几够力一下

commented on

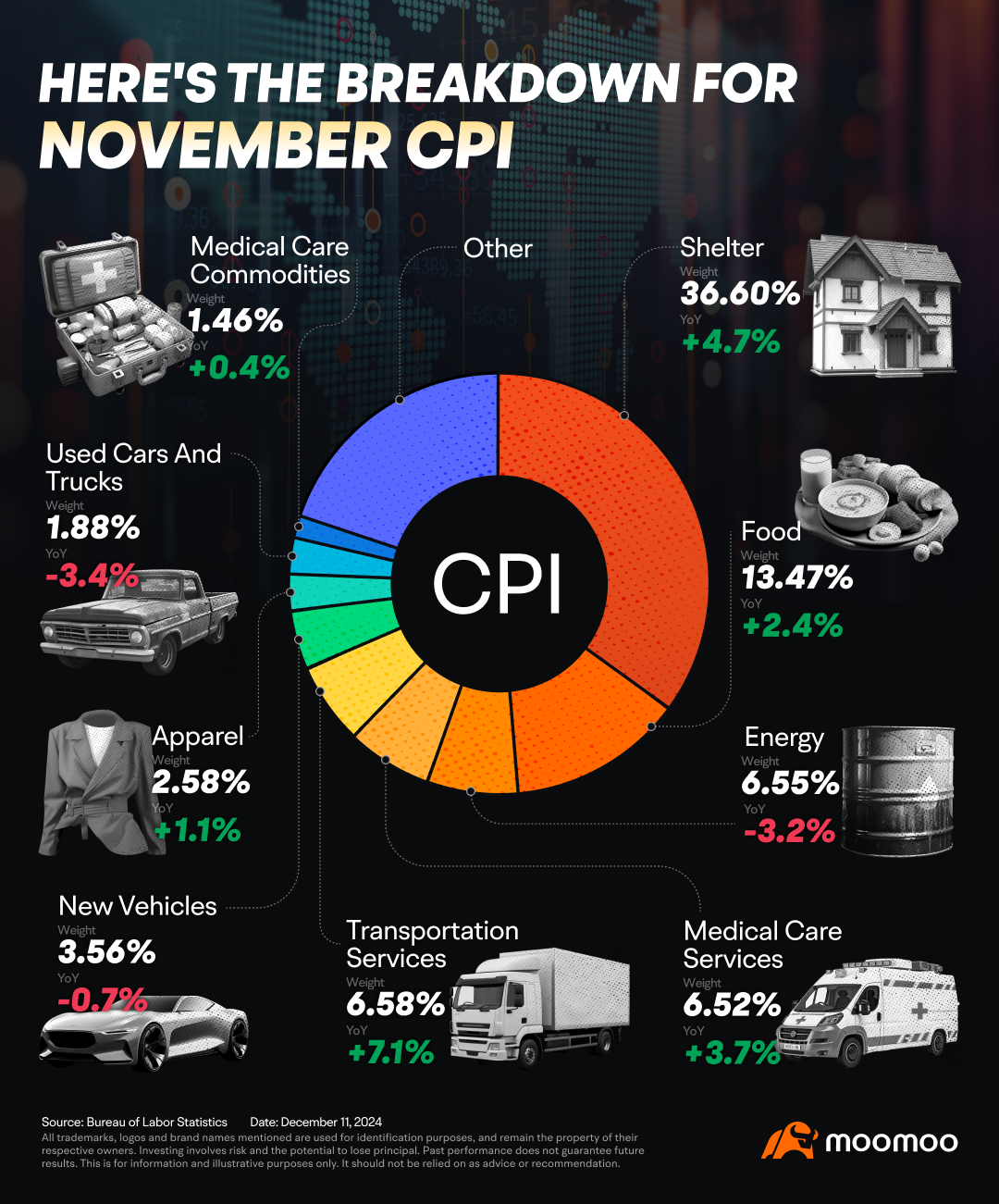

The US annual inflation rate increased for the second consecutive month, reaching 2.7% in November 2024, up from 2.6% in October, aligning with forecasts. The rise reflects partially the low base effects from the previous year.

Food costs were up 2.4% compared with one year ago, after increasing by 2.1% YoY last month.

Energy costs decreased by 3.2% YoY, after decreasing by 4.9% YoY in September. Energy prices increased by 2.2% on a MoM base.

Us...

Food costs were up 2.4% compared with one year ago, after increasing by 2.1% YoY last month.

Energy costs decreased by 3.2% YoY, after decreasing by 4.9% YoY in September. Energy prices increased by 2.2% on a MoM base.

Us...

