教養チャンネル

liked

✔️ Production Index

In November, the industrial production index was 101.7, a decrease of 2.3% compared to the previous month. It is the first negative in 3 months.

Mainly due to

The main reason is the downturn in the production machinery industry and the automobile industry.

Comparison with forecasts

Results exceeded private forecasts (-3.4% decline).

Trends by Global Sectors

Out of 15 industries, 11 experienced a decline, with a broad range of industries contracting.

Mixed assessment of the overall trend.

Maintain.

No signs of recovery.

Background factors

Slowdown in overseas demand (USA, Europe, China), sluggish domestic capital investment.

✔️ Market impact

Stock market

Downward pressure on Automobiles and Machinery related stocks.

Foreign Exchange Market

Concerns of economic downturn leading to a weak yen.

Points to Watch in the Future

The impact of the US-China economy.

Wage trends in spring labor negotiations.

Potential temporary production recovery due to year-end demand.

【Educational Perspective】

The industrial production index in November saw a negative trend for the first time in 3 months. Particularly, the production of industrial machinery and automobile industry underperformed, believed to be influenced by sluggish domestic and overseas demand.

Overall, out of 15 industries, 11 industries experienced a decline, highlighting a widespread weakness.

However, the results exceeded expectations, serving as a factor that somewhat restrained market pessimism.

On the other hand, as the basic judgment is considered "two steps forward, one step back", there are uncertainties in the production recovery...

In November, the industrial production index was 101.7, a decrease of 2.3% compared to the previous month. It is the first negative in 3 months.

Mainly due to

The main reason is the downturn in the production machinery industry and the automobile industry.

Comparison with forecasts

Results exceeded private forecasts (-3.4% decline).

Trends by Global Sectors

Out of 15 industries, 11 experienced a decline, with a broad range of industries contracting.

Mixed assessment of the overall trend.

Maintain.

No signs of recovery.

Background factors

Slowdown in overseas demand (USA, Europe, China), sluggish domestic capital investment.

✔️ Market impact

Stock market

Downward pressure on Automobiles and Machinery related stocks.

Foreign Exchange Market

Concerns of economic downturn leading to a weak yen.

Points to Watch in the Future

The impact of the US-China economy.

Wage trends in spring labor negotiations.

Potential temporary production recovery due to year-end demand.

【Educational Perspective】

The industrial production index in November saw a negative trend for the first time in 3 months. Particularly, the production of industrial machinery and automobile industry underperformed, believed to be influenced by sluggish domestic and overseas demand.

Overall, out of 15 industries, 11 industries experienced a decline, highlighting a widespread weakness.

However, the results exceeded expectations, serving as a factor that somewhat restrained market pessimism.

On the other hand, as the basic judgment is considered "two steps forward, one step back", there are uncertainties in the production recovery...

Translated

3

教養チャンネル

liked

① Intention of Russia's attacks

Targeting energy facilities to undermine the morale by destroying civilian livelihoods.

Utilizing the winter season to undermine civilian support for the government.

Inducing support fatigue in Western countries.

② Response and impact of Ukraine.

Restricting power supply to maintain the stability of the Energy System.

In Kharkiv Oblast, 0.5 million people are unable to use heating, having a serious impact on the daily lives of citizens.

③ Geopolitical Factors

President-elect Trump promises peace mediation, with potentially unfavorable outcomes for Ukraine depending on negotiation conditions.

Spreading to the European Energy market, concerns about price increases and economic pressure.

Risk and long-term challenges

Increasing costs of energy infrastructure restoration.

Increased import dependence and expanded financial burden.

The international tension is worsening due to the prolonged war.

【Educational Perspective】

The attacks on Ukraine's energy facilities by Russia are considered part of the strategy to prolong the war.

This is considered to be a trend that will attract higher oil prices.

By cutting off energy supply in winter, they are trying to undermine the livelihoods of Ukrainian citizens and shake support for the Zelensky administration.

On the other hand, Ukraine is trying to maintain its system through measures such as restricting power supply, but the damage...

Translated

6

教養チャンネル

liked

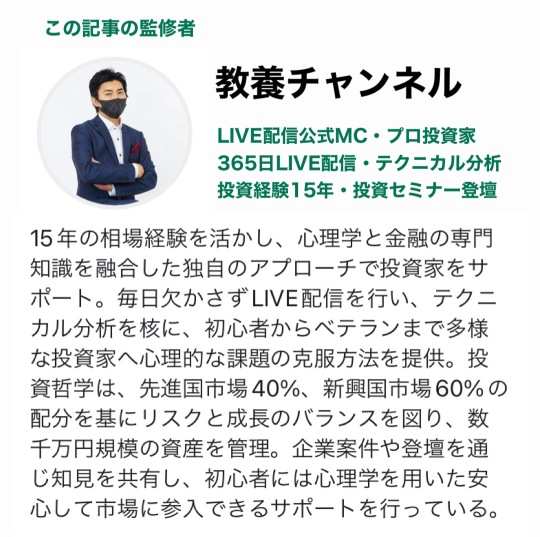

Analysis of the FOMC in 2025.

