一如既往跟你到月球

liked

$Bitcoin (BTC.CC)$ $NVIDIA (NVDA.US)$ $Meta Platforms (META.US)$

First, let's understand the techniques for using these 6 core stock indicators.

DKW: a trend indicator for both long and short positions, determining buy and sell points based on the structure numbers [1-9] and arrow hints of the ladder.

CD: a bottom-fishing signal indicator, where red represents a bull market, and orange-yellow represents a bearish market. Use the changing colors of the DKW trend ladder, as well as the CD indicator colors and hints [buy, clear position], to find a relatively suitable buy and sell point.

CM: a capital indicator, where orange-yellow represents the entry of block orders, usually indicating a bull market; blue represents retail funds, typically indicating a bear market. When individual stocks attract speculative funds, it indicates a potential strong breakout in the short term, and the increase will be significant.

SXHY: [Three-in-One Indicator] Green represents resistance, red represents trendlines, and yellow represents support. When the three lines come together, it's a long position, and when they separate it's a short position.

STZ: a three-wave resonance indicator that optimizes the advantages of KDJ and MACD indicators, enhancing the accuracy of DKW buy and sell points, needing to be used in conjunction with each other.

CKDJ: a super stochastic indicator. It strengthens the accuracy of DKW, CD, and STZ indicators based on the strength of stock price trends and overbought/oversold phenomena.

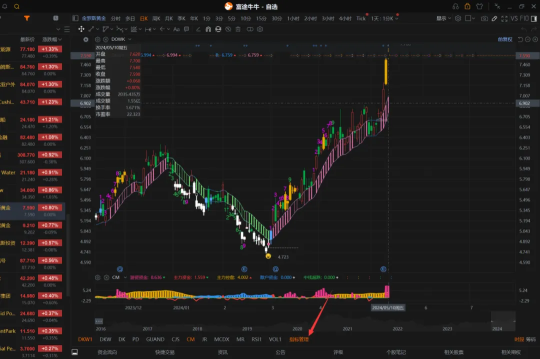

Next, let's look at the technique for using the CM chip indicator.

CM indicator...

First, let's understand the techniques for using these 6 core stock indicators.

DKW: a trend indicator for both long and short positions, determining buy and sell points based on the structure numbers [1-9] and arrow hints of the ladder.

CD: a bottom-fishing signal indicator, where red represents a bull market, and orange-yellow represents a bearish market. Use the changing colors of the DKW trend ladder, as well as the CD indicator colors and hints [buy, clear position], to find a relatively suitable buy and sell point.

CM: a capital indicator, where orange-yellow represents the entry of block orders, usually indicating a bull market; blue represents retail funds, typically indicating a bear market. When individual stocks attract speculative funds, it indicates a potential strong breakout in the short term, and the increase will be significant.

SXHY: [Three-in-One Indicator] Green represents resistance, red represents trendlines, and yellow represents support. When the three lines come together, it's a long position, and when they separate it's a short position.

STZ: a three-wave resonance indicator that optimizes the advantages of KDJ and MACD indicators, enhancing the accuracy of DKW buy and sell points, needing to be used in conjunction with each other.

CKDJ: a super stochastic indicator. It strengthens the accuracy of DKW, CD, and STZ indicators based on the strength of stock price trends and overbought/oversold phenomena.

Next, let's look at the technique for using the CM chip indicator.

CM indicator...

Translated

![Using stock indicators [Part 2]: CM Chip Indicator.](https://ussnsimg.moomoo.com/sns_client_feed/103623318/20240823/1724386684716-random5618-103623318-android-org.jpeg/thumb?area=999&is_public=true)

![Using stock indicators [Part 2]: CM Chip Indicator.](https://ussnsimg.moomoo.com/sns_client_feed/103623318/20240823/1724404060323-random3864-103623318-android-compress.jpg/thumb?area=999&is_public=true)

![Using stock indicators [Part 2]: CM Chip Indicator.](https://ussnsimg.moomoo.com/sns_client_feed/103623318/20240823/1724405394462-random8911-103623318-android-compress.jpg/thumb?area=999&is_public=true)

+2

12

3

13

一如既往跟你到月球

liked

Translated

From YouTube

4

1

2

一如既往跟你到月球

liked and commented on

$NVIDIA (NVDA.US)$

Statement: Predicting the trend of stock prices is only for the convenience of having a buying and selling mindset during trading. Even if the stock price prediction is accurate, improper trading strategies can still result in losses. Therefore, the accuracy of predicting stock prices is not very meaningful. What is more important is to make timely adjustments to the buying and selling mindset according to the market conditions.

