investing long term is generally safer whenever it's done on a company or stock that you believe will go up in the near future. and as long as you have that in mind, it's all about growing your money in the market rather than chasing and trying to make money on the market which is hard for a lot of people. but it is also best most especially if you have a lot of work or passionate hobbies in mind and just want to have a peace of mind while investing your money, and not lose all your hair in the process. if you think such a strategy suits your lifestyle, you should definitely think about it.

永远的牛市

liked

132

77

永远的牛市

liked

Then your actions determine your life. That is to say, the way you think can define how you live. Keep grinding. Keep sharpening your mindset, prepare yourself for all challenges along the way. Stop questioning yourself when you're down. Try to put the blame on other people. Although it doesn't sound entirely politically correct. But it's a hack for having great weekends lol.

as usual, vote first plz

Let's go![]()

![]()

![]()

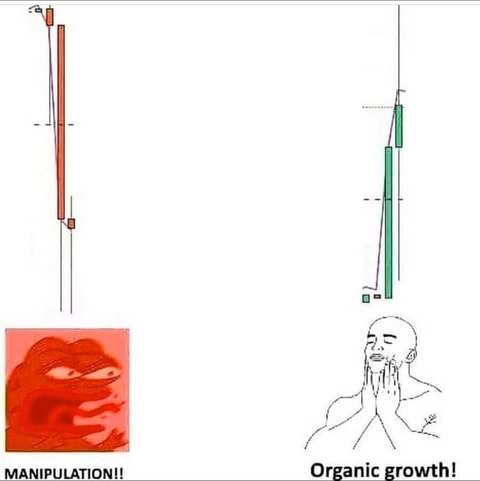

@gorgeousevan: Without comment $Tesla (TSLA.US)$

@Carry only: Makes sense. $AMC Entertainment (AMC.US)$ $Nasdaq Composite Index (.IXIC.US)$

@demntia: $AMC Entertainment (AMC.US)$

@ProTraderMark: It's all about perspective $AMC Entertainment (AMC.US)$ $GameStop (GME.US)$ $Camber Energy (CEI.US)$

@Lukas Pivar: $Sea (SE.US)$ It is a continuous stock price adjustment for rapidly rising growth stocks. For long-term investors, this is just a dip.

@XDFX: $GameStop (GME.US)$ $AMC Entertainment (AMC.US)$

@Smart Jerry:![]()

![]()

![]()

@Tyler Maltz: Crypto is always volatile. This is nothing new. Just like the bashers that come out of hiding when Doge comes to the bottom of its range then they all disappear when it goes a back over .30… $Dogecoin (DOGE.CC)$ $Tesla (TSLA.US)$

@Ankur Tiwari: $Tesla (TSLA.US)$

@Blackwidow helen: $AMC Entertainment (AMC.US)$

This week, we'd like to invite you to comment below and tell about:

Have you ever questioned yourself when investing?

How did you get through it?

We will select 20 TOP COMMENTS by next Monday.

Winners will get 88 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

You may post:

● A related meme in gif or jpeg

● Your real-life experience

● Other creative ways to show your sense of humor

That's all for this week. Wish you have a wonderful weekend.

Peace!![]()

![]()

![]()

as usual, vote first plz

Let's go

@gorgeousevan: Without comment $Tesla (TSLA.US)$

@Carry only: Makes sense. $AMC Entertainment (AMC.US)$ $Nasdaq Composite Index (.IXIC.US)$

@demntia: $AMC Entertainment (AMC.US)$

@ProTraderMark: It's all about perspective $AMC Entertainment (AMC.US)$ $GameStop (GME.US)$ $Camber Energy (CEI.US)$

@Lukas Pivar: $Sea (SE.US)$ It is a continuous stock price adjustment for rapidly rising growth stocks. For long-term investors, this is just a dip.

