木樑

voted

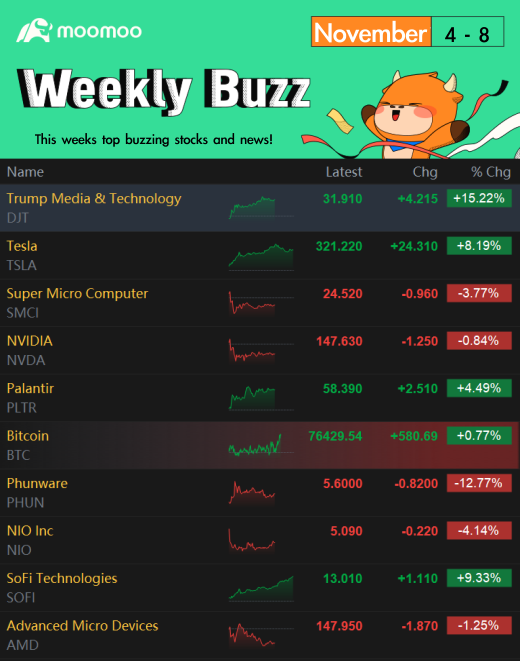

Happy weekend, investors! Welcome back to Weekly Buzz, where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

It was an extreme week in the U.S. stock market: a match-up months in the making that culminated Tuesday night. In an extremely close race and with a relatively furious pace of vote counting, Former Pr...

Make Your Choice

Weekly Buzz

It was an extreme week in the U.S. stock market: a match-up months in the making that culminated Tuesday night. In an extremely close race and with a relatively furious pace of vote counting, Former Pr...

+10

83

28

4

木樑

liked

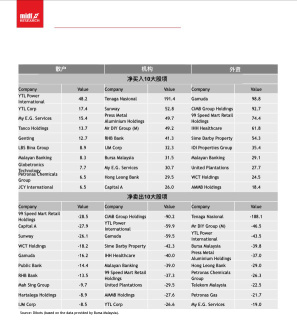

Following the 2025 budget, the stock market buying interest failed to continue, with foreign net inflow only maintained for one week and reversing to outflow last week, with a net outflow of 0.1 billion and 96.2 million ringgit.

In the fund flow report released by MIDF Research on Monday, it was mentioned that apart from small net buys of 39.1 million and 176 million ringgit by foreign funds on Monday and Tuesday last week, they were net sellers of Malaysian stocks on the other trading days.

Among them, the biggest net selling activity was on Thursday, totaling 0.2 billion and 30.3 million ringgit.

Sectors that saw net buying from foreign funds last week were mainly construction (86.5 million ringgit), financial services (85.7 million ringgit), and medical care (53 million ringgit).

Sector that was sold off by foreign investors last week include utilities (-0.2 billion 66.9 million ringgit), technology (-50.9 million ringgit), and telecommunications and media (-45.7 million ringgit).

As foreign investors exited, local institutions entered to support the market, with a net purchase of 0.2 billion 44.6 million ringgit last week.

On the other hand, local institutions followed suit with foreign investors, recording a net sale of 48.4 million ringgit last week.

In terms of participation, the Average Daily Trading Volume (ADTV) in the domestic market last week saw a 19.6% decline by foreign investors; while local institutions and retail investors increased by 1.8% and 2.2% respectively.

———

📊 Weekly net buying and selling stock summary 📊

Buy

Retail investors

$YTLPOWR (6742.MY)$

$YTL (4677.MY)$

$MYEG (0138.MY)$

$TANCO (2429.MY)$

$GENTING (3182.MY)$

���������...

In the fund flow report released by MIDF Research on Monday, it was mentioned that apart from small net buys of 39.1 million and 176 million ringgit by foreign funds on Monday and Tuesday last week, they were net sellers of Malaysian stocks on the other trading days.

Among them, the biggest net selling activity was on Thursday, totaling 0.2 billion and 30.3 million ringgit.

Sectors that saw net buying from foreign funds last week were mainly construction (86.5 million ringgit), financial services (85.7 million ringgit), and medical care (53 million ringgit).

Sector that was sold off by foreign investors last week include utilities (-0.2 billion 66.9 million ringgit), technology (-50.9 million ringgit), and telecommunications and media (-45.7 million ringgit).

As foreign investors exited, local institutions entered to support the market, with a net purchase of 0.2 billion 44.6 million ringgit last week.

On the other hand, local institutions followed suit with foreign investors, recording a net sale of 48.4 million ringgit last week.

In terms of participation, the Average Daily Trading Volume (ADTV) in the domestic market last week saw a 19.6% decline by foreign investors; while local institutions and retail investors increased by 1.8% and 2.2% respectively.

———

📊 Weekly net buying and selling stock summary 📊

Buy

Retail investors

$YTLPOWR (6742.MY)$

$YTL (4677.MY)$

$MYEG (0138.MY)$

$TANCO (2429.MY)$

$GENTING (3182.MY)$

���������...

Translated

49

2

13

木樑

voted

$Tesla (TSLA.US)$ July surge fueled by Robo Taxi rumors. That surge was a classic case of "buy the rumor, sell the news," illustrating how markets often price in events before they actually happen. Musk's statement hinting at Cybercab production "before 2027" has raised eyebrows, given his history of missed deadlines. 🤔

Tesla has recently secured approval from local authorities near its Berlin gigafactory to proceed with a three-stage expa...

Tesla has recently secured approval from local authorities near its Berlin gigafactory to proceed with a three-stage expa...

