牛去冲天

liked

Thank you all for your support on my last annual review post (2024 stock market review + 2025 outlook), today let's talk about cryptocurrency and future investment opportunities.

Recently, BTC has been consolidating, with a confirmed bottom at $93,000, first resistance at 0.1 million, second resistance at 10.6 to 0.108 million, expecting a new high in January after recent short-term fluctuations.

After BTC's mid-term rise from 50k to 100k, the market's expectations for BTC's sharp rise again have decreased significantly, and BTC-related concepts are no longer the market focus. However, this wave of pullback has basically bottomed out, medium-term hold positions, preferring significant benefits in the bull market. $Bitdeer Technologies (BTDR.US)$ , $Coinbase (COIN.US)$ With BTC leverage $MicroStrategy (MSTR.US)$ Waiting for the opportunity brought by the bull market in BTC. Pure mining stocks have been lagging behind BTC in the past and in the future, not suitable for long-term holding, but can still be used for some short-term trading combined with the BTC market.

Apart from BTC-related concepts, where are the main opportunities in the current market?

Stock investments are based on expectations and the future. Although we may find it difficult to predict the specific trends of individual stocks during this period, it is worth imagining what the world will be like 5 or 10 years from now. Which will be the most outstanding companies at that time? By looking ahead, we can identify the industries and companies that will benefit the most in this cycle, and focus on investing in those specific targets. What scenarios will we see in 10 years? Wel...

Recently, BTC has been consolidating, with a confirmed bottom at $93,000, first resistance at 0.1 million, second resistance at 10.6 to 0.108 million, expecting a new high in January after recent short-term fluctuations.

After BTC's mid-term rise from 50k to 100k, the market's expectations for BTC's sharp rise again have decreased significantly, and BTC-related concepts are no longer the market focus. However, this wave of pullback has basically bottomed out, medium-term hold positions, preferring significant benefits in the bull market. $Bitdeer Technologies (BTDR.US)$ , $Coinbase (COIN.US)$ With BTC leverage $MicroStrategy (MSTR.US)$ Waiting for the opportunity brought by the bull market in BTC. Pure mining stocks have been lagging behind BTC in the past and in the future, not suitable for long-term holding, but can still be used for some short-term trading combined with the BTC market.

Apart from BTC-related concepts, where are the main opportunities in the current market?

Stock investments are based on expectations and the future. Although we may find it difficult to predict the specific trends of individual stocks during this period, it is worth imagining what the world will be like 5 or 10 years from now. Which will be the most outstanding companies at that time? By looking ahead, we can identify the industries and companies that will benefit the most in this cycle, and focus on investing in those specific targets. What scenarios will we see in 10 years? Wel...

Translated

47

1

牛去冲天

commented on

$Baosheng Media Group (BAOS.US)$ Why did it suddenly erupt?

Translated

1

1

牛去冲天

commented on

牛去冲天

reacted to

2024 review

Before you know it, it's already Christmas, which also means 2024 is coming to an end and a new year. This year was a big bull market full of opportunities for both US stocks and cryptocurrency. Although Hong Kong stocks $Hang Seng Index (800000.HK)$ Probably no one would think of it as a bull market, but it also ushered in at least two small summers, and I believe everyone should also reap some benefits. However, even if there are no gains or losses, it should be viewed as a learning opportunity, scrutinize the mistakes made and missed opportunities, and prepare for the next year.

Let's start with early 2024. In January, the first thing to mention was a Bitcoin spot ETF $Crypto Spot ETF (LIST22873.HK)$ Listed. On the day of listing, the market immediately provided a short-term short selling opportunity for “Sell The News”. Bitcoin dropped to a maximum of $49,000 to $38,500 within the next two weeks. However, this event laid the foundation for this year's big cryptocurrency year.

Also in January, the two major shareholders of this year were born, Nvidia (NVDA) $NVIDIA (NVDA.US)$ and ultra-microcomputer (SMCI) $Super Micro Computer (SMCI.US)$ They all broke through the long-term consolidation range, then swayed all the way up, and the AI sector boom was rekindled. If you're a trend investor, these two stocks are textbook-style breakout trades. It's actually not difficult to seize rising points; the difficulty is whether you...

Before you know it, it's already Christmas, which also means 2024 is coming to an end and a new year. This year was a big bull market full of opportunities for both US stocks and cryptocurrency. Although Hong Kong stocks $Hang Seng Index (800000.HK)$ Probably no one would think of it as a bull market, but it also ushered in at least two small summers, and I believe everyone should also reap some benefits. However, even if there are no gains or losses, it should be viewed as a learning opportunity, scrutinize the mistakes made and missed opportunities, and prepare for the next year.