New members replacing previous members.

Collins (Dove Faction)

Mussalem (Hawkish)

Schmidt (Neutral)

Goolsbee (Slightly Dovish)

Fallen members

Hammock (Hawkish)

Daily (Neutral)

Focus of interest rate cut policy

Pace adjustment: Expecting gradual interest rate cuts of about twice a year.

Data dependent: Inflation and employment data influence policy decisions.

Increase in dissenting votes: Expected to see increased divergence of opinions among members.

Impact of external factors

Trump policies: Risks of tax cuts and tariffs pushing up inflation.

Geopolitical risks: Middle East and US-China relations affecting the market.

Impact on the market

Short-term interest rates: Possibility of staying high.

Long-term interest rates: Limited decrease depending on the pace of rate cuts.

Dollar exchange rate: Potential to prevent excessive decline.

Stock market: Mild rate cuts are reassuring, but falling short of market expectations can also lead to disappointment.

Conclusion

Data dependence is further strengthened, making policy decisions more complex.

Inflation and employment data are key.

The market needs to pay attention to each FOMC.

【Educational Perspective】

The focus of the 2025 FOMC will be on the pace of rate cuts and the divergence of opinions among members.

New voting rights will...

New members replacing previous members.

Collins (Dove Faction)

Mussalem (Hawkish)

Schmidt (Neutral)

Goolsbee (Slightly Dovish)

Fallen members

Hammock (Hawkish)

Daily (Neutral)

Focus of interest rate cut policy

Pace adjustment: Expecting gradual interest rate cuts of about twice a year.

Data dependent: Inflation and employment data influence policy decisions.

Increase in dissenting votes: Expected to see increased divergence of opinions among members.

Impact of external factors

Trump policies: Risks of tax cuts and tariffs pushing up inflation.

Geopolitical risks: Middle East and US-China relations affecting the market.

Impact on the market

Short-term interest rates: Possibility of staying high.

Long-term interest rates: Limited decrease depending on the pace of rate cuts.

Dollar exchange rate: Potential to prevent excessive decline.

Stock market: Mild rate cuts are reassuring, but falling short of market expectations can also lead to disappointment.

Conclusion

Data dependence is further strengthened, making policy decisions more complex.

Inflation and employment data are key.

The market needs to pay attention to each FOMC.

【Educational Perspective】

The focus of the 2025 FOMC will be on the pace of rate cuts and the divergence of opinions among members.

New voting rights will...

Translated

6

教養チャンネル

liked

Benefits

• Improving Market Competitiveness

• Reduce trucking costs and expedite supply.

• Entry into the luxury EV market (Lexus).

• Transition to EV shift.

• Boosting the achievement of the 2035 goal.

• Prompt response to environmental regulation and subsidy policies.

• Improvement of brand value.

• Strengthening Position in the Luxury Car Market

• Appeal of Next-Generation Technology

• Improvement of production efficiency

• Introduction of the latest technology and promotion of automation.

• Optimization of the supply chain.

Technical Analysis is conducted via LIVE broadcast.

Demerits

• Price competition.

• Intense competition with local manufacturers and Tesla.

• Difficulties in product differentiation.

• Investment Risk

• High Costs for Factory Construction and Land Acquisition

• The preparation period before starting operation is long (scheduled for 2027).

• Market and policy risks.

• Possibility of reduced subsidies and slowing market growth.

• Political risk (deterioration of US-China relations)

• Impact on existing businesses

• Impact on production system focusing on engine cars.

• The necessity of changing global strategy.

• Issues with talent and supply system.

• Securing technical experts and skilled workers is necessary.

• EV特化型サプライチェーン構築の難しさ

【Educational Perspective】

トヨ...

• Improving Market Competitiveness

• Reduce trucking costs and expedite supply.

• Entry into the luxury EV market (Lexus).

• Transition to EV shift.

• Boosting the achievement of the 2035 goal.

• Prompt response to environmental regulation and subsidy policies.

• Improvement of brand value.

