Hmm!

With this, can you trade confidently by the end of the year?

But I think it's only that level of "information!"

The American Federal Reserve Board (FRB) kept the "policy interest rate increased by 0.25 points (%)" at the December meeting. ⇒

Due to the events of 'Tora🐯jii-san becoming president ❗️' this December, various uncertainties about the future of politics such as 'domestic economic measures, overall economy, internal affairs (illegal immigrants, etc.), foreign policy ❗️(especially import tariffs?)', including policy formulation and response capabilities, remain unclear, right ❗️?

Therefore, is the future of the 'Japanese economy ❗️ greatly influenced by American policies, right ❗️? ⇒

Because President Ueda and the following 'committee members? Everyone is uncertain?', we can't determine it.

Just until the day before yesterday, it was on the state-owned Broadcasting of "some ◯◯K Broadcasting", ⇒

Currently in Japan, the sentiment ❗️・ is generally positive ❗️, ⇒

First of all, with a big "news headline❗️", they easily manipulated the public impression by saying things like "big companies❗️・Manufacturing❗️ at the center, improves economy⇧" (laughs)

However, you know? Immediately after that in the second "news headline❗️", it was quietly written like this❗️

Even within the same large company, the sentiment of the economy and the retail sector...

With this, can you trade confidently by the end of the year?

But I think it's only that level of "information!"

The American Federal Reserve Board (FRB) kept the "policy interest rate increased by 0.25 points (%)" at the December meeting. ⇒

Due to the events of 'Tora🐯jii-san becoming president ❗️' this December, various uncertainties about the future of politics such as 'domestic economic measures, overall economy, internal affairs (illegal immigrants, etc.), foreign policy ❗️(especially import tariffs?)', including policy formulation and response capabilities, remain unclear, right ❗️?

Therefore, is the future of the 'Japanese economy ❗️ greatly influenced by American policies, right ❗️? ⇒

Because President Ueda and the following 'committee members? Everyone is uncertain?', we can't determine it.

Just until the day before yesterday, it was on the state-owned Broadcasting of "some ◯◯K Broadcasting", ⇒

Currently in Japan, the sentiment ❗️・ is generally positive ❗️, ⇒

First of all, with a big "news headline❗️", they easily manipulated the public impression by saying things like "big companies❗️・Manufacturing❗️ at the center, improves economy⇧" (laughs)

However, you know? Immediately after that in the second "news headline❗️", it was quietly written like this❗️

Even within the same large company, the sentiment of the economy and the retail sector...

Translated

Update - [Breaking News] The Bank of Japan maintains the policy interest rate at 0.25%.

Update - [Breaking News] The Bank of Japan maintains the policy interest rate at 0.25%.

大負けネコ(HYPER)

reacted to

Good morning, MOOMOO users! We will deliver the hot stocks and latest rating information for the morning session.

Today's strengths and weaknesses

12/19 Strong and Weak Factors

Three points to focus on in the morning session

●After the sharp decline, once selling pressure eases, buying on dips is expected.

● $OKANO VALVE MFG (6492.JP)$Announced a revision to the financial forecast for the term ending in November 2024. Revenue was revised upward from 7.506 billion yen to 8.169 billion yen, and operating profit from 0.88 billion yen to 1.185 billion yen.

● $Nissan Motor (7201.JP)$Honda is in discussions for integration, establishing a holding company, with the possibility of merging with Mitsubishi Motors.

Active stocks, hot stocks.

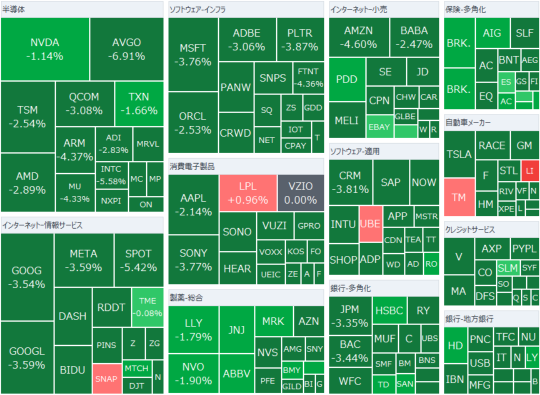

Following the sharp decline in the US stocks, selling pressure is leading the market. With the strengthening of the US dollar and the depreciation of the yen, the decline is leveling off. As of 11:00, the number of advancing stocks on the Tokyo Stock Exchange Prime Board is 603, declining stocks are 969, and unchanged stocks are 68, with the number of declining stocks significantly outnumbering advancing stocks. Among the various sectors, 6 out of 33 industries have shown gains. Shipping ranks first, followed by other products, warehouse and transportation, and textiles. In the top decliners are electricity and gas, real estate, petroleum, and coal.

