东方路易

commented on

$Fangdd Network (DUO.US)$ i see that anyone Q to buy at 0.76 etc at 50k, 60k shares, immediately got people dump it. For now looms bad, hope it gain some strong support later. else any mid size fish just dump, straight fall to 0.5

1

2

东方路易

liked

Have you ever heard of a company that is considered a "secret weapon" by the USA government and jokingly referred to by investors as the "Tesla of the data world"? That's right, it's Palantir Technologies (PLTR). Despite carrying the "mysterious label" since its inception, it has now caused a stir in the investment community. Some say it is the pioneer of the AI revolution, while others question whether it is an "overhyped stock". So, is PLTR an "upgrade" or a "gamble"? Today, let's talk about this company.

When talking about the "story" of PLTR, not mentioning its assistance to the USA government in epidemic prevention and control would be like talking about the Three-Body Problem without mentioning the Dark Forest. In 2020, using its Gotham platform, PLTR assisted the Centers for Disease Control and Prevention (CDC) in analyzing epidemic data and predicting epidemic trends in real-time. This not only saved countless lives but also showcased the enormous potential of data analysis in the public domain. Looking at the figures: In the 2023 fiscal year, PLTR achieved an 18% revenue growth rate, with free cash flow reaching 0.443 billion US dollars, accounting for a significant 22%. What's even more noteworthy is its profitability turnaround, shifting from previous losses to entering the GAAP profit phase, indicating that PLTR has found its rhythm in commercialization and sustainable development.

If PLTR is called the "Three-Body company" in the AI field, it is not an exaggeration. Why? Because it is both aloof and complex: its core technology is difficult to replicate...

When talking about the "story" of PLTR, not mentioning its assistance to the USA government in epidemic prevention and control would be like talking about the Three-Body Problem without mentioning the Dark Forest. In 2020, using its Gotham platform, PLTR assisted the Centers for Disease Control and Prevention (CDC) in analyzing epidemic data and predicting epidemic trends in real-time. This not only saved countless lives but also showcased the enormous potential of data analysis in the public domain. Looking at the figures: In the 2023 fiscal year, PLTR achieved an 18% revenue growth rate, with free cash flow reaching 0.443 billion US dollars, accounting for a significant 22%. What's even more noteworthy is its profitability turnaround, shifting from previous losses to entering the GAAP profit phase, indicating that PLTR has found its rhythm in commercialization and sustainable development.

If PLTR is called the "Three-Body company" in the AI field, it is not an exaggeration. Why? Because it is both aloof and complex: its core technology is difficult to replicate...

Translated

22

3

1

东方路易

liked

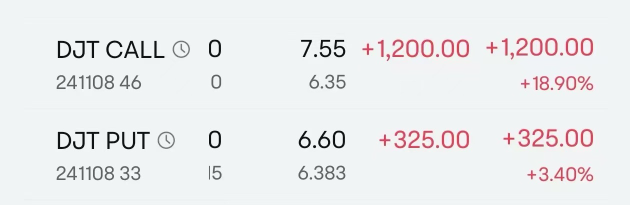

If you're holding both a call and a put on the same stock, that's your classic Straddle strategy. The goal with a Straddle is to profit from big price swings in either direction – up or down. If the stock makes a big enough move, you can actually make money on both sides. In fact, with enough volatility, it’s possible to score profits on both the call and the put.

I’ll break down how that works with a real-life exa...

I’ll break down how that works with a real-life exa...

38

9

东方路易

commented on

东方路易

liked

$ZIM Integrated Shipping (ZIM.US)$

At the moment it will not recover to pre-pandemic levels where shipping rates and demand was at it highest

ZIM failed to meet analysts' top- and bottom-line expectations. Management foresees a sharp decline in profitability from 2022 to 2023.

Representing a year-over-year decrease of 63%, ZIM reported Q1 2023 revenue of $1.37 billion. Besides the startling decline in performance compared to the same period last year, ZIM's inability to meet analysts' expectation...

At the moment it will not recover to pre-pandemic levels where shipping rates and demand was at it highest

ZIM failed to meet analysts' top- and bottom-line expectations. Management foresees a sharp decline in profitability from 2022 to 2023.

Representing a year-over-year decrease of 63%, ZIM reported Q1 2023 revenue of $1.37 billion. Besides the startling decline in performance compared to the same period last year, ZIM's inability to meet analysts' expectation...

4

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

东方路易 103789013 : L8o{i