嘉宝666

liked

$FUTU 241018 130.00C$ All options are gone.

Translated

1

3

嘉宝666

reacted to

$China Concept Stocks (LIST2517.US)$ On October 6, Guoxin News Network released a notice: The State Council Information Office will hold a press conference at 10:00 on October 8 (Tuesday morning), where NDRC Director Zheng Zhajie and Deputy Directors Liu Sushe, Zhao Chenxin, Li Chunlin, and Zheng Bei will introduce the situation regarding the "systematically implementing a package of incremental policies, solidly promoting the improvement of economic structure towards excellence, and the continued positive development trend" and answer questions from reporters.

Since the new loose mmf policy was introduced last Tuesday (September 24), the mainland stock market has been soaring all the way.

Since the new loose mmf policy was introduced last Tuesday (September 24), the mainland stock market has been soaring all the way.

Translated

2

嘉宝666

liked

$Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$

But too bad im already all in $ProShares UltraPro Short QQQ ETF (SQQQ.US)$

But too bad im already all in $ProShares UltraPro Short QQQ ETF (SQQQ.US)$

1

4

嘉宝666

reacted to

$Hang Seng Index (800000.HK)$ $Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$

The reason for the stock market's rise this time is the practice of converting equity into bonds, which is the first time in the history of human finance. Objectively reducing the number of stocks, similar to the concept of companies repurchasing stocks to raise stock prices, but in reality, the companies did not spend money to repurchase, instead they used stocks as collateral, leveraging commercial banks to handle the bonds, and the banks did not actually withhold money or bear risks because the bonds were issued by the central bank.

This perfectly solves the problem that the central bank issues bonds to inject liquidity into the market but cannot directly give money to companies. It also solves the problem that companies want to repurchase stocks to increase stock value but do not have the funds. By leveraging the entire stock market with minimal cost (500 billion yuan in national bonds) without violating financial rules.

If commercial banks hold onto stocks and do not release them, the number of stocks in the stock market will not increase, and appreciation is inevitable, rather than undergoing large-scale devaluation. Since Chinese commercial banks are state-owned, they can hold onto stocks without any cost.

This approach is the first of its kind for mankind, aimed at increasing the value of stocks that have lost value due to the sluggish stock market. The premise is that objectively, the A-share market in China is sluggish due to psychological factors, rather than a lack of actual economic investment, as the Chinese social savings amounts...

The reason for the stock market's rise this time is the practice of converting equity into bonds, which is the first time in the history of human finance. Objectively reducing the number of stocks, similar to the concept of companies repurchasing stocks to raise stock prices, but in reality, the companies did not spend money to repurchase, instead they used stocks as collateral, leveraging commercial banks to handle the bonds, and the banks did not actually withhold money or bear risks because the bonds were issued by the central bank.

This perfectly solves the problem that the central bank issues bonds to inject liquidity into the market but cannot directly give money to companies. It also solves the problem that companies want to repurchase stocks to increase stock value but do not have the funds. By leveraging the entire stock market with minimal cost (500 billion yuan in national bonds) without violating financial rules.

If commercial banks hold onto stocks and do not release them, the number of stocks in the stock market will not increase, and appreciation is inevitable, rather than undergoing large-scale devaluation. Since Chinese commercial banks are state-owned, they can hold onto stocks without any cost.

This approach is the first of its kind for mankind, aimed at increasing the value of stocks that have lost value due to the sluggish stock market. The premise is that objectively, the A-share market in China is sluggish due to psychological factors, rather than a lack of actual economic investment, as the Chinese social savings amounts...

Translated

35

12

嘉宝666

liked

$Tesla (TSLA.US)$

Following the main trend (primary trend, long-term trend), counter technology (secondary trend, short-term trend), against human nature (overcoming the restriction and constraint of liking to rise and hating to fall, people abandon and I take). Gambling is always high consumption. There are surprises, but more despair.

