$Coinbase (COIN.US)$ $Unity Software (U.US)$ $Palantir (PLTR.US)$ These three stocks are essentially not much different. Some have bad luck, while others are just lucky. But the ultimate direction is the same, just a matter of time. U will follow PLTR, and COIN will chase after U.

Translated

4

1

$Coinbase (COIN.US)$ Bitcoin didn't drop much, but Coinbase dropped a lot, just like fining Microsoft but it doesn't necessarily affect Nasdaq. COIN represents the third batch of ARKK series stocks that haven't risen in this round. You can buy at a bottom here, because the support is close at 47, which means the stop-loss space is very low. If it breaks below this downward trendline, tighten your stop-loss. COIN will continue to drop and test the support near 32.

Translated

1

Translated

From YouTube

1

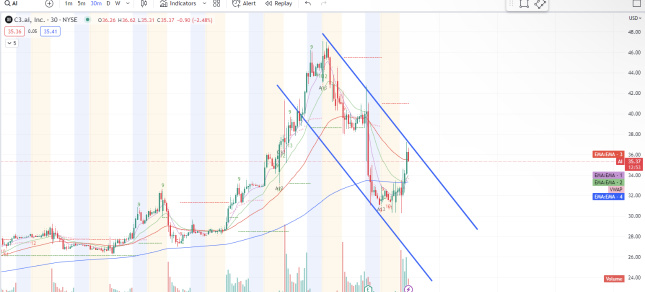

$C3.ai (AI.US)$ 风头正盛的AI业绩后大幅度回踩,但这个AI并不是 #ChatGPT 真正受益的AI股,NVDA才是。30分AI碰触了关键压力位,不突破这个下降趋势想要逆转还是很有难度的。突破再做多才能做顺势交易。如果能突破,我觉得AI真是挺厉害的,应该继续做多

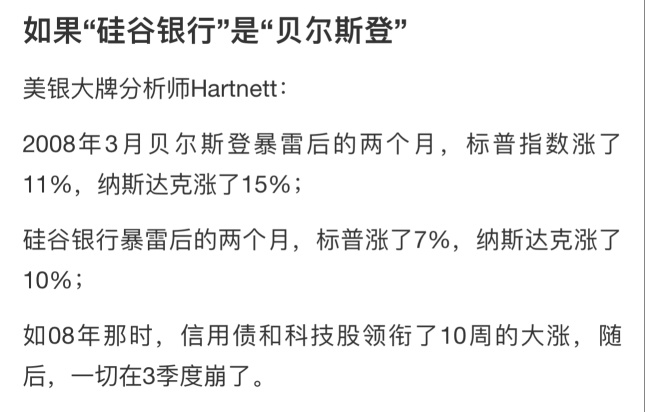

$NVIDIA (NVDA.US)$ The US stock market has a characteristic that once it enters the trillion-dollar club, it is unlikely to retreat easily. Therefore, NVDA should not be shorted in the short term just because it has risen too high. In fact, NVDA should continue to call. A combination of two highs and one low in the 30-minute chart is also a short-term bullish combination, and it is a strong upward trend before it falls below 375.

Translated

2

$E-micro Gold Futures(FEB5) (MGCmain.US)$ $E-micro Gold Futures(FEB5) (MGCmain.US)$ Powell stated that due to tightening credit, he would consider pausing rate hikes, clearly the US Federal Reserve prioritizes inflation over economic recession. The impact of this news on the large cap market still needs to be observed, as Japan and Germany have just reached new highs. It may be difficult for the S&P Nasdaq to rapidly decline in the short term, but the impact on gold and bitcoin is clear, with a bullish outlook in the medium to long term. $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $Direxion Daily Gold Miners Index Bull 2X Shares (NUGT.US)$

Translated

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ Although the Nasdaq has shown a daily high 9 signal, it can only serve as a cautious chase. In the short term, there is no downward trend, and it is very strong above the 8EMA. The Dow was extremely close to breaking through yesterday but did not fall. I also attempted to short and expected it to break through, but the support effectively rebounded strongly, temporarily dispelling the market's fear of decline. From a technical perspective, there is a probability of the Nasdaq reaching 14,000. The bears still need to lie low and continue to survive. $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

Translated

1

$Micro E-mini DJI Index Futures(DEC4) (MYMmain.US)$ $Micro E-mini DJI Index Futures(DEC4) (MYMmain.US)$ The Dow Jones futures have already fallen below a local minor support level. If the important support at 0.033 million cannot hold the decline, there will be a potential acceleration in the market. Buying on the dip at 0.033 million to snatch a rebound, but setting a stop loss at 0.033 million as well. It can only be said that the cost of buying on the dip is very low, and I'm not very sure about the success rate. Personally, I am bearish on the USA economy and stock market in the medium to long term. Although I have held this view since the beginning of the year, the rebound has not changed my expectations. $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$

Translated

$Tesla (TSLA.US)$ $Tesla (TSLA.US)$ Tesla has tightened job recruitment and Musk has informed that all recruitment must be approved by him personally. I believe that in addition to reflecting Musk's strong management style, this is also a precautionary measure against possible economic recession. Musk has been warning about an economic recession. In the past 30 minutes, TSLA has fallen below the upward trend and sideways support, indicating a bearish short-term trend. The overall trend on the daily chart is also in a downward channel. Personally, I am not optimistic about the trend.

Translated

1

$Micro E-mini Nasdaq-100 Index Futures(DEC4) (MNQmain.US)$ $E-mini S&P 500 Futures(DEC4) (ESmain.US)$ Before the market breaks through, you really need to be careful. Although $QQQ already has some signs of a breakthrough, $DIA $IWM $SPY has not shown any signs of a breakthrough. The market has no consistent market conditions and cannot be corroborated. It's too early to talk about a bull market now. In the first quarter, Buffett held 130 billion dollars in cash. His positions were only sold or not bought. When he cashed out at high prices, stocks didn't dare to buy too much. $Invesco QQQ Trust (QQQ.US)$ $iShares Russell 2000 ETF (IWM.US)$ $SPDR S&P 500 ETF (SPY.US)$

Translated

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)