@XDFX: $GameStop (GME.US)$ $AMC Entertainment (AMC.US)$

@Smart Jerry:

@Tyler Maltz: Crypto is always volatile. This is nothing new. Just like the bashers that come out of hiding when Doge comes to the bottom of its range then they all disappear when it goes a back over .30… $Dogecoin (DOGE.CC)$ $Tesla (TSLA.US)$

@Ankur Tiwari: $Tesla (TSLA.US)$

@Blackwidow helen: $AMC Entertainment (AMC.US)$

This week, we'd like to invite you to comment below and tell about:

Have you ever questioned yourself when investing?

How did you get through it?

We will select 20 TOP COMMENTS by next Monday.

Winners will get 88 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

You may post:

● A related meme in gif or jpeg

● Your real-life experience

● Other creative ways to show your sense of humor

That's all for this week. Wish you have a wonderful weekend.

Peace!

+8

247

67

永远的牛市

liked

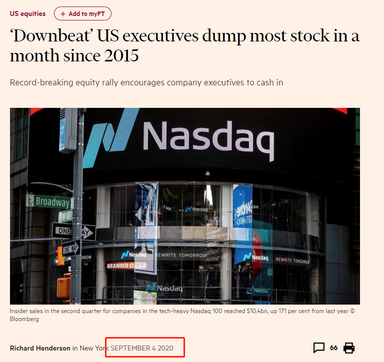

Recently, reports about cashing out by American business leaders have stirred the nerves of investors. It has reached its peak when the CEOs of $Tesla (TSLA.US)$and $Microsoft (MSFT.US)$ started selling their stock while their company's stock prices were hovering near new records.

$Microsoft (MSFT.US)$ Chief Executive Satya Nadella sold about half of his shares in the company last week, reported by Wall Street Journal on Nov. 29.

The filing of Mr. Nadella’s transaction was made public on the Wednesday before the long Thanksgiving weekend. The transaction yielded more than $285 million for Mr. Nadella. This is the single-largest stock sale for Mr. Nadella, according to InsiderScore.

How did the market react?

Interestingly, MSFT has fallen 2% since LAST Wednesday, while $S&P 500 Index (.SPX.US)$ has fallen 2.64% over the same period.

Ben Silverman, director of research at InsiderScore, said the sale is similar to Tesla CEO Elon Musk's recent stock sales. Mr. Musk took to Twitter on Nov. 7 pledging to sell 10% of his stockholdings. The Tesla CEO was taking advantage of gains in the company’s stock price, Mr. Silverman said.

$Tesla (TSLA.US)$'s stock price has fallen by about 7%, and its market value has shrunk by nearly $100 billion from that point.

Does CEOs’ sell-off mean it’s time to sell?

Action speaks louder than words. Of course, the behavior of business leaders will affect investors' confidence in the company. At least, for better or worse, news usually makes stocks more volatile in the short term.

However, their actions are not always noteworthy.

For one thing, insiders may have their own reason each time they sell stock. As to Nadella, analysts said the move could be related to Washington state instituting a 7% tax for long-term capital gains beginning at the start of next year for anything exceeding $250,000 a year.

For another, insider trading shouldn't be the only source of information, because not every executive is correct each time. In the long run, the best option is to research in-depth.

News about the sale of stocks by executives is reported from time to time. To paint a clearer picture of their effects, let's check the performance of markets and those stocks:

1. The broad market has continuously set new highs since the pandemic.

2. Taking Amazon as an example, after the CEO sold shares, the stock price has still climbed higher.

The same story also applies to $Pfizer (PFE.US)$, whose CEO sold stocks last November.

3. It's not all good news. $GameStop (GME.US)$ CEO announced to sell stocks in April. Here is how the stock price performed since then.

The bottom line

1. The CEO's sell-off may help you predict the future volatility of stock prices in the short term.

2. There is no obvious correlation between long-term stock performance and CEO selling.

3. Insider trading should not be the only source of information. Before making wise investment decisions, we should rely on in-depth research to check the company’s financial statements, annual reports, and other public opinions.

As a rule, value investors generally prefer to invest in high-quality companies with fair prices. The question is, how to identify the value of a company?

Click to our newly unveiled courses: How to invest in stocks: Quick-Start Guide.

Welcome to Courses in Moo Community, we help you trade like a pro.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

$Microsoft (MSFT.US)$ Chief Executive Satya Nadella sold about half of his shares in the company last week, reported by Wall Street Journal on Nov. 29.