First, let's review the market conditions.

The NASDAQ Index has already reached a bottoming out and stabilization state. It is expected to have a small rebound in the next week (August 9th - August 16th), and then continue to decline.

After NVIDIA's breakdown and decline on July 30th, it has now shown signs of stabilization. The target price for a small rebound is expected to return to the range of 115. The time period is from August 9th to August 16th. In late August, NVIDIA is estimated to continue to decline below 90 yuan and enter the 80-90 range.

Second, let's analyze the stock market situation of NVIDIA.

Reviewing the market conditions of the week starting from July 30th, after the breakdown and subsequent strong rebound on the next day, there was a continuous decline, with the Friday closing near the lowest point of 100. This is considering the weak performance of the technology stocks at that time. NVIDIA has already broken through the support level, and the downward trend has begun.

1. Looking at the feedback from our custom indicator DKW, there was no obvious breakthrough decline in the market on July 30th and 31st, especially on the 31st, where the candlestick chart showed a blue line, which is a signal of a trend reversal. However, the specific direction of the reversal...

Statement: Predicting the trend of stock prices is only for the convenience of having a buying and selling mindset during trading. Even if the stock price prediction is accurate, improper trading strategies can still result in losses. Therefore, the accuracy of predicting stock prices is not very meaningful. What is more important is to make timely adjustments to the buying and selling mindset according to the market conditions.

First, let's review the market conditions.

The NASDAQ Index has already reached a bottoming out and stabilization state. It is expected to have a small rebound in the next week (August 9th - August 16th), and then continue to decline.

After NVIDIA's breakdown and decline on July 30th, it has now shown signs of stabilization. The target price for a small rebound is expected to return to the range of 115. The time period is from August 9th to August 16th. In late August, NVIDIA is estimated to continue to decline below 90 yuan and enter the 80-90 range.

Second, let's analyze the stock market situation of NVIDIA.

Reviewing the market conditions of the week starting from July 30th, after the breakdown and subsequent strong rebound on the next day, there was a continuous decline, with the Friday closing near the lowest point of 100. This is considering the weak performance of the technology stocks at that time. NVIDIA has already broken through the support level, and the downward trend has begun.

1. Looking at the feedback from our custom indicator DKW, there was no obvious breakthrough decline in the market on July 30th and 31st, especially on the 31st, where the candlestick chart showed a blue line, which is a signal of a trend reversal. However, the specific direction of the reversal...

Translated

+3

24

11

9

一如既往跟你到月球

commented on

Immersive experience watching US stocks with moomoo indicators $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $Micron Technology (MU.US)$

Translated

+1

10

一如既往跟你到月球

liked and commented on

Dear friends, thank you for your attention and support. Next, I will bring you another indicator, the Funding Chip Analysis Index. Below is a detailed guide on how to use the indicator. Friends who trade frequently are welcome to join and discuss.

Index introduction: This indicator is based on analyzing stock price changes and trading volume, and may identify signs of trading pressure from different market participants. The main retail investors are clearly visible, which is more beneficial for investment decisions.

