油条仔

liked and commented on

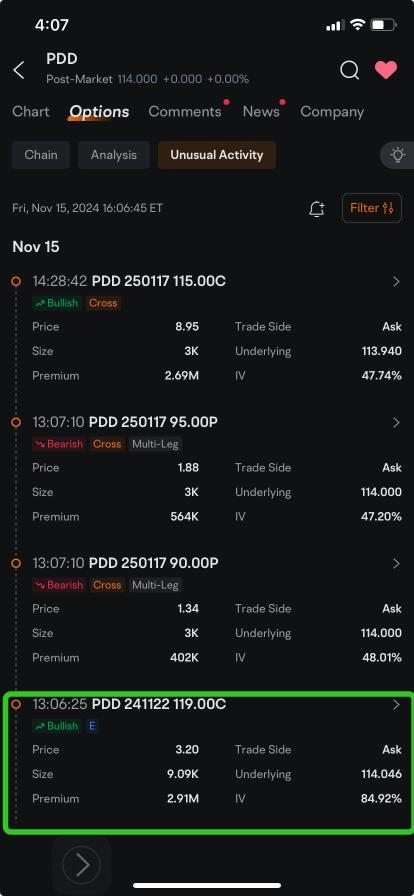

$PDD Holdings (PDD.US)$ saw bulls pour millions of dollars into call options after billionaire David Tepper's Appaloosa Management boosted its stake in the parent company of online retailer Temu.

Appaloosa added 3.36 million PDD American depositary receipts to its portfolio, taking its stake in the company to 456.7 million ADRs as of Sept. 30, according to Bloomberg data from the investment firm's 13F filing with ...

Appaloosa added 3.36 million PDD American depositary receipts to its portfolio, taking its stake in the company to 456.7 million ADRs as of Sept. 30, according to Bloomberg data from the investment firm's 13F filing with ...

+1

54

14

油条仔

reacted to

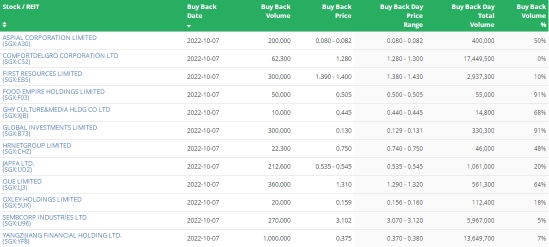

Good morning mooers! Here are things you need to know about today's Singapore:

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ decreased 1.01 per cent to 3,114.16 ...

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ decreased 1.01 per cent to 3,114.16 ...

1447

1387

油条仔

reacted to

The current stock market is giving a positive vibe and high valuation to the electric vehicle stocks regardless they have profit or not. $Tesla (TSLA.US)$ is currently the most valuable companies along with other Ev startups $Lucid Group (LCID.US)$ $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$ are worth billions despite little production.

Even the other huge manufacturers $General Motors (GM.US)$ $Ford Motor (F.US)$ $Honda Motor (HMC.US)$ are even trading at a lower PE ratio. EV stocks are currently over valued than traditional automakers as we can conclude that the Ev supply is constrained. In long term, these advantages will erode and Ev makers will face same challenges as these old automakers. 🍀

Even the other huge manufacturers $General Motors (GM.US)$ $Ford Motor (F.US)$ $Honda Motor (HMC.US)$ are even trading at a lower PE ratio. EV stocks are currently over valued than traditional automakers as we can conclude that the Ev supply is constrained. In long term, these advantages will erode and Ev makers will face same challenges as these old automakers. 🍀

41

2

油条仔

liked

The Barbell strategy is coined by Nassim Taleb. He is a Lebanese-American statistician, investor and writer and is well known for the term “Black Swan”. It refers to unexpected events at a large magnitude, such as Covid19.

The barbell investment strategy advocates pairing two distinctly different portfolio of investment assets – distributing between the two extremes with almost nothing in the middle.

One portfolio (85-90%) holds extremely safe investments, while the other aggressive portfolio (10-15%) holds highly speculative or leveraged investments.

The conservative portfolio should hold asset that can at least beat the inflation.

Depending if you are in the Wealth Accumulation stage or Wealth Preservation stage of your life, you can tweak the two portfolio accordingly.

Wealth Accumulation Stage:

The objective is to grow your wealth beyond this $1m windfall.

I would have 85% in the conservative portfolio.

Instead of low risk asset such as cash or short term deposit, I would allocate more into blue chip technology stocks such as

$Amazon (AMZN.US)$

$Alphabet-A (GOOGL.US)$

$Meta Platforms (FB.US)$

$Apple (AAPL.US)$

A portion of it will go into etf such as $Vanguard S&P 500 ETF (VOO.US)$.

I would also allocate 10% of the conservative portfolio to strong growth stock such as $NVIDIA (NVDA.US)$

For the remaining 15% in the Highly aggressive portfolio, 10% will be in $Tesla (TSLA.US)$ , 5% in crypto such as $Bitcoin (BTC.CC)$ and $Ethereum (ETH.CC)$ 1% can even go into meme stock coins such as a Moomoo coin suggested by @Mars Mooo or $Dogecoin (DOGE.CC)$ .