The filing of Mr. Nadella’s transaction was made public on the Wednesday before the long Thanksgiving weekend. The transaction yielded more than $285 million for Mr. Nadella. This is the single-largest stock sale for Mr. Nadella, according to InsiderScore.

How did the market react?

Interestingly, MSFT has fallen 2% since LAST Wednesday, while $S&P 500 Index (.SPX.US)$ has fallen 2.64% over the same period.

Ben Silverman, director of research at InsiderScore, said the sale is similar to Tesla CEO Elon Musk's recent stock sales. Mr. Musk took to Twitter on Nov. 7 pledging to sell 10% of his stockholdings. The Tesla CEO was taking advantage of gains in the company’s stock price, Mr. Silverman said.

$Tesla (TSLA.US)$'s stock price has fallen by about 7%, and its market value has shrunk by nearly $100 billion from that point.

Does CEOs’ sell-off mean it’s time to sell?

Action speaks louder than words. Of course, the behavior of business leaders will affect investors' confidence in the company. At least, for better or worse, news usually makes stocks more volatile in the short term.

However, their actions are not always noteworthy.

For one thing, insiders may have their own reason each time they sell stock. As to Nadella, analysts said the move could be related to Washington state instituting a 7% tax for long-term capital gains beginning at the start of next year for anything exceeding $250,000 a year.

For another, insider trading shouldn't be the only source of information, because not every executive is correct each time. In the long run, the best option is to research in-depth.

News about the sale of stocks by executives is reported from time to time. To paint a clearer picture of their effects, let's check the performance of markets and those stocks:

1. The broad market has continuously set new highs since the pandemic.

2. Taking Amazon as an example, after the CEO sold shares, the stock price has still climbed higher.

The same story also applies to $Pfizer (PFE.US)$, whose CEO sold stocks last November.

3. It's not all good news. $GameStop (GME.US)$ CEO announced to sell stocks in April. Here is how the stock price performed since then.

The bottom line

1. The CEO's sell-off may help you predict the future volatility of stock prices in the short term.

2. There is no obvious correlation between long-term stock performance and CEO selling.

3. Insider trading should not be the only source of information. Before making wise investment decisions, we should rely on in-depth research to check the company’s financial statements, annual reports, and other public opinions.

As a rule, value investors generally prefer to invest in high-quality companies with fair prices. The question is, how to identify the value of a company?

Click to our newly unveiled courses: How to invest in stocks: Quick-Start Guide.

Welcome to Courses in Moo Community, we help you trade like a pro.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

+5

98

28

永远的牛市

liked

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $Invesco QQQ Trust (QQQ.US)$

$NASDAQ 100 Index (.NDX.US)$

Currently on daily chart for futures on NDX there is a head and shoulders forming. If we do not break above the 16450 resistance today and instead continue falling, we will form the right shoulder neckline at the 16000 mark soon. If it does form, be extra cautious as this maybe bigger of a fall than what I initially thought. As VIX is still above 20 despite yesterday close, I did mention do not think the pullback is over yet and it might slowly turn into a correction soon if it falls further down.

As of now, 20SMA seems to be supporting it very well and we will have to see cash open in 1hr to determine through price action.

As always, trade safe & Invest wise!

Do subscribe to my new YouTube channel for your once a week TA and market outlook!

https://www.youtube.com/channel/UCyPNjiwKhSL1p37lqyowuZw

$NASDAQ 100 Index (.NDX.US)$

Currently on daily chart for futures on NDX there is a head and shoulders forming. If we do not break above the 16450 resistance today and instead continue falling, we will form the right shoulder neckline at the 16000 mark soon. If it does form, be extra cautious as this maybe bigger of a fall than what I initially thought. As VIX is still above 20 despite yesterday close, I did mention do not think the pullback is over yet and it might slowly turn into a correction soon if it falls further down.

As of now, 20SMA seems to be supporting it very well and we will have to see cash open in 1hr to determine through price action.

As always, trade safe & Invest wise!