18

4

4

木樑

voted

📃 Key Takeaways

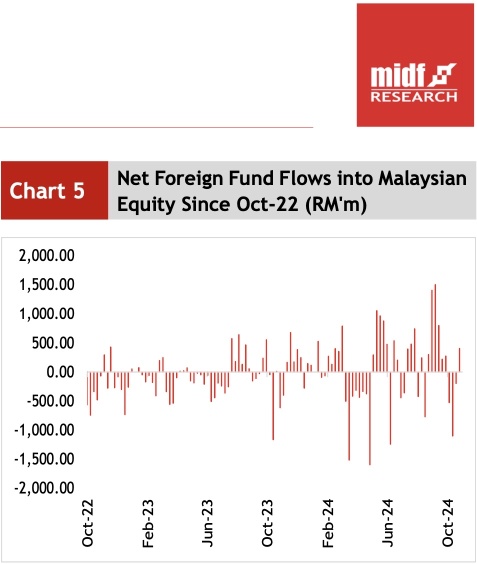

▫️ Nvidia closed at $132.65 on October 9, nearing its all-time high of $140.74, reflecting a year-to-date increase of around 168%.

▫️ The stock is developing a symmetrical triangle pattern and indicates a possible breakout. Technical indicators like RSI and MACD are positive on the daily timeframe, suggesting potential upward movement.

▫️ Nvidia CEO recently says ‘reasoning’ AI will depend on cheaper c...

▫️ Nvidia closed at $132.65 on October 9, nearing its all-time high of $140.74, reflecting a year-to-date increase of around 168%.

▫️ The stock is developing a symmetrical triangle pattern and indicates a possible breakout. Technical indicators like RSI and MACD are positive on the daily timeframe, suggesting potential upward movement.

▫️ Nvidia CEO recently says ‘reasoning’ AI will depend on cheaper c...

45

21

7

木樑

voted

Despite Golden Week, it's evident that 🇨🇳 stocks are still 🐉 soaring!

$Futu Holdings Ltd (FUTU.US)$ $PDD Holdings (PDD.US)$ ,and $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $CSI 300 Index (000300.SH)$ $Hang Seng Index (800000.HK)$ $FTSE China A50 Index (.FTXIN9.CN)$ helped my portfolio from the sea of red last night. I have to thank those who voted on my previous post; it helped me identify where the heavy plays were! 🙏🏻 The voters seems to know what they’re doing...

$Futu Holdings Ltd (FUTU.US)$ $PDD Holdings (PDD.US)$ ,and $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $CSI 300 Index (000300.SH)$ $Hang Seng Index (800000.HK)$ $FTSE China A50 Index (.FTXIN9.CN)$ helped my portfolio from the sea of red last night. I have to thank those who voted on my previous post; it helped me identify where the heavy plays were! 🙏🏻 The voters seems to know what they’re doing...

20

16

木樑

voted

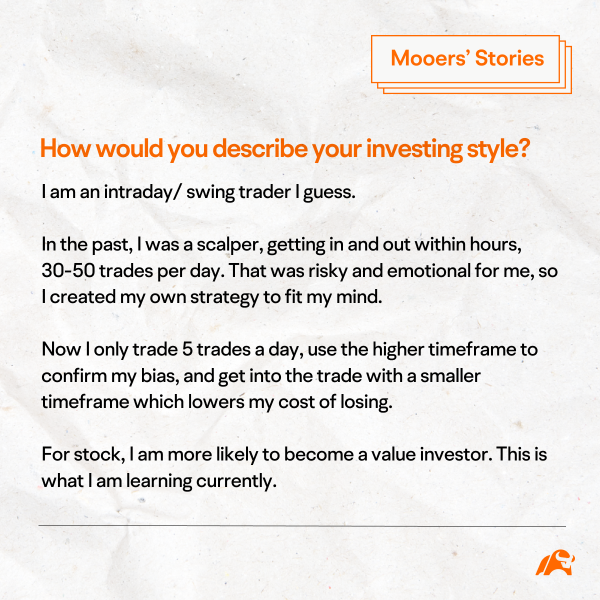

Hi, mooers. Welcome back to Mooers' Stories, where we present mooers' insights and experiences. As the dust settled on the Moomoo US Stocks Paper Trading Competition in Malaysia, @Jcheng01 surged ahead to claim the top spot.

Winning the first prize wasn't a stroke of luck, it might be attributed to the calculated moves and a unique approach. Intrigued by his ascent, we got him on board fo...

Winning the first prize wasn't a stroke of luck, it might be attributed to the calculated moves and a unique approach. Intrigued by his ascent, we got him on board fo...

+1

173

58

15

木樑

voted

Hi Mooers, ![]()

Welcome back!![]()

On today's topic, we will be discussing the top 6 stocks by market cap. **

Here, we have the top 6, with the number represent their market cap in trillion (USD).

![]() $Apple (AAPL.US)$

$Apple (AAPL.US)$

AAPL 3.026

![]() $Microsoft (MSFT.US)$

$Microsoft (MSFT.US)$

MSFT 2.178

![]() $Alphabet-C (GOOG.US)$

$Alphabet-C (GOOG.US)$

GOOG 1.584

![]() $Alphabet-A (GOOGL.US)$

$Alphabet-A (GOOGL.US)$

GOOGL 1.574

![]() $Amazon (AMZN.US)$

$Amazon (AMZN.US)$

AMZN 1.446

![]() $Tesla (TSLA.US)$

$Tesla (TSLA.US)$

TSLA 0.945

This could be one of the reasons why super investors bought them.![]()

It is also worthwhil...

Welcome back!

On today's topic, we will be discussing the top 6 stocks by market cap. **

Here, we have the top 6, with the number represent their market cap in trillion (USD).

AAPL 3.026

MSFT 2.178

GOOG 1.584

GOOGL 1.574

AMZN 1.446

TSLA 0.945

This could be one of the reasons why super investors bought them.

It is also worthwhil...

7

2

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)