● $ABC-Mart (2670.JP)$For the 1st quarter of the fiscal year ending in February 2025, revenue increased by 8.6% compared to the same period last year to 96.215 billion yen, and operating profit increased by 9% to 18.408 billion yen.

● $Suncall (5985.JP)$In the US, the production capacity of electric car distribution components is expected to increase fivefold by 2027.

Active stocks and hot stocks

$Kawasaki Heavy Industries (7012.JP)$The stock price has fallen. There is suspicion that the company raised slush funds through fictitious transactions with trading partners to cover the expenses of submarine crew members and food and drink. According to the Nikkei newspaper, the amount misappropriated could potentially exceed several billion yen.

$Sumitomo Metal Mining (5713.JP)$The stock price has risen significantly, with the rise in non-ferrous metal prices being seen as a contributing factor.

$ABC-Mart (2670.JP)$The fell sharply, the final 2... for the period from March to May.

Translated

16

1

1

A sharp rise is always followed by a crash.

It's important not to be able to put it on.

The scoundrel has profiteed by repeatedly doing this.

It's important not to be able to put it on.

The scoundrel has profiteed by repeatedly doing this.

Translated

8

I think the future is an age of energy and batteries. With that,

It's probably the age of genetic medicine.

It's probably the age of genetic medicine.

Translated

5

ロダン

commented on

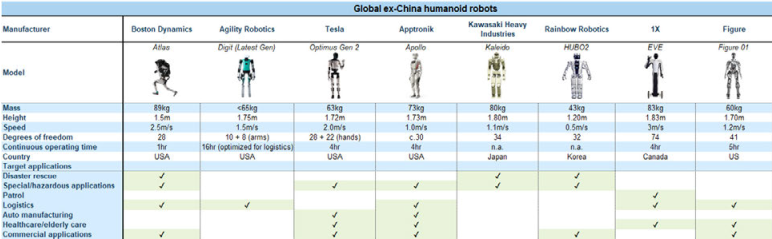

The development of artificial intelligence (AI)Bringing revolutionary changes to the humanoid robot industryIt is expected. End-to-end AI is completely different from conventional rule-based control, which means that the software system itself can execute tasks from initial commands and scenarios to final output under rules generated by AI rather than rules set in advance by software engineers. In February this year, $Microsoft (MSFT.US)$, open AI, $NVIDIA (NVDA.US)$has invested in FigureAI, an emerging robot company in Silicon Valley in the US, which aims to transform the global labor market. Figure AI is developing humanoid robots equipped with AI for work sites.

![]() What brands are related to the manufacture of doll robot parts?

What brands are related to the manufacture of doll robot parts?

Along with the expansion of the supply chain for humanoid robots, profits and potential growth potential are increasing in various fields. Investors, from electronics giants to software companies, will find investment opportunities in the rise of such robots.

Humanoid robots are a miracle of modern engineering...

Along with the expansion of the supply chain for humanoid robots, profits and potential growth potential are increasing in various fields. Investors, from electronics giants to software companies, will find investment opportunities in the rise of such robots.

Humanoid robots are a miracle of modern engineering...

Translated

70

4

44

ロダン

liked

This article uses auto-translation in some parts.

The number of non-farm payroll employees in the US in February...Scheduled to be announced on Friday (8th) at 10:30 PM Japan time.In the market, it is expected that the number of non-farm payroll employees in the US in February will increase by 0.198 million, with an unemployment rate of 3.7%.will increase by 0.198 million people, with an unemployment rate of 3.7%.Being done.

According to the ADP employment statistics announced on Wednesday this week, the number of private sector employees in the U.S. increased by 0.14 million in February. The growth expanded from 0.111 million increase in January but fell below expectations.

In addition, the U.S. Department of Labor's Job Openings and Labor Turnover Survey (JOLTS) announced on Thursday also showed a decrease in seasonally adjusted non-farm job vacancies from the previous month, with a decrease of 0.02 million 6000 to 8.86 million 3000, falling below the market forecast of 9 million.

Federal Reserve Chairman Powell testified before the House of Representatives this week, stating that he believes the policy interest rate has already reached its peak and that it would be appropriate to start lowering interest rates at some point during the year.