Let's start with early 2024. In January, the first thing to mention was a Bitcoin spot ETF $Crypto Spot ETF (LIST22873.HK)$ Listed. On the day of listing, the market immediately provided a short-term short selling opportunity for “Sell The News”. Bitcoin dropped to a maximum of $49,000 to $38,500 within the next two weeks. However, this event laid the foundation for this year's big cryptocurrency year.

Also in January, the two major shareholders of this year were born, Nvidia (NVDA) $NVIDIA (NVDA.US)$ and ultra-microcomputer (SMCI) $Super Micro Computer (SMCI.US)$ They all broke through the long-term consolidation range, then swayed all the way up, and the AI sector boom was rekindled. If you're a trend investor, these two stocks are textbook-style breakout trades. It's actually not difficult to seize rising points; the difficulty is whether you...

Translated

68

1

9

$Alibaba (BABA.US)$ Haha, it's really very trashy as long as it's related to A shares, really fed up.

Translated

1

1

牛去冲天

liked and commented on

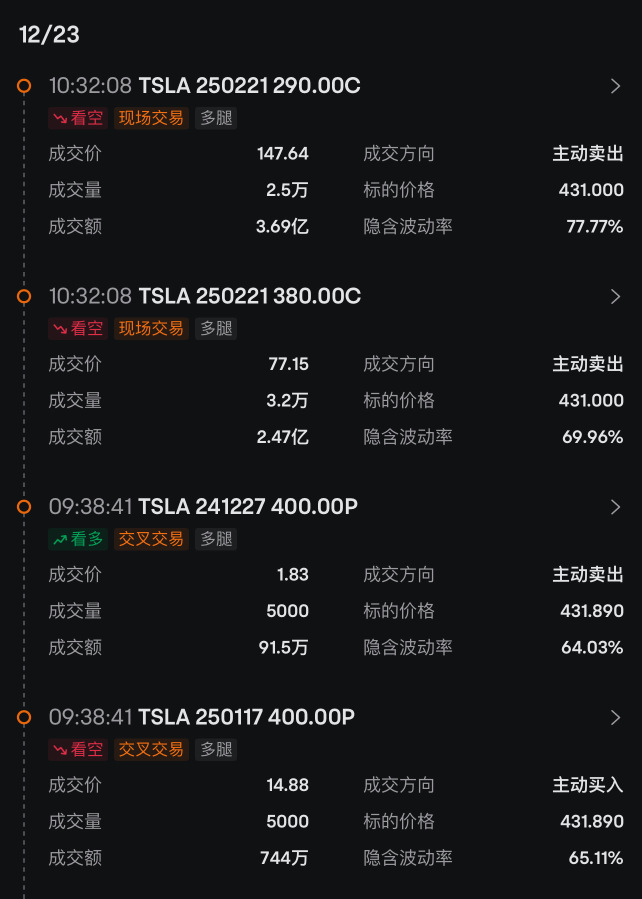

$Tesla (TSLA.US)$ Goodbye Moo friends, see you next New Year's Day.![]()

![]()

![]() I hope you all can end the final week with a full pot of winnings. If you have any questions, feel free to leave a message on this post. I will reply one by one (of course, I will still reply before I leave).

I hope you all can end the final week with a full pot of winnings. If you have any questions, feel free to leave a message on this post. I will reply one by one (of course, I will still reply before I leave).

In addition, I have set a limit order to Buy Tesla at 400 and 390. Hopefully, I can make the purchase. I'm not sure if this is correct, but buying valuable stocks in batches should be a good decision no matter what (personal hope).![]()

![]()

![]()

![]()

Additional reminder, if you just want to bottom-fish intraday and then sell immediately, positions can be sold at 418-425 during the trading day. (If you are under great pressure)![]()

![]()

![]() Do not try to buy at the lowest point or sell at the highest point within the day, always remember, it's good to make a profit.

Do not try to buy at the lowest point or sell at the highest point within the day, always remember, it's good to make a profit.![]()

![]()

![]() (But I still do not recommend it)

(But I still do not recommend it)

Wishing everyone a Happy New Year and good luck!![]()

![]() $NVIDIA (NVDA.US)$ $Invesco QQQ Trust (QQQ.US)$

$NVIDIA (NVDA.US)$ $Invesco QQQ Trust (QQQ.US)$

In addition, I have set a limit order to Buy Tesla at 400 and 390. Hopefully, I can make the purchase. I'm not sure if this is correct, but buying valuable stocks in batches should be a good decision no matter what (personal hope).

Additional reminder, if you just want to bottom-fish intraday and then sell immediately, positions can be sold at 418-425 during the trading day. (If you are under great pressure)

Wishing everyone a Happy New Year and good luck!

Translated

108

116

9

$Tesla (TSLA.US)$ Damn, there are still 20 minutes.

Translated

!

!

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)