我是坏人2

voted

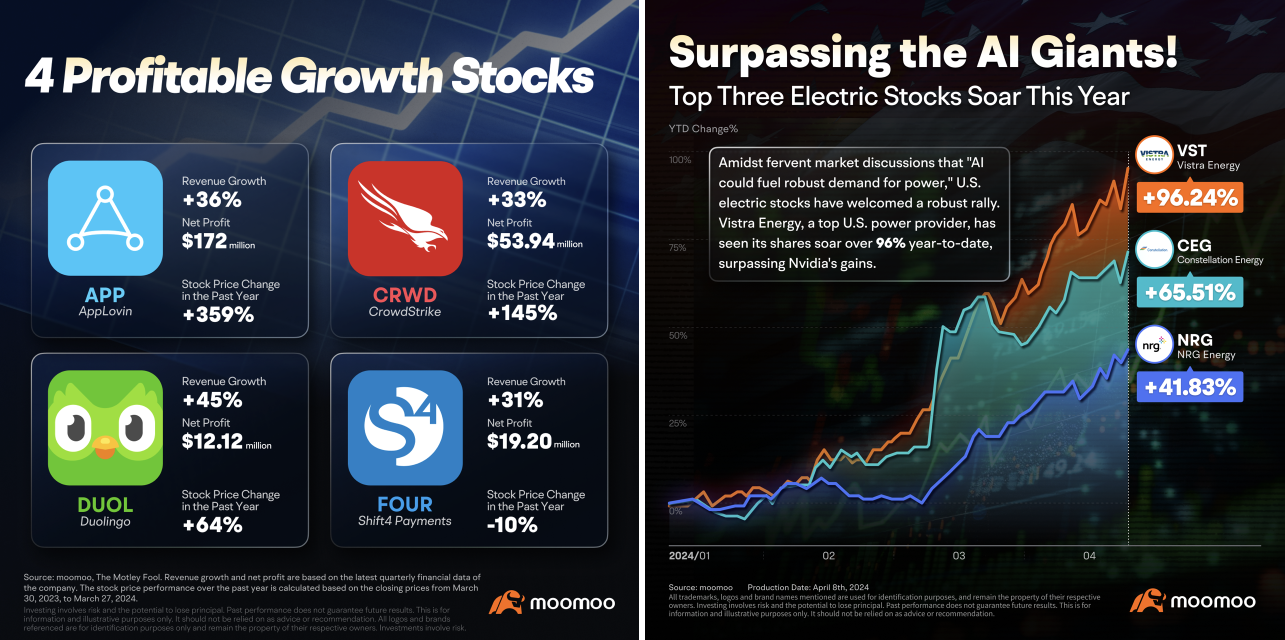

The U.S. stock market has hit new highs again! Congrats!👏 If you started investing in the US market at the beginning of the year and haven't made any major mistakes, you've probably seen some gains! 🎉