The U.S. Department of Labor's employment statistics for the previous period (January), announced on the 2nd of the previous month, showed an increase of 0.35 million 3000 employees in the non-farm sector compared to the previous month. The growth exceeded the market expectation of approximately 0.18 million people.

Unemployment...

The number of non-farm payroll employees in the US in February...Scheduled to be announced on Friday (8th) at 10:30 PM Japan time.In the market, it is expected that the number of non-farm payroll employees in the US in February will increase by 0.198 million, with an unemployment rate of 3.7%.will increase by 0.198 million people, with an unemployment rate of 3.7%.Being done.

According to the ADP employment statistics announced on Wednesday this week, the number of private sector employees in the U.S. increased by 0.14 million in February. The growth expanded from 0.111 million increase in January but fell below expectations.

In addition, the U.S. Department of Labor's Job Openings and Labor Turnover Survey (JOLTS) announced on Thursday also showed a decrease in seasonally adjusted non-farm job vacancies from the previous month, with a decrease of 0.02 million 6000 to 8.86 million 3000, falling below the market forecast of 9 million.

Federal Reserve Chairman Powell testified before the House of Representatives this week, stating that he believes the policy interest rate has already reached its peak and that it would be appropriate to start lowering interest rates at some point during the year.

The U.S. Department of Labor's employment statistics for the previous period (January), announced on the 2nd of the previous month, showed an increase of 0.35 million 3000 employees in the non-farm sector compared to the previous month. The growth exceeded the market expectation of approximately 0.18 million people.

Unemployment...

Translated

![[Preview] The February US employment statistics are scheduled to be released tonight, supporting speculation of an interest rate cut by the FRB in June.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240308/b6f3f83f6f864ba592ac081e8bcb2b17.png/thumb?area=105&is_public=true)

![[Preview] The February US employment statistics are scheduled to be released tonight, supporting speculation of an interest rate cut by the FRB in June.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240308/901d54e78da7401da18be2259b1bb7f8.jpg?area=105&is_public=true)

![[Preview] The February US employment statistics are scheduled to be released tonight, supporting speculation of an interest rate cut by the FRB in June.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240308/e7392913480243edbffe36450657ec59.jpg?area=105&is_public=true)

+9

16

9

ロダン

commented on

● $Nippon Telegraph & Telephone (9432.JP)$(NTT)February 8Consolidated financial results for the 3rd quarter (23/4/12) of the fiscal year ending 2024/3 will be announced.

● There has been no progress in discussions over the abolition of the “NTT Law,” which defines the purpose and content of the NTT Group's business,The government will contribute a maximum total of 45.25 billion yen, including subsidies, to the development of “semiconductor of light” technology (photoelectric fusion technology) to be promoted with US Intel and othersGood material came out.

●Second quarter (April-September)Consolidated sales (operating income) are at a record highWhile it was updated,Net profit declined for the first time in 3 years for the April-9 fiscal yearIt was. Full-year sales are expected to decrease 0.6% from the previous fiscal year to 13.60 trillion yen, operating profit is expected to increase 6.6% to 1.95 trillion yen, and net profit is expected to increase 3.5% to 1.255 billion yen. The EPS forecast is 14 yen 80 sen.

● Sales, operating profit, and net profit for the previous fiscal year (fiscal year ended March 23) all reached record highs.Dividends increased for 13 consecutive terms since fiscal 2011It has been done, and cost improvements have progressed this fiscal year as well,If an increase in profit is achieved as planned, an increase in dividends can be expectedSeemably.

● According to evaluations by 16 analysts, 43.75% are bullish, 31.2...

● There has been no progress in discussions over the abolition of the “NTT Law,” which defines the purpose and content of the NTT Group's business,The government will contribute a maximum total of 45.25 billion yen, including subsidies, to the development of “semiconductor of light” technology (photoelectric fusion technology) to be promoted with US Intel and othersGood material came out.

