猪猪boy__

commented on and voted

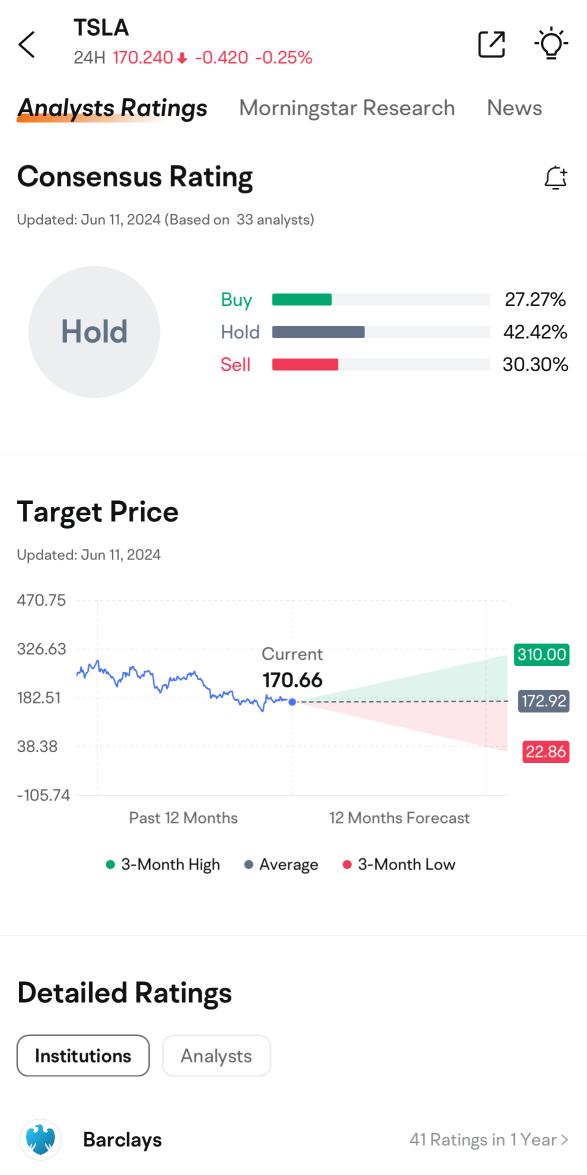

$Tesla (TSLA.US)$ is set to hold its annual shareholder meeting on June 13, with investors voting on whether to reapprove CEO Elon Musk's $55.8 billion pay package. The AGM outcome could affect Tesla's future trajectory and reveal shareholder sentiments on crucial governance matters. How will TSLA's annual meeting results drive its share price? Make your guess now! ![]()

![]()

![]()

![]() Rewards

Rewards

● An equal share of 10,000 points: For mooers ...

● An equal share of 10,000 points: For mooers ...

195

363

猪猪boy__

liked

The semiconductor sector completely crashed on Friday, but the Dow rose. Overall, the number of increases was about the same as the number of individual stocks falling. There was no panic in the market; it was just focused on semiconductors and big technology. The reason is simple. The demon stock SMCI announced financial results on 4/30, but did not give the same performance forecast as in the past. The other is that SoftBank holds 90% of ARM. Since SoftBank has already mortgaged most of ARM, once ARM's stock price falls, it is very likely to cause SoftBank to sell ARM to recover funds; SMCI's performance mainly comes from Nvidia, so Nvidia has also been questioned. Since there are too many semiconductors, it has caused a stomping phenomenon, which can be said to be a blood crash. Now we can only wait until the line improves before considering entering the semiconductor market. Next week's big tech earnings report will be another bloody storm.

Translated

6

1

猪猪boy__

commented on

This week, I bought back some NVDL and opened positions in AMD (because AMD has launched the MI300, which is said to be comparable to the H100 or even H200. I personally think there is a higher possibility of a positive financial report for AMD). I also opened positions in energy and gold. The AI sector is expected to enter a sideways consolidation phase next. If the overall market does not fall, funds will flow into major sectors for catch-up gains. The mistakes in options trading during this cycle resulted in a significant profit retracement, which is definitely frustrating. It's really difficult to not let emotions affect trading. I will review the week over the weekend and start anew next week.

Translated

2

5

猪猪boy__

liked and commented on

It has been a few days since I last shared, cleared the nvdl and other callbacks, bought a long call on Google. This week, mainly participated in selling puts on djt, realizing that when volatility is high, selling puts is basically profitable and risk-free because volatility will not remain high forever. Even if the stock price falls, we can still make money. Therefore, this strategy is relatively stable. Looking back on this quarter, I made a lot of profit, but also suffered a lot of losses. After learning many strategies and engaging in a lot of short-term actual combat, I discovered that offense is not the most important, defense is. The most important skill for a mature trader should be the ability to control capital drawdown. I am no longer pursuing multiplying returns by how many times in a year, but relying on the accumulated data and practical experience to make good decisions each time to achieve long-term, relatively stable compound interest and accumulate capital.

Translated

11

3

猪猪boy__

liked

Today, the Fed confirmed three interest rate cuts, and the dot plot remained unchanged. Powell's speech seemed more like downplaying the recent inflation rebound in order to justify the interest rate cuts. After all, it's an election year, and no one dares to act recklessly. In summary, it's holding stocks for a rise (I entered a small position in MU at the end of the day, and the financial report is good 😁).

Translated

2

猪猪boy__

liked and commented on

Yesterday's GTC by NVIDIA overall felt like NVIDIA strengthened its moat, but did not mention the price of Blackwell and potential customer demand, so it is impossible to evaluate the sales situation in 2025. Personally, I have decided to continue holding NVIDIA and will continue to increase my position in NVDL today. Companies in the semiconductor space will undergo differentiation. Tomorrow's Federal Reserve meeting, the main focus will be on whether there are any changes in the dot plot.

Translated

6

1

猪猪boy__

liked and commented on

I haven't been doing much these past couple of days. The implied volatility of chip stocks is still good, so I sold nvdl's call and put options to earn some premium. I feel that most of the volatility from tomorrow's quadruple witching day has already been reflected in today's stock prices. I'm holding 40% of nvdl and 10% of smci, waiting for next week's gtc conference.

Translated

3

4

猪猪boy__

liked

Today's CPI slightly exceeded expectations. However, Oracle's financial report yesterday specifically mentioned that the demand for AI base stations is still far greater than the supply, indicating that the AI trend is still fermenting. I opened a call option for MU during the trading session, but did not make any significant moves. The stocks I bought at the dip last Friday, SMCI and Nvidia, unexpectedly made profits today, demonstrating the strength of the semiconductor industry.

Translated

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)