$Tesla (TSLA.US)$

$Apple (AAPL.US)$

$The Mosaic (MOS.US)$

The first step in investing is to protect your principal, and the second step is to make money.

For most people, the margin of error in investing is actually very low. The reason is simple because the capital is limited. If risk control and position management are not done to protect it, the capital may be lost.

Therefore, ensuring the safety of the principal is the primary goal that allows us to survive and achieve stable profits in the market. When trading in the long term, there will inevitably be times when judgments are incorrect. How can we control risk to keep losses within a relatively small range? In addition to learning basic technical analysis methods, you can also use the following trading strategies:

1. Entry: It is necessary to prepare the trading plan in advance and strictly implement it, set the entry price, and set the stop loss price reminder.

2. Bargain hunting: Start with a small position to bargain hunt (for example, if you plan to buy 1000 shares of this stock, start by buying 200 shares as a tentative bargain hunting).

3. Adding positions: After the overall trend emerges, gradually add positions in the middle to maximize profits.

4. Stop loss: Once the stop loss level is breached, it must be strictly implemented, including setting the stop loss level below the opening price. Remember to always set a stop loss! (Key levels have strong support, once breached, institutions will short sell accordingly)

5. Take Profit: when the profit of the stocks in hand reaches the predetermined target, sell them to lock in the gains.

$Apple (AAPL.US)$

$The Mosaic (MOS.US)$

The first step in investing is to protect your principal, and the second step is to make money.

For most people, the margin of error in investing is actually very low. The reason is simple because the capital is limited. If risk control and position management are not done to protect it, the capital may be lost.

Therefore, ensuring the safety of the principal is the primary goal that allows us to survive and achieve stable profits in the market. When trading in the long term, there will inevitably be times when judgments are incorrect. How can we control risk to keep losses within a relatively small range? In addition to learning basic technical analysis methods, you can also use the following trading strategies:

1. Entry: It is necessary to prepare the trading plan in advance and strictly implement it, set the entry price, and set the stop loss price reminder.

2. Bargain hunting: Start with a small position to bargain hunt (for example, if you plan to buy 1000 shares of this stock, start by buying 200 shares as a tentative bargain hunting).

3. Adding positions: After the overall trend emerges, gradually add positions in the middle to maximize profits.

4. Stop loss: Once the stop loss level is breached, it must be strictly implemented, including setting the stop loss level below the opening price. Remember to always set a stop loss! (Key levels have strong support, once breached, institutions will short sell accordingly)

5. Take Profit: when the profit of the stocks in hand reaches the predetermined target, sell them to lock in the gains.

Translated

$SPDR S&P 500 ETF (SPY.US)$

$iShares China Large-Cap ETF (FXI.US)$

$Tesla (TSLA.US)$

Trading US stocks, etf is an indispensable stock trading tool. It has a wide range of applications and flexible usage. Mastering it will be a very good money-making tool.

For newcomers to the stock market, the difficulty lies not in how to pick stocks, but in how to avoid risks or minimize them. Often, stocks within each sector go up and down, and we cannot guarantee that the individual stock we choose will be the one that goes up in the sector. When we choose a stock, all the risks are concentrated on that one stock. However, when choosing an ETF for a sector, the risks of individual stocks will be relatively hedged, thereby reducing the holding risk, and the return will not be less than holding individual stocks. Furthermore, it can also relatively reduce the risk of holding a single stock. From the historical data perspective, investing in large cap indices like SPY or QQQ regularly, the annual return can reach 8%, which is quite considerable in the long term. In addition, if you want to choose other ETFs for short-term or long-term holding, or to find strong sectors through ETFs, it is also a feasible method. There are also many methods to choose ETFs, and it entirely depends on personal judgment to make the selection. Lately, I have been watching daily videos from the stock blogger Wolf King US Stocks, which includes weekly analysis and trends of ETFs. Interested friends can search for more information. Learning a little every day will enhance your survival skills in the stock market!

$iShares China Large-Cap ETF (FXI.US)$

$Tesla (TSLA.US)$

Trading US stocks, etf is an indispensable stock trading tool. It has a wide range of applications and flexible usage. Mastering it will be a very good money-making tool.