●Second quarter (April-September)Consolidated sales (operating income) are at a record highWhile it was updated,Net profit declined for the first time in 3 years for the April-9 fiscal yearIt was. Full-year sales are expected to decrease 0.6% from the previous fiscal year to 13.60 trillion yen, operating profit is expected to increase 6.6% to 1.95 trillion yen, and net profit is expected to increase 3.5% to 1.255 billion yen. The EPS forecast is 14 yen 80 sen.

● Sales, operating profit, and net profit for the previous fiscal year (fiscal year ended March 23) all reached record highs.Dividends increased for 13 consecutive terms since fiscal 2011It has been done, and cost improvements have progressed this fiscal year as well,If an increase in profit is achieved as planned, an increase in dividends can be expectedSeemably.

● According to evaluations by 16 analysts, 43.75% are bullish, 31.2...

Translated

![[Financial Results Preview] NTT supports “semiconductor of light” development! Expectations are growing that profit plans will be achieved for continuous dividend increases](https://sgsnsimg.moomoo.com/feed_image/181569713/b781b4ec6bc53130ad1dede5906450b1.png/thumb)

![[Financial Results Preview] NTT supports “semiconductor of light” development! Expectations are growing that profit plans will be achieved for continuous dividend increases](https://sgsnsimg.moomoo.com/feed_image/181569713/8781220287313f64b3265068612094d6.jpg/thumb)

50

3

30

ロダン

commented on

Columns Outlook for the US market: Waiting for tomorrow's US CPI, the Dow Jones starts 27 points higher.

Hello moomoo users, good evening!![]() Tonight's analysis of NY stocks.

Tonight's analysis of NY stocks.![]()

Market Overview

The Dow Jones Industrial Average, which consists of high-quality stocks, started in the US market at 37,552.91, up 27.75 dollars, while the Nasdaq Composite Index, with a high proportion of technology stocks, started at 14,877.70, up 19.99 points. The S&P 500, composed of 500 large-cap stocks in the US, closed at 4,759.94, up 3.44 points.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top News

The Federal Reserve Board (FRB) is considering ending its quantitative tightening (QT) of reducing holdings such as government bonds by 2024, which could affect the direction of the bond and stock markets.

In the U.S. market, there is a growing expectation that the Federal Reserve Board (FRB) will complete the Quantitative Tightening (QT) reducing its holdings of government bonds by 2024. Excessive tightening could lead to confusion in the financial markets, prompting a review of policies within the FRB. The process of collecting excess money circulating in the market...

Market Overview

The Dow Jones Industrial Average, which consists of high-quality stocks, started in the US market at 37,552.91, up 27.75 dollars, while the Nasdaq Composite Index, with a high proportion of technology stocks, started at 14,877.70, up 19.99 points. The S&P 500, composed of 500 large-cap stocks in the US, closed at 4,759.94, up 3.44 points.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top News

The Federal Reserve Board (FRB) is considering ending its quantitative tightening (QT) of reducing holdings such as government bonds by 2024, which could affect the direction of the bond and stock markets.

In the U.S. market, there is a growing expectation that the Federal Reserve Board (FRB) will complete the Quantitative Tightening (QT) reducing its holdings of government bonds by 2024. Excessive tightening could lead to confusion in the financial markets, prompting a review of policies within the FRB. The process of collecting excess money circulating in the market...

