小丑橘

reacted to

$Tesla (TSLA.US)$ if you are rich buy more tsla, if you are poor you should buy even more

13

小丑橘

voted

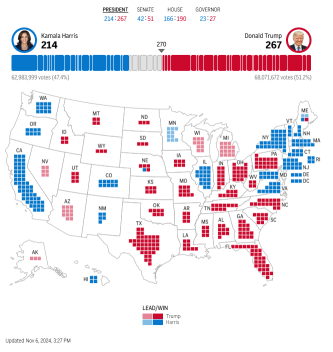

The moment of truth...

🟥 Trump

🟦 Harris

The suspense of this election is breathtaking, as both candidates give it their all for the final triumph. Will Trump reclaim his spot in the White House?![]()

![]() Let's wait together and witness this historic moment!

Let's wait together and witness this historic moment!

$Trump Media & Technology (DJT.US)$ $Tesla (TSLA.US)$ $Kamala Harris (LIST22990.US)$ $Donald Trump (LIST22962.US)$ $Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$

🟥 Trump

🟦 Harris

The suspense of this election is breathtaking, as both candidates give it their all for the final triumph. Will Trump reclaim his spot in the White House?

$Trump Media & Technology (DJT.US)$ $Tesla (TSLA.US)$ $Kamala Harris (LIST22990.US)$ $Donald Trump (LIST22962.US)$ $Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$

21

7

7

小丑橘

commented on

$Tesla (TSLA.US)$ just buy, see u guys at 300

3

小丑橘

voted

$Super Micro Computer (SMCI.US)$ Earnings call live broadcast is coming soon! Based on the recent market performance of SMCI, I have made predictions for 3 scenarios:

Best case scenario forecast

Probability:30%

In the best case scenario, SMCI can successfully turn the situation around through the following actions:

1. Quickly find and cooperate with a new audit firm, and rebuild market confidence through improved financial transparency.

2. Strengthen governance structure to ensure the independence and compliance of the management team and the board of directors, and improve internal controls.

3. Maintain technological innovation in AI servers and liquid cooling technology, seize current market demands, and continue to expand market share.

As these measures depend on the company's internal efforts, cooperation from external audit firms, and the stability of market demand, the probability is around 30%. This probability takes into account the significant impact of the current negative news on the company, but its technological advantages in the fields of AI and high-performance servers may still provide the company with a turnaround opportunity.

Worst-case scenario prediction

Probability:50%

In the worst-case scenario, the risks faced by SMCI are as follows:

1. Failure to effectively rectify financial and governance issues, leading to further escalation of audit issues, which may trigger in-depth investigations by regulatory institutions and more severe financial scrutiny.

2. Loss of customer and investor confidence, which may result in customers switching to competitors, leading to a decrease in company revenue and market share.

3. The continuous low stock price or further decline has led to financing difficulties, affecting future business expansion and technology...

Best case scenario forecast

Probability:30%

In the best case scenario, SMCI can successfully turn the situation around through the following actions:

1. Quickly find and cooperate with a new audit firm, and rebuild market confidence through improved financial transparency.

2. Strengthen governance structure to ensure the independence and compliance of the management team and the board of directors, and improve internal controls.

3. Maintain technological innovation in AI servers and liquid cooling technology, seize current market demands, and continue to expand market share.

As these measures depend on the company's internal efforts, cooperation from external audit firms, and the stability of market demand, the probability is around 30%. This probability takes into account the significant impact of the current negative news on the company, but its technological advantages in the fields of AI and high-performance servers may still provide the company with a turnaround opportunity.

Worst-case scenario prediction

Probability:50%

In the worst-case scenario, the risks faced by SMCI are as follows:

1. Failure to effectively rectify financial and governance issues, leading to further escalation of audit issues, which may trigger in-depth investigations by regulatory institutions and more severe financial scrutiny.

2. Loss of customer and investor confidence, which may result in customers switching to competitors, leading to a decrease in company revenue and market share.

3. The continuous low stock price or further decline has led to financing difficulties, affecting future business expansion and technology...

Translated

18

1

小丑橘

Set a live reminder

$Super Micro Computer (SMCI.US)$Super Micro Computer Q1 FY2025 earnings conference call is scheduled for November 5 at 5:00 PM ET /November 6 at 6:00 AM SGT /November 6 9:00 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from SMCI's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for inf...

Beat or Miss?

What do you expect from SMCI's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This presentation is for inf...

SMCI Q1 FY2025 earnings conference call

Nov 6 06:00

11

5

4

$Roblox (RBLX.US)$

overvalued, just take profit at top, it shouldnt be worth so much

overvalued, just take profit at top, it shouldnt be worth so much

1

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)