沧海桑田

voted

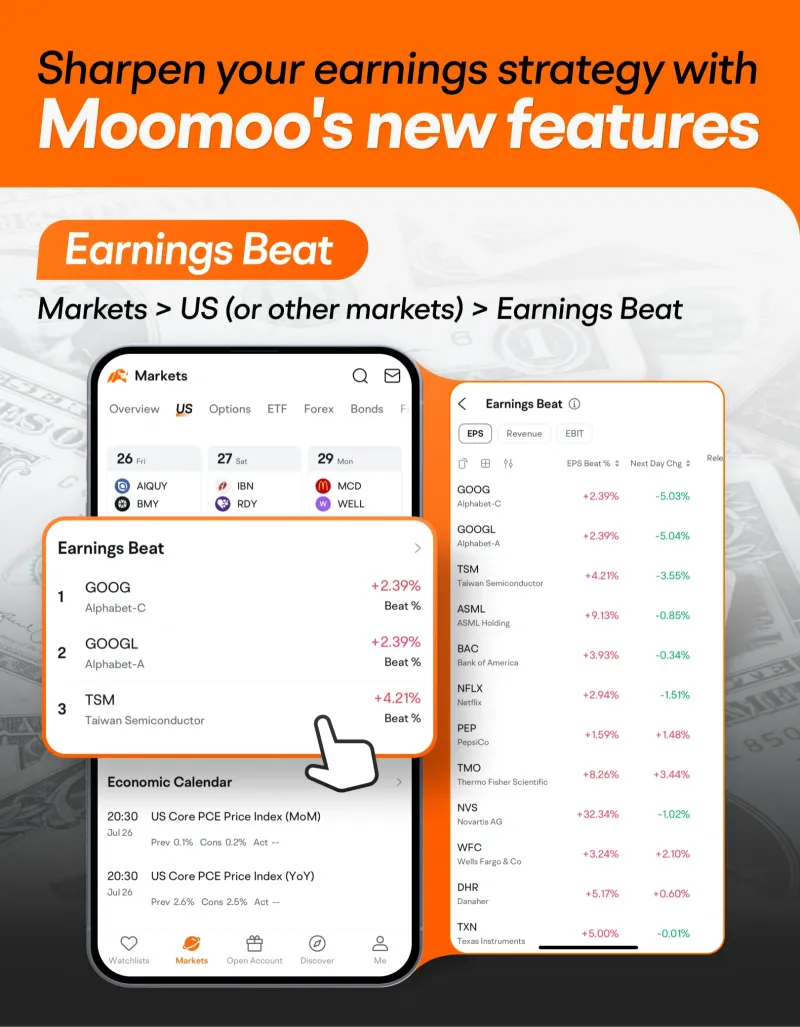

Hey mooers! Max here, wrapping up our exciting journey through the world of stock selection. ![]()

Can you believe how far we've come? Let's take a quick trip down memory lane:

1. We started by peeking into the portfolios of big institutions with the Institutional Tracker.

2. Then we hunted for passive income with the High Dividend Yield screener.

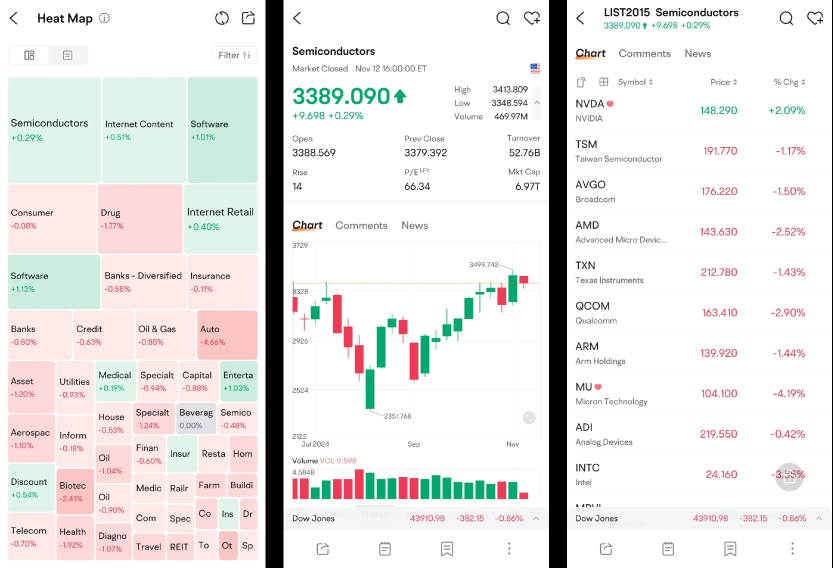

3. We got a bird's-eye view of the market with the Heat Map.

4. We explored entire industri...

Can you believe how far we've come? Let's take a quick trip down memory lane:

