$Super Micro Computer (SMCI.US)$ Will the market open sharply next Monday?

Translated

2

新人一枚

commented on

$Super Micro Computer (SMCI.US)$

Will complete the factory setup and shipments in Johor by the end of the year, strong order!😁

Will complete the factory setup and shipments in Johor by the end of the year, strong order!😁

Translated

1

16

新人一枚

commented on

$Super Micro Computer (SMCI.US)$ Go for it, Buffett made a big purchase of 20 billion US dollars.

Translated

1

5

新人一枚

liked

$Upexi (UPXI.US)$ Yesterday I could get out of the trap, today I can never get out of the trap for the rest of my life.

Translated

1

新人一枚

liked

#US stocks can make you rich. How to find skyrocketing stocks? 👆

First, look for trending stocks. These types of stocks experience a large number of losses in the early stages of growth, with the risk of bankruptcy, but if they can withstand until the market matures, then spring will come. This is my investment case.

In 2020-2021, I invested in electric vehicle stocks, including TESLA, NKLA, RIVN. The result was that TESLA rose from over 200 to over 2,000, with a profit of more than five times. NKLA broke even and exited, while RIVN incurred an 80% loss before selling, but still made a profit of 200% after settlement. Before the China-US trade war, I bought SE and ZOOM. I decisively sold ZOOM at a small loss of 20%, but made a big profit of 300% with SE. In 2022, I began to shift to chip stocks and successively bought TSM, AMD, NVDA. In 2023, I sold TSM (following in Buffett's footsteps) and bought AMD after my son's recommendation. I sold Intel and bought AMD when the price was around 25, and sold at around 120, making a substantial profit before going all in on NVDA at a price of around 220 when the AI trend emerged in the market. After holding for about two years, the price rose to 650-800, and I added a small amount at 850 and prepared to sell at 1200. I saw the news of a 1>10 stock split, and decided after the split. The price surged to 140, and I sold half of my holdings at 135 to realize the profit first. After settlement, the cost of my remaining holdings was about 33.

First, look for trending stocks. These types of stocks experience a large number of losses in the early stages of growth, with the risk of bankruptcy, but if they can withstand until the market matures, then spring will come. This is my investment case.

In 2020-2021, I invested in electric vehicle stocks, including TESLA, NKLA, RIVN. The result was that TESLA rose from over 200 to over 2,000, with a profit of more than five times. NKLA broke even and exited, while RIVN incurred an 80% loss before selling, but still made a profit of 200% after settlement. Before the China-US trade war, I bought SE and ZOOM. I decisively sold ZOOM at a small loss of 20%, but made a big profit of 300% with SE. In 2022, I began to shift to chip stocks and successively bought TSM, AMD, NVDA. In 2023, I sold TSM (following in Buffett's footsteps) and bought AMD after my son's recommendation. I sold Intel and bought AMD when the price was around 25, and sold at around 120, making a substantial profit before going all in on NVDA at a price of around 220 when the AI trend emerged in the market. After holding for about two years, the price rose to 650-800, and I added a small amount at 850 and prepared to sell at 1200. I saw the news of a 1>10 stock split, and decided after the split. The price surged to 140, and I sold half of my holdings at 135 to realize the profit first. After settlement, the cost of my remaining holdings was about 33.