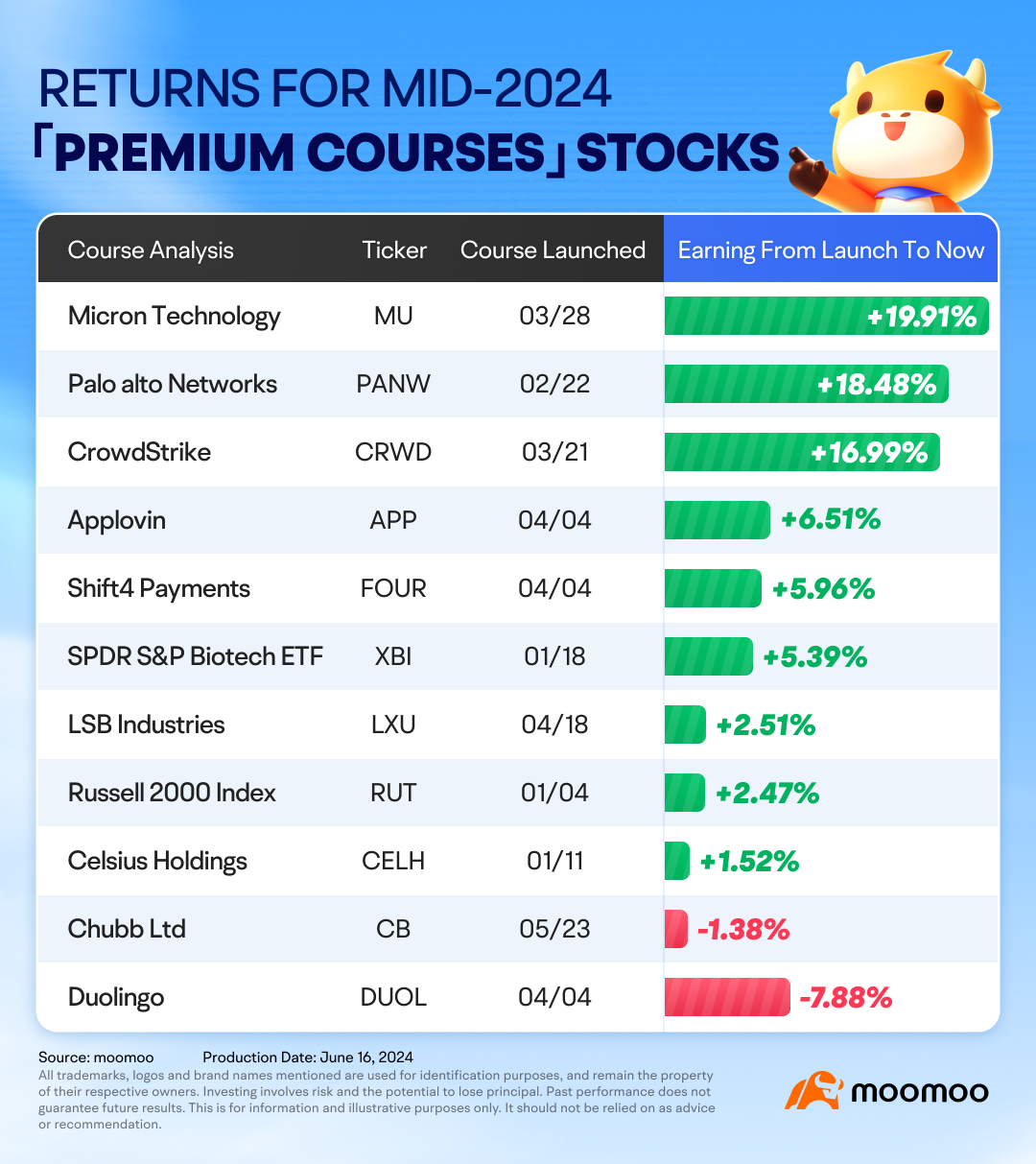

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

+5

437

226

我是坏人2

voted

Hey, mooers! Welcome back to Moomoo's Feature Challenge, where we help you master powerful tools on moomoo and take on quiz challenges to win rewards!

Navigating the complex world of investing and selecting the right stocks can be daunting for new traders. Fortunately, by providing a comprehensive overview of stock ratings, target prices, and top analysts, all easily accessible from a single tab, Analyst ...

Navigating the complex world of investing and selecting the right stocks can be daunting for new traders. Fortunately, by providing a comprehensive overview of stock ratings, target prices, and top analysts, all easily accessible from a single tab, Analyst ...

+2

423

249

我是坏人2

liked

6

1

我是坏人2

liked

$Senseonics (SENS.US)$ I have lots of share I keep buying more on those deeps because I believe in this company

11

1

我是坏人2

liked

$Senseonics (SENS.US)$ Actually, I have a feeling that this year's sales will increase a lot. Sens has given a low expectation and the epidemic is under control. The mortality rate is already very low, and in the future, it will probably be similar to the flu. Sales will definitely exceed expectations because the expectations given are very low. Sens is too conservative. The key is the sales in the second and third quarters to come.

Translated

4

我是坏人2

liked

3

我是坏人2

liked

$Roundhill Ball Metaverse ETF (META.US)$

Averaged down a lot this morning on this dip... META ETF is a definite long term hold

Averaged down a lot this morning on this dip... META ETF is a definite long term hold

31

1

我是坏人2

liked

Defiance ETFs launched the $DEFIANCE DIGITAL REVOLUTION ETF (NFTZ.US)$ on Thursday, which offers investors thematic exposure to the NFT (Non-Fungible Tokens), blockchain and cryptocurrency ecosystems, which include NFT marketplaces and issuers such as $Coinbase (COIN.US)$ and $PLBY Group (PLBY.US)$.

![]() What is NFT?

What is NFT?

NFTs, which allow holders of art, collectibles and just about any other asset to track ownership, have caught fire this year amid a wider boom in crypto markets. Investors have doled out eye-popping sums toward pictures of rocks, cartoonish depictions of penguins and apes, and other concoctions and artworks.