For newcomers to the stock market, the difficulty lies not in how to pick stocks, but in how to avoid risks or minimize them. Often, stocks within each sector go up and down, and we cannot guarantee that the individual stock we choose will be the one that goes up in the sector. When we choose a stock, all the risks are concentrated on that one stock. However, when choosing an ETF for a sector, the risks of individual stocks will be relatively hedged, thereby reducing the holding risk, and the return will not be less than holding individual stocks. Furthermore, it can also relatively reduce the risk of holding a single stock. From the historical data perspective, investing in large cap indices like SPY or QQQ regularly, the annual return can reach 8%, which is quite considerable in the long term. In addition, if you want to choose other ETFs for short-term or long-term holding, or to find strong sectors through ETFs, it is also a feasible method. There are also many methods to choose ETFs, and it entirely depends on personal judgment to make the selection. Lately, I have been watching daily videos from the stock blogger Wolf King US Stocks, which includes weekly analysis and trends of ETFs. Interested friends can search for more information. Learning a little every day will enhance your survival skills in the stock market!

Translated

1

$Hang Seng Index (800000.HK)$

$Tesla (TSLA.US)$

$Occidental Petroleum (OXY.US)$

I've mentioned this topic before, and I'm going to talk about it again today. I used to blindly buy and sell stocks according to the positions of video bloggers. Moreover, I followed not just one video blogger. The stocks I bought were basically similar to index funds. My experience was losing money. I don't know if any of you viewers who operate like this have made money. If you have made money and endorse this approach, then just stick with it. Perhaps this is your trading plan.

However, upon reflection, I realized that I simply don't have the time to look at so many stocks, nor the possibility of knowing the bloggers' actions immediately. So, I can't copy this method of doing homework.

After encountering langwang, I started trying to learn trading techniques, attempting to make plans and trade based on my own knowledge. Although most of the time his entry points are crucial references, even the only answer for me. But now, I am still trying hard to adhere to my own trading plan.

If you carefully look at Langwang's video description column and channel homepage, you will find that Langwang's channel layout is very thoughtful. Please take a moment to think about why Langwang puts the latest videos at the bottom of the homepage, instead of following the common practice of many bloggers who put...

$Tesla (TSLA.US)$

$Occidental Petroleum (OXY.US)$

I've mentioned this topic before, and I'm going to talk about it again today. I used to blindly buy and sell stocks according to the positions of video bloggers. Moreover, I followed not just one video blogger. The stocks I bought were basically similar to index funds. My experience was losing money. I don't know if any of you viewers who operate like this have made money. If you have made money and endorse this approach, then just stick with it. Perhaps this is your trading plan.

However, upon reflection, I realized that I simply don't have the time to look at so many stocks, nor the possibility of knowing the bloggers' actions immediately. So, I can't copy this method of doing homework.

After encountering langwang, I started trying to learn trading techniques, attempting to make plans and trade based on my own knowledge. Although most of the time his entry points are crucial references, even the only answer for me. But now, I am still trying hard to adhere to my own trading plan.

If you carefully look at Langwang's video description column and channel homepage, you will find that Langwang's channel layout is very thoughtful. Please take a moment to think about why Langwang puts the latest videos at the bottom of the homepage, instead of following the common practice of many bloggers who put...

Translated

1

$FULU HOLDINGS (02101.HK)$

$Tesla (TSLA.US)$

$Apple (AAPL.US)$

Make sure you have a good profit and loss ratio before making a trade. In disguise, you need to figure out where to take profit and stop loss before trading. You can judge take-profit and stop-loss here from fundamentals or technology. Or judge the fundamentals and technical aspects together. Normally, the take-profit and stop-loss points judged by fundamentals are only far from the current price. But it's not about value investing. If I hold on for a long time, I don't need to stop loss or stop profit. Value investing also requires stop-loss.