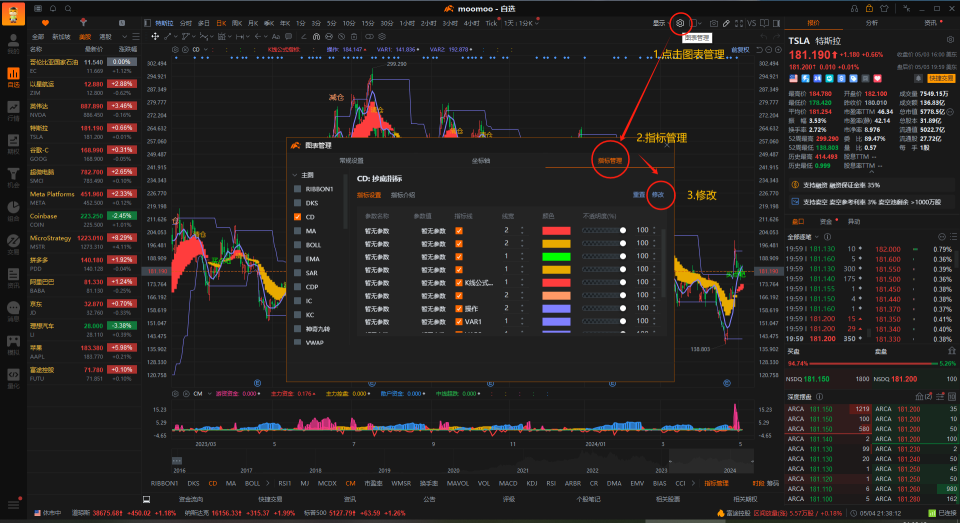

Step 1: Download moomoo PC

Step 2. Click "Index Management" in the upper right corner

Step 3. Click Edit and create a new indicator ➕ above

Abbreviation: CM

Full name: Funding chip chart

The object is: image

Then just click Test App.

The same account is automatically synced to different terminals, that is, if you add indicators to the PC version and log in to the phone with the same account, you can see the newly added indicators, and just call them up directly.

If an error is reported, check if you have entered full-width punctuation, and change all the codes to English input methods and re-enter them.

Indicator usage:

Next, I'll explain the code principle to you. This indicator consists of three parts: variable definition, indicator calculation, and curve drawing.

Variable definitions:

VAR1 and VAR4: These variables capture the difference between the closing price and the opening price and are standardized by the opening price. They represent positive and negative price changes (VAR1 and VAR2) and range size (VAR3 and...

Index introduction: This indicator is based on analyzing stock price changes and trading volume, and may identify signs of trading pressure from different market participants. The main retail investors are clearly visible, which is more beneficial for investment decisions.

Step 1: Download moomoo PC

Step 2. Click "Index Management" in the upper right corner

Step 3. Click Edit and create a new indicator ➕ above

Abbreviation: CM

Full name: Funding chip chart

The object is: image

Then just click Test App.

The same account is automatically synced to different terminals, that is, if you add indicators to the PC version and log in to the phone with the same account, you can see the newly added indicators, and just call them up directly.

If an error is reported, check if you have entered full-width punctuation, and change all the codes to English input methods and re-enter them.

Indicator usage:

Next, I'll explain the code principle to you. This indicator consists of three parts: variable definition, indicator calculation, and curve drawing.

Variable definitions:

VAR1 and VAR4: These variables capture the difference between the closing price and the opening price and are standardized by the opening price. They represent positive and negative price changes (VAR1 and VAR2) and range size (VAR3 and...

Translated

16

5

33

一如既往跟你到月球

commented on

一如既往跟你到月球

liked and commented on

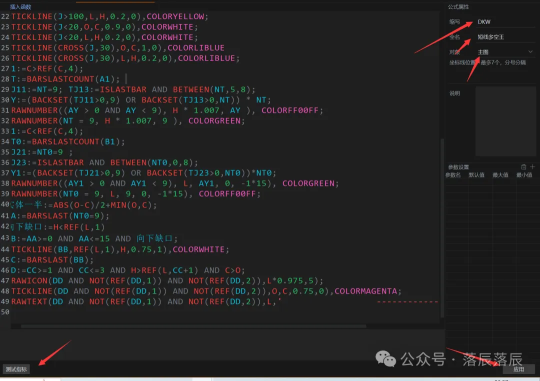

Hello everyone, I'm Luochen. Today, I'll continue to share with you a super easy-to-use short-term indicator, which is also one of the indicators I often use, the short-term bull and bear king.