1. We started by peeking into the portfolios of big institutions with the Institutional Tracker.

2. Then we hunted for passive income with the High Dividend Yield screener.

3. We got a bird's-eye view of the market with the Heat Map.

4. We explored entire industri...

112

38

23

沧海桑田

voted

Welcome back to "Max Learns to Invest" – our story-driven series that explores moomoo's features through the eyes of Max, our avatar representing new investors like you. Got thoughts or questions? Share them below! We're rewarding 88 points for every comment that provides actionable suggestions or answers to our end-of-article questions. (Offer valid for one week after posting)

Hey mooers, Max ba...

Hey mooers, Max ba...

101

33

28

沧海桑田

voted

Hi mooers! ![]()

$Alibaba (BABA.US)$ is releasing its Q2 FY2025 earnings on November 15 before the bell. Unlock insights with BABA Earnings Hub>>

Amid Trump victory, Chinese stocks and ETFs are sliding, as higher tariffs are anticipated. $Alibaba (BABA.US)$'s share price has been dropping ever since its peak of $308 per share in 2020. In the wake of recent Double 11 Shopping Festival competition in China, what outlook will Alibaba's man...

$Alibaba (BABA.US)$ is releasing its Q2 FY2025 earnings on November 15 before the bell. Unlock insights with BABA Earnings Hub>>

Amid Trump victory, Chinese stocks and ETFs are sliding, as higher tariffs are anticipated. $Alibaba (BABA.US)$'s share price has been dropping ever since its peak of $308 per share in 2020. In the wake of recent Double 11 Shopping Festival competition in China, what outlook will Alibaba's man...

67

110

10

沧海桑田

voted

Columns Operation plan after the general election and during the Chinese concept financial reporting season.

$NASDAQ 100 Index (.NDX.US)$Under the dual stimulus of the settled election and a 25 basis point rate cut, the market rose by 5% this week to reach 21117 points, which is currently a bit high. Last week's rise was mainly driven by bank stocks, small cap stocks, semiconductors, and technology stocks, reaching the upper band of the Bollinger Bands. An expected short-term pullback is anticipated. Next week, the USA's CPI and PPI data will be released, with a high probability of meeting expectations and a low possibility of a market crash. The current prediction is that the current upward trend should continue until the Christmas market, but with Donald Trump's return to the White House in January next year, there may be a significant pullback in January. Therefore, during this period of policy vacuum, the US stocks are likely to experience an oscillating upward trend. In the short term, due to the crazy rise of US stocks last week, a brief pullback is expected this week, presenting a buying opportunity during the dip.

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Translated

38

4

4

沧海桑田

liked

Today, both the Hong Kong stock market and A-share market have experienced a comprehensive surge.The Hang Seng Index has experienced a two-week consolidation phase and finally decided to break out upwards, indicating that the market for Chinese assets is preparing to take off.

Just saw a very good analysis piece and decided to share it with everyone in the community.

Note: This content is not original and is reposted. The intention is to share with everyone for learning and analysis together.

This market launch is similar to the one in mid-September, coinciding with bullish monetary policy announcements in China and military demonstrations of strength, particularly the recent joint carrier training with the Liaoning and Shandong aircraft carriers, as well as official induction of the J-35A fighter jet. This sets the stage for a potential surge in Chinese assets.

At this moment, the frequent appearances of Chinese aircraft carriers and fighter jets could be seen as a hedge against potential risks from the U.S. presidential election.Regardless of who becomes the next U.S. president, the policy towards China is unlikely to change significantly, and in order to address internal conflicts, the conflict is likely to escalate further. Demonstrating military strength could help offset these concerns to some extent.

The competition between China and the U.S. is actually a tripartite competition involving technology, finance, and military, with military power being the key underlying factor.The strength of the United States relies primarily on its powerful military strength. With the support of military strength, it has subsequently achieved technological monopoly and financial hegemony. Chinese assets have been suppressed for more than 3 years, in fact, it's capital determining the pricing of China...