• Strengthening Position in the Luxury Car Market

• Appeal of Next-Generation Technology

• Improvement of production efficiency

• Introduction of the latest technology and promotion of automation.

• Optimization of the supply chain.

Technical Analysis is conducted via LIVE broadcast.

Demerits

• Price competition.

• Intense competition with local manufacturers and Tesla.

• Difficulties in product differentiation.

• Investment Risk

• High Costs for Factory Construction and Land Acquisition

• The preparation period before starting operation is long (scheduled for 2027).

• Market and policy risks.

• Possibility of reduced subsidies and slowing market growth.

• Political risk (deterioration of US-China relations)

• Impact on existing businesses

• Impact on production system focusing on engine cars.

• The necessity of changing global strategy.

• Issues with talent and supply system.

• Securing technical experts and skilled workers is necessary.

• EV特化型サプライチェーン構築の難しさ

【Educational Perspective】

トヨ...

Translated

9

教養チャンネル

liked

Current background

Residence sales slump leading to revenue deterioration, debt crisis continues.

Developer's dollar-denominated corporate bond market is collapsing, making it difficult to raise new funds.

The impact is expanding to domestic and foreign markets such as Hong Kong.

Main Case Studies

CHINA VANKE: Liquidity crisis, avoiding default with government intervention.

NEW WORLD DEV: Negotiating extension of bank and loan repayment deadlines.

PARK VIEW GROUP: Securing funds through asset sales.

Signs of recent stress

Residential sales slump puts pressure on the entire industry.

Affects related industries such as furniture and automobiles.

CHINA VANKE's crisis leads to a decrease in market confidence.

Government policies and their impact

Regulatory relaxation alleviates the deterioration speed of the industry.

It does not lead to demand stimulation or restoration of investor confidence.

Delays in improving the credit environment are significant.

Default risk and market outlook

Default rates are decreasing, but there is a possibility of new defaults.

Bottoming out is expected in 1-2 years.

The market is becoming more opaque, with low levels of trust.

Future challenges

The need for sustainable recovery measures for residential sales demand.

Implementation of specific measures to improve corporate funding environment.

Enhancement of domestic and international risk management and transparency.

Conclusion

The crisis continues, but rapid deterioration can be avoided with government measures.

For fundamental recovery...

Translated

1

教養チャンネル

liked

National CPI (year-on-year) results at 2.9% (market expectation 2.8%, previous 2.3%).

Core CPI (excluding fresh food, year-on-year) results at 2.7% (market expectation 2.6%, previous 2.3%).

Exceeded the Bank of Japan's target (2%): 32 consecutive months.

Energy prices: The rise in import prices due to the weakening of the yen is having an impact.

Service prices: Rising due to the recovery of inbound demand.

①Exchange Rates: Weakening of the yen is a factor pushing up prices.

Bank of Japan's Response: Possibility of discussing revisions to the YCC policy.

Foreign Exchange Market: Risk of yen strength due to expected policy changes.

Bond Market: Pressure for a rise in long-term interest rates (JGBs).

Stock Market: Concerns about increased corporate costs, benefit of a weaker yen to export industries.

Impact on consumption: Risks of slowdown due to decreased household purchasing power.

Key indicators to watch: Tokyo metropolitan area CPI (leading indicator) and wage trends (spring labor negotiation results).

【Educational Perspective】

In November, the national CPI exceeded market expectations, and the stickiness of inflation became clear.

Energy prices and yen depreciation are pushing up prices, while service prices are also rising due to demand recovery.

On the other hand, if the situation continues without wage increases, the risk of consumption slowdown will increase.

The Bank of Japan may be forced to adjust monetary policy due to inflation exceeding the target, but it is likely to wait for the wage trends in the spring labor negotiations.

In the market, the focus is on the Bank of Japan's...

Core CPI (excluding fresh food, year-on-year) results at 2.7% (market expectation 2.6%, previous 2.3%).

Exceeded the Bank of Japan's target (2%): 32 consecutive months.

Energy prices: The rise in import prices due to the weakening of the yen is having an impact.

Service prices: Rising due to the recovery of inbound demand.

①Exchange Rates: Weakening of the yen is a factor pushing up prices.

Bank of Japan's Response: Possibility of discussing revisions to the YCC policy.

Foreign Exchange Market: Risk of yen strength due to expected policy changes.

Bond Market: Pressure for a rise in long-term interest rates (JGBs).

Stock Market: Concerns about increased corporate costs, benefit of a weaker yen to export industries.

Impact on consumption: Risks of slowdown due to decreased household purchasing power.

Key indicators to watch: Tokyo metropolitan area CPI (leading indicator) and wage trends (spring labor negotiation results).