If you understand the above, you just need to think, what kind of profit and loss can you accept? If you're willing to try it out with a profit and loss ratio of 1:10, then go back to Tesla's 700 to 950 example, and you can go in at any time. According to the points given by the bloggers I read, the profit to loss ratio is excellent. If you think this profit to loss ratio is too conservative, and I can accept a small profit and loss ratio, then you can change your points and you're done entering the market.

Watching other people's videos is always a reference. Make changes based on your own circumstances before making a deal. If you choose to follow without thinking, then if you don't have time to get on the bus, then just ignore it without thinking, which is also great. In turn, they complained that there is no need for this; if you have this time, it's better to learn technology.

$Tesla (TSLA.US)$

$Apple (AAPL.US)$

Make sure you have a good profit and loss ratio before making a trade. In disguise, you need to figure out where to take profit and stop loss before trading. You can judge take-profit and stop-loss here from fundamentals or technology. Or judge the fundamentals and technical aspects together. Normally, the take-profit and stop-loss points judged by fundamentals are only far from the current price. But it's not about value investing. If I hold on for a long time, I don't need to stop loss or stop profit. Value investing also requires stop-loss.

If you understand the above, you just need to think, what kind of profit and loss can you accept? If you're willing to try it out with a profit and loss ratio of 1:10, then go back to Tesla's 700 to 950 example, and you can go in at any time. According to the points given by the bloggers I read, the profit to loss ratio is excellent. If you think this profit to loss ratio is too conservative, and I can accept a small profit and loss ratio, then you can change your points and you're done entering the market.

Watching other people's videos is always a reference. Make changes based on your own circumstances before making a deal. If you choose to follow without thinking, then if you don't have time to get on the bus, then just ignore it without thinking, which is also great. In turn, they complained that there is no need for this; if you have this time, it's better to learn technology.

Translated

$Apple (AAPL.US)$

$Tesla (TSLA.US)$

$Netflix (NFLX.US)$

After buying stocks, when losses occur, how long can you tolerate unrealized losses? Personally, I think this mostly depends on your confidence in holding the stocks. There are several sources of confidence, such as:

1. Understanding the fundamentals of stocks

2. Inferring from technical analysis

3. Or continue to hold due to friends around holding

4. Heard that the stock price can triple

5. The stock analyst's bullish rating on this stock, and they generally do not make mistakes

6. Due to recommendations from financial bloggers

7. Personal intuition judgment, company's performance is very good, and will soon break out

etc...

Which type of confident stock operation do you hold above, will definitely influence it. Furthermore, the so-called sources of this confidence also affect whether we can make correct and rational judgments on investment stocks, thereby selecting symbols rationally and setting rational stop losses and profits. I believe that some of these so-called sources of confidence can be used for reference, and some require thinking, rather than blindly following others. In order to avoid blind following, one must improve their ability to judge the market. There are many ways to improve, such as self-study and finding a mentor who suits you. Because I have always been interested in technical analysis of stocks, I choose technical analysis to increase my confidence in holding stocks. Nearly a year ago, I was fortunate enough to learn pure technical analysis methods from the video lessons of the Wolf King Financial blogger, benefiting...

$Tesla (TSLA.US)$

$Netflix (NFLX.US)$

After buying stocks, when losses occur, how long can you tolerate unrealized losses? Personally, I think this mostly depends on your confidence in holding the stocks. There are several sources of confidence, such as:

1. Understanding the fundamentals of stocks

2. Inferring from technical analysis

3. Or continue to hold due to friends around holding

4. Heard that the stock price can triple

5. The stock analyst's bullish rating on this stock, and they generally do not make mistakes

6. Due to recommendations from financial bloggers

7. Personal intuition judgment, company's performance is very good, and will soon break out

etc...

Which type of confident stock operation do you hold above, will definitely influence it. Furthermore, the so-called sources of this confidence also affect whether we can make correct and rational judgments on investment stocks, thereby selecting symbols rationally and setting rational stop losses and profits. I believe that some of these so-called sources of confidence can be used for reference, and some require thinking, rather than blindly following others. In order to avoid blind following, one must improve their ability to judge the market. There are many ways to improve, such as self-study and finding a mentor who suits you. Because I have always been interested in technical analysis of stocks, I choose technical analysis to increase my confidence in holding stocks. Nearly a year ago, I was fortunate enough to learn pure technical analysis methods from the video lessons of the Wolf King Financial blogger, benefiting...