Translated

19

1

2

ロダン

commented on

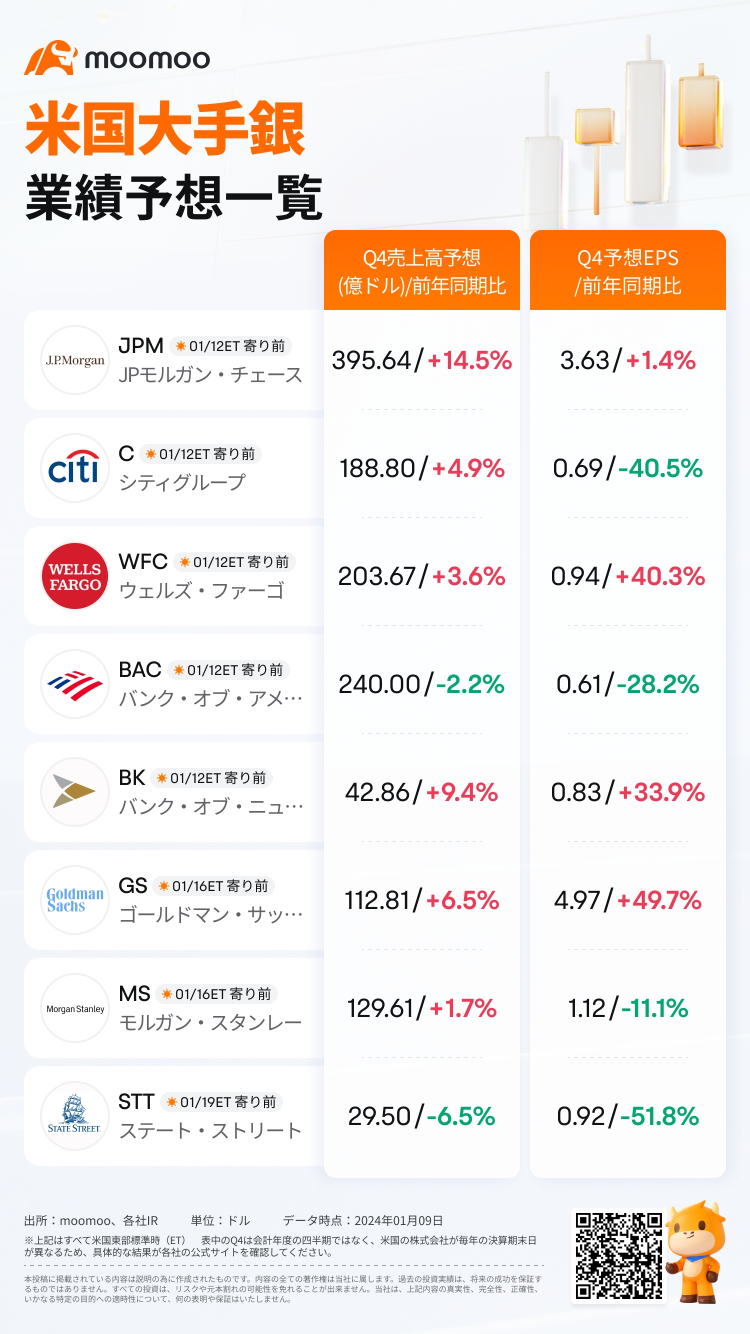

This Friday, $JPMorgan (JPM.US)$、 $Citigroup (C.US)$、 $Wells Fargo & Co (WFC.US)$Five banks, etc. will announce 2023 Q4 financial results, and the banking business Q4 financial season will begin. Other major banks will follow suit next week.

As an important barometer of the real economy, the performance of the US banking industry draws widespread attention at the beginning of every financial results announcement season. What are some notable points in this performance?

According to the consensus of Bloomberg analysts, the four largest US banks - JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup's bad loans (bad loans here are debts that have not been repaid for 90 days or more) are in the last 3 months of 2023It will increase to 24.4 billion dollarsIt is expected,An increase of nearly 6 billion dollars from the end of 2022. In the market, the fourth quarter results of the six megabanks, including Goldman Sachs and Morgan Stanley, were compared to the same period last yearProfit will decrease by an average of 13%It is expected.

Analysts are...

As an important barometer of the real economy, the performance of the US banking industry draws widespread attention at the beginning of every financial results announcement season. What are some notable points in this performance?

According to the consensus of Bloomberg analysts, the four largest US banks - JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup's bad loans (bad loans here are debts that have not been repaid for 90 days or more) are in the last 3 months of 2023It will increase to 24.4 billion dollarsIt is expected,An increase of nearly 6 billion dollars from the end of 2022. In the market, the fourth quarter results of the six megabanks, including Goldman Sachs and Morgan Stanley, were compared to the same period last yearProfit will decrease by an average of 13%It is expected.

Analysts are...

Translated

21

1

6

.

.

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

ロダン : Trump's purpose would be to shift economic control from currency control of Jewish financial capital to digital currency.

DS is weakening.