【Educational Perspective】

In November, the national CPI exceeded market expectations, and the stickiness of inflation became clear.

Energy prices and yen depreciation are pushing up prices, while service prices are also rising due to demand recovery.

On the other hand, if the situation continues without wage increases, the risk of consumption slowdown will increase.

The Bank of Japan may be forced to adjust monetary policy due to inflation exceeding the target, but it is likely to wait for the wage trends in the spring labor negotiations.

In the market, the focus is on the Bank of Japan's...

Translated

1

教養チャンネル

liked

Chairman Powell's press conference after the FOMC

Careful policy operation and response to the upcoming Trump administration

Chair Powell's remarks emphasize the FOMC's stance of maintaining a data-dependent approach while transitioning from past rapid easing measures to a cautious pace.

On the other hand, there is high uncertainty about the impact of the economic policies of the upcoming Trump administration (especially regarding tariffs and immigration policies), and the FRB determines that it is necessary to assess the situation without rushing to conclusions.

【Educational Perspective】

In particular, attention should be paid to the following points in the future.

① Tariff Policy: The impact of tariffs on price increases and inflationary pressures.

Policy adjustments depending on data: slowing pace of rate cuts in line with inflation progress and labor market trends.

Geopolitical risks: new downside risks to economic growth.

The Federal Reserve's stance aiming to maintain economic strength while restraining inflation will be the linchpin of future policy operations.

Technical analysis and detailed analysis are being explained separately on notes, YouTube, and online salons.

#Investment #USDJPY #ExchangeRate #NISA #Retirement #Assets #AssetManagement #Pound #Dollar #Yen #Euro #MexicanPeso #TurkishLira

Careful policy operation and response to the upcoming Trump administration

Chair Powell's remarks emphasize the FOMC's stance of maintaining a data-dependent approach while transitioning from past rapid easing measures to a cautious pace.

On the other hand, there is high uncertainty about the impact of the economic policies of the upcoming Trump administration (especially regarding tariffs and immigration policies), and the FRB determines that it is necessary to assess the situation without rushing to conclusions.

【Educational Perspective】

In particular, attention should be paid to the following points in the future.

① Tariff Policy: The impact of tariffs on price increases and inflationary pressures.

Policy adjustments depending on data: slowing pace of rate cuts in line with inflation progress and labor market trends.

Geopolitical risks: new downside risks to economic growth.

The Federal Reserve's stance aiming to maintain economic strength while restraining inflation will be the linchpin of future policy operations.

Technical analysis and detailed analysis are being explained separately on notes, YouTube, and online salons.

#Investment #USDJPY #ExchangeRate #NISA #Retirement #Assets #AssetManagement #Pound #Dollar #Yen #Euro #MexicanPeso #TurkishLira

Translated

+2

1

教養チャンネル

liked

1. Background and strategic significance of the integration

✔️Rapid growth of the EV market

Tesla (USA) and BYD (China) are leading the way, intensifying competition in the EV sector.

Honda and NISSAN alone face significant investment burdens and also have limitations on the speed of technological development.

Software and self-driving technology.

The competitiveness of the automobile industry is shifting from 'Hardware (vehicle body)' to 'Software'.

The development of in-vehicle OS and self-driving system requires massive investment, and efficiency improvement through integration is needed.

Global share and economies of scale ✅

Rising to 3rd place in the world (7.35 million units) through the merger of Honda and NISSAN MOTOR CO.

Competitive strength against top players like Toyota and Volkswagen is strengthened.

2. Benefits of Integration

Reduced investment burden with significant investments required in EVs, Software, and Self-Driving technology sectors.

By integrating the two companies, it is possible to share development costs and improve efficiency.

✔️ Strengthening technological capabilities

By combining Honda's 'EV technology and internal combustion engine technology' with Nissan's 'EV track record with Leaf and battery technology', competitiveness is strengthened.

Economies of scale ✔️

Total sales reach 7.35 million units, expected cost reduction through standardization of production lines and component sourcing.

✔️ Strength in the global market...

✔️Rapid growth of the EV market

Tesla (USA) and BYD (China) are leading the way, intensifying competition in the EV sector.

Honda and NISSAN alone face significant investment burdens and also have limitations on the speed of technological development.

Software and self-driving technology.

The competitiveness of the automobile industry is shifting from 'Hardware (vehicle body)' to 'Software'.

The development of in-vehicle OS and self-driving system requires massive investment, and efficiency improvement through integration is needed.

