坚持3年 VS 短线复利

liked and voted

Morning mooers! It is Tuesday, June 4th. The market is open, lower after yet another meme injection from Roaring Kitty. My name is Kevin Travers, here are stories heard on a Wall Street today.

The largest climber on the S&P 500 and Nasdaq 100 was $Old Dominion Freight Line (ODFL.US)$, climbing 6%.

$Bath & Body Works (BBWI.US)$ was the highest decliner on the S&P, down 10% after the firm announced Q1 earnings, and projected a 2% drop in sal...

The largest climber on the S&P 500 and Nasdaq 100 was $Old Dominion Freight Line (ODFL.US)$, climbing 6%.

$Bath & Body Works (BBWI.US)$ was the highest decliner on the S&P, down 10% after the firm announced Q1 earnings, and projected a 2% drop in sal...

54

5

坚持3年 VS 短线复利

liked

$Super Micro Computer (SMCI.US)$

1. Retail investors and institutions explosively bought call options for a company.

2. Options market makers prevent exercise and are forced to buy the underlying stock.

3. Options market makers' buying behavior becomes a driving force for the stock price.

4. With the general price soaring, retail investors and institutions buy more call options.

5. Options market makers are forced to buy the underlying stock again.

6. The above process is repeated continuously, eventually forming a GAMMASqueeze, where everyone in the market is buying.

7. Options market makers have bought too many underlying stocks, accumulating massive risks.

Options market makers further hedge with Delta hedging, adjust their buy and sell quotes, and can indirectly impact the market price of options. If the market price changes, the calculated IV will also change accordingly based on options pricing models (such as the Black-Scholes model). This means that although market makers cannot directly set IV, their quoting strategy and market behavior can affect the market price of options, thereby indirectly affecting the level of IV. Market makers make buying call less profitable, causing retail investors and institutions to stop buying call options.

Since no one is buying call options, options market makers will sell the underlying stock, creating selling pressure, causing retail investors and institutions to start taking profits. As the stock price falls, retail investors and institutions begin buying put options.

Options market makers need to hedge put options, hence forced to sell the underlying stock, further triggering a chain reaction in the options and stock markets.

1. Retail investors and institutions explosively bought call options for a company.

2. Options market makers prevent exercise and are forced to buy the underlying stock.

3. Options market makers' buying behavior becomes a driving force for the stock price.

4. With the general price soaring, retail investors and institutions buy more call options.

5. Options market makers are forced to buy the underlying stock again.

6. The above process is repeated continuously, eventually forming a GAMMASqueeze, where everyone in the market is buying.

7. Options market makers have bought too many underlying stocks, accumulating massive risks.

Options market makers further hedge with Delta hedging, adjust their buy and sell quotes, and can indirectly impact the market price of options. If the market price changes, the calculated IV will also change accordingly based on options pricing models (such as the Black-Scholes model). This means that although market makers cannot directly set IV, their quoting strategy and market behavior can affect the market price of options, thereby indirectly affecting the level of IV. Market makers make buying call less profitable, causing retail investors and institutions to stop buying call options.

Since no one is buying call options, options market makers will sell the underlying stock, creating selling pressure, causing retail investors and institutions to start taking profits. As the stock price falls, retail investors and institutions begin buying put options.

Options market makers need to hedge put options, hence forced to sell the underlying stock, further triggering a chain reaction in the options and stock markets.

Translated

5

3

坚持3年 VS 短线复利

commented on

$Tesla (TSLA.US)$ The article revealed that Tesla EV delivery in August almost doubled in market share indicated the EV price cutting initiated by Tesla is working well as compared to other Chinese EV companies.

Quote:

According to data from the China Passenger Car Association (CPCA) released on Friday, car sales saw a 2.2% increase in August compared to the same month the previous year, reaching a tot...

Quote:

According to data from the China Passenger Car Association (CPCA) released on Friday, car sales saw a 2.2% increase in August compared to the same month the previous year, reaching a tot...

6

11

1

$XPeng (XPEV.US)$ Veteran actors in the performing arts industry criticize popular stars for relying solely on their looks. Can they act?

This shows how important looks are.