Just saw a very good analysis piece and decided to share it with everyone in the community.

Note: This content is not original and is reposted. The intention is to share with everyone for learning and analysis together.

This market launch is similar to the one in mid-September, coinciding with bullish monetary policy announcements in China and military demonstrations of strength, particularly the recent joint carrier training with the Liaoning and Shandong aircraft carriers, as well as official induction of the J-35A fighter jet. This sets the stage for a potential surge in Chinese assets.

At this moment, the frequent appearances of Chinese aircraft carriers and fighter jets could be seen as a hedge against potential risks from the U.S. presidential election.Regardless of who becomes the next U.S. president, the policy towards China is unlikely to change significantly, and in order to address internal conflicts, the conflict is likely to escalate further. Demonstrating military strength could help offset these concerns to some extent.

The competition between China and the U.S. is actually a tripartite competition involving technology, finance, and military, with military power being the key underlying factor.The strength of the United States relies primarily on its powerful military strength. With the support of military strength, it has subsequently achieved technological monopoly and financial hegemony. Chinese assets have been suppressed for more than 3 years, in fact, it's capital determining the pricing of China...

Translated

+3

48

9

7

沧海桑田

voted

Hi mooers! ![]()

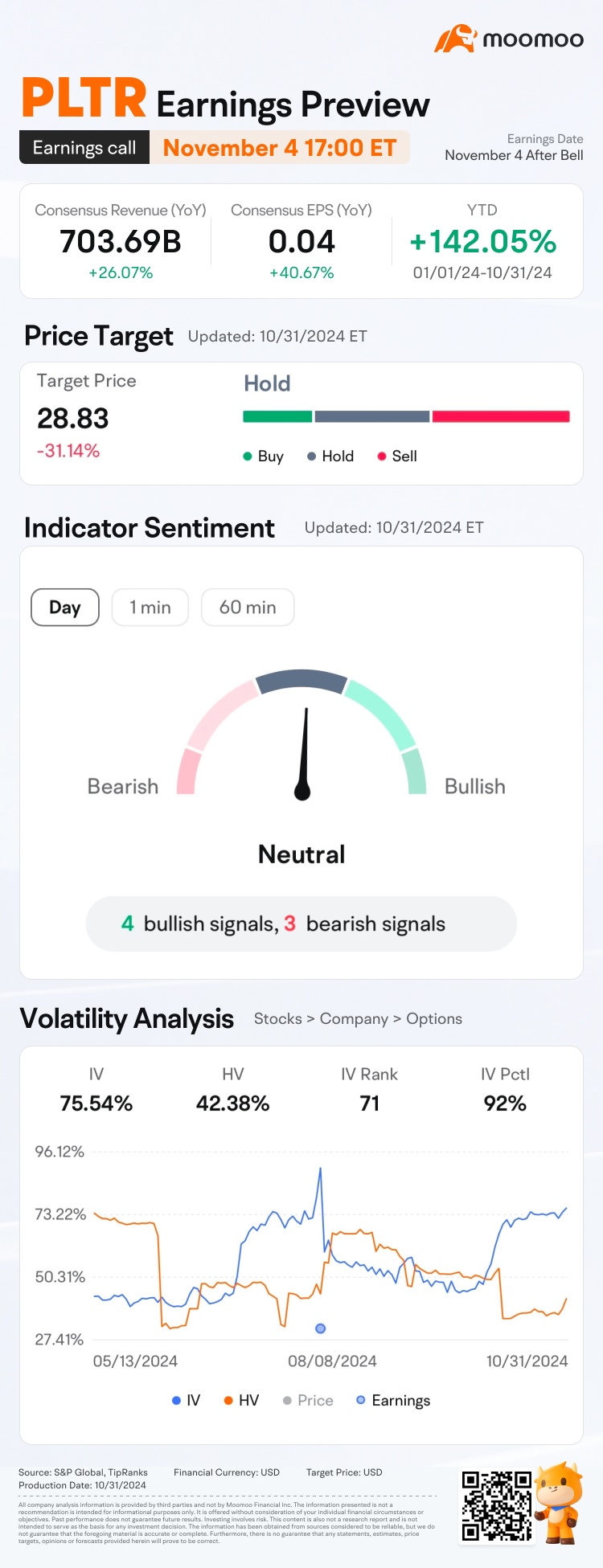

$Palantir (PLTR.US)$ is releasing its Q3 earnings on November 4 after the bell. Unlock insights with PLTR Earnings Hub>>

$Palantir (PLTR.US)$ recently joined the S&P 500 index. The company has been riding the AI and big data wave recently, and gained +140% increase on its share price. PLTR's current market cap is standing near $100 billion.![]()

What will the company's future performance look like? Subscribe to @Moo Live...

