Ping983

reacted to

Last week's review 👉🏻Market review + Hold Positions (03/10 - 03/14 2025)

This week's market behavior:

$NASDAQ 100 Index (.NDX.US)$ Wednesdays and Fridays are absorbing funds;

$S&P 500 Index (.SPX.US)$ Accumulation on Wednesday, distribution on Friday;

$Russell 2000 Index (.RUT.US)$ Accumulation on Monday and Wednesday, distribution on Thursday and Friday.

ndx > spx > rut.

There has been no rebound this week; instead, there has been lateral consolidation, and volatility VIX has temporarily returned below 20; the potential for SPX to follow the recent Gold period (4-7 days after the low) is only 1 day left (next Monday), and if it cannot be realized, reassessment is needed; the market is currently filled with opposing and contradictory views, mostly noise, returning to basics, and continuing to patiently observe the feedback from the market Index information day by day while looking for those names that are significantly stronger than the Index 🚴🏻.

Weekly Chart:

It is still terrible right now and has not returned to normal.

Breadth:

Continuing to stay in the red, slightly better than last week; meanwhile, the consecutive red days record has been broken, previously 20 consecutive red days from 18/12/24 to 17/01/25, now it is 21 consecutive red days.

Weekly Notes:

The RS of the leveraged Index ETF continues to downgrade.

Market Sentiment:

AAII's bearish sentiment has slightly decreased this week, with the market showing mixed performance on Thursday and Friday; extreme bearish data has been recorded for four consecutive weeks so far.

The following is information about AAII similar data...

This week's market behavior:

$NASDAQ 100 Index (.NDX.US)$ Wednesdays and Fridays are absorbing funds;

$S&P 500 Index (.SPX.US)$ Accumulation on Wednesday, distribution on Friday;

$Russell 2000 Index (.RUT.US)$ Accumulation on Monday and Wednesday, distribution on Thursday and Friday.

ndx > spx > rut.

There has been no rebound this week; instead, there has been lateral consolidation, and volatility VIX has temporarily returned below 20; the potential for SPX to follow the recent Gold period (4-7 days after the low) is only 1 day left (next Monday), and if it cannot be realized, reassessment is needed; the market is currently filled with opposing and contradictory views, mostly noise, returning to basics, and continuing to patiently observe the feedback from the market Index information day by day while looking for those names that are significantly stronger than the Index 🚴🏻.

Weekly Chart:

It is still terrible right now and has not returned to normal.

Breadth:

Continuing to stay in the red, slightly better than last week; meanwhile, the consecutive red days record has been broken, previously 20 consecutive red days from 18/12/24 to 17/01/25, now it is 21 consecutive red days.

Weekly Notes:

The RS of the leveraged Index ETF continues to downgrade.

Market Sentiment:

AAII's bearish sentiment has slightly decreased this week, with the market showing mixed performance on Thursday and Friday; extreme bearish data has been recorded for four consecutive weeks so far.

The following is information about AAII similar data...

Translated

+18

11

1

Ping983

reacted to

let's look at some stock charts these are stocks I like 👍 and charts i have shared in my group.

$Invesco QQQ Trust (QQQ.US)$

I don't necessarily like qqq, but it shows how willing buyers are to step up

$E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$

here is futu (moomoo). they reported this morning. look at the similarities between futu and qqq charts.

$Futu Holdings Ltd (FUTU.US)$

Eggs! my stop is 29. my upside target is 66

$Vital Farms (VITL.US)$

vix. did the vix temp top? I think so, is think we get...

$Invesco QQQ Trust (QQQ.US)$

I don't necessarily like qqq, but it shows how willing buyers are to step up

$E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$

here is futu (moomoo). they reported this morning. look at the similarities between futu and qqq charts.

$Futu Holdings Ltd (FUTU.US)$

Eggs! my stop is 29. my upside target is 66

$Vital Farms (VITL.US)$

vix. did the vix temp top? I think so, is think we get...

