$MAYBANK (1155.MY)$

What is an economic moat?

An economic moat acts as a protective barrier, helping companies stay ahead of competitors and maintain profits over time. It can come from a strong brand (such as trusted Banks like Maybank), cost advantages (making products or services cheaper than competitors), customer loyalty, or unique features that are difficult to replicate (such as exclusive technology or patents). Companies with a wide moat are more likely to succeed in the long run, as competitors find it hard to take away their market share. Think of it as a "business moat" that keeps challengers at bay.

How strong is Maybank's economic moat?

1. Brand and customer loyalty: very strong

Maybank is a leading bank in Malaysia with strong brand recognition and trust among customers. Its extensive network of branches and digital banking platform help to maintain customer loyalty, which is a key driver of its competitive advantage.

2. Cost Advantage: Strong

Due to its large asset base and extensive business in Southeast Asia, Maybank benefits from economies of scale. This enables it to maintain competitively priced products and services while achieving strong profitability. However, the cost advantage is somewhat offset by competition from smaller, more agile fintech companies.

3. Switching Costs: Above Average

The financial services industry typically incurs moderate switching costs because of the relationships established, ...

What is an economic moat?

An economic moat acts as a protective barrier, helping companies stay ahead of competitors and maintain profits over time. It can come from a strong brand (such as trusted Banks like Maybank), cost advantages (making products or services cheaper than competitors), customer loyalty, or unique features that are difficult to replicate (such as exclusive technology or patents). Companies with a wide moat are more likely to succeed in the long run, as competitors find it hard to take away their market share. Think of it as a "business moat" that keeps challengers at bay.

How strong is Maybank's economic moat?

1. Brand and customer loyalty: very strong

Maybank is a leading bank in Malaysia with strong brand recognition and trust among customers. Its extensive network of branches and digital banking platform help to maintain customer loyalty, which is a key driver of its competitive advantage.

2. Cost Advantage: Strong

Due to its large asset base and extensive business in Southeast Asia, Maybank benefits from economies of scale. This enables it to maintain competitively priced products and services while achieving strong profitability. However, the cost advantage is somewhat offset by competition from smaller, more agile fintech companies.

3. Switching Costs: Above Average

The financial services industry typically incurs moderate switching costs because of the relationships established, ...

Translated

11

丰衣足食

liked

$MAYBANK (1155.MY)$

As of December 24, 2024, Malayan Banking Berhad (Maybank) is trading at 10.02 MYR per share.

Analysts have set an average 12-month price target of 11.48 MYR for Maybank, indicating a potential upside of approximately 14.5% from the current price. The highest forecast is 13.44 MYR, and the lowest is 8.94 MYR.

AlphaSpread

Recent developments include Maybank's launch of the "HERpower" initiative, aiming to increase its women-led SME portfolio from 20% to 25% by 2026.

Maybank

...

As of December 24, 2024, Malayan Banking Berhad (Maybank) is trading at 10.02 MYR per share.

Analysts have set an average 12-month price target of 11.48 MYR for Maybank, indicating a potential upside of approximately 14.5% from the current price. The highest forecast is 13.44 MYR, and the lowest is 8.94 MYR.

AlphaSpread

Recent developments include Maybank's launch of the "HERpower" initiative, aiming to increase its women-led SME portfolio from 20% to 25% by 2026.

Maybank

...

1

丰衣足食

commented on

$NOTION (0083.MY)$ strong resistance at 1.32. but looking at income, cash flow, etc, it should be uptrend

3

4

丰衣足食

liked

$NOTION (0083.MY)$ seems to be consolidating here between RM 1.23 - RM 1.30 here within a triangle pattern.

For now won't be expecting much unless able to breakout from its RM 1.32+ immediate downtrend resistance with good volume and buying momentum.

Support: RM 1.25, RM 1.22 areas

Resistance: RM 1.28, RM 1.30, RM 1.32, RM 1.35 areas

For now won't be expecting much unless able to breakout from its RM 1.32+ immediate downtrend resistance with good volume and buying momentum.

Support: RM 1.25, RM 1.22 areas

Resistance: RM 1.28, RM 1.30, RM 1.32, RM 1.35 areas

![NOTION [Titan Weekend Chart Reviews]](https://sgsnsimg.moomoo.com/sns_client_feed/103290357/20241223/976d994755769b1175cb7f0dd5c8a546.jpg/thumb?area=104&is_public=true)

1

丰衣足食

commented on

$NOTION (0083.MY)$Hi please move.

1

2

丰衣足食

commented on

$NOTION (0083.MY)$ sold some other stocks with little profit and get myself NOTION. You better be good ![]()