$Palantir (PLTR.US)$ is releasing its Q3 earnings on November 4 after the bell. Unlock insights with PLTR Earnings Hub>>

$Palantir (PLTR.US)$ recently joined the S&P 500 index. The company has been riding the AI and big data wave recently, and gained +140% increase on its share price. PLTR's current market cap is standing near $100 billion.

What will the company's future performance look like? Subscribe to @Moo Live...

91

142

9

Join this Positive Yield Challenge with global traders and compete for a share of $100,000 in cash rewards! Tap this link to begin>>

topping up when the stocks selected are pulling back into consolidation phase while the fundamental remains unchanged

topping up when the stocks selected are pulling back into consolidation phase while the fundamental remains unchanged

3

沧海桑田

voted

Hi mooers! ![]()

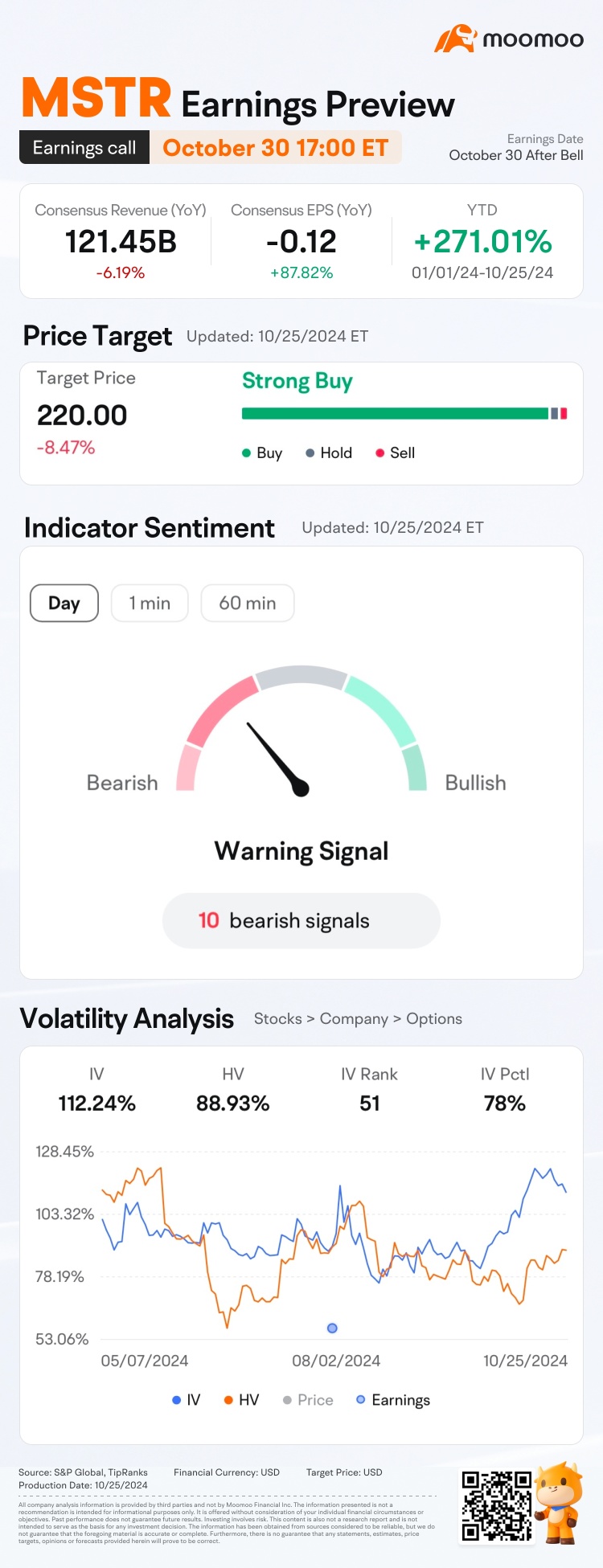

$MicroStrategy (MSTR.US)$ is releasing its Q3 earnings on October 30 after the bell. Unlock insights with MSTR Earnings Hub>>

$MicroStrategy (MSTR.US)$'s share price has risen 304.26% this year![]() , as of October 28. The recent crypto stocks and 'Trump Trade' heat has driven MSTR's price to a new high. What guidance will the MSTR management provide? Subscribe to @Moo Live and book the conference call!

