十年投资计划

liked

The Jackson Hole Global Central Bank Annual Economic Policy Symposium is seen as an important stage for central banks around the world to convey monetary policy signals. It attracts central bank leaders and economists from many countries each year. The theme of this year's conference is "Reassessing the Effectiveness and Transmission of Monetary Policy".

On Friday, August 23rd, US Fed Chair Powell made it clear that a rate cut is coming, driving the three major US stock indexes to open and close significantly higher, and US bond yields to plummet. It was a day of overall gains in the US stock market, with 80% of US companies seeing an increase in stock prices. The 11 sectors of the S&P 500 all closed higher, with the real estate sector leading the way with a 2% gain.

At the Jackson Hole Global Central Bank Annual Symposium,Powell said the long-awaited words - it is time to adjust the policy, and "the upward risks to inflation have diminished"..

Just as the words fell, global stock markets were volatile! US stocks, gold and other currencies rose sharply in response!

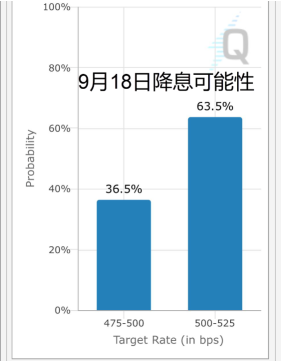

Saying goodbye to the interest rate cycle, finally, a rate cut in September.

In his speech, Powell said, "I am increasingly confident that inflation is recovering sustainably on the path to 2%; the labor market has clearly cooled down and is no longer as overheated as before... We are not seeking or welcoming the labor market to cool further." Powell's series of speeches means that the Federal Reserve is very likely to cut interest rates at next month's policy meeting, which will be the first rate cut in over four years."

Powell said, "The timing and pace of interest rate cuts will depend on the data and outlook..."

On Friday, August 23rd, US Fed Chair Powell made it clear that a rate cut is coming, driving the three major US stock indexes to open and close significantly higher, and US bond yields to plummet. It was a day of overall gains in the US stock market, with 80% of US companies seeing an increase in stock prices. The 11 sectors of the S&P 500 all closed higher, with the real estate sector leading the way with a 2% gain.

At the Jackson Hole Global Central Bank Annual Symposium,Powell said the long-awaited words - it is time to adjust the policy, and "the upward risks to inflation have diminished"..

Just as the words fell, global stock markets were volatile! US stocks, gold and other currencies rose sharply in response!

Saying goodbye to the interest rate cycle, finally, a rate cut in September.

In his speech, Powell said, "I am increasingly confident that inflation is recovering sustainably on the path to 2%; the labor market has clearly cooled down and is no longer as overheated as before... We are not seeking or welcoming the labor market to cool further." Powell's series of speeches means that the Federal Reserve is very likely to cut interest rates at next month's policy meeting, which will be the first rate cut in over four years."

Powell said, "The timing and pace of interest rate cuts will depend on the data and outlook..."

Translated

+8

11

十年投资计划

liked

The recent rapid surge is a bit too fast, making me want to sell nvidia short. I have been gradually adding positions from a cost of 104, and luckily set a sell at $130 to make a small profit of 30%. There is also a bit of luck involved. Next is to wait for the financial report to come out, I believe the volatility in the next few days will increase, once some people start arbitrage, panic will magnify, the collapse should happen quite quickly, I will patiently wait for the opportunity to add positions.

Translated

6

1

十年投资计划

reacted to

Keep up the good work, and 10 years of development will definitely get better and better.

Don't follow suit blindly, learn to analyze your own, invest wisely, and manage your finances rationally.

Don't follow suit blindly, learn to analyze your own, invest wisely, and manage your finances rationally.

Translated

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)