刻苦的饕餮

commented on

$Tesla (TSLA.US)$ If not split, the stock price of 3520 would be the most expensive stock in the world.

Translated

2

1

刻苦的饕餮

commented on

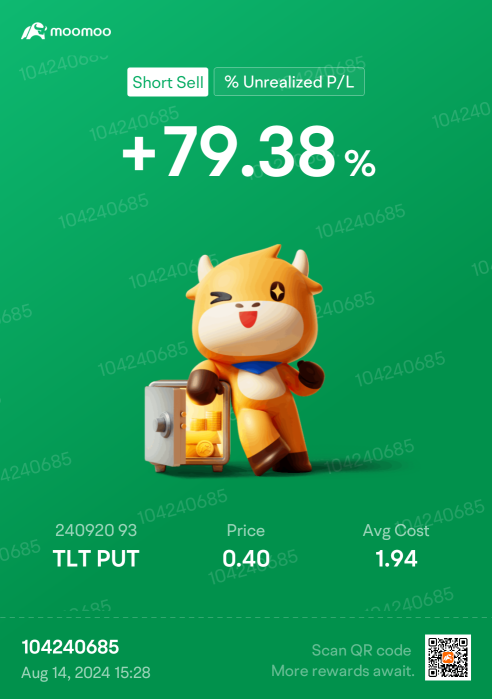

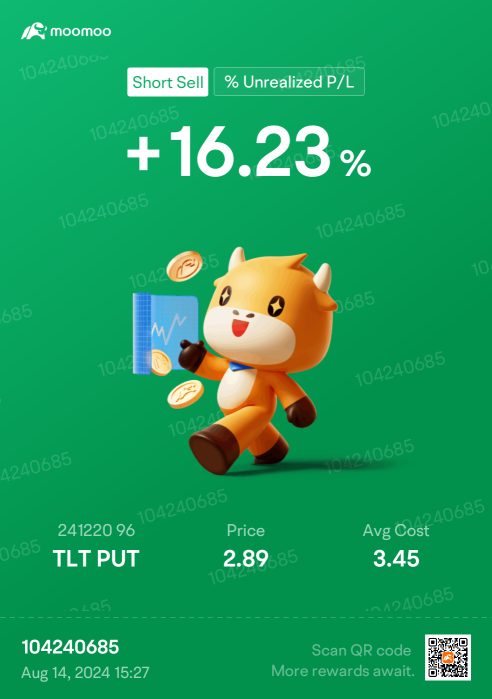

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ This water is about to splash soon.

Translated

1

2

刻苦的饕餮

commented on

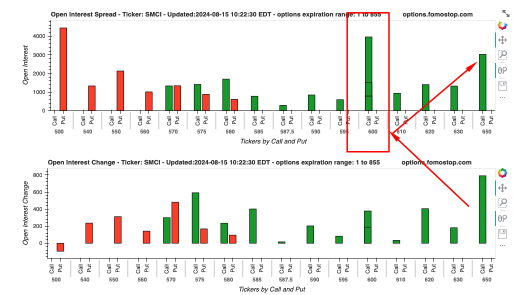

$Meta Platforms (META.US)$ Ready for 480. Look at the put call volume. Run when you can fellow and buy back later![]()

![]()

![]()

4

刻苦的饕餮

commented on

$TSLA 241025 250.00P$ Bought a put spread 260/250 expiring tomorrow, let's see what the market maker has to say.

Translated

3

刻苦的饕餮

commented on

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ It is possible to add positions at the bottom of the uptrend channel.

Translated

3

2

刻苦的饕餮

liked

Non-farm payroll rate(Non-farm Payrolls, NFP) refers toUS Bureau of Labor Statisticsfirst Friday of each month A significant economic data release that reflects the changes in the number of new job additions in the non-agricultural sector in the United States. This data does not include employment numbers in the agricultural industry, hence it is called 'non-farm employment'.The significance of the non-farm employment rate.'Non-farm employment'.

$NASDAQ 100 Index (.NDX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$

The significance of the non-farm employment rate.You can find the "News" feature under the "Market"-"More" section.

1. Indicators of economic health.: The non-farm employment rate reflects the overall economic health of the USA. An increase in employment usually indicates economic growth, with businesses expanding production and increasing employment. A decrease in employment may indicate economic slowdown or recession.

2. Impact on market trends.: After the release of non-farm payroll data, it usually has a significant impact on the financial markets, especially the forex market, stocks market, and bonds market. Strong non-farm employment data often bolster the US dollar, as it indicates that economic growth may prompt the Fed to raise interest rates. Conversely, weak non-farm data may lead to a weakening of the US dollar.

3. Impact on policy decision-making: Non-farm employment data is also a factor in the Federal Reserve's monetary policy...

$NASDAQ 100 Index (.NDX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$

The significance of the non-farm employment rate.You can find the "News" feature under the "Market"-"More" section.

1. Indicators of economic health.: The non-farm employment rate reflects the overall economic health of the USA. An increase in employment usually indicates economic growth, with businesses expanding production and increasing employment. A decrease in employment may indicate economic slowdown or recession.

2. Impact on market trends.: After the release of non-farm payroll data, it usually has a significant impact on the financial markets, especially the forex market, stocks market, and bonds market. Strong non-farm employment data often bolster the US dollar, as it indicates that economic growth may prompt the Fed to raise interest rates. Conversely, weak non-farm data may lead to a weakening of the US dollar.

3. Impact on policy decision-making: Non-farm employment data is also a factor in the Federal Reserve's monetary policy...

Translated

8

1

5

刻苦的饕餮

liked and commented on

$iShares 20+ Year Treasury Bond ETF (TLares 2 Something to note. Price is very close to the previous, long-term descending channel going back to March 2020 (in blue) . On Moomoo, price shows as above the old support line, but on ThinkorSwim it is showing as still below it, just barely.

Either way, I think it's close enough that confirmation is needed, otherwise it could reject. That said, there are a lot of economic and geopolitical factors that I believe could cause this to continue to rally a...

Either way, I think it's close enough that confirmation is needed, otherwise it could reject. That said, there are a lot of economic and geopolitical factors that I believe could cause this to continue to rally a...

5

2

刻苦的饕餮

commented on

Translated

1

3

刻苦的饕餮

reacted to and commented on

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ CPI God don't fail me now! With any luck, I'm gonna roll up these put options and tp.

5

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

刻苦的饕餮 : Is Berkshire gone?