$Advantest (6857.JP)$Selling. The drop in US tech stocks and $Micron Technology (MU.US)$dislike for sudden drops in after-hours trading...

Today's strengths and weaknesses

12/19 Strong and Weak Factors

Three points to focus on in the morning session

●After the sharp decline, once selling pressure eases, buying on dips is expected.

● $OKANO VALVE MFG (6492.JP)$Announced a revision to the financial forecast for the term ending in November 2024. Revenue was revised upward from 7.506 billion yen to 8.169 billion yen, and operating profit from 0.88 billion yen to 1.185 billion yen.

● $Nissan Motor (7201.JP)$Honda is in discussions for integration, establishing a holding company, with the possibility of merging with Mitsubishi Motors.

Active stocks, hot stocks.

Following the sharp decline in the US stocks, selling pressure is leading the market. With the strengthening of the US dollar and the depreciation of the yen, the decline is leveling off. As of 11:00, the number of advancing stocks on the Tokyo Stock Exchange Prime Board is 603, declining stocks are 969, and unchanged stocks are 68, with the number of declining stocks significantly outnumbering advancing stocks. Among the various sectors, 6 out of 33 industries have shown gains. Shipping ranks first, followed by other products, warehouse and transportation, and textiles. In the top decliners are electricity and gas, real estate, petroleum, and coal.

$Advantest (6857.JP)$Selling. The drop in US tech stocks and $Micron Technology (MU.US)$dislike for sudden drops in after-hours trading...

Translated

+1

13

3

大負けネコ(HYPER)

reacted to

Leading memory semiconductor company $Kioxia Holdings (285A.JP)$listed on the Tokyo Stock Exchange Prime Market through an IPO on the 18th. The opening price of 1440 yen was 1% below the public price of 1455 yen.October's IPO exceeded the opening price by 36% over the public price, surpassing a market cap of 1 trillion yen on the first day, lacking the popularity compared to that, but after the initial price, it rebounded and increased.reaching new highs, with strong support from large-scale orders. This was due to the recovery in demand for smartphones and PCs. $Tokyo Metro (9023.JP)$After setting the opening price, the stock rebounded and continued to riseachieving a steady upward trend with support from large orders. The recovery in demand for smartphones and PCs contributed to this.After setting the opening price, the stock rebounded and continued to rise, with strong support from large orders. The recovery in demand for smartphones and PCs contributed to this.The period from April to September of fiscal year 24 turned profitable.and.Expectations are growing for an increase in demand for AI Datacenter.It seems that there was a surge in buying.It exceeded the public offering price by 10%.Based on the closing price of 1601 yen, the market cap reached approximately 863 billion yen.

▼Order Capital Size on the listing date

![]() Institutions are on the sidelines, leading to a wait-and-see attitude

Institutions are on the sidelines, leading to a wait-and-see attitude

A major factor that the momentum of investors in the initial stage did not pick upwas that the public offering price was not set at the upper limit of the tentative conditionsIt was determined at the neutral tentative condition, resulting in the book-building processInstitutions are cautious.It has been revealed. Generally, the public offering price is a provisional...

▼Order Capital Size on the listing date

A major factor that the momentum of investors in the initial stage did not pick upwas that the public offering price was not set at the upper limit of the tentative conditionsIt was determined at the neutral tentative condition, resulting in the book-building processInstitutions are cautious.It has been revealed. Generally, the public offering price is a provisional...

Translated

+4

30

7

大負けネコ(HYPER)

reacted to

Hello MOOMOO users, good morning!![]() Here is a summary of the morning opening. Thank you.

Here is a summary of the morning opening. Thank you.

Market Overview

The Nikkei Stock Average on the Tokyo Stock Exchange started at ¥0.0358522 billion, down ¥559.44 from the previous trading day. The Tokyo Stock Price Index (TOPIX) started at 2685.41, down 34.46 points. The US market on the 18th saw Dow Jones Industrial Average down by 1123 points and Nasdaq down by 716 points.