Do subscribe to my new YouTube channel for your once a week TA and market outlook!

https://www.youtube.com/channel/UCyPNjiwKhSL1p37lqyowuZw

7

1

永远的牛市

liked

$Advanced Micro Devices (AMD.US)$

AMD looking like sideways movement for now. Good rally up and seems still very bullish. However can't rule out any possibilities of a incoming pullback for it to go even higher.

Do watch my video if you have not to know your support and resistance level so you know where are your entry points!

As always, trade safe & invest wise!

Do subscribe to my new YouTube channel for your once a week TA and market outlook!

https://www.youtube.com/channel/UCyPNjiwKhSL1p37lqyowuZw

AMD looking like sideways movement for now. Good rally up and seems still very bullish. However can't rule out any possibilities of a incoming pullback for it to go even higher.

Do watch my video if you have not to know your support and resistance level so you know where are your entry points!

As always, trade safe & invest wise!

Do subscribe to my new YouTube channel for your once a week TA and market outlook!

https://www.youtube.com/channel/UCyPNjiwKhSL1p37lqyowuZw

14

6

永远的牛市

liked

$E-mini Dow Futures(DEC4) (YMmain.US)$

$Dow Jones Industrial Average (.DJI.US)$

$SPDR Dow Jones Industrial Average Trust (DIA.US)$

We saw the Dow failing to break back above 20sma on daily chart and going down all the way to touch the 5EMA on the weekly chart. It was bought right up after hitting the 5EMA which is actually a bullish sign. 5EMA on weekly chart is a good support for minor pullbacks on a bull trend.

We still have to see the Dow close back above 20sma before we can start to see this bull trend resuming. As of now, nasdaq has closed at a new high thanks to amazon, apple and nvidea and I do expect the rest of the indexes to follow through with bullish movements. But we will have to let price action determine.

If the 5EMA on weekly chart doesn't hold, we will see Dow coming back down to the 50EMA as critical support and that if that critical support breaks, we will be looking at a larger pullback than I have expected. We have to be cautious on both scenarios so we are prepared to do what needs to be done when the time comes.

For now, let the price determine the trend of the market and do not be overly bearish yet despite we closed below 20sma twice in a row.

As always, trade safe & invest wise!

$Dow Jones Industrial Average (.DJI.US)$

$SPDR Dow Jones Industrial Average Trust (DIA.US)$

We saw the Dow failing to break back above 20sma on daily chart and going down all the way to touch the 5EMA on the weekly chart. It was bought right up after hitting the 5EMA which is actually a bullish sign. 5EMA on weekly chart is a good support for minor pullbacks on a bull trend.

We still have to see the Dow close back above 20sma before we can start to see this bull trend resuming. As of now, nasdaq has closed at a new high thanks to amazon, apple and nvidea and I do expect the rest of the indexes to follow through with bullish movements. But we will have to let price action determine.

If the 5EMA on weekly chart doesn't hold, we will see Dow coming back down to the 50EMA as critical support and that if that critical support breaks, we will be looking at a larger pullback than I have expected. We have to be cautious on both scenarios so we are prepared to do what needs to be done when the time comes.

For now, let the price determine the trend of the market and do not be overly bearish yet despite we closed below 20sma twice in a row.

As always, trade safe & invest wise!

40

4

永远的牛市

liked

$Alibaba (BABA.US)$

Most chinese tech stocks other than Baidu getting hit quite badly from china side mass sell off today. But baba is still not the one taking the lead in the fall. Guess why? It has fallen over 17% already the past 5 days.

And the support at 129 is a strong support as well. It held the US-China trade tension fall on 2018. It should not break that easily. Thats why when people ask for you to short at this level, its equivalent as asking you to buy at the top of 319 knowing it is the ATH.

Even if 129 should break, it will break only after a test and a rebound. Which if you shorted at 132, you will get stopped out pretty easily when it rebounds.

Critical supports do not slice through just like that. If you have been trading in the markets long enough you'll know critical supports only breaks immediately if it is a black swan event.

There is a saying, Buy the Dip, Sell the Rip. You dont sell the dip and buy the rip.

Similarly, you dont buy high and sell low!