Translated

10

新人一枚

reacted to

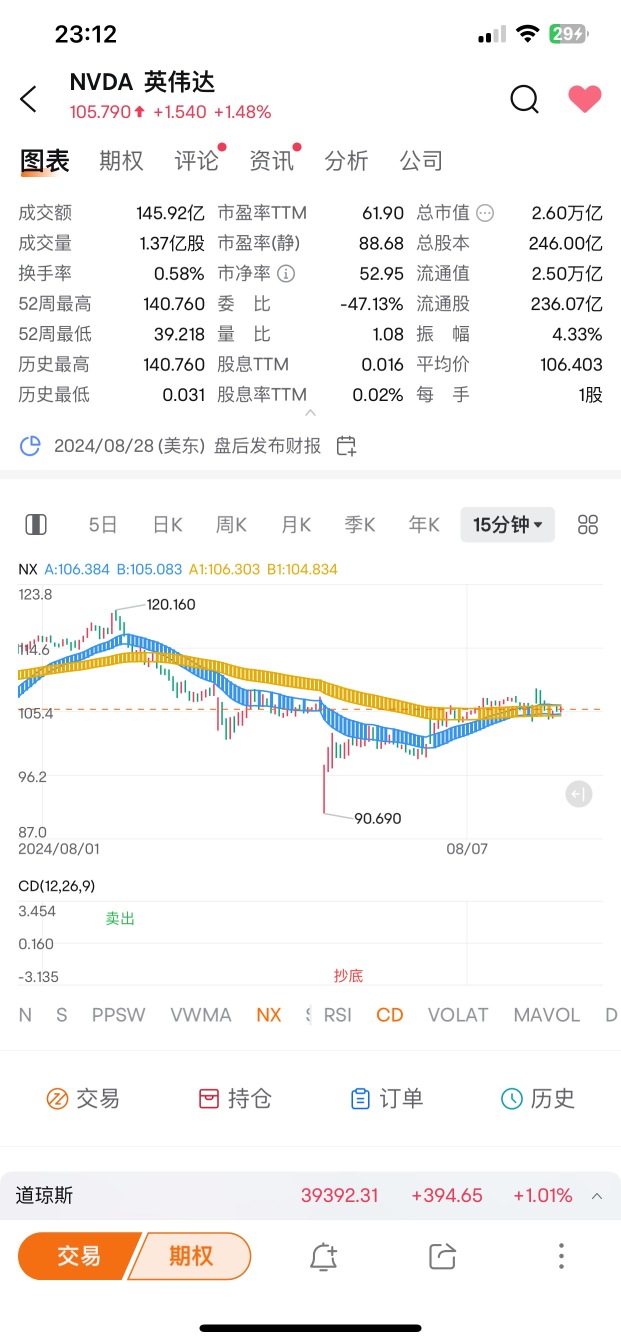

$Apple (AAPL.US)$ $NVIDIA (NVDA.US)$ $Taiwan Semiconductor (TSM.US)$ Reference for technical trends:

Translated

+1

8

1

新人一枚

commented on

$MicroStrategy (MSTR.US)$ $Tesla (TSLA.US)$ $GameStop (GME.US)$

Let's talk about gamestop first. As I mentioned in last week's analysis video, there will be another wave, because the CD indicators suggest that it's a good time to buy low:

(as stated in the previous pictureBuy lowThe two words are included in the CD indicator.

MSTR. In last week's analysis video, I mentioned that MSTR would take off. Let everyone prepare in advance: the options I have made are as follows,

I bought the underlying stock twice, as follows:

After the MARA CD indicator signaled to buy the dip, quickly climbed out of the blue ladder:

(as stated in the previous pictureBuy lowis a CD indicator by default

Next, let's talk about DJT:

Next, you can be bolder, do not sell below the lower edge of the blue ladder on the candlestick chart.

Tesla is as I mentioned in the previous interpretation video, holding above the yellow ladder on the 30-minute blue ladder:

New individual stock opportunities, we can also research ffie.

Let's talk about gamestop first. As I mentioned in last week's analysis video, there will be another wave, because the CD indicators suggest that it's a good time to buy low:

(as stated in the previous pictureBuy lowThe two words are included in the CD indicator.

MSTR. In last week's analysis video, I mentioned that MSTR would take off. Let everyone prepare in advance: the options I have made are as follows,

I bought the underlying stock twice, as follows:

After the MARA CD indicator signaled to buy the dip, quickly climbed out of the blue ladder:

(as stated in the previous pictureBuy lowis a CD indicator by default

Next, let's talk about DJT:

Next, you can be bolder, do not sell below the lower edge of the blue ladder on the candlestick chart.

Tesla is as I mentioned in the previous interpretation video, holding above the yellow ladder on the 30-minute blue ladder:

New individual stock opportunities, we can also research ffie.

Translated

+4

27

1

新人一枚

voted

Hi, mooers!![]()

As the first half wraps up, we witnessed a series of remarkable events in the stock market that have captured the world's attention! The US stock market has maintained momentum, from the AI boom to meme stocks mania, the US election year, and the expectations of rate cuts; these events have created a lot of buzz.

Now, let’s take a trip down memory lane and revisit these key moments that have shaped our shared experiences.![]()

![]()

���������...

As the first half wraps up, we witnessed a series of remarkable events in the stock market that have captured the world's attention! The US stock market has maintained momentum, from the AI boom to meme stocks mania, the US election year, and the expectations of rate cuts; these events have created a lot of buzz.

Now, let’s take a trip down memory lane and revisit these key moments that have shaped our shared experiences.

���������...

+6

87

10

新人一枚

commented on

$Faraday Future Intelligent Electric Inc. (FFIE.US)$ Run quickly. At this point, setting a stop-loss can still leave a little lunch money. Nothing is scarier than PowerPoint on wheels. He talked about AI frameworks for half a day, not even mentioning how to use them. Respectfully, it's better to run first!

Translated

loading...

2

2

新人一枚

commented on

$Faraday Future Intelligent Electric Inc. (FFIE.US)$ Standing on the high hill, looking down, feeling helpless.

Translated

1

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)