我要越来越好

liked

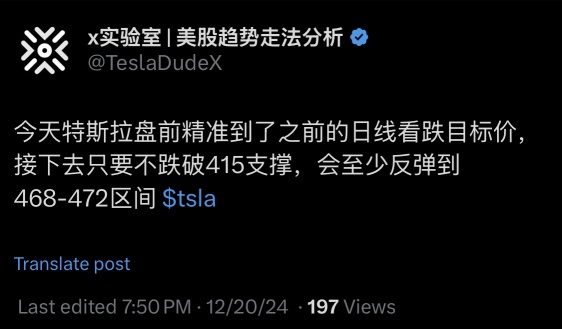

$Tesla (TSLA.US)$ As long as it does not fall below the support at 415, it will rebound to at least the range of 468-472.

Translated

3

我要越来越好

liked

$Tesla (TSLA.US)$From the Candlestick pattern perspective, in the process of a stock rising in stage retracement, the formation of a very obvious long upper shadow is called the Tianjian. If there is no Bullish news, there will be a lower low on the next trading day, followed by the formation of a long lower shadow called the Dijian. On the following trading day, confirming the establishment of the Tianjian and Dijian, the downtrend is successful. The opportunity will be on next Monday, if a deep pit is created, it is the best Hershey to go long. Set a stop-loss, no new lower low should be formed on Tuesday. For reference only.

Translated

9

2

我要越来越好

liked

我要越来越好

liked

Again, some bulls will certainly bash me for shorting, but mind you, we’re all here with the same objective of making good trades. This is technical-based price movement predictions and if you don’t like it then you’re trading with emotions.

Before all, let me remind you that $Tesla (TSLA.US)$ is a stock that trades based on fea...

Before all, let me remind you that $Tesla (TSLA.US)$ is a stock that trades based on fea...

+1

34

11

8

我要越来越好

liked

$Tesla (TSLA.US)$ First of all, let's review yesterday's overnight call. The logic inside is actually very simple. Half an hour before the close, I noticed abnormal fund inflows leading to a rise. Subconsciously, I would assume that the next day would open higher, so I entered the call position. However, in the last 3 minutes, unusually large short positions suddenly entered the market. At this point, I felt something was wrong and considered whether to stop loss and exit, but time passed quickly and I missed the opportunity to exit before the closing. Then everyone saw the opening scene today.![]()

![]()

![]()

![]()

Despite the failure overnight, I adjusted my mindset and temporarily forgot about the losses, re-entering a focused state. When I saw Tesla drop 3% in pre-market trading, I decisively took the opportunity to buy the dip.![]()

![]()

![]() (This action was the key to turning defeat into victory later) as shown in the following figure.

(This action was the key to turning defeat into victory later) as shown in the following figure.

As expected, the overnight call, which incurred a staggering 40% loss at the opening, was essentially halved. However, I remained calm and believed that since there was a 3% gain yesterday and a subsequent drop before rising again, today's opening decline would likely prompt some Block Orders to exit. So, I seized the opportunity to gradually stop losses with each rise, strategically switching to longer call positions at certain levels, in order to increase my survival chances and make up for the earlier mistake. Subsequently, as everyone witnessed, both stocks and Options staged an impressive comeback.![]()

![]()

![]() (This requires courage and a steady mindset adjustment. If mastered, the benefits are considerable.)

(This requires courage and a steady mindset adjustment. If mastered, the benefits are considerable.)

Finally, although...

Despite the failure overnight, I adjusted my mindset and temporarily forgot about the losses, re-entering a focused state. When I saw Tesla drop 3% in pre-market trading, I decisively took the opportunity to buy the dip.

As expected, the overnight call, which incurred a staggering 40% loss at the opening, was essentially halved. However, I remained calm and believed that since there was a 3% gain yesterday and a subsequent drop before rising again, today's opening decline would likely prompt some Block Orders to exit. So, I seized the opportunity to gradually stop losses with each rise, strategically switching to longer call positions at certain levels, in order to increase my survival chances and make up for the earlier mistake. Subsequently, as everyone witnessed, both stocks and Options staged an impressive comeback.

Finally, although...

Translated

+4

80

96

16

我要越来越好

liked

$Tesla (TSLA.US)$ Today's review mainly continued the overnight call from yesterday. I saw the rally at the end of yesterday and without hesitation chased after it, betting that today would open higher. The result was lucky, closing right after the market opened, all easy and relaxed.![]()

![]()

![]()

Originally, after clearing the call, I planned to continue observing but unexpectedly it immediately dropped. Decisively continued to chase the call, the logic inside is very simple, a sudden drop means there will be a certain level of rally.![]()

![]()

![]()

Furthermore, when it rallied to 480, I noticed signs of the dissipation of the bull momentum, hence immediately put as shown in the chart. Once again gained 30% profit from the puts, the fluctuations today truly made me comfortable.![]()

![]()

![]()

Finally, upon reviewing, the earnings from the beginning of this week have not been as much as before. I still feel that the prices are relatively high with a high probability of falling back at any time, so I am very conservative in my trades. Fortunately, I have been consistently earning. Truly grateful.![]()

![]()

I still want to remind everyone to be cautious, better to earn less and lose less, and to control the position well. Otherwise, it will only lead to losses and defeat.![]()

![]()

![]() $NVIDIA (NVDA.US)$ $Invesco QQQ Trust (QQQ.US)$ I'm about to go check on my other child, nvda.