Ahead of the announcement of the Federal Open Market Committee (FOMC) results, cautious sentiment is strengthening, leading to mixed openings after the market opened. Some buying was observed in key stocks. However, as expected, the main policy interest rate was lowered by 0.25% at the FOMC meeting, disappointing investors as the expected rate cut for 2025 was reduced from previous estimates, resulting in a sharp decline. The decline widened towards the closing bell.

The Chicago Nikkei 225 Futures (March) settlement price closed at ¥38,460, down ¥740 from Osaka. The yen is trading around ¥154.70 to the dollar.

Top News

FRB cuts interest rates by 0.25 points, suggesting a slowdown in pace next year.

The Federal Reserve Board (FRB) held the Federal Open Market Committee (FO... open until the 18th.

Market Overview

The Nikkei Stock Average on the Tokyo Stock Exchange started at ¥0.0358522 billion, down ¥559.44 from the previous trading day. The Tokyo Stock Price Index (TOPIX) started at 2685.41, down 34.46 points. The US market on the 18th saw Dow Jones Industrial Average down by 1123 points and Nasdaq down by 716 points.

Ahead of the announcement of the Federal Open Market Committee (FOMC) results, cautious sentiment is strengthening, leading to mixed openings after the market opened. Some buying was observed in key stocks. However, as expected, the main policy interest rate was lowered by 0.25% at the FOMC meeting, disappointing investors as the expected rate cut for 2025 was reduced from previous estimates, resulting in a sharp decline. The decline widened towards the closing bell.

The Chicago Nikkei 225 Futures (March) settlement price closed at ¥38,460, down ¥740 from Osaka. The yen is trading around ¥154.70 to the dollar.

Top News

FRB cuts interest rates by 0.25 points, suggesting a slowdown in pace next year.

The Federal Reserve Board (FRB) held the Federal Open Market Committee (FO... open until the 18th.

Translated

17

8

大負けネコ(HYPER)

reacted to

Dear MOOMOO users, good morning!![]() The key points of this morning's report are here.

The key points of this morning's report are here.

Tokyo stock market is expected to range from 800,000 yen to 870,000 yen (closing price on the 18th is 908,181 yen and 71 sen).

FRB cuts interest rates by 0.25 points, hinting at a slowdown in the pace next year.

Micron tumbles after earnings hours with significant downturn, reflecting dislike for guidance due to weak demand for smartphones and PCs.

Mr. Mask expresses opposition to interim budget proposal, deepening confusion within the Republican Party.

EU to investigate the link between Pfizer and eye diseases.

Netflix fined by Dutch authorities in regards to handling of personal information.

moomoo News Mark

Market Overview

◇On the 18th, the US stock market plunged significantly. It was the first time in August that all three major indexes fell by 2% or more. The Dow Jones Industrial Average has been declining for 10 consecutive trading days. As the announcement of the Federal Open Market Committee (FOMC) results approaches, the cautious sentiment strengthens, resulting in mixed trading after the opening. While the Dow average, which had been declining until the previous day, rose due to buying in some key stocks, the Nasdaq started with a slight decline. As expected, the main policy interest rate was cut by 0.25% in the FOMC meeting...

Tokyo stock market is expected to range from 800,000 yen to 870,000 yen (closing price on the 18th is 908,181 yen and 71 sen).

FRB cuts interest rates by 0.25 points, hinting at a slowdown in the pace next year.

Micron tumbles after earnings hours with significant downturn, reflecting dislike for guidance due to weak demand for smartphones and PCs.

Mr. Mask expresses opposition to interim budget proposal, deepening confusion within the Republican Party.

EU to investigate the link between Pfizer and eye diseases.

Netflix fined by Dutch authorities in regards to handling of personal information.

moomoo News Mark

Market Overview

◇On the 18th, the US stock market plunged significantly. It was the first time in August that all three major indexes fell by 2% or more. The Dow Jones Industrial Average has been declining for 10 consecutive trading days. As the announcement of the Federal Open Market Committee (FOMC) results approaches, the cautious sentiment strengthens, resulting in mixed trading after the opening. While the Dow average, which had been declining until the previous day, rose due to buying in some key stocks, the Nasdaq started with a slight decline. As expected, the main policy interest rate was cut by 0.25% in the FOMC meeting...