The NFT revolution will fundamentally change the economic model for artists, athletes, creators, and many more industries that we can't even conceive of today. "In October, all time NFT trading volume surpassed $15 Billion," says Jablonski.

![]() What is NFTZ?

What is NFTZ?

NFTZ is testament to our vision of the revolutionary potential for growth in crypto and digital asset related securities, and our commitmen to offering exposure to the dynamic and disruptive NFT space. NFTZ seeks to track an index of a portfolio of publicly listed companies with relevant thematic exposure to the NFT, blockchain and cryptocurrency ecosystems.

--- According to 'Investment case for NFTZ, the first NFT focused ETF', Defiance ETFs

[The NFTZ fund] is a great way for investors to gain access to not only the fast-growth blockchain technology aspect of the digital world, but companies involved in the renaissance of NFT. The companies in this index are key players in the build-out of Web 3.0, [or an idealized version of the internet that is decentralized and based on blockchains.]

--- said Sylvia Jablonski, chief investment officer for Defiance ETFs.

The ETF is tracking the BITA NFT and Blockchain Select Index.

NFTZ holdings

The initial makeup of the ETF consists of asset allocation of 32.5% for non-fungible token stocks, 25.9% cryptocurrency mining stocks, 21.9% crypto asset management and trading stocks, 15.2% crypto banking, payments and services stocks and 4.6% blockchain technology stocks.

Here are the top 10 initial holdings on the ETF:

· $Silvergate Capital (SI.US)$ : 6.7%

· $PLBY Group (PLBY.US)$ : 5.3%

· $Cloudflare (NET.US)$ : 5.2%

· Northern Data AG : 5.1%

· $Bitfarms (BITF.US)$ : 4.9%

· $MARA Holdings (MARA.US)$ : 4.8%

· $Hut 8 (HUT.US)$ : 4.5%

· Sbi Holdings Inc : 4.3%

· $Coinbase (COIN.US)$ : 4.3%

· $Riot Platforms (RIOT.US)$ : 4.3%

Have you ever traded NFT? Would you invest in this NFT-focused ETF?

Source: Defiance ETFs, PR Newswires, Bloomberg, Benzinga

NFTs, which allow holders of art, collectibles and just about any other asset to track ownership, have caught fire this year amid a wider boom in crypto markets. Investors have doled out eye-popping sums toward pictures of rocks, cartoonish depictions of penguins and apes, and other concoctions and artworks.

The NFT revolution will fundamentally change the economic model for artists, athletes, creators, and many more industries that we can't even conceive of today. "In October, all time NFT trading volume surpassed $15 Billion," says Jablonski.

NFTZ is testament to our vision of the revolutionary potential for growth in crypto and digital asset related securities, and our commitmen to offering exposure to the dynamic and disruptive NFT space. NFTZ seeks to track an index of a portfolio of publicly listed companies with relevant thematic exposure to the NFT, blockchain and cryptocurrency ecosystems.

--- According to 'Investment case for NFTZ, the first NFT focused ETF', Defiance ETFs

[The NFTZ fund] is a great way for investors to gain access to not only the fast-growth blockchain technology aspect of the digital world, but companies involved in the renaissance of NFT. The companies in this index are key players in the build-out of Web 3.0, [or an idealized version of the internet that is decentralized and based on blockchains.]

--- said Sylvia Jablonski, chief investment officer for Defiance ETFs.

The ETF is tracking the BITA NFT and Blockchain Select Index.

NFTZ holdings

The initial makeup of the ETF consists of asset allocation of 32.5% for non-fungible token stocks, 25.9% cryptocurrency mining stocks, 21.9% crypto asset management and trading stocks, 15.2% crypto banking, payments and services stocks and 4.6% blockchain technology stocks.

Here are the top 10 initial holdings on the ETF:

· $Silvergate Capital (SI.US)$ : 6.7%

· $PLBY Group (PLBY.US)$ : 5.3%

· $Cloudflare (NET.US)$ : 5.2%

· Northern Data AG : 5.1%

· $Bitfarms (BITF.US)$ : 4.9%

· $MARA Holdings (MARA.US)$ : 4.8%

· $Hut 8 (HUT.US)$ : 4.5%

· Sbi Holdings Inc : 4.3%

· $Coinbase (COIN.US)$ : 4.3%

· $Riot Platforms (RIOT.US)$ : 4.3%

Have you ever traded NFT? Would you invest in this NFT-focused ETF?

Source: Defiance ETFs, PR Newswires, Bloomberg, Benzinga

57

15

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)