你最喜欢的绿色

liked

MACRO

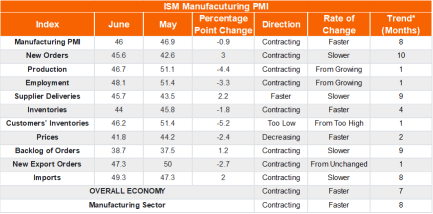

U.S. Factory Sector Contracts in June for Eighth Consecutive Month -- ISM

Activity among U.S. goods producers contracted again in June, reflecting companies' efforts to pare down outputs as optimism about the second half of 2023 weakens.

The Institute for Supply Management said Monday that its index of U.S. manufacturing activity slipped to 46.0 in June from 46.9 in May, indicating that demand eased again as ...

U.S. Factory Sector Contracts in June for Eighth Consecutive Month -- ISM

Activity among U.S. goods producers contracted again in June, reflecting companies' efforts to pare down outputs as optimism about the second half of 2023 weakens.

The Institute for Supply Management said Monday that its index of U.S. manufacturing activity slipped to 46.0 in June from 46.9 in May, indicating that demand eased again as ...

+1

20

1

你最喜欢的绿色

voted

Life is full of regrets

But all we can do is live with it and try hard every day to become better investors.

![]()

![]()

![]()

But all we can do is live with it and try hard every day to become better investors.

20

2

你最喜欢的绿色

liked

$Apple (AAPL.US)$ Are you asking about the opening price and the high price?

Translated

2

你最喜欢的绿色

voted

Many consumers developed a strong appetite for live video and online digital media over the dire months of lockdowns.

Platforms like:

Netflix $Netflix (NFLX.US)$

Disney+ $Disney (DIS.US)$

HBOMax $AT&T (T.US)$ have grown strongly over the past year.

However, $Netflix (NFLX.US)$'s 25% dip on Jan 21 was like a warning to all investors. The number of subscribers won't grow forever.

Billionaire investor William Ackman said his hedge...

Platforms like:

Netflix $Netflix (NFLX.US)$

Disney+ $Disney (DIS.US)$

HBOMax $AT&T (T.US)$ have grown strongly over the past year.

However, $Netflix (NFLX.US)$'s 25% dip on Jan 21 was like a warning to all investors. The number of subscribers won't grow forever.

Billionaire investor William Ackman said his hedge...

20

你最喜欢的绿色

voted

In January 2021, a short squeeze of the stock of the American video game retailer $GameStop (GME.US)$ and other securities took place, causing major financial consequences for certain hedge funds and large losses for short sellers. The short-selling spree of GME stocks reached its climax on Jan 28, 2021.

It has been nearly a year since the "epic battle."

Do you think the once-in-a-decade stock spike can happen again in 2022?

If it happens, will yo...

It has been nearly a year since the "epic battle."

Do you think the once-in-a-decade stock spike can happen again in 2022?

If it happens, will yo...

50

8

你最喜欢的绿色

voted

Trump SPAC $Digital World Acquisition Corp (DWAC.US)$ stock rises after the social media app set a target launch date of February 21.

Its stock jumped by nearly 20% by the close of trading on Thursday.

Trump is launching the company after being banned from just about every social media platform like $Twitter (Delisted) (TWTR.US)$ and $Meta Platforms (FB.US)$ out there following the January 6 insurrection. The new social media company is called TRUTH Social.

And...

Its stock jumped by nearly 20% by the close of trading on Thursday.

Trump is launching the company after being banned from just about every social media platform like $Twitter (Delisted) (TWTR.US)$ and $Meta Platforms (FB.US)$ out there following the January 6 insurrection. The new social media company is called TRUTH Social.

And...

38

4

你最喜欢的绿色

liked

Can we ride on the coattails of star institutions to the moon? Moomoo app allows us to see the positions of top funds based on 13F filings (Quotes > Explore > Star Institutions). Compared to retail investors, institutional investors (sovereign funds, hedge funds, mutual funds, insurance companies, pension funds, etc) have the advantage of immense capital, teams of dedicated analysts and connections retail investors can only dream of. They may be aware of information that retail investor are not aware of or get the information earlier and they can influence the price of a stock due to the size of their trades. Thus, the positions they take can serve as a useful clue of which stocks are undervalued or overvalued.