Indicator Introduction: This indicator consists of three parts: short-term bull and bear, five color bars, and nine cycles of accelerated bottom-fishing. (Some code is from the internet, and I have optimized and improved it through repeated testing and received good feedback from some friends.)

Step 1 Download the Futu moomoo PC version

Step 2 Click on the "Indicator Management" in the lower right corner

Step 3 Click on the "➕" button to create a new indicator

Abbreviation: DKW

Full Name: Short-term Bull and Bear King

Target: Main Chart

Then just click on the test.

The same account will automatically sync to different terminals. That is to say, if you add indicators on the PC version and log in to the mobile version with the same account, you can see the newly added indicators and directly call them up.

If there is an error, check if you have entered full-width punctuation marks and change all the code to English input methods and re-enter.

Next, I will explain the code principle to you.

This indicator consists of four parts:

Part 1: Long and short trend lines

Define variable TF for the time period of the exponential moving average (EMA). (This indicator is a short-term indicator with a period of 13, users can adjust it according to their preferences).

Calculate the EMA of the highest and lowest prices of stocks, referred to as UP and DW, and calculate them according to the specified time period.

Define conditions F1 and F2 to identify the call and put engulfing candlestick patterns...

Indicator Introduction: This indicator consists of three parts: short-term bull and bear, five color bars, and nine cycles of accelerated bottom-fishing. (Some code is from the internet, and I have optimized and improved it through repeated testing and received good feedback from some friends.)

Step 1 Download the Futu moomoo PC version

Step 2 Click on the "Indicator Management" in the lower right corner

Step 3 Click on the "➕" button to create a new indicator

Abbreviation: DKW

Full Name: Short-term Bull and Bear King

Target: Main Chart

Then just click on the test.

The same account will automatically sync to different terminals. That is to say, if you add indicators on the PC version and log in to the mobile version with the same account, you can see the newly added indicators and directly call them up.

If there is an error, check if you have entered full-width punctuation marks and change all the code to English input methods and re-enter.

Next, I will explain the code principle to you.

This indicator consists of four parts:

Part 1: Long and short trend lines

Define variable TF for the time period of the exponential moving average (EMA). (This indicator is a short-term indicator with a period of 13, users can adjust it according to their preferences).

Calculate the EMA of the highest and lowest prices of stocks, referred to as UP and DW, and calculate them according to the specified time period.

Define conditions F1 and F2 to identify the call and put engulfing candlestick patterns...

Translated

+7

15

3

25

一如既往跟你到月球

liked

Translated

9

3

一如既往跟你到月球

liked

New friends can check out my previous works! I want to start sharing some useful knowledge with you all, but unfortunately, I don't have the time to do it right now. After all, running a one-person team is quite challenging. But who knows what the future holds! Many people ask me why I don't participate in paper trading competitions, but I feel like it's unnecessary. If I were to go, I might do well, but since you all are following me, I wouldn't be able to help you earn lunch money if I spend time on paper trading.

Translated

46

21

一如既往跟你到月球

voted

Yooo mooers,

Nice to see you again!!

Hope you guys find the first 2 sessions helpful and interesting.

Sooooo glad to see you in the 3rd session of mooSchool summer camp, I know persistence is not easy in any form. Continue the good work and I believe your efforts will be paid.

We are going to talk about 'Stock Screener' in this session, I mean literally 'talk'. The stock screener allows you to define criteria that fit your investment objectives. Fo...

Nice to see you again!!

Hope you guys find the first 2 sessions helpful and interesting.

Sooooo glad to see you in the 3rd session of mooSchool summer camp, I know persistence is not easy in any form. Continue the good work and I believe your efforts will be paid.

We are going to talk about 'Stock Screener' in this session, I mean literally 'talk'. The stock screener allows you to define criteria that fit your investment objectives. Fo...

来自YouTube

440

469

99

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)