This is how the allocation will look like:

Wealth Preservation Stage:

The objective is to protect this $1m.

I would take a more conservative approach and keep some money as cash. The rest of the allocation will be very similar to the weakth accumulation stage, using a barbell strategy.

The conservative portfolio will be 90% and the aggressive one is 10%.

Quoting @NANA123" There is no best, only the most suitable “ strategy.

How you deploy the $1m totally depends on:

* Your risk appetite

* Your life stage

* Your investing style

* Your objective

I believe that using a barbell strategy can help me to meet the 4 points mentioned. The allocation % can be reviewed and adjusted annually if required. Most importantly, it should help me to sleep soundly at night.

Now…the question is….how should i get this $1m windfall?![]()

Any ideas guys?

@Investing with moomoo @HopeAlways @GratefulPanda @Syuee @Tupack H Mcsnacks

The barbell investment strategy advocates pairing two distinctly different portfolio of investment assets – distributing between the two extremes with almost nothing in the middle.

One portfolio (85-90%) holds extremely safe investments, while the other aggressive portfolio (10-15%) holds highly speculative or leveraged investments.

The conservative portfolio should hold asset that can at least beat the inflation.

Depending if you are in the Wealth Accumulation stage or Wealth Preservation stage of your life, you can tweak the two portfolio accordingly.

Wealth Accumulation Stage:

The objective is to grow your wealth beyond this $1m windfall.

I would have 85% in the conservative portfolio.

Instead of low risk asset such as cash or short term deposit, I would allocate more into blue chip technology stocks such as

$Amazon (AMZN.US)$

$Alphabet-A (GOOGL.US)$

$Meta Platforms (FB.US)$

$Apple (AAPL.US)$

A portion of it will go into etf such as $Vanguard S&P 500 ETF (VOO.US)$.

I would also allocate 10% of the conservative portfolio to strong growth stock such as $NVIDIA (NVDA.US)$

For the remaining 15% in the Highly aggressive portfolio, 10% will be in $Tesla (TSLA.US)$ , 5% in crypto such as $Bitcoin (BTC.CC)$ and $Ethereum (ETH.CC)$ 1% can even go into meme stock coins such as a Moomoo coin suggested by @Mars Mooo or $Dogecoin (DOGE.CC)$ .

This is how the allocation will look like:

Wealth Preservation Stage:

The objective is to protect this $1m.

I would take a more conservative approach and keep some money as cash. The rest of the allocation will be very similar to the weakth accumulation stage, using a barbell strategy.

The conservative portfolio will be 90% and the aggressive one is 10%.

Quoting @NANA123" There is no best, only the most suitable “ strategy.

How you deploy the $1m totally depends on:

* Your risk appetite

* Your life stage

* Your investing style

* Your objective

I believe that using a barbell strategy can help me to meet the 4 points mentioned. The allocation % can be reviewed and adjusted annually if required. Most importantly, it should help me to sleep soundly at night.

Now…the question is….how should i get this $1m windfall?

Any ideas guys?

@Investing with moomoo @HopeAlways @GratefulPanda @Syuee @Tupack H Mcsnacks

379

33

油条仔

reacted to

$Lucid Group (LCID.US)$ Even though I’m super bullish on this one, I sold at 3/4 of my holdings for 40 bucks, and will rebuy under 28. When i sold $NIO Inc (NIO.US)$ for 57 and it got to 60’s people where laughing at me, with my idea that I will rebuy at 38, they were saying that we will never se 40s again, and after couple months we have seen 32! So guys after +50 % gain in 2 days last week, there have to be a pullback! My PT is still 60 for 2022 and over 100 bucks in 2025. But i think we before 60 we will see 28.

31

6

油条仔

commented on

Options, the English term for '期权'. It aims to increase personal profits based on the principle of leverage. Simply put, it's about risking a small amount to gain big.

Unusual options activity, the English term for '期权异动'. Unusual options activity refers to a large volume of trades occurring within a short period, leading to a significant surge or drop in options/stocks. Unlike stocks, all options trades are publicly disclosed and displayed on the options chain. By observing unusual options activity on the options chain, we can determine the potential surge/drop in stocks.

Since the majority of unusual options activity is driven by institutions, who possess sufficient information, thorough research, and substantial funds to make purchases, basing stock price predictions on the direction of unusual options activity can be somewhat helpful.

These anomalies occur within a very short timeframe. By tracking/following unusual options activity, it provides us with a reference for potential 'surges/drops' in the stock market.

Unusual options activity, the English term for '期权异动'. Unusual options activity refers to a large volume of trades occurring within a short period, leading to a significant surge or drop in options/stocks. Unlike stocks, all options trades are publicly disclosed and displayed on the options chain. By observing unusual options activity on the options chain, we can determine the potential surge/drop in stocks.

Since the majority of unusual options activity is driven by institutions, who possess sufficient information, thorough research, and substantial funds to make purchases, basing stock price predictions on the direction of unusual options activity can be somewhat helpful.

These anomalies occur within a very short timeframe. By tracking/following unusual options activity, it provides us with a reference for potential 'surges/drops' in the stock market.

Translated

117

34

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

油条仔 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)