Volkswagen in Germany has taken an interest in the technology of the G9, but they will have to design the look themselves. Being recognized by peers proves that Xiaopeng's csi leading technology index is ahead of its peers, also proving that the G9's look is really not good.

Recommend designing several trendy or exaggerated looks for online voting.

This shows how important looks are.

Volkswagen in Germany has taken an interest in the technology of the G9, but they will have to design the look themselves. Being recognized by peers proves that Xiaopeng's csi leading technology index is ahead of its peers, also proving that the G9's look is really not good.

Recommend designing several trendy or exaggerated looks for online voting.

Translated

$XPeng (XPEV.US)$ Li Hui, Deputy Director of the Comprehensive Department of the National Development and Reform Commission, said that new energy vehicles have become a prominent highlight in the development of the Chinese economy. The next step will focus on support.

Translated

坚持3年 VS 短线复利

commented on

坚持3年 VS 短线复利

liked

Understanding candlesticks

Candlesticks are used to show the price action of a stock. They are the foundation of technical analysis (TA). Technical indicators are applied to them in TA. A chart is made of bars that have little lines stemming from the top and the bottom; these are known as candles. The candle conveys 4 pieces of information: open price, close price, high price and low price.

Candles refer to that information for a specific period of time. For a daily ch...

Candlesticks are used to show the price action of a stock. They are the foundation of technical analysis (TA). Technical indicators are applied to them in TA. A chart is made of bars that have little lines stemming from the top and the bottom; these are known as candles. The candle conveys 4 pieces of information: open price, close price, high price and low price.

Candles refer to that information for a specific period of time. For a daily ch...

+4

107

30

41

$XPeng (XPEV.US)$ It is rumored that United Airlines will collaborate with two airlines to operate the flying autos rental business, with one location being San Francisco and serving the surrounding areas for quick commuting during busy times.

Translated

1

坚持3年 VS 短线复利

voted

Rewards

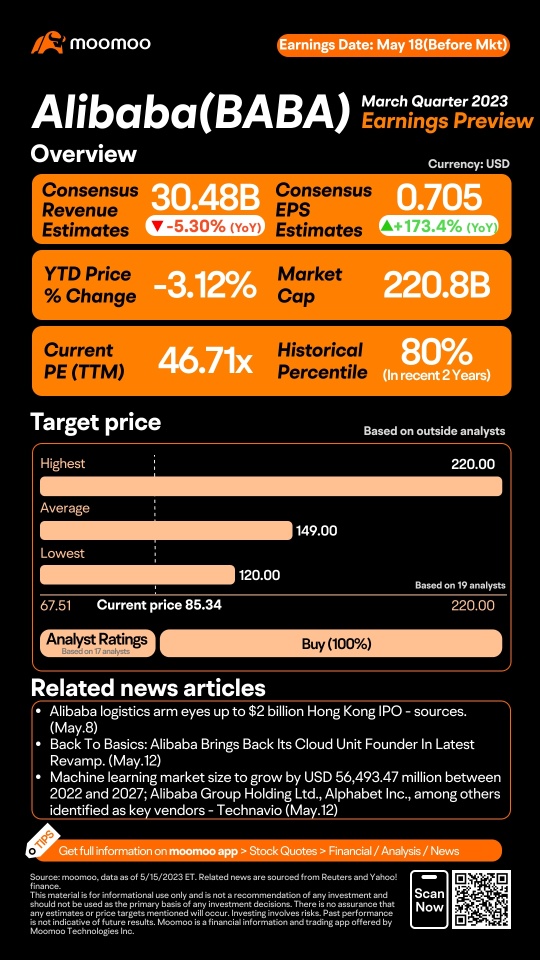

● An equal share of 1,000 points: For mooers who correctly guess BABA's (US Market) closing price range on 18 May ET by 2:30 PM, May 18 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing BABA's earnings preview as an inspiration reward.

*The selection is based on post quality, originality, and user engagement.

N...

● An equal share of 1,000 points: For mooers who correctly guess BABA's (US Market) closing price range on 18 May ET by 2:30 PM, May 18 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing BABA's earnings preview as an inspiration reward.

*The selection is based on post quality, originality, and user engagement.

N...

43

61

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)