+16

19

6

3

Ping983

liked

7 charts worth paying attention to later 👇

Translated

+4

6

Ping983

commented on

Translated

1

2

Ping983

commented on

Fortunately, ran half yesterday and recouped the initial amount. It's good enough. As long as it doesn't go back to zero, it's fine to make a profit. This is impressive...

Translated

5

2

Ping983

commented on

$Unity Software (U.US)$ Very fortunate to have exited completely the day before yesterday, not betting on the Earnings Reports, and it turns out that the top winners take it all.

Translated

2

7

$Immunome (IMNM.US)$ What good news has this product released?

Translated

Ping983

liked

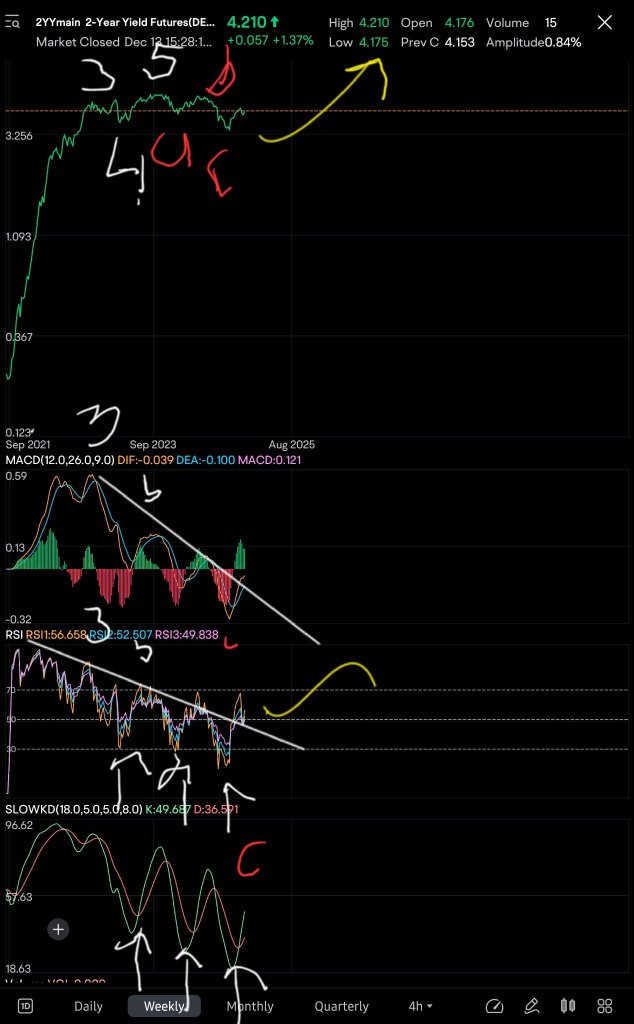

All things must end. It has been a long time since I have done any update, so it may seem odd to make one last update after such a long break. I have over 40 written incomplete Updates that I never got to post. I have a blockage with completing them...

On one of my last posts, I explained why I was ending. I said the path was set, Powell had chosen -

(from my post with this 👇)

In that post i highlighted some stocks (tesla) that did quite well. But that cycle has ende...

On one of my last posts, I explained why I was ending. I said the path was set, Powell had chosen -

(from my post with this 👇)

In that post i highlighted some stocks (tesla) that did quite well. But that cycle has ende...

+7

11

5

2

$SoundHound AI (SOUN.US)$ Another batch is trapped.

Translated

1

1

Ping983

liked

is recommended as a speculative investment despite its past missteps, with new leadership aiming to revitalize the company and its offerings.

The company's "Grow" segment, which focuses on in-game advertising, has faced significant challenges but is undergoing a fundamental rebuild to enhance ROAS.

Unity's "Create" business has launched Unity 6 with substantial improvements and repealed unpopular runtime fees, aiming to regain developer trust a...

The company's "Grow" segment, which focuses on in-game advertising, has faced significant challenges but is undergoing a fundamental rebuild to enhance ROAS.

Unity's "Create" business has launched Unity 6 with substantial improvements and repealed unpopular runtime fees, aiming to regain developer trust a...

25

1

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)