专业扶眼镜

commented on

Recently, as expected, the Federal Reserve cut interest rates by 25 basis points, meeting market expectations. However, why is there a slowdown in rate cuts next year? First of all, let me clarify that I will not provide direct answers. For those who are willing to learn, I will provide hints. Please go find the answers and think independently. Interest rate cuts and hikes have different effects. Hikes mainly suppress inflation, while rate cuts mainly have three effects. What are these three effects, you can go do some research. ![]()

Why is the market reacting so strongly to Powell's slowdown in rate cuts? Because of concerns about inflation rebounding. Why? Due to Trump's tariff policies (here you can go ask "orthopedics" to learn how they are formed). If in the future inflation leads the Federal Reserve back to a rate hike path, what impact will this have on the stock market? I know this may be a bit challenging for those without financial knowledge, so I'll give the answer directly. In a situation where the U.S. economy is already in a soft landing, rather than a hard landing or face landing, combined with U.S. tech stocks, especially visible applications of AI starting up recently, as long as the rate of return on tech stocks grows higher than the Fed's rate hikes, tech stocks may show no fear of rate hikes and soar (but the premise is, as I already hinted in the narrative, remember to pay attention to the key points).

Let's briefly discuss the direction of the large cap. Based on observation and celestial calculations, the technology stocks representing Nasdaq have not met the satisfaction level of increase. Funds will need to be rotated in the future, while individual stock Indicators have been hovering near oversold levels for several days. If you think it's about to fail, I can only hope... $NVIDIA (NVDA.US)$ Indicators have been hovering near oversold levels for a few days. If you think it's about to fail, I can only hope...

Why is the market reacting so strongly to Powell's slowdown in rate cuts? Because of concerns about inflation rebounding. Why? Due to Trump's tariff policies (here you can go ask "orthopedics" to learn how they are formed). If in the future inflation leads the Federal Reserve back to a rate hike path, what impact will this have on the stock market? I know this may be a bit challenging for those without financial knowledge, so I'll give the answer directly. In a situation where the U.S. economy is already in a soft landing, rather than a hard landing or face landing, combined with U.S. tech stocks, especially visible applications of AI starting up recently, as long as the rate of return on tech stocks grows higher than the Fed's rate hikes, tech stocks may show no fear of rate hikes and soar (but the premise is, as I already hinted in the narrative, remember to pay attention to the key points).

Let's briefly discuss the direction of the large cap. Based on observation and celestial calculations, the technology stocks representing Nasdaq have not met the satisfaction level of increase. Funds will need to be rotated in the future, while individual stock Indicators have been hovering near oversold levels for several days. If you think it's about to fail, I can only hope... $NVIDIA (NVDA.US)$ Indicators have been hovering near oversold levels for a few days. If you think it's about to fail, I can only hope...

