$THPLANT (5112.MY)$ Is it a callback to 665/660?

Translated

1

孤独求胜

voted

U.S. Election & Stock Market

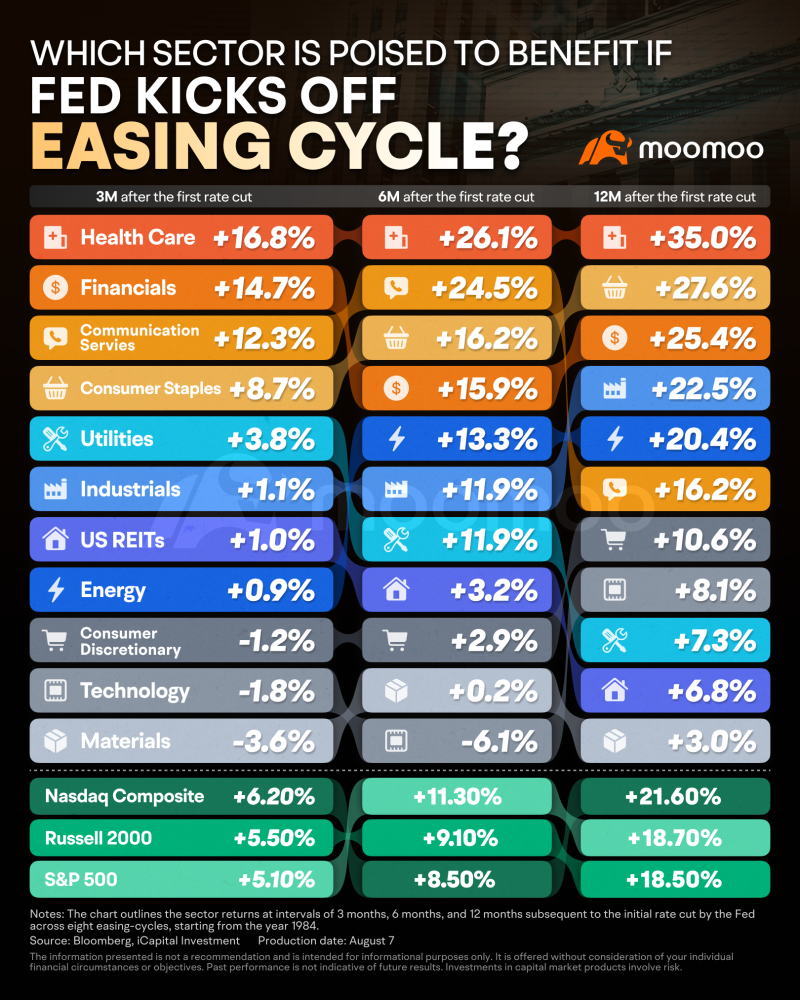

During U.S. presidential elections, financial markets often experience increased volatility. Key trends include:

1. Market Uncertainty: Investors may react to the uncertainty surrounding potential policy changes, leading to fluctuations in stock prices.

2. Sector Performance: Certain sectors may perform better depending on the candidates’ platforms. For example, healthcare and energy stocks might rea...

During U.S. presidential elections, financial markets often experience increased volatility. Key trends include:

1. Market Uncertainty: Investors may react to the uncertainty surrounding potential policy changes, leading to fluctuations in stock prices.

2. Sector Performance: Certain sectors may perform better depending on the candidates’ platforms. For example, healthcare and energy stocks might rea...

47

27

7

孤独求胜

voted

Recently, $Tesla (TSLA.US)$ has once again become the center of attention![]() .

.

The Robotaxi launch event has just wrapped up, SpaceX's Starship has launched, and Tesla's financial report is set to be released this week.

Many investors may be puzzled by Tesla's option prices during this time: they are exceptionally high, and the Implied Volatility (IV) is also soaring. Why is that![]() ?

?

Let's take a cl...

The Robotaxi launch event has just wrapped up, SpaceX's Starship has launched, and Tesla's financial report is set to be released this week.

Many investors may be puzzled by Tesla's option prices during this time: they are exceptionally high, and the Implied Volatility (IV) is also soaring. Why is that

Let's take a cl...

+4

64

8

27

$Property (LIST22971.MY)$ Hope to stand firm today

Translated

孤独求胜

voted

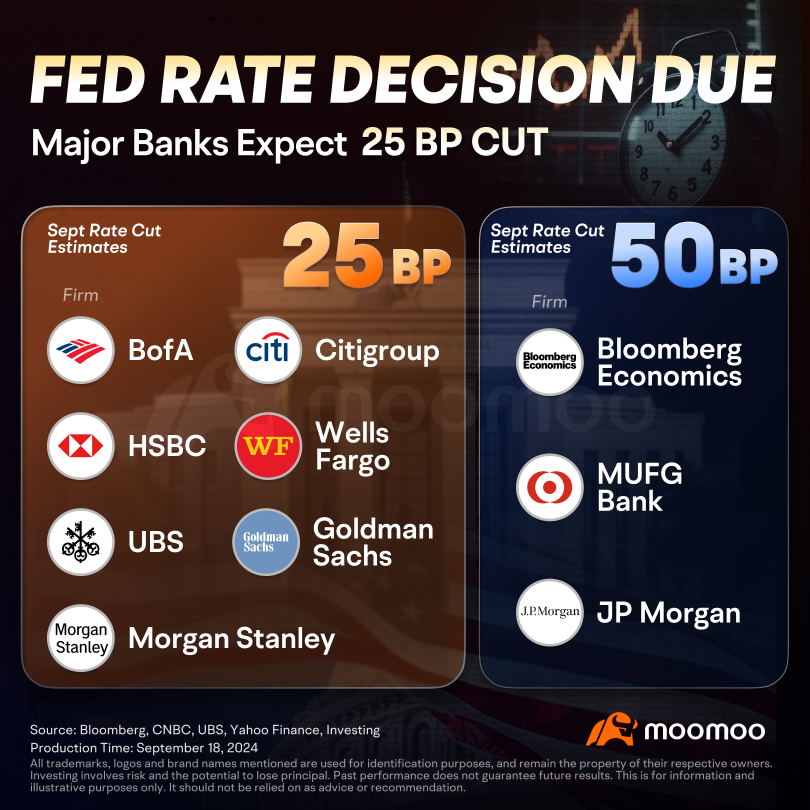

The Federal Reserve is set to announce its first rate cut in over four years on Wednesday, signaling a major pivot from its previous emphasis on inflation control.

Markets remain split on the scale of the cut. Futures markets indicate a 63% chance of a 50-basis-point reduction as of Wednesday morning, up from 14% a week ago. The odds of a 25-basis-point cut stand at 37%.

Wall Street and the futures market show divergence as most institutio...

Markets remain split on the scale of the cut. Futures markets indicate a 63% chance of a 50-basis-point reduction as of Wednesday morning, up from 14% a week ago. The odds of a 25-basis-point cut stand at 37%.

Wall Street and the futures market show divergence as most institutio...

78

6

65

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)