, as of October 28. The recent crypto stocks and 'Trump Trade' heat has driven MSTR's price to a new high. What guidance will the MSTR management provide? Subscribe to @Moo Live and book the conference call!

For the details of...

$MicroStrategy (MSTR.US)$ is releasing its Q3 earnings on October 30 after the bell. Unlock insights with MSTR Earnings Hub>>

$MicroStrategy (MSTR.US)$'s share price has risen 304.26% this year

For the details of...

55

80

11

沧海桑田

voted

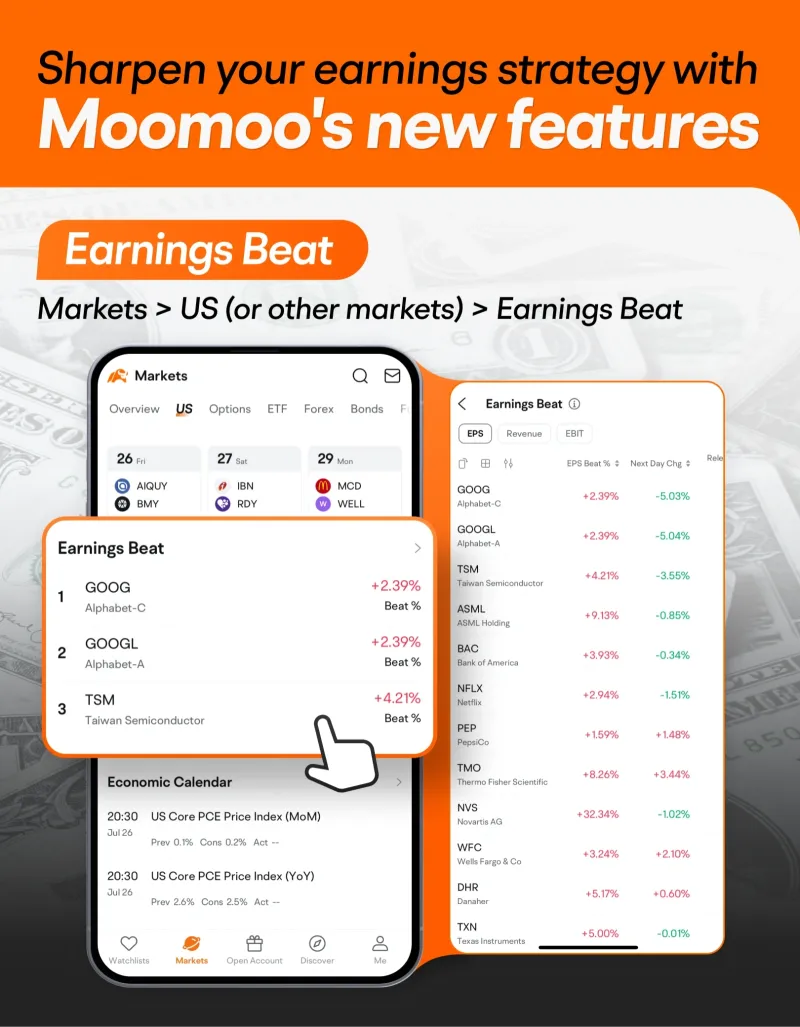

Hi mooers!![]()

$Meta Platforms (META.US)$ and $Microsoft (MSFT.US)$ are both scheduled to release their last quarter earnings on October 30 after bell.

This year, both companies have seen their share prices reach historical high. As two members of the Mag 7 group, the two companies have invested heavily on AI technology in the fast two years.

Want to compare their performances? Check out the Stock Compare feature on Moomoo!

For the introducti...

$Meta Platforms (META.US)$ and $Microsoft (MSFT.US)$ are both scheduled to release their last quarter earnings on October 30 after bell.

