发8发

liked

As AI technology advances, top investment banks have recently shared reports on which chip stocks could perform well in 2025.

Bank of America: AI to Supercharge the Semiconductor Market

Bank of America predicts that AI will drive strong growth in the semiconductor industry. The market is expected to reach $725 billion by 2025, growing at an annual rate of over 15%. AI GPUs, memory chips (like DRAM and NAND), and ASIC custom chips are leadi...

Bank of America: AI to Supercharge the Semiconductor Market

Bank of America predicts that AI will drive strong growth in the semiconductor industry. The market is expected to reach $725 billion by 2025, growing at an annual rate of over 15%. AI GPUs, memory chips (like DRAM and NAND), and ASIC custom chips are leadi...

95

10

56

发8发

liked and commented on

The trading journey of this year can be said to be full of twists and turns, with exciting highlights and lows that require deep breaths. I still remember the beginning when everything about the market was confusing, but as time went by, I gradually found my rhythm and also got used to the market's ups and downs 📈📉.

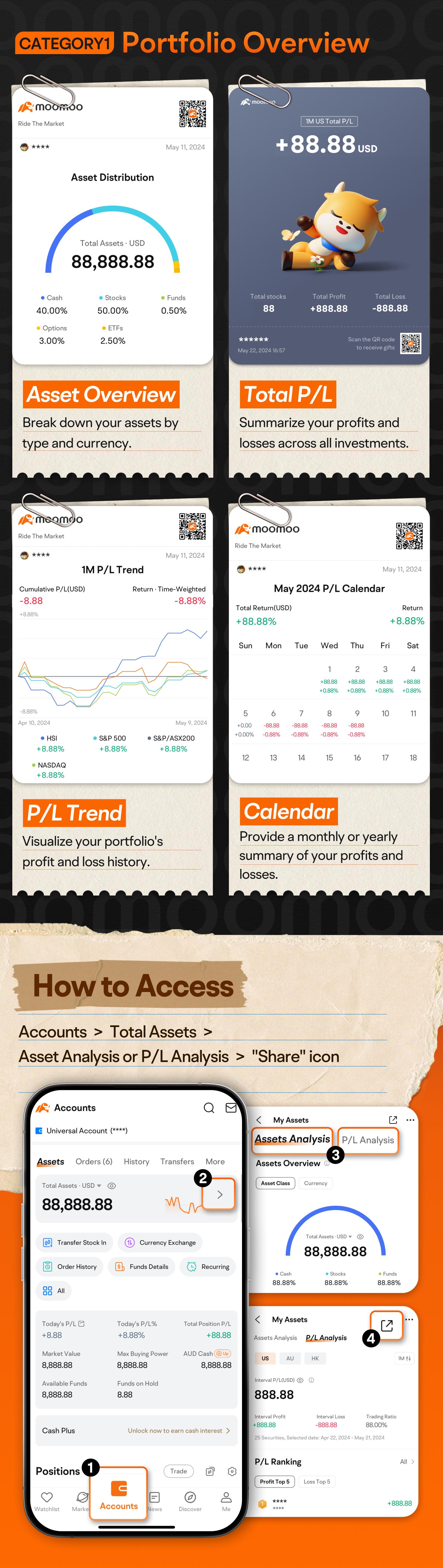

What impressed me the most this year was the use of the dividend reinvestment feature! Every time I receive dividends, the system automatically reinvests for me, this feature is simply a lazy person's financial tool 🙌, not only saving the hassle of manual operations, but also making me feel the power of compounding getting stronger and stronger 📊. It's like constantly adding a little snow to the snowball for the future, watching the assets gradually grow, truly a sense of achievement!

In addition, I am particularly happy this year to start Assets in RSP for $VOO and $QQQ. The feeling of long-term investment is especially reassuring, like planting a small forest 🌳 for the future. Thanks to moomoo for providing P/L analysis and trend charts, which give me a better sense of direction and more confidence in my trades.

Of course, there are regrets at times, such as the "tuition fees" paid for not setting stop-loss orders in time 😂. But looking back, these experiences have actually helped me maintain a more stable mindset. Now I understand that investment is a journey that requires patience and time ⏳.

In the future, I will continue to learn and accumulate! I hope to get closer to financial freedom and wish every comrade striving in trading to find their own path to success 💪✨!

