武太郎

reacted to and commented on

武太郎

voted

Please tell us about the first financial commodity you bought. What happened to that financial commodity or brand? Please share your stories in the comments section 🙇

Translated

1

1

1

武太郎

liked

Yesterday, Berkshire Hathaway led by famous investor Warren Buffett took place from midnight to early morning on 5/6 (Sat) Japan time ( $Berkshire Hathaway-A (BRK.A.US)$ I've compiled the main points about what Berkshire executives, starting with Mr. Buffett, said at the annual general meeting of shareholders of), so I'll tell you.

■About the market and economy

・It's not that we don't think there will be confusion about the future

· Commercial real estate could struggle with higher borrowing rates and banks could face more pressure, but deposits are safe

· Berkshire's earnings will decline year over year as economic activity slows

■Occidental Petroleum ( $Occidental Petroleum (OXY.US)$ About)

・There is speculation that we will buy Occidental Petroleum, but we have no intention of buying controls. Even if I do, I don't know what to do

■Prospects for value investments

・Me...

■About the market and economy

・It's not that we don't think there will be confusion about the future

· Commercial real estate could struggle with higher borrowing rates and banks could face more pressure, but deposits are safe

· Berkshire's earnings will decline year over year as economic activity slows

■Occidental Petroleum ( $Occidental Petroleum (OXY.US)$ About)

・There is speculation that we will buy Occidental Petroleum, but we have no intention of buying controls. Even if I do, I don't know what to do

■Prospects for value investments

・Me...

Translated

43

3

武太郎

liked

I will continue to work hard on posting steadily, so please continue to support me 😊

Translated

9

武太郎

commented on

🔸 FY23Q2 Performance

⭕️ EPS: $1.52 (estimate +$0.09)

⭕️ Revenue: $94.84 billion (estimate +$1.9 billion)

📉 Revenue growth rate: -3% Y/Y

🔸Shareholder returns

📈Dividends: $0.24 per share (+4.3%)

⭕️11 consecutive years of dividend growth

📈Share buyback: $90 billion

🔸Revenue by category

📈iPhone: $51.33 billion (+1.5% Y/Y)

📉Mac: $7.17 billion (-31.3% Y/Y)

📉iPad: $6.67 billion (-12.7% Y/Y)

Wearables, Home and Accessories: $8.75 billion (-0.7% Y/Y)

Services: $20.9 billion (+5.4% Y/Y)

🔸 Summary

✔︎ iPhone: Despite the sluggish global smartphone market, sales are growing

Service: Apple Care and Apple TV are performing well.

Paid subscriptions: 975 million (+150 million Y/Y, twice the amount from 3 years ago).

India market: Strong growth, expecting expansion of the next middle class.

🔸 Blog article...

⭕️ EPS: $1.52 (estimate +$0.09)

⭕️ Revenue: $94.84 billion (estimate +$1.9 billion)

📉 Revenue growth rate: -3% Y/Y

🔸Shareholder returns

📈Dividends: $0.24 per share (+4.3%)

⭕️11 consecutive years of dividend growth

📈Share buyback: $90 billion

🔸Revenue by category

📈iPhone: $51.33 billion (+1.5% Y/Y)

📉Mac: $7.17 billion (-31.3% Y/Y)

📉iPad: $6.67 billion (-12.7% Y/Y)

Wearables, Home and Accessories: $8.75 billion (-0.7% Y/Y)

Services: $20.9 billion (+5.4% Y/Y)

🔸 Summary

✔︎ iPhone: Despite the sluggish global smartphone market, sales are growing

Service: Apple Care and Apple TV are performing well.

Paid subscriptions: 975 million (+150 million Y/Y, twice the amount from 3 years ago).

India market: Strong growth, expecting expansion of the next middle class.

🔸 Blog article...