Translated

+2

21

1

22

大負けネコ(HYPER)

reacted to

Hello MOOMOO users!![]() Here is tonight's analysis of NY stocks.

Here is tonight's analysis of NY stocks.

Market Overview

The US market started with the Dow Jones Industrial Average, which consists of high-quality stocks, rising by $9.82 to $43,459.72, while the Nasdaq Composite Index with a high tech stock ratio, began at 20,114.98, up 5.92 points. The S&P 500 Index, composed of 500 large-cap stocks in the US, fell by 2.96 points to 6,047.65.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top News

FOMC meeting, rate cut certain. Attention also on the pace of rate cuts in 2025.

Tonight, at 4 a.m. Japan time on the 19th, the Federal Open Market Committee (FOMC) will announce its results, followed by a press conference by Chairman Powell of the Federal Reserve at 4:30 a.m. It is expected that the FOMC will announce a 0.25 point rate cut, marking the third rate cut this year, and a total of 1 point rate cuts by 2024. According to CME's FedWatch tool, 1...

Market Overview

The US market started with the Dow Jones Industrial Average, which consists of high-quality stocks, rising by $9.82 to $43,459.72, while the Nasdaq Composite Index with a high tech stock ratio, began at 20,114.98, up 5.92 points. The S&P 500 Index, composed of 500 large-cap stocks in the US, fell by 2.96 points to 6,047.65.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top News

FOMC meeting, rate cut certain. Attention also on the pace of rate cuts in 2025.

Tonight, at 4 a.m. Japan time on the 19th, the Federal Open Market Committee (FOMC) will announce its results, followed by a press conference by Chairman Powell of the Federal Reserve at 4:30 a.m. It is expected that the FOMC will announce a 0.25 point rate cut, marking the third rate cut this year, and a total of 1 point rate cuts by 2024. According to CME's FedWatch tool, 1...

Translated

43

16

大負けネコ(HYPER)

reacted to

The last important event for the domestic market this year is,The Bank of Japan's monetary policy decision meeting on December 18-19will take place. The decision will be announced around noon on the 19th, with Governor Kuroda holding a press conference in the afternoon.

The focus is onwhether to raise the policy interest rate for the third time this year or postpone it to the new year.Considering the theory of "weakening yen = rising stocks", if there is an interest rate hike in December, it may lead to a "strong yen -> falling stocks" scenario, which may seem negative at first glance. However, looking ahead to 2025, it may be perceived positively to digest the inevitable "bad news" within the year.The main scenario is a rate hike postponement in December.It seems to be the case.If the rate hike in December is postponed, multiple risks are expected to arise.It is also anticipated that several risks will surface.

![]() If the rate hike is delayed to December"Hike Risk"Year-end

If the rate hike is delayed to December"Hike Risk"Year-end

Before and after the meeting held in October, a rate hike in December had become the main scenario in the market. At the press conference after the October meeting, Governor Ueda mentioned that the expression "having some time flexibility" used during the September meeting "will not be used in the future", indicating that the timing of the rate hike is approaching...

The focus is onwhether to raise the policy interest rate for the third time this year or postpone it to the new year.Considering the theory of "weakening yen = rising stocks", if there is an interest rate hike in December, it may lead to a "strong yen -> falling stocks" scenario, which may seem negative at first glance. However, looking ahead to 2025, it may be perceived positively to digest the inevitable "bad news" within the year.The main scenario is a rate hike postponement in December.It seems to be the case.If the rate hike in December is postponed, multiple risks are expected to arise.It is also anticipated that several risks will surface.

Before and after the meeting held in October, a rate hike in December had become the main scenario in the market. At the press conference after the October meeting, Governor Ueda mentioned that the expression "having some time flexibility" used during the September meeting "will not be used in the future", indicating that the timing of the rate hike is approaching...

Translated

![The final important event of the year! If the interest rate hike in December is postponed, is "Trump risk" unavoidable and will the depreciation of the yen accelerate? [BOJ Meeting Preview]](https://sgsnsimg.moomoo.com/sns_client_feed/181569713/20241216/web-1734334543982-t5Bo9YxvVK.png/thumb?area=105&is_public=true)

50

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)