Translated

2

$Tesla (TSLA.US)$

$Apple (AAPL.US)$

$Occidental Petroleum (OXY.US)$

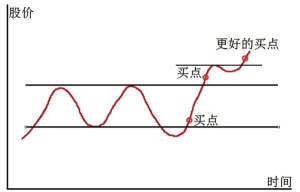

Recently, the market is becoming more and more difficult to control, and I don't know whether to go short or go long. Either they can't keep up with the pace of the market, or they're frustrated that they can't get out of it, or FOMO is catching up with the duvet. I don't know the reason why I should do it. After careful thought, I still haven't established an operation strategy that suits me. There are various operating strategies, and what is right for others may not be right for you. I personally think that either left-hand trading or right-side trading is the main one. Just set your own trading strategy and execute it according to the strategy. If left-hand trading is the main focus, wait patiently for lows and opportunities. In actual operation, when judgments are inaccurate, strict implementation of stop-loss can reduce losses. However, if you mainly trade on the right side, don't worry about going short for a while, and wait until the trend is clear before operating. Regardless of the method, there is no such thing as right or wrong. The most important thing is to practice and operate in whichever way suits you. Operation without a trading strategy is easy to be punched in the face by the market. I think I'm still a stock market nob, and I have a lot to learn. My method of learning is to find videos that suit my trading style, which also allowed me to find the right mentors for me to follow. Recently, I've been following his Reading Notes channel to learn the interpretation of Wall Street stock master Jesse Livermore's legendary experience in the stock market, benefiting...

$Apple (AAPL.US)$

$Occidental Petroleum (OXY.US)$

Recently, the market is becoming more and more difficult to control, and I don't know whether to go short or go long. Either they can't keep up with the pace of the market, or they're frustrated that they can't get out of it, or FOMO is catching up with the duvet. I don't know the reason why I should do it. After careful thought, I still haven't established an operation strategy that suits me. There are various operating strategies, and what is right for others may not be right for you. I personally think that either left-hand trading or right-side trading is the main one. Just set your own trading strategy and execute it according to the strategy. If left-hand trading is the main focus, wait patiently for lows and opportunities. In actual operation, when judgments are inaccurate, strict implementation of stop-loss can reduce losses. However, if you mainly trade on the right side, don't worry about going short for a while, and wait until the trend is clear before operating. Regardless of the method, there is no such thing as right or wrong. The most important thing is to practice and operate in whichever way suits you. Operation without a trading strategy is easy to be punched in the face by the market. I think I'm still a stock market nob, and I have a lot to learn. My method of learning is to find videos that suit my trading style, which also allowed me to find the right mentors for me to follow. Recently, I've been following his Reading Notes channel to learn the interpretation of Wall Street stock master Jesse Livermore's legendary experience in the stock market, benefiting...

Translated

3

1

$Tesla (TSLA.US)$

$Apple (AAPL.US)$

$FULU HOLDINGS (02101.HK)$

This question has been discussed many times. What is my role in the marketplace? Value investor or trader? Everyone can have a different role. Just like everyone can have several stock accounts. Just do what's right for your character. But be sure to be careful and don't screw it off. It's like a comment in a comment. I think they clearly confused their characters and wrote their comments after coming back to the perspective of God.

Let me first talk about my first thoughts after seeing the reviews. I'm not disappointed; I'm affirming myself. I am very happy that I have not been interrupted by the market. I have stuck to my trading plan, that is, I have not opened a position until the opening range on the left. Chasing breakthroughs is something I don't want to do in the current environment. So I haven't touched Tesla at all.

No matter what type of role you are in, make your own trading plan before you trade. Then try to abide by it. This is a big rule. There is no such principle. If you hear someone say buy today, buy it; if you hear someone say sell tomorrow, sell it. Unless this person is God, if this is the case for a long time, and if I don't lose money, I'd be happy to see why? When it comes to people who complain, I don't want to argue with them, and I don't want to try to make them understand my point of view. I just wanted to use this example...