5

2

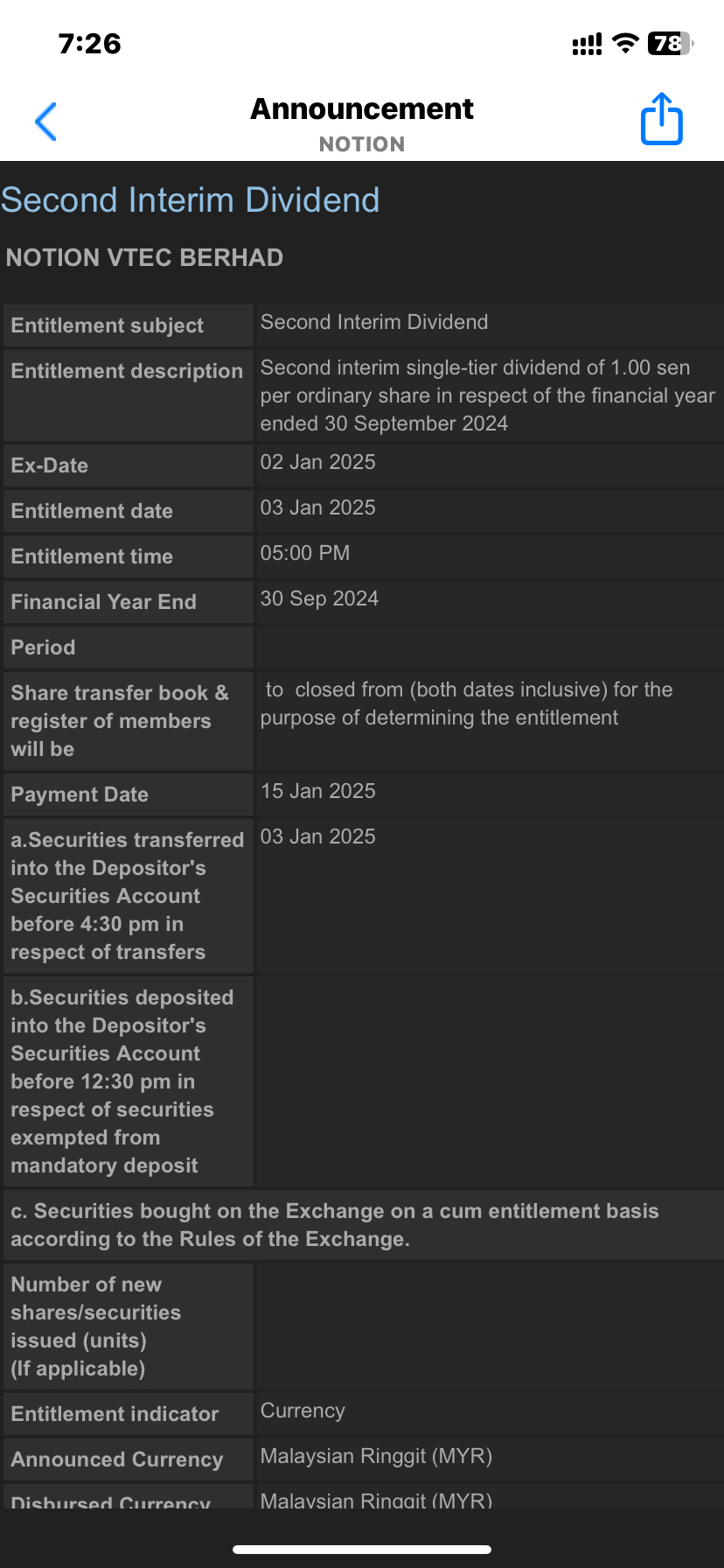

$NOTION (0083.MY)$

Dividend of 1 sen is ex-dividend on 2/1/2025.

Distribution on 15/1/2025.

— - YouTube

Diversified Notion VTec seeks next earnings boost. Author: Liew Jia Teng / The Edge Malaysia June 4, 2024, 5:00 PM. "Our next growth catalyst could be the aluminum extrusion business. If new businesses do materialize, they will have a significant impact on our revenue for the 2025 fiscal year." - Thoo (Photo: Low Yen Yeing/The Edge). This article first appeared in The Edge Malaysia from May 27, 2024, to June 2, 2024. In recent years, precision component manufacturer Notion VTec Bhd (KL: NOTION) has been under investors' radar and its stock price has surged by 225% since the beginning of this year, seemingly on a steady path. Its peers in the hard disk drive (HDD) component manufacturing - JCY International Bhd (KL: JCY) and Dufu Technology Corp Bhd (KL: DUFU) - have also piqued investors' interest, despite only rising by 81% and 25% respectively. It is believed that the strong stock performance of these three stocks is partly due to Western Digital (WD) and Seagate Tech...

Dividend of 1 sen is ex-dividend on 2/1/2025.

Distribution on 15/1/2025.

— - YouTube

Diversified Notion VTec seeks next earnings boost. Author: Liew Jia Teng / The Edge Malaysia June 4, 2024, 5:00 PM. "Our next growth catalyst could be the aluminum extrusion business. If new businesses do materialize, they will have a significant impact on our revenue for the 2025 fiscal year." - Thoo (Photo: Low Yen Yeing/The Edge). This article first appeared in The Edge Malaysia from May 27, 2024, to June 2, 2024. In recent years, precision component manufacturer Notion VTec Bhd (KL: NOTION) has been under investors' radar and its stock price has surged by 225% since the beginning of this year, seemingly on a steady path. Its peers in the hard disk drive (HDD) component manufacturing - JCY International Bhd (KL: JCY) and Dufu Technology Corp Bhd (KL: DUFU) - have also piqued investors' interest, despite only rising by 81% and 25% respectively. It is believed that the strong stock performance of these three stocks is partly due to Western Digital (WD) and Seagate Tech...

Translated

1

丰衣足食

liked

Translated

4

3

3

丰衣足食

commented on

$NOTION (0083.MY)$ What happened?

Translated

4

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)