102

10

46

几够力一下

commented on

$CEB (5311.MY)$ Today, the large cap opened high and went low. Many followed the decline, and in these past few days, the leading gainers list included those demon stocks that suddenly skyrocketed out of nowhere. I believe many investors will adopt a cautious attitude. Moreover, the large cap has pretty much finished consolidating. If all sorts of stocks surge afterwards and funds are diversified, the upward momentum should be a bit challenging. If there is a breakthrough above the resistance level against the market trend, that would be Very Good! I believe many people will choose to follow. Market makers, can you go up a little today?![]()

Translated

5

5

几够力一下

commented on

$CEB (5311.MY)$ You know that pertama took 3 years to rise from 0.1x to 3.xx, an increase of over 30 times. It rose so high that people forgot it was a junk stock, and then within a month, it went back to its original state. Besides pertama, there are also Artroniq, cfm, hongseng, and others, all following the same pattern. Market makers' strategies take years, not days, so be patient.

Translated

4

3

几够力一下

liked and commented on

Lucky I decided to take profit at 0.4, was worried I sold too early when it went to 0.405, buy in again tomorrow

8

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

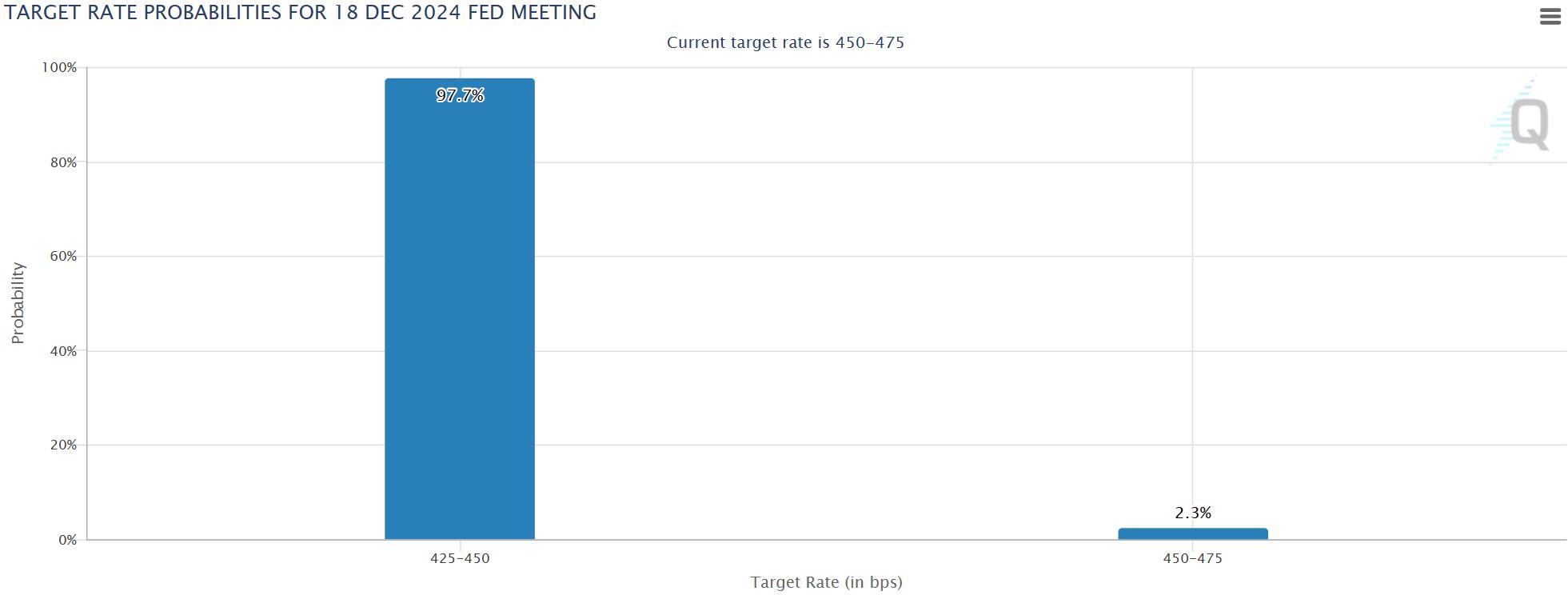

几够力一下 : basically saying that its very certain a rate cut is coming in the US. what does it mean for us ? well, a rate cut usually leads to investors seeking higher return elsewhere, be it in commodities, equities, real estate or even cryptocurrency. what will happen essentially is alot of money will be flowing into these sectors with higher returns, and expect bull markets in several sectors soon and well into 2025 most likely