Translated

26

22

5

专业扶眼镜

commented on

Translated

3

15

1

2

专业扶眼镜

commented on

$SoundHound AI (SOUN.US)$ wow, flying up

Translated

9

专业扶眼镜

commented on

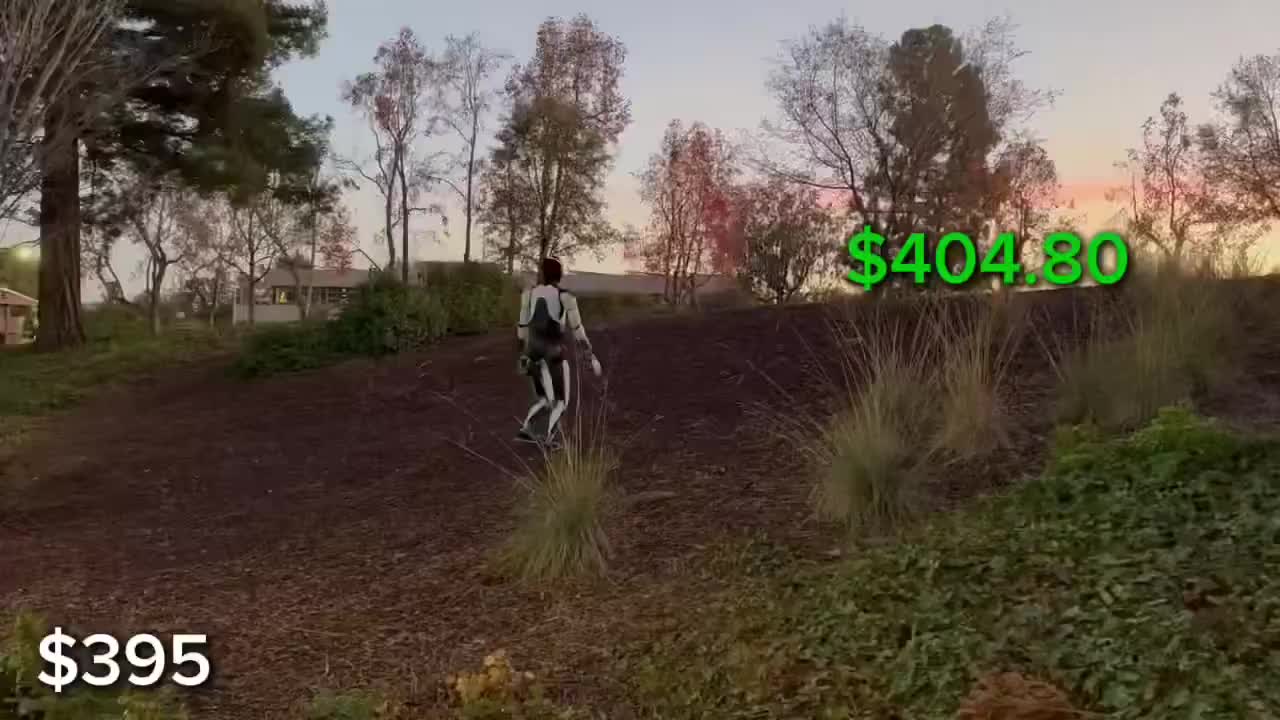

$Tesla (TSLA.US)$ 5 and a half months 173 to 414.5~ The next 18 and a half months (starting from January 2025) are preparing to usher in a new chapter. ![]()

![]()

![]()

Translated

3

11

专业扶眼镜

commented on

11

5

1

专业扶眼镜

commented on

2

18

3

1

$Tesla (TSLA.US)$ As a Tesla shareholder, what I need to do next is to take a photo and witness the moment when it breaks through the historical high point. ![]()

![]()

![]() Intervening from July, surpassing 173 to 414, ending 2024 in such a perfect way, and January 2025 will mark the first year of explosive industrial growth.

Intervening from July, surpassing 173 to 414, ending 2024 in such a perfect way, and January 2025 will mark the first year of explosive industrial growth.

Translated

1

1

专业扶眼镜

commented on

5

6

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

专业扶眼镜 OP 看神吃饭 : Thank you, you too.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

专业扶眼镜 OP 66668888 : The slowdown in interest rate cuts, in my opinion, is due to the Federal Reserve's concerns about inflation, driven by the volatility of prices excluding food and energy. And why do I say that the ROI of technology stocks (especially true AI stocks) is higher than interest rates so they are not afraid of the Federal Reserve returning to raising interest rates? For example, if the return on your bank deposits is only 5%, but the ROI of investing in technology stocks is at 10%, smart funds will definitely choose the latter. Besides, capital seeks profit, you can refer to the historical development during the late 90s dot-com bubble, this 'may' happen again, but perhaps it will take some time.

专业扶眼镜 OP Sandy777 : No problem, long-term development, those who are willing to learn and have the ability to learn can pave their own way through their efforts.

专业扶眼镜 OP Ricky的音乐盒 : Those who only copy answers will feel anxious if they don't have answers for a day.

专业扶眼镜 OP Ricky的音乐盒 : If you want to be a god, go somewhere else. This is not heaven. If you don't understand Chinese, remember to go back to school to enroll.

View more comments...