What impressed me the most this year was the use of the dividend reinvestment feature! Every time I receive dividends, the system automatically reinvests for me, this feature is simply a lazy person's financial tool 🙌, not only saving the hassle of manual operations, but also making me feel the power of compounding getting stronger and stronger 📊. It's like constantly adding a little snow to the snowball for the future, watching the assets gradually grow, truly a sense of achievement!

In addition, I am particularly happy this year to start Assets in RSP for $VOO and $QQQ. The feeling of long-term investment is especially reassuring, like planting a small forest 🌳 for the future. Thanks to moomoo for providing P/L analysis and trend charts, which give me a better sense of direction and more confidence in my trades.

Of course, there are regrets at times, such as the "tuition fees" paid for not setting stop-loss orders in time 😂. But looking back, these experiences have actually helped me maintain a more stable mindset. Now I understand that investment is a journey that requires patience and time ⏳.

In the future, I will continue to learn and accumulate! I hope to get closer to financial freedom and wish every comrade striving in trading to find their own path to success 💪✨!

Translated

6

4

发8发

liked

Hi, mooers! ![]()

Do you keep track of your profit or loss (P/L) data on moomoo to guide your investments? Think of P/L as a reliable ally. It shows you the state of your investments during and after your financial ventures.

![]() In this post, we'll cover:

In this post, we'll cover:

1 | Why tracking P/L records is crucial

2 | Four P/L categories & their strategic value

3 | Exciting P/L sharing events

![]() 1. Why tracking P/L records is crucial

1. Why tracking P/L records is crucial

Monitoring your P/L records is a corne...

Do you keep track of your profit or loss (P/L) data on moomoo to guide your investments? Think of P/L as a reliable ally. It shows you the state of your investments during and after your financial ventures.

1 | Why tracking P/L records is crucial

2 | Four P/L categories & their strategic value

3 | Exciting P/L sharing events

Monitoring your P/L records is a corne...

+3

164

66

94

发8发

liked

$Tesla (TSLA.US)$ Thank god I didn't press any sell button this morning.

7

发8发

liked

$Tesla (TSLA.US)$ Goodbye Moo friends, see you next New Year's Day.![]()

![]()

![]() I hope you all can end the final week with a full pot of winnings. If you have any questions, feel free to leave a message on this post. I will reply one by one (of course, I will still reply before I leave).

I hope you all can end the final week with a full pot of winnings. If you have any questions, feel free to leave a message on this post. I will reply one by one (of course, I will still reply before I leave).

In addition, I have set a limit order to Buy Tesla at 400 and 390. Hopefully, I can make the purchase. I'm not sure if this is correct, but buying valuable stocks in batches should be a good decision no matter what (personal hope).![]()

![]()

![]()

![]()

Additional reminder, if you just want to bottom-fish intraday and then sell immediately, positions can be sold at 418-425 during the trading day. (If you are under great pressure)![]()

![]()

![]() Do not try to buy at the lowest point or sell at the highest point within the day, always remember, it's good to make a profit.

Do not try to buy at the lowest point or sell at the highest point within the day, always remember, it's good to make a profit.![]()

![]()

![]() (But I still do not recommend it)

(But I still do not recommend it)

Wishing everyone a Happy New Year and good luck!![]()

![]() $NVIDIA (NVDA.US)$ $Invesco QQQ Trust (QQQ.US)$

$NVIDIA (NVDA.US)$ $Invesco QQQ Trust (QQQ.US)$

In addition, I have set a limit order to Buy Tesla at 400 and 390. Hopefully, I can make the purchase. I'm not sure if this is correct, but buying valuable stocks in batches should be a good decision no matter what (personal hope).

Additional reminder, if you just want to bottom-fish intraday and then sell immediately, positions can be sold at 418-425 during the trading day. (If you are under great pressure)

Wishing everyone a Happy New Year and good luck!

Translated

108

116

9

发8发

liked

发8发

liked

$Tesla (TSLA.US)$ First of all, let's review yesterday's overnight call. The logic inside is actually very simple. Half an hour before the close, I noticed abnormal fund inflows leading to a rise. Subconsciously, I would assume that the next day would open higher, so I entered the call position. However, in the last 3 minutes, unusually large short positions suddenly entered the market. At this point, I felt something was wrong and considered whether to stop loss and exit, but time passed quickly and I missed the opportunity to exit before the closing. Then everyone saw the opening scene today.![]()

![]()

![]()

![]()

Despite the failure overnight, I adjusted my mindset and temporarily forgot about the losses, re-entering a focused state. When I saw Tesla drop 3% in pre-market trading, I decisively took the opportunity to buy the dip.![]()

![]()

![]() (This action was the key to turning defeat into victory later) as shown in the following figure.