Translated

+1

1

1

武太郎

commented on

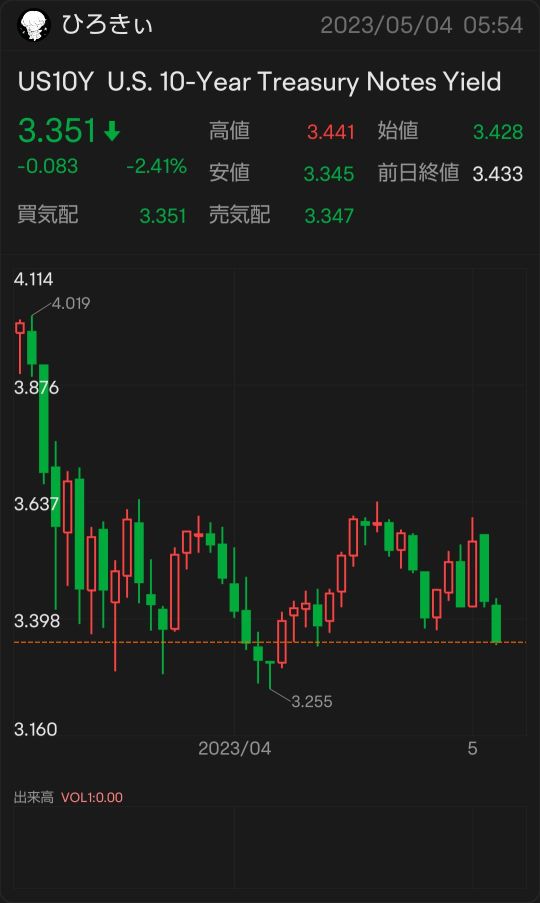

At the recent FOMC meeting held until just now, a 0.25% rate hike was implemented.

The rate hike itself was as expected by the market, but the subsequent remarks of Chairman Powell of the Federal Reserve were crucial.

The statement included a sense of 'approaching a halt in rate hikes' and I felt a sense of consciousness about the next phase.

It is likely that the rate hike cycle will end at this FOMC, but attention is now shifting to how much inflation will slow down in the current high interest rate environment.

I would like to carefully monitor how the FRB will steer while balancing the bank's credit concerns.

$U.S. 10-Year Treasury Notes Yield (US10Y.BD)$

The rate hike itself was as expected by the market, but the subsequent remarks of Chairman Powell of the Federal Reserve were crucial.

The statement included a sense of 'approaching a halt in rate hikes' and I felt a sense of consciousness about the next phase.

It is likely that the rate hike cycle will end at this FOMC, but attention is now shifting to how much inflation will slow down in the current high interest rate environment.

I would like to carefully monitor how the FRB will steer while balancing the bank's credit concerns.

$U.S. 10-Year Treasury Notes Yield (US10Y.BD)$

Translated

4

1

1

武太郎

reacted to

Interest rate

It's the end of May, but don't call it the last, Bauer-san.

It's the end of May, but don't call it the last, Bauer-san.

Translated

3

武太郎

reacted to

Oh my god, the FOMC is before dawn tomorrow ^_^

A 0.25% increase is expected this time as well, but I think the focus is on how it will create an atmosphere for the next trend. I think it's a pity that Japanese stocks have a mosquito net due to the consecutive holidays ♪

A 0.25% increase is expected this time as well, but I think the focus is on how it will create an atmosphere for the next trend. I think it's a pity that Japanese stocks have a mosquito net due to the consecutive holidays ♪

Translated

2

武太郎

liked

The dollar-yen environmental perception perspective is higher than 4H on a daily basis. 1H subtle.

Fifteen minutes later, the short-term Dow finally changed.

It's still an environment where people are aiming for push buying at the top, but isn't it difficult for the downward trend to stop right away once long position settlements etc. come in so far?

If you're aiming for a short, let's manage risk well with an awareness of going backwards and progressively!

If you're aiming for the long run, it's impossible if you don't stop lowering your lower leg, so wait leisurely. There's also FOMC, so don't be impatient and think after seeing the directionthat's right!

Fifteen minutes later, the short-term Dow finally changed.

It's still an environment where people are aiming for push buying at the top, but isn't it difficult for the downward trend to stop right away once long position settlements etc. come in so far?

If you're aiming for a short, let's manage risk well with an awareness of going backwards and progressively!

If you're aiming for the long run, it's impossible if you don't stop lowering your lower leg, so wait leisurely. There's also FOMC, so don't be impatient and think after seeing the directionthat's right!

Translated

+1

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

武太郎 : Let's buy Lululemon