$ARK Fintech Innovation ETF (ARKF.US)$ $ARK Innovation ETF (ARKK.US)$ $ARK Autonomous Technology & Robotics ETF (ARKQ.US)$ $ARK Next Generation Internet ETF (ARKW.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ $Alphabet-C (GOOG.US)$ $Alphabet-A (GOOGL.US)$ $Tesla (TSLA.US)$ $Meta Platforms (FB.US)$ $Netflix (NFLX.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Advanced Micro Devices (AMD.US)$ $Lucid Group (LCID.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Tiger Global Holdings (LIST2121.US)$ $BYD Co. (BYDDF.US)$ $Alibaba (BABA.US)$ $DiDi Global (Delisted) (DIDI.US)$ $PDD Holdings (PDD.US)$ $Temasek Holdings (LIST2536.US)$ $Snowflake (SNOW.US)$ $Microsoft (MSFT.US)$ $TAL Education (TAL.US)$

Having said that, institutional investors are not infallible. They have made their share of costly mistakes because they too cannot predict the future (the regulation in China against the private education sector was a prime example $New Oriental (EDU.US)$ which caught institutional funds like Temasek Holdings by surprise).

Most importantly, the structuring of one’s investment portfolio should be guided by one’s investment objective, financial needs, time horizon of investment and risk profile which would not match those of institutional investors. What is a suitable investment for the fund may not be suitable for oneself due to differences in the depth of the pocket and exposure to risks, among others.

In addition, the information from 13F may be too late for retail investors to leverage on as the price may have changed since the trades. It also does not tell us the whole story; for instance, institutional funds may take up long positions as a hedge against short positions.

While we all desire our investments to fly to the moon, the positions of star institutions should be used with care; it should be one of many things to consider as part of our research rather than something to be followed blindly.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

Check out Long Term Investment - A Strategy For Growing Returns Without Sleepless Nights https://www.moomoo.com/community/feed/107495017873414?lang_code=2

$ARK Fintech Innovation ETF (ARKF.US)$ $ARK Innovation ETF (ARKK.US)$ $ARK Autonomous Technology & Robotics ETF (ARKQ.US)$ $ARK Next Generation Internet ETF (ARKW.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ $Alphabet-C (GOOG.US)$ $Alphabet-A (GOOGL.US)$ $Tesla (TSLA.US)$ $Meta Platforms (FB.US)$ $Netflix (NFLX.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Advanced Micro Devices (AMD.US)$ $Lucid Group (LCID.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Tiger Global Holdings (LIST2121.US)$ $BYD Co. (BYDDF.US)$ $Alibaba (BABA.US)$ $DiDi Global (Delisted) (DIDI.US)$ $PDD Holdings (PDD.US)$ $Temasek Holdings (LIST2536.US)$ $Snowflake (SNOW.US)$ $Microsoft (MSFT.US)$ $TAL Education (TAL.US)$

Having said that, institutional investors are not infallible. They have made their share of costly mistakes because they too cannot predict the future (the regulation in China against the private education sector was a prime example $New Oriental (EDU.US)$ which caught institutional funds like Temasek Holdings by surprise).

Most importantly, the structuring of one’s investment portfolio should be guided by one’s investment objective, financial needs, time horizon of investment and risk profile which would not match those of institutional investors. What is a suitable investment for the fund may not be suitable for oneself due to differences in the depth of the pocket and exposure to risks, among others.

In addition, the information from 13F may be too late for retail investors to leverage on as the price may have changed since the trades. It also does not tell us the whole story; for instance, institutional funds may take up long positions as a hedge against short positions.

While we all desire our investments to fly to the moon, the positions of star institutions should be used with care; it should be one of many things to consider as part of our research rather than something to be followed blindly.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

Check out Long Term Investment - A Strategy For Growing Returns Without Sleepless Nights https://www.moomoo.com/community/feed/107495017873414?lang_code=2

151

16

你最喜欢的绿色

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved lower last week. Here is the week...

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved lower last week. Here is the week...

+11

116

64

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)