However with all this being said, BABA is still a downward trend and although some early signals of an accumuation phase is in motion, I still have not gotten the 2nd and 3rd signal which will confirm the next phase which what many of you will call ''To the Moon Phase''.

So it is not advisable to just blindly buy any dips here yet as BABA may still push below the 129 support despite I have a strong feeling 129 is the bottom as the next critical support is all the way down at 108.

As always, Trade Safe & Invest wise!

Most chinese tech stocks other than Baidu getting hit quite badly from china side mass sell off today. But baba is still not the one taking the lead in the fall. Guess why? It has fallen over 17% already the past 5 days.

And the support at 129 is a strong support as well. It held the US-China trade tension fall on 2018. It should not break that easily. Thats why when people ask for you to short at this level, its equivalent as asking you to buy at the top of 319 knowing it is the ATH.

Even if 129 should break, it will break only after a test and a rebound. Which if you shorted at 132, you will get stopped out pretty easily when it rebounds.

Critical supports do not slice through just like that. If you have been trading in the markets long enough you'll know critical supports only breaks immediately if it is a black swan event.

There is a saying, Buy the Dip, Sell the Rip. You dont sell the dip and buy the rip.

Similarly, you dont buy high and sell low!

However with all this being said, BABA is still a downward trend and although some early signals of an accumuation phase is in motion, I still have not gotten the 2nd and 3rd signal which will confirm the next phase which what many of you will call ''To the Moon Phase''.

So it is not advisable to just blindly buy any dips here yet as BABA may still push below the 129 support despite I have a strong feeling 129 is the bottom as the next critical support is all the way down at 108.

As always, Trade Safe & Invest wise!

46

9

永远的牛市

liked

$ProShares UltraPro QQQ ETF (TQQQ.US)$

To answer those 2 queries below, why is TQQQ worse than QQQ? Aside from the leveraged gains of 3:1, there is also a leveraged loss of 3:1. Thus if a crash were to happen and QQQ loses 33% in the crash, TQQQ will essentially lose 99% due to the 3x leverage. this will clear your account to almost 0. So yes, market usually goes up and you will earn higher returns than putting it in QQQ. But we all know it takes a lot longer for you to recover from a 99% loss than a 33% loss as well in an event of a crash.

Another scenario would be, USD100 in both TQQQ and QQQ. TQQQ losses will also be multiplied in an event of correction or pullback.

QQQ loses 10% or USD10, TQQQ loses 30% which is USD30.

And when QQQ recovers back up by 10% which is USD9 gain, which means your total loss is only USD1.

TQQQ will go up by 30% likewise from the 3x leverage but only get USD21 which gives you a net loss of USD9.

Because you lost more during the pullback thus when it recovers, you gain less. So in an event of choppy market, you end up losing more than putting the money in QQQ.

So TQQQ is a short term hold as people usually buy it during a pullback low and cash it out during the highs.

As Always, trade safe & invest wise!

To answer those 2 queries below, why is TQQQ worse than QQQ? Aside from the leveraged gains of 3:1, there is also a leveraged loss of 3:1. Thus if a crash were to happen and QQQ loses 33% in the crash, TQQQ will essentially lose 99% due to the 3x leverage. this will clear your account to almost 0. So yes, market usually goes up and you will earn higher returns than putting it in QQQ. But we all know it takes a lot longer for you to recover from a 99% loss than a 33% loss as well in an event of a crash.

Another scenario would be, USD100 in both TQQQ and QQQ. TQQQ losses will also be multiplied in an event of correction or pullback.

QQQ loses 10% or USD10, TQQQ loses 30% which is USD30.

And when QQQ recovers back up by 10% which is USD9 gain, which means your total loss is only USD1.

TQQQ will go up by 30% likewise from the 3x leverage but only get USD21 which gives you a net loss of USD9.

Because you lost more during the pullback thus when it recovers, you gain less. So in an event of choppy market, you end up losing more than putting the money in QQQ.

So TQQQ is a short term hold as people usually buy it during a pullback low and cash it out during the highs.

As Always, trade safe & invest wise!

8

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)