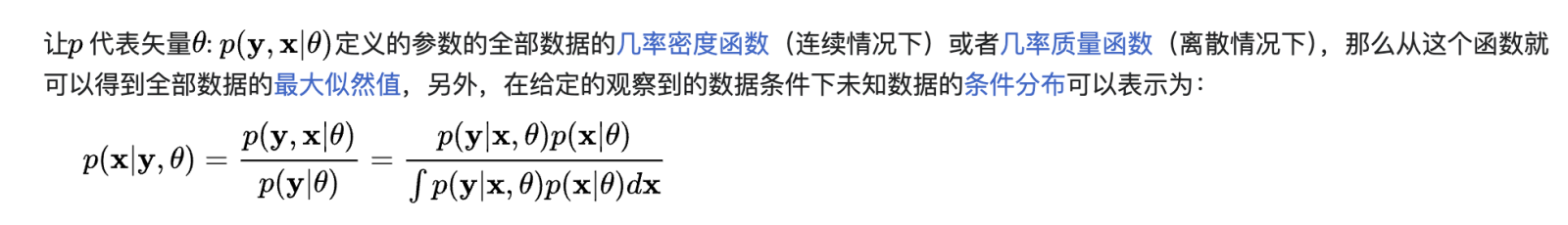

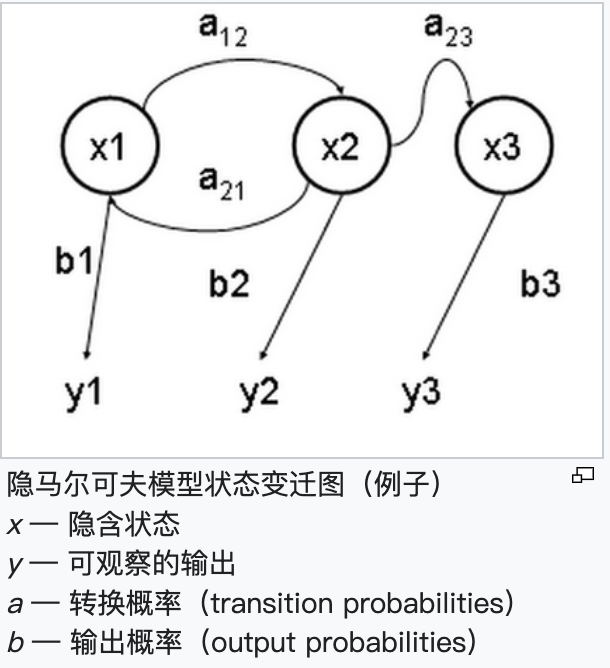

When the Baum-Welch algorithm model and Hidden Markov model, as well as the profit-chip ratio function curve trajectory equation, are crucial, it is essential to find.the primary settlement area of high probability events; then deploy the main capital firepower in that area; For the high probability events innon-primary settlement areaAs a result, to a certain extent, it is ignored, greatly improving the effectiveness and efficiency of capital firepower. This is also the main reason why in 1988, led by the world-class mathematician, investor, and philanthropist with a net worth of over $24 billion, James Harris Simons, Renaissance Technologies LLC founded the company's most profitable investment portfolio, the "Medallion Fund", dominating Wall Street in the financial markets, outperforming stock market guru Warren Edward Buffett and overshadowing financial titan George Soros, averaging a yearly ROI of over 70%.

Following the main trend (primary trend, long-term trend), counter technology (secondary trend, short-term trend), against human nature (overcoming the restriction and constraint of liking to rise and hating to fall, people abandon and I take). Gambling is always high consumption. There are surprises, but more despair.

When the Baum-Welch algorithm model and Hidden Markov model, as well as the profit-chip ratio function curve trajectory equation, are crucial, it is essential to find.the primary settlement area of high probability events; then deploy the main capital firepower in that area; For the high probability events innon-primary settlement areaAs a result, to a certain extent, it is ignored, greatly improving the effectiveness and efficiency of capital firepower. This is also the main reason why in 1988, led by the world-class mathematician, investor, and philanthropist with a net worth of over $24 billion, James Harris Simons, Renaissance Technologies LLC founded the company's most profitable investment portfolio, the "Medallion Fund", dominating Wall Street in the financial markets, outperforming stock market guru Warren Edward Buffett and overshadowing financial titan George Soros, averaging a yearly ROI of over 70%.

Translated

+17

2

1

嘉宝666

liked

$Tesla (TSLA.US)$

Have a good weekend

The size of this world depends on the people you know. Every time you meet someone with a broader vision, the world will become a little bigger for you.

The world is only as big as the people you know, and every time you meet someone whose eyes are wider, the world seems a little bigger to you.

For a technical player who rules the world with a ruler, the chart tells us everything. It is crucial to carefully and accurately interpret all the information contained in the chart, including the precise interpretation of the psychological activities behind candlestick combination patterns.

There are many sophisticated people in the world, and there are also many interesting people, but those who are both sophisticated and interesting are few and far between. Sophisticated people command respect, interesting people are likable, and those who are both sophisticated and interesting inspire respect without fear, familiarity without disrespect. The longer the interaction, the richer the fragrance. Elegance is a difficult thing. More difficult than restraint. More difficult than being reckless. Restraint can be feigned. Being reckless is easier. But elegance is not. Elegance requires temperament. It requires experience. It requires years of accumulation. It requires that sense of composure and light-heartedness. Trouble yourself, maintain kindness. Trouble yourself, continue to progress. Trouble yourself, remember the goodness of others...

Have a good weekend

The size of this world depends on the people you know. Every time you meet someone with a broader vision, the world will become a little bigger for you.

The world is only as big as the people you know, and every time you meet someone whose eyes are wider, the world seems a little bigger to you.

For a technical player who rules the world with a ruler, the chart tells us everything. It is crucial to carefully and accurately interpret all the information contained in the chart, including the precise interpretation of the psychological activities behind candlestick combination patterns.

There are many sophisticated people in the world, and there are also many interesting people, but those who are both sophisticated and interesting are few and far between. Sophisticated people command respect, interesting people are likable, and those who are both sophisticated and interesting inspire respect without fear, familiarity without disrespect. The longer the interaction, the richer the fragrance. Elegance is a difficult thing. More difficult than restraint. More difficult than being reckless. Restraint can be feigned. Being reckless is easier. But elegance is not. Elegance requires temperament. It requires experience. It requires years of accumulation. It requires that sense of composure and light-heartedness. Trouble yourself, maintain kindness. Trouble yourself, continue to progress. Trouble yourself, remember the goodness of others...

Translated

+1

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)