Global share and economies of scale ✅

Rising to 3rd place in the world (7.35 million units) through the merger of Honda and NISSAN MOTOR CO.

Competitive strength against top players like Toyota and Volkswagen is strengthened.

2. Benefits of Integration

Reduced investment burden with significant investments required in EVs, Software, and Self-Driving technology sectors.

By integrating the two companies, it is possible to share development costs and improve efficiency.

✔️ Strengthening technological capabilities

By combining Honda's 'EV technology and internal combustion engine technology' with Nissan's 'EV track record with Leaf and battery technology', competitiveness is strengthened.

Economies of scale ✔️

Total sales reach 7.35 million units, expected cost reduction through standardization of production lines and component sourcing.

✔️ Strength in the global market...

Translated

7

教養チャンネル

liked

Trends in the yen exchange rate

Dollar fell to the mid-154 yen range.

Updated to a temporary low of 154.48 yen, the lowest level since November 26th.

Cause

FOMC: Hawkish rate cut stance supports dollar buying.

BOJ: Expectations of postponing rate hikes lead to selling of yen on a dovish outlook.

US economic indicators: November PMI is favorable, confirming the strength of the US economy.

Trends in the interest rate market

FOMC: The rate cut on the 17th-18th is already priced in.

Bank of Japan: Expectations of a rate hike on the 18th-19th have decreased to the 10% range.

Opinion [superficial]

The yen continues to weaken before the Japan-U.S. policy decision meeting.

The downside target is in the upper 154 yen range.

Focus for the future

Confirmation of the hawkish stance by the FOMC.

Will the Bank of Japan indicate a more dovish content than expected?

Will the strength of the US economic indicators continue?

Short-term outlook

There is a high possibility that the yen will continue to weaken due to the policy differences between Japan and the United States.

Attention is paid to the decline to the latter half of the 154 yen range.

【Educational Perspective】

The yen continues to weaken, falling to the upper 154 yen range.

Behind this is the contrasting outlook of monetary policies between Japan and the United States. While a rate cut is expected in the US FOMC, a hawkish stance is supporting the strength of the dollar.

On the other hand, there is growing speculation that the Bank of Japan will postpone raising interest rates, leading to increased selling pressure on the yen.

...

Translated

1

教養チャンネル

liked

① Importance of Robusta in the global market.

It is used for bitter taste, low-priced coffees, and instant products.

Price increase due to substitute demand for Arabica.

Background of supply shortage in Vietnam

Harvest reduced due to drought.

Cost increase due to compliance with EU regulations on forest protection.

Exporters struggling to secure a stable source of supply.

3. Price trends and factors driving the increase.

London futures prices have risen by about 50% this year.

Drought, new regulations, and inflation are driving price increases.

The forecasted increase in domestic prices in Vietnam is from $5.13 to $5.89 per kilogram.

④ Impact on consumers and the market

Prices of instant and espresso coffees are soaring.

Price hikes for lattes and cafe menus are unavoidable.

Possible blend change due to narrowing price difference with Arabica.

⑤ Future outlook

Prices are expected to remain high in the short term.

Increased production in other countries (Indonesia, Brazil) is key.

Depending on the impact of climate change, supply shortages could become chronic.

Delay in sustainability measures leads to long-term cost increases.

【Educational Perspective】

The price of Robusta coffee beans has significantly increased.

In Vietnam, the harvest has decreased due to drought, and compliance with the EU's forest protection regulations has also led to increased costs.

This year, in London...

It is used for bitter taste, low-priced coffees, and instant products.

Price increase due to substitute demand for Arabica.

Background of supply shortage in Vietnam

Harvest reduced due to drought.

Cost increase due to compliance with EU regulations on forest protection.

Exporters struggling to secure a stable source of supply.

3. Price trends and factors driving the increase.

London futures prices have risen by about 50% this year.

Drought, new regulations, and inflation are driving price increases.

The forecasted increase in domestic prices in Vietnam is from $5.13 to $5.89 per kilogram.

④ Impact on consumers and the market

Prices of instant and espresso coffees are soaring.

Price hikes for lattes and cafe menus are unavoidable.

Possible blend change due to narrowing price difference with Arabica.

⑤ Future outlook

Prices are expected to remain high in the short term.

Increased production in other countries (Indonesia, Brazil) is key.

Depending on the impact of climate change, supply shortages could become chronic.

Delay in sustainability measures leads to long-term cost increases.

【Educational Perspective】

The price of Robusta coffee beans has significantly increased.

In Vietnam, the harvest has decreased due to drought, and compliance with the EU's forest protection regulations has also led to increased costs.

This year, in London...

Translated

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)