(This action was the key to turning defeat into victory later) as shown in the following figure.

As expected, the overnight call, which incurred a staggering 40% loss at the opening, was essentially halved. However, I remained calm and believed that since there was a 3% gain yesterday and a subsequent drop before rising again, today's opening decline would likely prompt some Block Orders to exit. So, I seized the opportunity to gradually stop losses with each rise, strategically switching to longer call positions at certain levels, in order to increase my survival chances and make up for the earlier mistake. Subsequently, as everyone witnessed, both stocks and Options staged an impressive comeback.![]()

![]()

![]() (This requires courage and a steady mindset adjustment. If mastered, the benefits are considerable.)

(This requires courage and a steady mindset adjustment. If mastered, the benefits are considerable.)

Finally, although...

Despite the failure overnight, I adjusted my mindset and temporarily forgot about the losses, re-entering a focused state. When I saw Tesla drop 3% in pre-market trading, I decisively took the opportunity to buy the dip.

As expected, the overnight call, which incurred a staggering 40% loss at the opening, was essentially halved. However, I remained calm and believed that since there was a 3% gain yesterday and a subsequent drop before rising again, today's opening decline would likely prompt some Block Orders to exit. So, I seized the opportunity to gradually stop losses with each rise, strategically switching to longer call positions at certain levels, in order to increase my survival chances and make up for the earlier mistake. Subsequently, as everyone witnessed, both stocks and Options staged an impressive comeback.

Finally, although...

Translated

+4

80

96

16

发8发

liked

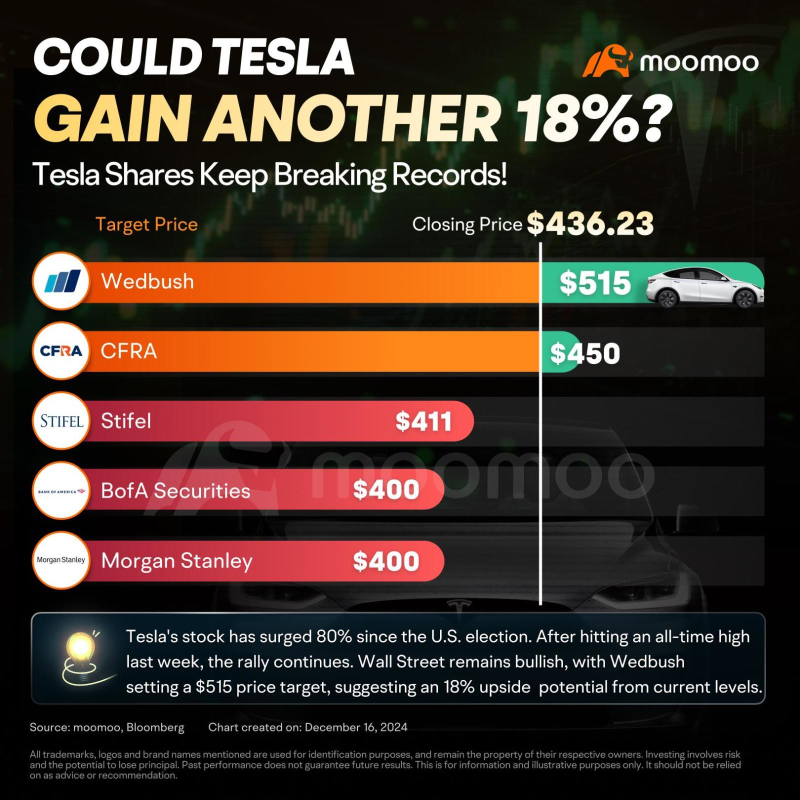

Driven by Elon Musk's close relationship with Trump and the potential benefits of deregulation, Tesla's stock price soared after the 2024 election, with an increase of over 85% since November 5, 2024. Tesla's innovative business and stock performance are remarkable, but the debate among investors regarding Tesla's high valuation has never ceased. In addition to the favorable outcome of Trump's election victory, the...

+1

52

4

92

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)