$NVIDIA (NVDA.US)$ $Invesco QQQ Trust (QQQ.US)$ I'm about to go check on my other child, nvda.![]()

![]()

![]()

Originally, after clearing the call, I planned to continue observing but unexpectedly it immediately dropped. Decisively continued to chase the call, the logic inside is very simple, a sudden drop means there will be a certain level of rally.

Furthermore, when it rallied to 480, I noticed signs of the dissipation of the bull momentum, hence immediately put as shown in the chart. Once again gained 30% profit from the puts, the fluctuations today truly made me comfortable.

Finally, upon reviewing, the earnings from the beginning of this week have not been as much as before. I still feel that the prices are relatively high with a high probability of falling back at any time, so I am very conservative in my trades. Fortunately, I have been consistently earning. Truly grateful.

I still want to remind everyone to be cautious, better to earn less and lose less, and to control the position well. Otherwise, it will only lead to losses and defeat.

Translated

+7

62

59

4

我要越来越好

liked

$NVIDIA (NVDA.US)$

sometimes bottom is lowest wick of the 6. we still need 9s down to complete. this may be lining up with fomc could become bullish after. 3rd chart berkshire is doing the similar

sometimes bottom is lowest wick of the 6. we still need 9s down to complete. this may be lining up with fomc could become bullish after. 3rd chart berkshire is doing the similar

4

4

我要越来越好

liked

$Tesla (TSLA.US)$ The beginning of this week was very smooth because tsla brought me a 10% profit in just two days, which was really lucky. However, my mood was affected on Wednesday when I made a reverse put trade. Although it was a profitable put, it affected me on Thursday.![]()

![]()

![]()

The logic here is that I put Options on TSLA because after trying to break through 430 four times unsuccessfully, there should be a significant adjustment, so I set a target of 410-420. Thursday really reached 420 as I expected, but I was too tired and fell asleep, missing the opportunity to liquidate. This left me unprepared for the whole Thursday and led me to blindly wait for it to drop (which was a wrong decision). During the waiting period, I did nothing and missed the great intraday trading volatility on Thursday, which needs to be reflected upon.![]()

![]()

![]()

On Friday, I was originally determined to close the position and switch to call once it dropped a bit, but I still hoped it would break even. As everyone can see, I missed the best opportunity again, which will not happen today. Therefore, I had to exit with even greater losses. Fortunately, I did learn from yesterday's lesson. I made myself forget about this put trade, and when the right time came for tsla, I boldly entered with a call, turning today's loss into profit. This was really good. At least not taking the same path as yesterday is a kind of progress.![]()

![]()

![]()

Finally, currently I have not...

The logic here is that I put Options on TSLA because after trying to break through 430 four times unsuccessfully, there should be a significant adjustment, so I set a target of 410-420. Thursday really reached 420 as I expected, but I was too tired and fell asleep, missing the opportunity to liquidate. This left me unprepared for the whole Thursday and led me to blindly wait for it to drop (which was a wrong decision). During the waiting period, I did nothing and missed the great intraday trading volatility on Thursday, which needs to be reflected upon.

On Friday, I was originally determined to close the position and switch to call once it dropped a bit, but I still hoped it would break even. As everyone can see, I missed the best opportunity again, which will not happen today. Therefore, I had to exit with even greater losses. Fortunately, I did learn from yesterday's lesson. I made myself forget about this put trade, and when the right time came for tsla, I boldly entered with a call, turning today's loss into profit. This was really good. At least not taking the same path as yesterday is a kind of progress.

Finally, currently I have not...

Translated

+3

loading...

78

69

8

我要越来越好

liked

$NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $Invesco QQQ Trust (QQQ.US)$ Yesterday felt unwell, overall not in a good state, maybe from earning too much and lying in bed for too long.![]()

![]()

![]()

![]() So yesterday I only made two trades and then stopped playing. However, during yesterday's trading session, when I saw Block Orders lifting TSLA to 409, I believed it would break through 414 in one go. Therefore, I decisively added to my position with 410 end-of-day calls. The subsequent decline at the end of the day resulted in a loss at 410, eating up the day's profit, which was considered a bad Trade. Fortunately, my experience was the saving grace.

So yesterday I only made two trades and then stopped playing. However, during yesterday's trading session, when I saw Block Orders lifting TSLA to 409, I believed it would break through 414 in one go. Therefore, I decisively added to my position with 410 end-of-day calls. The subsequent decline at the end of the day resulted in a loss at 410, eating up the day's profit, which was considered a bad Trade. Fortunately, my experience was the saving grace.![]()

![]()

![]() Decisively believing that today's CPI would meet expectations, I decisively added to my position with 400 end-of-day calls. Today's opening lived up to expectations, recovering the initial investment and making a profit. However, I still need to reflect on being more careful when chasing highs, as well as not wanting to share at that time because the risk was too high. The 410 call plummeted by as much as 41% by the closing, selling today only recovered yesterday's losses, luckily 400 showed some determination.

Decisively believing that today's CPI would meet expectations, I decisively added to my position with 400 end-of-day calls. Today's opening lived up to expectations, recovering the initial investment and making a profit. However, I still need to reflect on being more careful when chasing highs, as well as not wanting to share at that time because the risk was too high. The 410 call plummeted by as much as 41% by the closing, selling today only recovered yesterday's losses, luckily 400 showed some determination.![]()

![]()

![]() Sometimes to make money, you must keep a stable mindset.

Sometimes to make money, you must keep a stable mindset.![]()

![]()

Translated

+3

76

89

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)