This year, both companies have seen their share prices reach historical high. As two members of the Mag 7 group, the two companies have invested heavily on AI technology in the fast two years.

Want to compare their performances? Check out the Stock Compare feature on Moomoo!

For the introducti...

+2

44

43

10

沧海桑田

voted

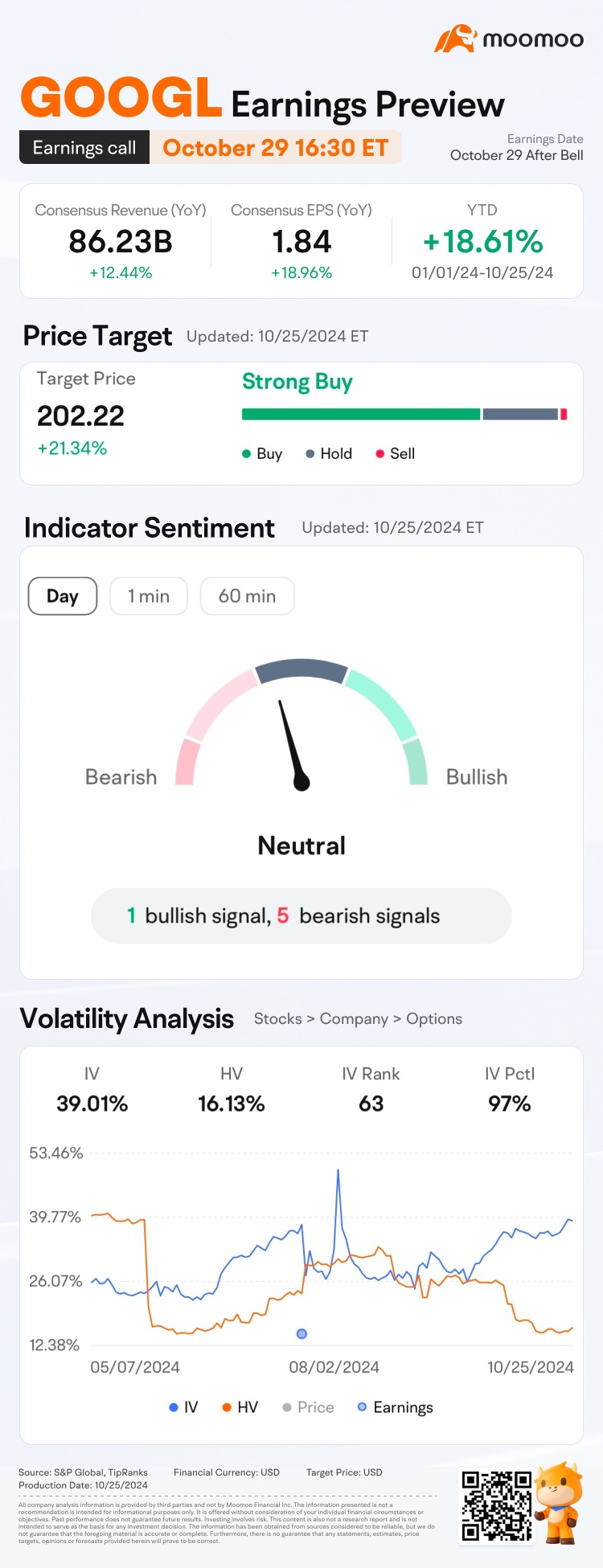

Hi mooers! ![]()

$Alphabet-A (GOOGL.US)$ is releasing its Q3 earnings on October 29 after the bell. Unlock insights with GOOGL Earnings Hub>>

$Alphabet-A (GOOGL.US)$'s stock price has risen 18.61% this year![]() , as of October 25. Recently the company announced that they are developing AI technology that takes over a web browser to complete tasks. Interested in the management's announcement? Subscribe to @Moo Live and book the conferenc...

, as of October 25. Recently the company announced that they are developing AI technology that takes over a web browser to complete tasks. Interested in the management's announcement? Subscribe to @Moo Live and book the conferenc...

$Alphabet-A (GOOGL.US)$ is releasing its Q3 earnings on October 29 after the bell. Unlock insights with GOOGL Earnings Hub>>

$Alphabet-A (GOOGL.US)$'s stock price has risen 18.61% this year

+1

80

111

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)