$Apple (AAPL.US)$

$FULU HOLDINGS (02101.HK)$

This question has been discussed many times. What is my role in the marketplace? Value investor or trader? Everyone can have a different role. Just like everyone can have several stock accounts. Just do what's right for your character. But be sure to be careful and don't screw it off. It's like a comment in a comment. I think they clearly confused their characters and wrote their comments after coming back to the perspective of God.

Let me first talk about my first thoughts after seeing the reviews. I'm not disappointed; I'm affirming myself. I am very happy that I have not been interrupted by the market. I have stuck to my trading plan, that is, I have not opened a position until the opening range on the left. Chasing breakthroughs is something I don't want to do in the current environment. So I haven't touched Tesla at all.

No matter what type of role you are in, make your own trading plan before you trade. Then try to abide by it. This is a big rule. There is no such principle. If you hear someone say buy today, buy it; if you hear someone say sell tomorrow, sell it. Unless this person is God, if this is the case for a long time, and if I don't lose money, I'd be happy to see why? When it comes to people who complain, I don't want to argue with them, and I don't want to try to make them understand my point of view. I just wanted to use this example...

Translated

9

3

卓管家

liked and commented on

$S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $iShares Russell 2000 ETF (IWM.US)$

In the current market situation, either wait for the bull market trend to return before entering long positions, or wait for a true support level to buy at the bottom. In the current state of neither rising nor falling, it's best to observe more and do less, or even not do anything at all. Each of us has worked hard to earn our money, so let's not waste it. In the stock market, the most important thing is to protect your capital. Remember the experience of our ancestors, keep what we have and not be afraid of losing opportunities. To put it simply, even if the market rebounds tomorrow and returns to a bull market, you would only miss out on 15 points in the QQQ, earning a little less, but your capital would remain intact. If a trend emerges, there could be at least 40 points for you. If the market continues to decline and you really have to explore lower positions, then you would incur losses. In case you can't hold on and cut losses at the bottom, you would be left with no means to buy at the bottom and can only watch others make money. So, it's not just about losing money, but it might also take a long time to correct your mindset. When trading stocks, remember to avoid a gambling mentality and a mentality of being unwilling to accept losses. Gambling doesn't guarantee a steady win, even if you say that trading stocks is also a form of gambling, we still choose the best entry points after precise analysis, greatly increasing the winning rate compared to gambling. And if you do lose, don't be unwilling to accept it. Whether in life or making mistakes, we need to take responsibility, especially in trading stocks. If you don't admit your mistakes, the market will twist your neck and force you to admit them.

In the current market situation, either wait for the bull market trend to return before entering long positions, or wait for a true support level to buy at the bottom. In the current state of neither rising nor falling, it's best to observe more and do less, or even not do anything at all. Each of us has worked hard to earn our money, so let's not waste it. In the stock market, the most important thing is to protect your capital. Remember the experience of our ancestors, keep what we have and not be afraid of losing opportunities. To put it simply, even if the market rebounds tomorrow and returns to a bull market, you would only miss out on 15 points in the QQQ, earning a little less, but your capital would remain intact. If a trend emerges, there could be at least 40 points for you. If the market continues to decline and you really have to explore lower positions, then you would incur losses. In case you can't hold on and cut losses at the bottom, you would be left with no means to buy at the bottom and can only watch others make money. So, it's not just about losing money, but it might also take a long time to correct your mindset. When trading stocks, remember to avoid a gambling mentality and a mentality of being unwilling to accept losses. Gambling doesn't guarantee a steady win, even if you say that trading stocks is also a form of gambling, we still choose the best entry points after precise analysis, greatly increasing the winning rate compared to gambling. And if you do lose, don't be unwilling to accept it. Whether in life or making mistakes, we need to take responsibility, especially in trading stocks. If you don't admit your mistakes, the market will twist your neck and force you to admit them.

Translated

4

1

1

.

.![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)